Press release

India Peer To Peer Lending Market Outlook 2026-2034: Digital Lending Trends and Industry Forecast

According to IMARC Group's report titled "India Peer To Peer Lending Market Size, Share, Trends and Forecast by Business Model, End User, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.India Peer To Peer Lending Market Analysis

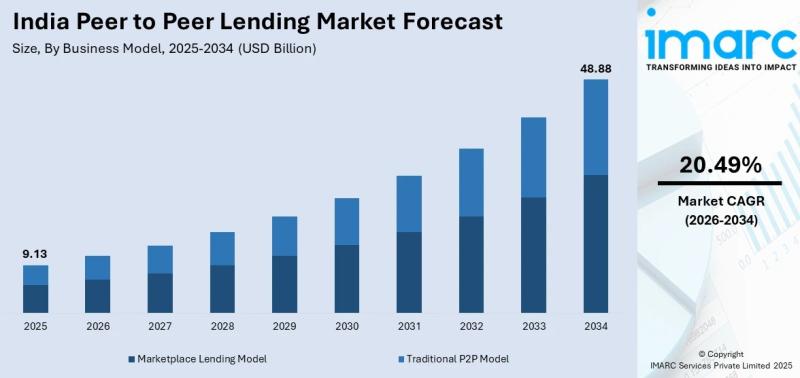

The India peer to peer lending market size was valued at USD 9.13 Billion in 2025 and is projected to reach USD 48.88 Billion by 2034, growing at a compound annual growth rate of 20.49% from 2026-2034. The market is expanding rapidly due to increasing digital financial inclusion, growing demand for alternative credit solutions among underserved borrowers, and advancements in AI-driven credit assessment technologies. The strong regulatory support and growing investor participation further enhance market growth across urban and rural regions.

Note: To access the most recent data, insights, and industry updates, please request a free sample report.

• Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID): https://www.imarcgroup.com/india-peer-to-peer-lending-market/requestsample

India Peer To Peer Lending Market Growth Factors

The peer-to-peer (P2P) lending market in India is expanding slowly due to growing demand for accessible and flexible financing solutions. The P2P lending market serves a diverse clientele, including salaried employees, professionals, and small business owners seeking loans, particularly those who may find it difficult to access loans from customary lending institutions. Peer-to-peer platforms are relevant to the larger financial industry by targeting specific segments of the unbanked market while increasing the size of the market for potential customers. Growing penetration of mobile devices and the internet has increased the opportunity for peer-to-peer firms and helped penetrate semi-urban and other emerging urban markets.

The growth potential of the industry is further strengthened by increased regulatory clarity, which engenders trust among industry players and improved responsible lending practices, as well as rising financial literacy and awareness of alternative lending models, which are leading to greater participation by borrowers and lenders alike. Such platforms also tend to offer additional services, such as improving customer service, easing onboarding, and providing personalized loan and investment options. The digital nature of the platform allows P2P lenders to grow quickly and without the need for branching and teller systems employed by customary banks for lending.

Partnerships with payment gateways, credit assessors and technology companies are focused on building platforms and achieving growth in a sustainable manner while increasing transparency, grievance redressal and investor protection. As the India P2P lending market evolves, its high levels of trust and commitment to innovation will fuel growth in the segment across different types of users in the market. Overall, this positions the market as a highly important area of growth within the country's evolving digital financial services ecosystem over the long term.

India Peer To Peer Lending Market Trends

Digital transformation is one of the most meaningful factors shaping the India Peer to Peer Lending Market. The increasing comfort with online payment transactions among borrowers and lenders makes it easier to adopt peer-to-peer lending by using digital payment methods and mobile applications that allow online access to lending options. Higher investment in fintech has enabled data analytics, alternative credit scoring and automation software to be utilized by platforms, improving their borrower evaluations and risk ratings, operations and overall efficiency.

P2P lending has become increasingly attractive to retail customers and SMEs as the sector has focused on rapid loan approvals, flexible repayment options and an alternative to bank finance. Another factor in market development is changing investor behavior. Investors want better risk-adjusted returns and portfolio diversification opportunities beyond cash or savings accounts. Peer-to-peer lending platforms respond to these trends by offering more loan types, improving risk segmentation, and improving investor dashboards to make them more transparent, engaging, and trustworthy. Platforms are increasingly working with fintechs or third-party providers to jointly improve their compliance infrastructure.

There is a growing focus on security, compliance and transparency in the design of platforms and the way they engage with their users. Peer-to-peer lending is becoming more mainstream with better internet marketing and referrals. Peer to peer lending is also becoming more mainstream within groups more used to transacting over the internet. Further, the use of data-led artificial intelligence and machine learning is improving loan matching, fraud detection, platform operations and the overall peer-to-peer lending ecosystem.

India Peer To Peer Lending Market Recent Developments & News

• Regulatory Overhaul (RBI/NPCI): Following high defaults, the RBI mandated that P2P platforms must move to a direct, one-to-one or one-to-many model, banning the "pooling" of funds. Additionally, the NPCI has banned P2P "collect requests" on UPI, effective October 1, 2025, to curb fraud.

• Market Transformation: The industry is moving away from guaranteed, high-return, low-risk promises, forcing platforms like LenDenClub and Faircent to emphasize transparency and risk-based pricing.

• Technological Shift: Platforms are heavily adopting blockchain for transparency and AI for better credit scoring.

• Expansion & Partnerships: P2P platforms are increasingly collaborating with traditional banks for co-lending, while also expanding into Tier 2 and Tier 3 cities to access underserved populations.

If you have any questions or need assistance, feel free to ask our expert analysts: https://www.imarcgroup.com/request?type=report&id=31108&flag=C

India Peer To Peer Lending Market Segmentation

Business Model Insights:

• Traditional P2P Model

• Marketplace Lending Model

End User Insights:

• Consumer Credit

• Small Business

• Student Loan

• Real Estate

Regional Insights

• North India

• South India

• East India

• West India

India Peer To Peer Lending Market Key Players

The report offers an in-depth examination of the competitive landscape, including market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Discuss Your Requirements With an Analyst and Get Your Customized Market Report Now: https://www.imarcgroup.com/request?type=report&id=31108&flag=E

Key Questions Answered in This Report

Q1. How big is the India peer to peer lending market?

A1. The India peer to peer lending market size was valued at USD 9.13 Billion in 2025.

Q2. What is the projected growth rate of the India peer to peer lending market?

A2. The India peer to peer lending market is expected to grow at a compound annual growth rate of 20.49% from 2026-2034 to reach USD 48.88 Billion by 2034.

Q3. Which business model held the largest India peer to peer lending market share?

A3. Marketplace lending model dominated the market with a share of 65.8%, driven by its scalability, advanced AI-driven underwriting capabilities, and seamless integration with institutional investors expanding lending capacity.

Q4. What are the key factors driving market growth?

A4. Key factors driving the India peer to peer lending market include rising financial inclusion among the underserved segments, expanding digital infrastructure and smartphone penetration, gig economy expansion, and favorable regulatory frameworks supporting alternative lending mechanisms.

Q5. What are the major challenges facing the India peer to peer lending market?

A5. Major challenges include credit default risk and rising non-performing assets, regulatory compliance complexity following RBI's amended guidelines, liquidity constraints with limited early withdrawal options, operational cost increases, and evolving investor trust dynamics within the sector.

Explore More Research Reports & Get Your Free Sample Now:

India Personal Finance Software Market: https://www.imarcgroup.com/india-personal-finance-software-market/requestsample

India Gold Loan Market: https://www.imarcgroup.com/india-gold-loan-market/requestsample

Indonesia Fintech Market: https://www.imarcgroup.com/indonesia-fintech-market/requestsample

India Trade Credit Insurance Market: https://www.imarcgroup.com/india-trade-credit-insurance-market/requestsample

India Vehicle Financing Market: https://www.imarcgroup.com/india-vehicle-financing-market/requestsample

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel: (D) +91 120 433 0800

United States: +1-201971-6302

IMARC Group is a global management consulting firm that helps ambitious changemakers create a lasting impact. The company offers comprehensive market assessment, feasibility studies, incorporation support, regulatory assistance, branding and strategy services, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Peer To Peer Lending Market Outlook 2026-2034: Digital Lending Trends and Industry Forecast here

News-ID: 4387768 • Views: …

More Releases from IMARC Group

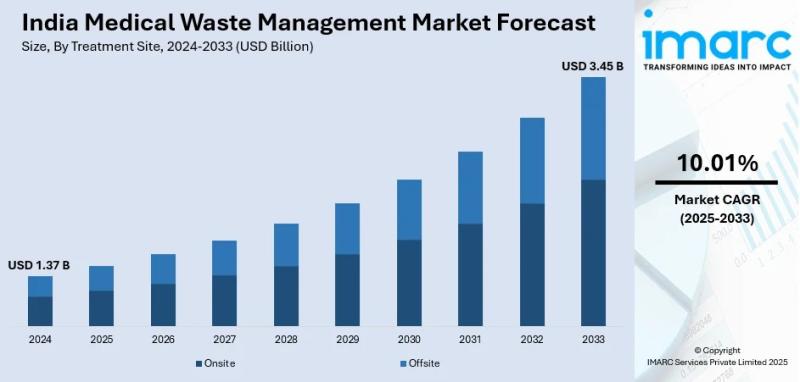

India Medical Waste Management Market to Reach USD 3.45 Billion by 2033, Growing …

Source: IMARC Group | Category: Healthcare | Author Name: Gaurav

Report Introduction

According to IMARC Group's latest report titled "India Medical Waste Management Market Size, Share, Trends and Forecast by Treatment Site, Treatment, and Region, 2025-2033", the market is growing rapidly due to the expansion of healthcare infrastructure and increasing volumes of biomedical waste. The study offers a profound analysis of the industry, encompassing market share, size, growth factors, key trends, and…

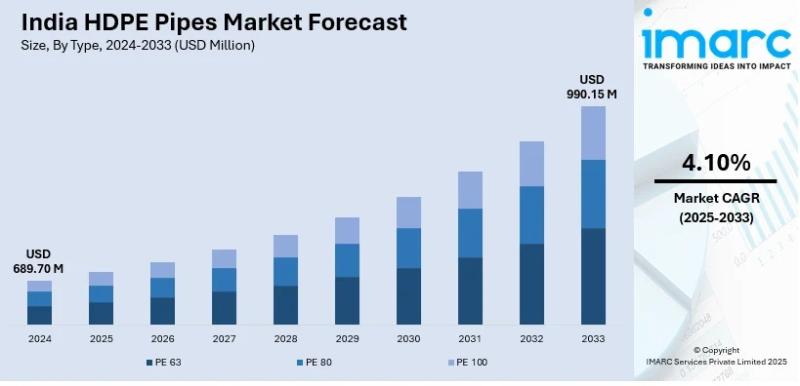

India HDPE Pipes Market to Reach USD 990.15 Million by 2033, Growing at 4.10% CA …

Source: IMARC Group | Category: Industrial Materials | Author Name: Gaurav

Report Introduction

According to IMARC Group's latest report titled "India HDPE Pipes Market Size, Share, Trends, and Forecast by Type, Application, and Region, 2025-2033", the market is growing steadily due to government-led infrastructure initiatives, agricultural modernization, and the increasing adoption of sustainable piping solutions. The study offers a profound analysis of the industry, encompassing market share, size, growth factors, key trends,…

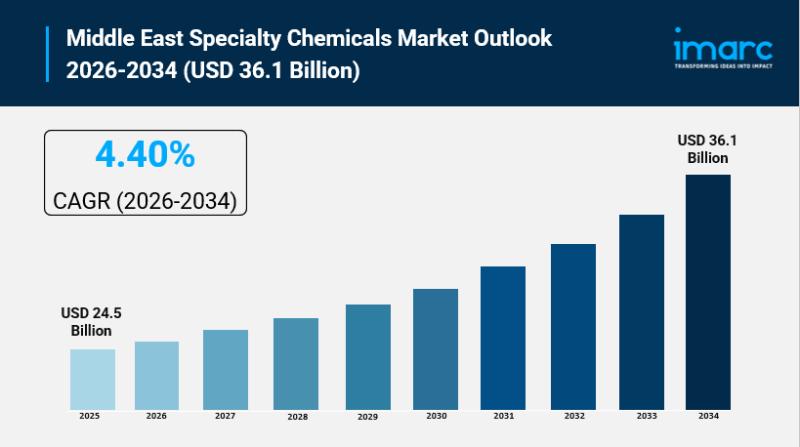

Middle East Specialty Chemicals Market Size to Surpass USD 36.1 Billion by 2034 …

Middle East Specialty Chemicals Market Overview

Market Size in 2025: USD 24.5 Billion

Market Size in 2034: USD 36.1 Billion

Market Growth Rate 2026-2034: 4.40%

According to IMARC Group's latest research publication, "Middle East Specialty Chemicals Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Middle East specialty chemicals market size was valued at USD 24.5 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 36.1 Billion by…

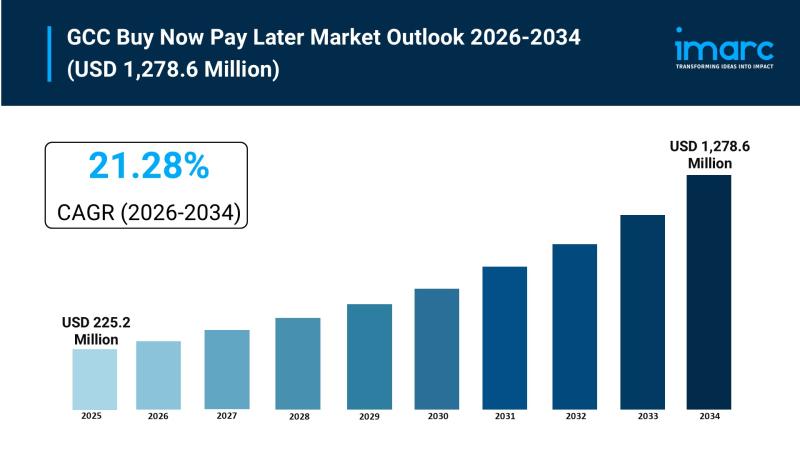

GCC Buy Now Pay Later Market Size to Hit USD 1,278.6 Million by 2034 | With a 21 …

GCC Buy Now Pay Later Market Overview

Market Size in 2025: USD 225.2 Million

Market Size in 2034: USD 1,278.6 Million

Market Growth Rate 2026-2034: 21.28%

According to IMARC Group's latest research publication, "GCC Buy Now Pay Later Market Report by Channel (Online, Point of Sale (POS)), Organization Size (Large Enterprises, Small and Medium Enterprises), End Use (Consumer Electronics, Fashion and Garment, Healthcare, Leisure and Entertainment, Retail, and Others), Purchase (Small Ticket Items (Up…

More Releases for India

India Smart Air Purifier Market Set to Witness Significant Growth by 2035 | Phil …

India smart air purifier market was valued at $125.8 million in 2024 and is projected to reach $298.7 million by 2035, growing at a CAGR of 8.3% during the forecast period (2025-2035).

India Smart Air Purifier Market Overview

The Indian smart air purifier market is experiencing significant growth, driven by increasing concerns over air pollution and its impact on health. Consumers are increasingly adopting smart air purifiers equipped with advanced features…

Ayurvedic Service Market is Flourishing Like Never Before | Patanjali Ayurved Li …

RnM newly added a research report on the Ayurvedic Service market, which represents a study for the period from 2020 to 2026.

The research study provides a near look at the market scenario and dynamics impacting its growth. This report highlights the crucial developments along with other events happening in the market which are marking on the growth and opening doors for future growth in the coming years. Additionally, the…

Pasta Market Report 2018 Companies included Bambino (India), Nestle (USA), Field …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides detailed segmentation on the…

Interior Designers India, Designers and Architects India, Interior Design Consul …

Synergy Corporate Interiors Pvt. Ltd. are offer Designers and Architects India Our architects, designers are working an national and international client base. The final design output is then integrated with the various technical and engineering aspects and taken into production. The expression is also individualistic, based on the communication of the correct corporate identity. Our designers, engineers and architects perform any plan successfully combine handy knowledge with creative ideas into…

Domain Registration India, Web Hosting India, VPS Hosting India , SSL Certificat …

All the Domain Registration services are at affordable price and assure you for the 100% quality.

India Internet offers cheap domain name registration for many domain extensions available. We are a full-service web site solutions provider. We offer a full range of web services including domain registration India, Web Hosting India, Web design, SEO marketing and etc.

We offer different standard and different Windows .NET low-cost, full-featured, all-inclusive web hosting and domain…

Domain Registration India, Web Hosting India, Payment Gateway India

Indiainternet.in is a Quality Web Hosting Company India, provide all web related support and Web hosting services like linux web hosting, windows web hosting, web hosting packages, domain registration in india, Corporate email solution, business email hosting, payment gateway integration, SSL with supports like free php, cgi, asp, free msaccess, free cdonts, free webmail, web based control panel, unlimited ftp access, unlimited data transfer.

During the domain registration process, you will…