Press release

Sodium Metabisulfite Manufacturing Plant DPR 2026: Investment Cost, Market Growth & ROI

The global sodium metabisulfite manufacturing industry is experiencing robust growth driven by the rapidly expanding food and beverage sector, increasing demand for water treatment solutions, and rising applications across pharmaceutical, textile, and mining industries. At the heart of this expansion lies a critical specialty chemical-sodium metabisulfite. As industries worldwide transition toward effective preservation, oxidation prevention, and water treatment methods, establishing a sodium metabisulfite manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and chemical industry investors seeking to capitalize on this growing and essential market.Market Overview and Growth Potential

The global sodium metabisulfite market demonstrates a strong growth trajectory, valued at USD 200.78 Million in 2025. According to comprehensive market analysis, the market is projected to reach USD 303.56 Million by 2034, exhibiting a robust CAGR of 4.7% from 2026-2034. This sustained expansion is driven by rapidly expanding food and beverage industry, increasing demand for water treatment chemicals, rising adoption of preservation technologies, and expanding applications in pharmaceuticals, textiles, and mining sectors.

Sodium metabisulfite is a water-soluble, white or yellowish-white crystalline chemical compound with the formula Na2S2O5. It appears as a powder or granular solid with a characteristic sulfur dioxide odor. Sodium metabisulfite serves as a versatile chemical compound widely recognized for its strong reducing, antioxidant, and preservative properties. It functions as a convenient solid replacement for gaseous sulfur dioxide in various industrial applications. Its high solubility, effective antimicrobial action, and compatibility with diverse industrial processes make it an indispensable chemical across multiple sectors.

Water treatment applications account for global consumption, with sodium metabisulfite serving critical roles in dechlorination processes and oxygen scavenging in boiler feedwater systems. The compound effectively removes excess chlorine or chloramines after disinfection processes, making water safe for discharge or further processing. Use sodium metabisulfite as a flotation agent and for cyanide detoxification in wastewater treatment.

Plant Capacity and Production Scale

The proposed sodium metabisulfite manufacturing facility is designed with an annual production capacity ranging between 20,000-30,000 tons per year, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to cater to diverse market segments-from food and beverage preservation, water treatment, pharmaceuticals, textile bleaching, leather processing, to mining and chemical synthesis applications-ensuring steady demand and consistent revenue streams across multiple industry verticals.

Request for a Sample Report: https://www.imarcgroup.com/sodium-metabisulfite-manufacturing-plant-project-report/requestsample

Financial Viability and Profitability Analysis

The sodium metabisulfite manufacturing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

Gross Profit Margins: 20-30%

Net Profit Margins: 8-15%

These margins are supported by stable demand across food, water treatment, pharmaceutical, and industrial sectors, value-added specialty chemical positioning, and the critical nature of sodium metabisulfite in preservation and oxidation prevention applications. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established chemical manufacturers looking to diversify their product portfolio in the specialty chemicals sector.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a sodium metabisulfite manufacturing plant is primarily driven by:

Raw Materials: 60-75% of total OpEx

Utilities: 15-25% of OpEx

Other Expenses: Including labor, packaging, transportation, maintenance, depreciation, and taxes

Raw materials constitute the largest portion of operating costs, with sulfur dioxide (SO2) and sodium hydroxide (NaOH) being the primary input materials. Sulfur dioxide is the primary sulfur source for sodium metabisulfite production, produced industrially through combustion of elemental sulfur, roasting of sulfide ores, or as a byproduct from smelting of non-ferrous metals. Sodium hydroxide is a fundamental industrial chemical primarily produced via the energy-intensive chlor-alkali process. Establishing long-term contracts with reliable sulfur dioxide and sodium hydroxide suppliers helps mitigate price volatility and ensures consistent raw material supply, which is critical given that raw material price fluctuations represent the most significant cost factor in sodium metabisulfite manufacturing.

Capital Investment Requirements

Setting up a sodium metabisulfite manufacturing plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to sulfur dioxide and sodium hydroxide suppliers is essential. Proximity to target industrial markets will help minimize distribution costs. The site must have robust infrastructure, including reliable transportation networks, utilities (electricity, water, gas), and waste management systems. Crucial considerations for handling fuming acids, corrosive gases (SO2), and strong alkalis (NaOH) are essential. Buildings must be well-ventilated and designed for chemical resistance and safety. Compliance with local zoning laws, environmental regulations, and safety standards must also be ensured.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers specialized manufacturing equipment essential for production. Key machinery includes:

• SO2 Gas Absorption Towers for efficient absorption of sulfur dioxide into sodium carbonate or sodium hydroxide solution

• Controlled Reaction Vessels for chemical synthesis under regulated temperature and pressure conditions

• Crystallization Equipment for promoting crystal formation from reaction solution

• Centrifuge or Filtration Systems for solid-liquid separation of crystals from mother liquor

• Drying Equipment (Spray Dryers or Rotary Dryers) for moisture control and achieving final product specifications

• Milling and Grinding Machinery for achieving desired particle size distribution

• Screening and Sieving Equipment for particle size classification and quality control

• Packaging Lines for filling moisture-resistant bags, drums, or bulk containers for storage and transport

• Quality Control Laboratory Equipment for nutrient content, purity testing, and specification verification

• Effluent Treatment Systems for managing acidic effluents, SO2 emissions, and ensuring environmental compliance

• Storage Tanks and Silos for raw material and finished product storage with appropriate safety systems

Civil Works: Building construction, factory layout optimization, and infrastructure development designed to enhance workflow efficiency, ensure workplace safety, and minimize material handling complexities throughout the production process. The layout should be optimized with separate areas for raw material storage, SO2 gas absorption zone, reaction and crystallization unit, filtration and centrifuge section, drying unit, milling and sieving area, quality control laboratory, finished goods warehouse, utility block, effluent treatment area, and administrative block. Buildings must incorporate proper ventilation systems, corrosion-resistant materials, emergency response infrastructure, and compliance with chemical industry safety standards.

Other Capital Costs: Pre-operative expenses, machinery installation costs, regulatory compliance certifications (environmental permits, hazardous chemical handling certifications), initial working capital requirements, and contingency provisions for unforeseen circumstances during plant establishment. Investment in emission control systems is essential to meet stringent SO2 emission regulations.

Speak to Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=9693&flag=C

Major Applications and Market Segments

Sodium metabisulfite products find extensive applications across diverse market segments, demonstrating their versatility and critical importance:

Food and Beverage Preservation: Primary use as a preservative, antioxidant, and coloring-fixing agent in food products. Widely used in wine production (sterilization and oxidation prevention), dried fruits (apricots, raisins), fruit juices, seafood processing, baked goods, and vegetable preservation. Food-grade sodium metabisulfite meets strict purity standards required for direct food contact applications. Its antimicrobial properties help extend shelf life depending on product type, preventing spoilage by inhibiting microbial growth and oxidative browning.

Water Treatment: Critical applications in municipal and industrial water treatment for dechlorination processes. Functions as a reducing agent to remove excess chlorine or chloramines after disinfection, making water safe for discharge or further processing. Used as an oxygen scavenger in boiler feedwater to prevent corrosion. Essential for wastewater treatment in compliance with environmental discharge standards.

Pharmaceuticals: Serves as an excipient (inactive ingredient) in various pharmaceutical preparations. Acts as an antioxidant to prevent oxidation of active ingredients, especially in injectable drugs (e.g., adrenaline/epinephrine solutions), eye drops, and oral drug solutions, thereby increasing medication stability and shelf life. Critical for maintaining drug potency and preventing degradation.

Textile and Leather Industry: Applications in textile production as a bleaching agent and reduction agent for dyeing and finishing operations. Helps improve color fastness, fabric brightness, and dye consistency. Used in leather processing for bleaching applications.

Pulp and Paper Industry: Significant utilization in paper and pulp manufacturing as a bleaching agent and for rust removal operations. The sector represents a major end-use application due to the product being significantly safer, less expensive, and easily accessible for paper processing operations.

Mining Industry: Utilized in mining operations for cyanide detoxification in wastewater treatment, as it oxidizes cyanide to less harmful compounds. Used as a flotation agent for separating precious metals from ore. Essential for environmental compliance and safe disposal of mining waste materials.

Other Industrial Applications: Used as a reducing agent in various chemical synthesis processes, as a component in certain detergents and cosmetics formulations, in photographic and film processing (though declining due to digitalization), and in construction chemicals. End-use industries include food and beverage, water treatment, pharmaceuticals, textiles, leather, pulp and paper, mining, chemical synthesis, and specialty industrial applications, all of which contribute to sustained market demand.

Why Invest in Sodium Metabisulfite Manufacturing?

Several compelling factors make sodium metabisulfite manufacturing an attractive investment opportunity:

Essential Specialty Chemical Segment: Sodium metabisulfite serves as a critical specialty chemical supporting food preservation, water treatment, pharmaceutical formulations, and diverse industrial processes, making it indispensable for modern industries focused on product quality, safety, and regulatory compliance.

Expanding Water Treatment Infrastructure: Stringent environmental regulations and water quality standards across countries are driving demand for effective dechlorination chemicals. Industrial wastewater treatment requirements, and increasing regulatory pressure for water quality improvement.

Multi-Industry Demand Diversification: The product's versatility across food preservation, water treatment, pharmaceuticals, textiles, mining, and chemical synthesis ensures steady demand and reduces market concentration risk. This diversification provides revenue stability across multiple industry verticals.

Regulatory Support and Food Safety Focus: The Food and Drug Administration (FDA) and European Union have approved the utility of sodium metabisulfite in the food industry as a food additive (E223), supporting its continued use in food preservation. Growing focus on food safety, shelf-life extension, and regulatory compliance drives sustained demand.

Rising Pharmaceutical Applications: Increasing use as an excipient in medications, particularly those sensitive to oxidation, to prevent degradation and improve stability. Advances in pharmaceutical technologies and government investments in healthcare are expected to drive this demand segment.

Import Substitution Opportunities: Emerging economies such as India, China, Brazil, and Southeast Asian countries are expanding local manufacturing as part of their strategy to reduce dependence on imported specialty chemicals, creating opportunities for domestic producers to capture market share.

Technological Advancements: Innovations in production technologies focusing on emission reduction, energy efficiency, and dust-free granule production are enhancing product quality and environmental sustainability. Manufacturers are developing low-dust and low-emission formulations to fulfill workplace safety standards.

Asia-Pacific Growth Leadership: The Asia-Pacific region, led by China, India, and South Korea, accounts for global market share. Rapid industrialization, growing food processing sectors, expanding textile and leather industries, and increasing water treatment infrastructure provide exceptional growth opportunities.

Manufacturing Process Excellence

The sodium metabisulfite manufacturing process involves several precision-controlled stages using chemical synthesis methodology:

• Raw Material Preparation: Sulfur dioxide (SO2) is produced through combustion of elemental sulfur or obtained from smelting operations. Sodium hydroxide (NaOH) solution or sodium carbonate (Na2CO3) solution is prepared at specified concentrations.

• SO2 Gas Absorption: Sulfur dioxide gas is passed through absorption towers containing sodium hydroxide or sodium carbonate solution. The chemical reaction produces sodium sulfite (Na2SO3) and sodium bisulfite (NaHSO3) in solution.

• Metabisulfite Formation: Additional sulfur dioxide is introduced to the solution of sodium sulfite and sodium bisulfite under controlled temperature conditions. The chemical reaction yields sodium metabisulfite (Na2S2O5) in solution.

• Crystallization: The reaction mixture is cooled to promote crystal formation of sodium metabisulfite from the concentrated solution.

• Solid-Liquid Separation: Crystals are separated from the mother liquor using centrifuge or filtration systems to recover sodium metabisulfite crystals.

• Drying: Wet crystals are dried using spray dryers or rotary dryers to achieve the specified moisture content and final product specifications.

• Milling and Grinding: Dried material is milled and ground to achieve uniform particle size distribution according to customer requirements (powder, granular, or crystal forms).

• Screening and Quality Control: Product is screened and sieved for particle size classification. Quality control testing verifies SO2 content, purity, pH, heavy metals, and other specifications.

• Packaging: Final product is packed into moisture-resistant bags, drums, or bulk containers for storage and transport. Proper packaging prevents moisture absorption and SO2 loss during storage.

The process requires strict temperature control, proper ventilation systems, SO2 emission control equipment, and comprehensive safety protocols for handling corrosive chemicals. Environmental compliance measures include effluent treatment for managing acidic wastewater and scrubbing systems for controlling SO2 emissions.

Buy Now:

https://www.imarcgroup.com/checkout?id=9693&method=2175

Industry Leadership

The global sodium metabisulfite industry is led by established chemical manufacturers with extensive production capabilities and diverse application portfolios.

Key industry players include:

Akkim

BASF SE

Solvay

Grillo-werke

Esseco USA

Hydrite Chemical

Surpass Chemical

Aditya Birla Chemicals

Seidler Chemical

Tangshan Sanjiang Chemical

Weifang Taida United chemical

Ineos Calabrian corporation

Santa Cruz Biotechnology

These companies serve diverse end-use sectors including food and beverage, water treatment, pharmaceuticals, textiles, leather, pulp and paper, mining, and chemical synthesis, demonstrating the broad market applicability of sodium metabisulfite products. Major manufacturers are investing in capacity expansions, R&D initiatives for high-purity grades, and sustainable production technologies to meet growing market demand.

Recent Industry Developments

September 2025: Southern Ionics revealed plans to invest in its sulfur chemicals manufacturing plant in Tuscaloosa, Alabama, focusing on capacity expansion, infrastructure modernization, and the addition of sodium metabisulfite production. This initiative is intended to reinforce domestic supply across water treatment, food processing, chemical manufacturing, and pharmaceutical sectors.

August 2025: China's National Health Commission (NHC) released notices confirming the acceptance of applications for three new food-related products. These include fermented mycelial protein sourced from Fusarium venenatum as a novel food ingredient and sodium metabisulfite as a new food additive. Issued between July and August 2025, the announcements signal continued progress in China's regulatory assessment of innovative food ingredients and additives.

Conclusion

The sodium metabisulfite manufacturing sector presents a strategically positioned investment opportunity at the intersection of food preservation, water treatment, pharmaceutical applications, and diverse industrial processes. With favorable profit margins ranging from 20-30% gross profit and 8-15% net profit, strong market drivers including expanding food and beverage industry, growing water treatment infrastructure, rising pharmaceutical applications, increasing textile and mining sector requirements, and supportive regulatory frameworks governing food safety and environmental standards, establishing a sodium metabisulfite manufacturing plant offers significant potential for long-term business success and sustainable returns.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers create a lasting impact. The company excels in understanding its clients' business priorities and delivering tailored solutions that drive meaningful outcomes. IMARC Group provides a comprehensive suite of market entry and expansion services, including market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Sodium Metabisulfite Manufacturing Plant DPR 2026: Investment Cost, Market Growth & ROI here

News-ID: 4384389 • Views: …

More Releases from IMARC Group

Cost of Setting Up a PET Bottle Manufacturing Plant & DPR 2026

The global PET bottle industry is experiencing sustained growth propelled by rising packaged beverage consumption, pharmaceutical packaging expansion, increasing demand for ready-to-drink products, and the lightweight, recyclable advantages of PET packaging. As urbanization accelerates, consumer lifestyles shift toward convenience packaging, and regulatory frameworks increasingly mandate recyclable materials, establishing a PET bottle manufacturing plant positions investors in one of the most stable and essential segments of the consumer packaging value chain.

IMARC…

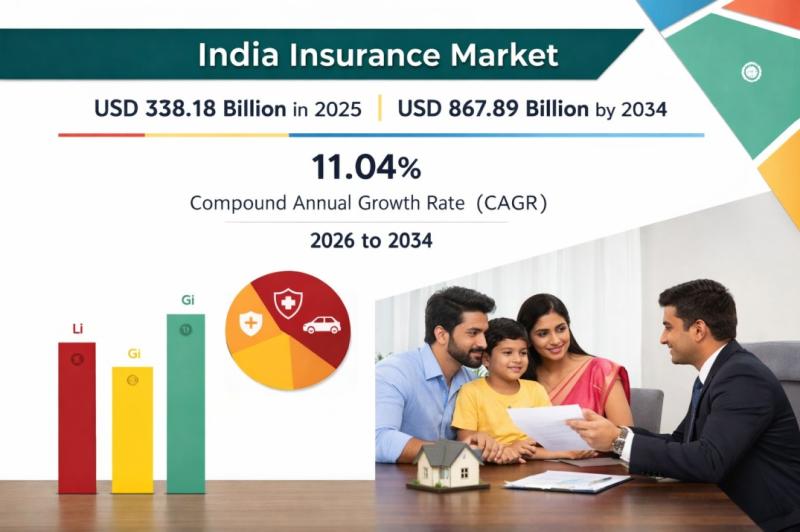

India Insurance Market Forecast 2026: Industry Size, Expansion & Future Scope 20 …

India Insurance Market Overview 2026-2034

According to IMARC Group's report titled India Insurance Market Size, Share, Trends and Forecast by Type of Product, Distribution Channel, End User, and Region, 2026-2034 the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

The India insurance market size was valued at USD 338.18 Billion in 2025 and is projected to reach USD 867.89 Billion by 2034, growing at…

Global Diammonium Phosphate (DAP) Prices January 2026: Asia Gains, Europe Steady …

What is Diammonium Phosphate (DAP)?

Diammonium Phosphate (DAP) is a widely used phosphorus-based fertilizer crucial for global agriculture. Monitoring Diammonium Phosphate (DAP) prices helps manufacturers, distributors, and buyers make informed procurement decisions and manage costs amid fluctuating demand and supply conditions.

Global Price Overview

The global Diammonium Phosphate (DAP) market shows moderate stability with regional supply differences affecting prices. The Diammonium Phosphate (DAP) price trend has remained mixed, while the price index and…

Titanium Prices, Index, Supply Factors & Uses | Jan 2026

North America Titanium Prices Movement Jan 2026

In January 2026, Titanium prices in North America reached USD 7.09/KG, reflecting a 3.1% increase. The upward movement was supported by firm demand from aerospace, automotive, and defense industries. Stable raw material supply and improving manufacturing activity strengthened market sentiment, contributing to positive pricing momentum across the region.

Regional Analysis: The price analysis can be extended to provide detailed Titanium price information for the following…

More Releases for SO2

Electronic Grade Sulfur Dioxide (SO2) Market Trends: the market is projected to …

QYResearch latest industry analysis shows the global Electronic Grade Sulfur Dioxide (SO2) market reached US$10 million in 2024 and is projected to grow to US$35.1 million by 2031, representing a robust 20.0% CAGR from 2025 to 2031. Although electronic-grade SO2 is still in the early stages of commercialization, research momentum and infrastructure investments are accelerating adoption. The compound is gaining attention in semiconductor etching, lithium battery recycling, and laboratory corrosion…

Complex Iron Desulfurization Catalyst Market Grows Amid Demand for Cleaner Indus …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the " Complex Iron Desulfurization Catalyst Market- (By Form (Dry, Wet), By Application (Refinery Gas Treatment, Natural Gas Processing, Biogas Treatment, Ammonia Synthesis, Others), By End-User (Water Treatment, Oil and Gas, Chemical Industry, Others)), Trends, Industry Competition Analysis, Revenue and Forecast To 2034."

According to the latest research by InsightAce Analytic, the Complex Iron Desulfurization Catalyst Market is…

Flue Gas Desulfurization Market (FGD): Protecting the Environment from SO2 Emiss …

The Flue Gas Desulfurization Market is estimated to record significant growth by reaching at a CAGR of 5.5% during the forecast period (2024-2031).

Flue Gas Desulfurization Market report, published by DataM Intelligence, provides in-depth insights and analysis on key market trends, growth opportunities, and emerging challenges. Committed to delivering actionable intelligence, DataM Intelligence empowers businesses to make informed decisions and stay ahead of the competition. Through a combination of qualitative…

Global Electronic Grade Sulfur Dioxide (SO2) Market Imapct of AI and Automation

Electronic Grade Sulfur Dioxide (SO2) Market Impact of AI and Automation

The global Electronic Grade Sulfur Dioxide (SO2) market was valued at approximately USD 1.5 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of around 6.2% over the forecast period. This growth is driven by the increasing demand for high-purity SO2 in the electronics industry, particularly for the production of semiconductors and other high-tech…

High Purity Sulfur Dioxide (SO2) Market Opportunities, Sales, Revenue, Gross Mar …

LOS ANGELES, United States: QY Research offers an encyclopedic study of the global High Purity Sulfur Dioxide (SO2) market with holistic insights into vital factors and aspects that impact future market growth. The global High Purity Sulfur Dioxide (SO2) market has been analyzed for the forecast period 2023-2029 and historical period 2015-2020. In order to help players to gain comprehensive understanding of the global High Purity Sulfur Dioxide (SO2) market and…

High Purity Sulfur Dioxide (SO2) Market 2023 Key Factors and Emerging Opportunit …

Los Angeles, United State: The global High Purity Sulfur Dioxide (SO2) market is comprehensive and accurately presented in the report with the help of detailed market information and data, critical findings, error-free statistics, and reliable forecasts. The report digs deep into important aspects of the global High Purity Sulfur Dioxide (SO2) market, including competition, segmentation, regional expansion, and market dynamics. Each leading trend of the global High Purity Sulfur Dioxide…