Press release

Australia Private Equity Market Projected to Reach USD 48.5 Billion by 2034

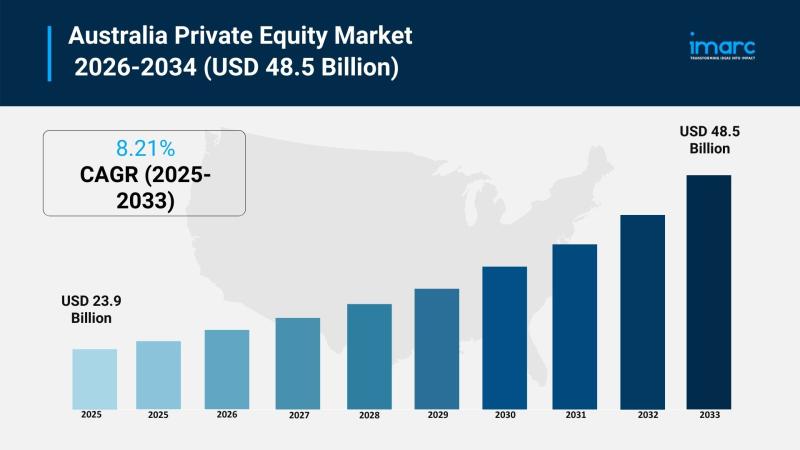

Market OverviewThe Australia private equity market size reached USD 23.9 billion in 2025 and is forecast to grow to USD 48.5 billion by 2034. The market is expected to expand during 2026-2034 at a CAGR of 8.21%. Growth is driven by demand across fund types including buyout, venture capital, infrastructure, and real estate, with investors focusing on technology, fintech, healthcare, and renewable energy sectors. Australia's strong economic stability and regulatory support position it as a preferred destination for private equity investments. For detailed insights visit the Australia Private Equity Market : https://www.imarcgroup.com/australia-private-equity-market

How AI is Reshaping the Future of Australia Energy Storage Market:

• Increased adoption of AI-powered data analytics is enhancing deal sourcing and due diligence efficiency within Australia's private equity firms.

• Government-backed initiatives promoting digital infrastructure investment have accelerated funding into AI-driven startups.

• AI enhances portfolio management by enabling predictive analytics, optimizing operational improvements, and identifying growth opportunities in tech-driven enterprises.

• Integration of AI with ESG (Environmental, Social, Governance) metrics allows firms to better assess sustainability and regulatory compliance, leading to smarter investments.

• AI technologies assist in automating regulatory reporting, reducing compliance costs and improving transparency under rising government scrutiny.

• Australian private equity firms are launching AI-enabled funds to target sectors such as fintech, healthcare, and renewable energy, reflecting emerging market priorities.

Grab a sample PDF of this report: https://www.imarcgroup.com/australia-private-equity-market/requestsample

Market Growth Factors

The increasing demand for venture capital and buyout funds is a significant driver of growth in the Australia private equity market. Investors are notably focusing on high-growth startups and established companies with strong expansion potential, especially in technology-driven sectors like fintech, healthcare, and renewable energy. For example, Rest, one of Australia's largest superannuation funds managing approximately USD 59.52 billion, committed USD 300 million to infrastructure investments including digital infrastructure and transportation. This rising capital availability from institutional investors and family offices coupled with government-backed innovation initiatives fuels deal activity and market expansion.

Infrastructure and real estate investments are gaining significant traction amid Australia's ongoing economic expansion and urban development projects. The strategic merger of ISPT, a premier Australian property funds manager, with IFM Investors aims to enhance growth strategies and customer value in this domain. Private equity firms increasingly target large infrastructure projects such as transportation, energy, and telecommunications to capitalize on long-term returns. The real estate sector benefits from strong demand for commercial and residential properties supported by population growth. Additionally, sustainable and ESG investment strategies are becoming key focuses, positively impacting market outlook.

The growing emphasis on Environmental, Social, and Governance (ESG) factors is shaping investment strategies within the Australia private equity market. Investors demand higher sustainability and transparency, compelling private equity firms to embed ESG considerations deeply into portfolio management. These ESG initiatives are recognized to correlate closely with long-term financial performance and risk mitigation. Enhanced regulatory support and investor requirements for ESG reporting underline its importance. Firms integrating ESG models differentiate themselves and improve investment success as regulatory scrutiny intensifies, making sustainability a core competitive advantage.

Market Segmentation

Fund Type Insights:

• Buyout

• Venture Capital (VCs)

• Real Estate

• Infrastructure

• Others

Regional Insights:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Key Players

• I Squared Capital

• Rest

• ISPT

• IFM Investors

• Ares Management Corporation

• NB Private Equity Partners

Recent Developement & News

• March 2025: I Squared Capital announced Rest's commitment of USD 300 million towards infrastructure investments, targeting digital infrastructure, transportation, and renewable energy, marking a significant boost in fund allocation within the Australia private equity market.

• December 2024: ISPT merged with IFM Investors to integrate expertise in property funds management, enhancing infrastructure and real estate investment capabilities, signaling growth opportunities driven by urban development projects.

• December 2024: Ares Management Corporation launched the Ares Private Markets Fund (AUT), an Australian-domiciled unit trust allowing wholesale clients local access to North American and European private equity fund stakes, increasing market accessibility and diversity.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Request Customization : https://www.imarcgroup.com/request?type=report&id=31707&flag=E

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Private Equity Market Projected to Reach USD 48.5 Billion by 2034 here

News-ID: 4386717 • Views: …

More Releases from IMARC Group

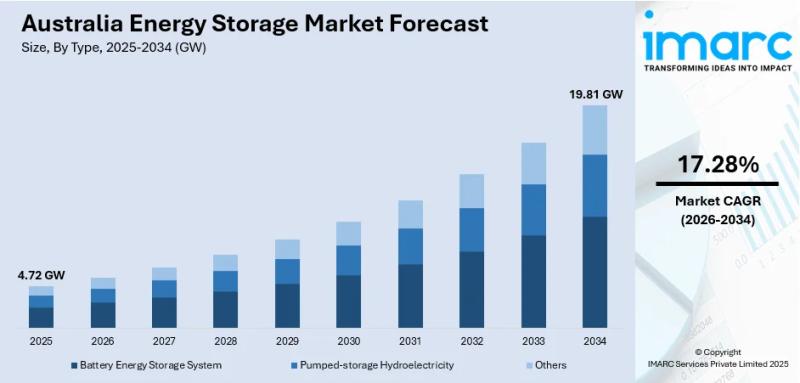

Australia Energy Storage Market Projected to Reach GW 19.81 by 2034

Market Overview

The Australia energy storage market size reached 4.72 GW in 2025 and is projected to reach 19.81 GW by 2034, growing at a compound annual growth rate of 17.28% from 2026 to 2034. This growth is fueled by rising renewable energy adoption, declining battery technology costs, and increasing electricity demand across residential, commercial, and industrial sectors. Government initiatives and investments in grid stability and modernization support this expanding market.

Australia…

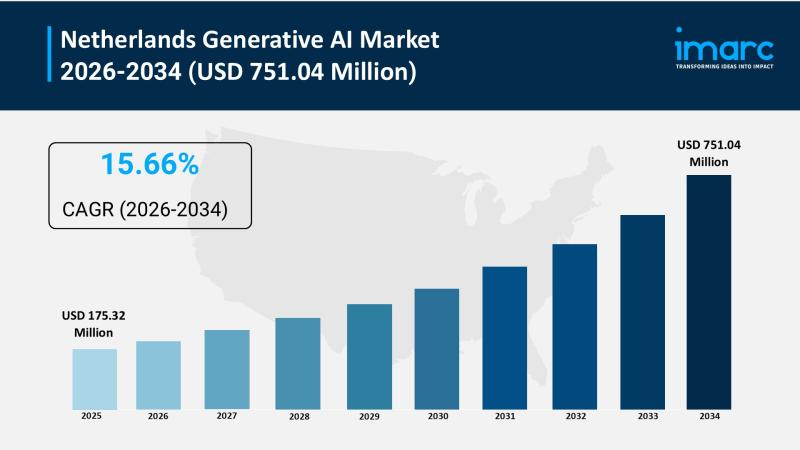

Netherlands Generative AI Market to Hit USD 751.04 Million to 2026-2034 - IMARC …

Market Overview

The Netherlands generative AI market reached a size of USD 175.32 Million in 2025. The market is expected to grow substantially, reaching USD 751.04 Million by 2034 with a CAGR of 15.66% during the 2026-2034 forecast period. The growth is driven by increasing demand for automation and personalized experiences in sectors such as healthcare, finance, and retail. Additionally, strong technology infrastructure and significant investments in AI research and development…

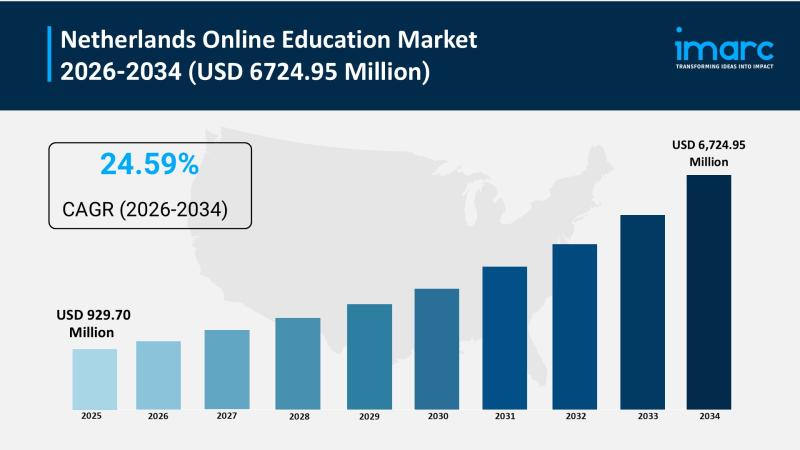

Netherlands Online Education Market Estimated to Exceed USD 6,724.95 Million By …

Market Overview

The Netherlands online education market reached a market size of USD 929.70 Million in 2025. It is predicted to grow substantially to USD 6,724.95 Million by 2034, based on a forecast period from 2026 to 2034 at a compound annual growth rate of 24.59%. The market growth is driven by increasing demand for flexible learning, rising digital literacy, widespread adoption of hybrid and remote education, government support for e-learning…

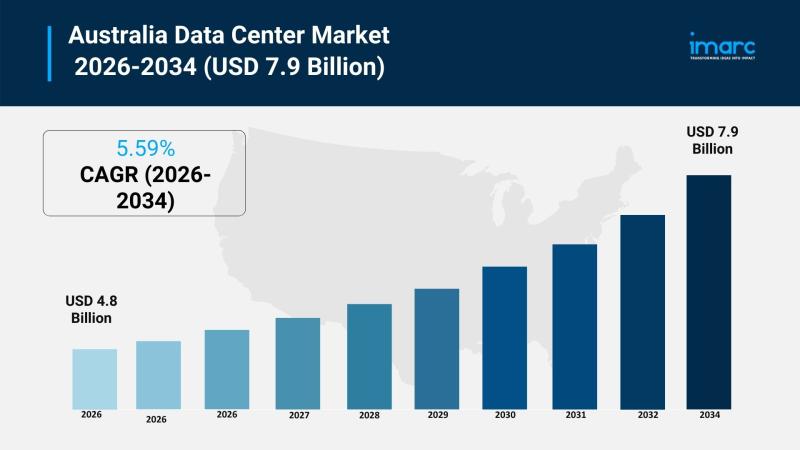

Australia Data Center Market Projected to Reach USD 7.9 Billion by 2034

Market Overview

The Australia data center market was valued at USD 4.8 Billion in 2025 and is projected to grow to USD 7.9 Billion by 2034. This expansion is driven by rising cloud adoption, an increasing digital transformation across industries, and strong demand for edge computing. Enhanced connectivity, advanced infrastructure, and government initiatives for data localization are also supporting the market growth. The market is forecasted to achieve a CAGR of…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…