Press release

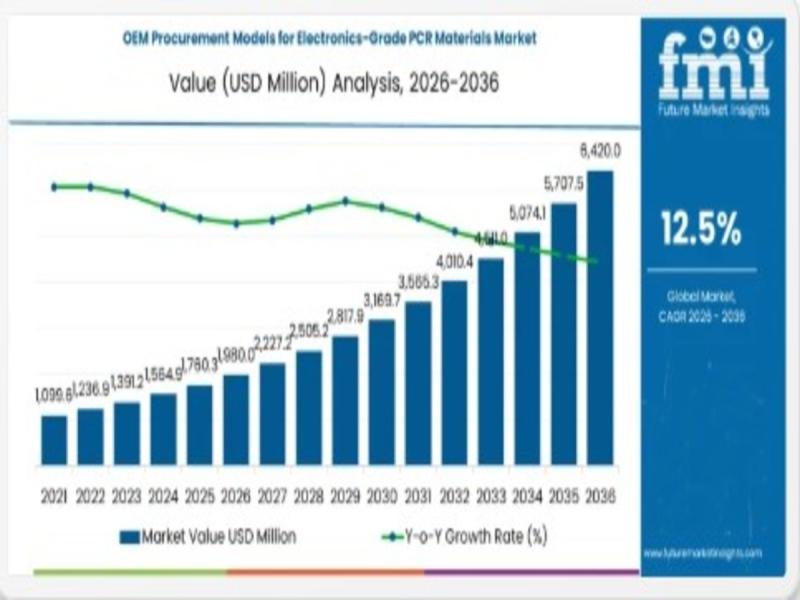

OEM Procurement Models for Electronics-Grade PCR Materials Market Set to Soar from $1,980 Million in 2026 to $6,420 Million by 2036 at a 12.5% CAGR

The global OEM Procurement Models for Electronics-Grade PCR Materials Market is entering a high-growth phase, projected to surge from an estimated USD 1,980.0 million in 2026 to USD 6,420.0 million by 2036, posting a robust 12.5% compound annual growth rate (CAGR) over the forecast period, underpinned by strategic sourcing trends among leading electronics OEMs. This transformation marks a decisive pivot toward structured, quality-driven supply chain frameworks that embed post-consumer recycled (PCR) materials as engineered inputs rather than commodity alternatives, boosting performance assurance and sustainability across electronics portfolios.Key Market Insights at a Glance

The market's expansion is being propelled by escalating demands for consistent supply, traceability, and quality compliance in electronics manufacturing. OEMs are increasingly favoring long-term certified supply agreements, which dominate procurement strategies by locking in quality thresholds, audit rights, and batch traceability requirements that align with product reliability and regulatory expectations. Rising sustainability mandates and heightened contamination control needs are accelerating adoption of structured procurement frameworks, aimed at mitigating production risks while achieving recycled content targets.

Segment Overview

By procurement model, long-term certified supply agreements account for approximately half of the market share, reflecting OEMs' preference for stable, pre-qualified PCR sources over volatile spot markets. Electronics end-use segments, led by smartphones, laptops, and IT hardware, claim a dominant position with roughly 45% share, as these categories demand stringent material performance metrics including mechanical resilience, thermal stability, and cosmetic consistency across global device portfolios. This alignment between procurement discipline and end-use demands underscores a broader shift toward integrated PCR strategies that support both quality benchmarks and sustainability claims through device lifecycles.

Regional Overview

Geographically, Asia Pacific, North America, and Europe emerge as the fastest-growing regional markets, with China leading adoption dynamics at a 14.0% CAGR through 2036. In China, large-scale electronics production and export compliance drive OEMs toward certified supplier programs and batch verification protocols to meet global expectations. The United States follows with solid growth driven by ESG disclosure integration and compliance reporting frameworks, while Europe's regulatory rigor reinforces structured procurement commitments. South Korea and Japan also contribute meaningful growth, led by precision manufacturing and quality-centric integration strategies.

Request for Sample Report | Customize Report |purchase Full Report - https://www.futuremarketinsights.com/reports/sample/rep-gb-30974

Competitive Landscape

The competitive terrain of the OEM procurement models market is defined by strategic alignment between global OEMs and material suppliers that can guarantee compliance, traceability, and performance. Leading electronics brands such as Apple, HP, and Dell are anchoring procurement around long-term supplier qualifications and closed-loop material strategies. Meanwhile, industrial innovators like Bosch and Panasonic integrate vertical procurement models emphasizing internal quality standards and dual-source frameworks. Material developers including BASF, Covestro, and Mitsubishi Chemical are transitioning from transactional suppliers to strategic partners by delivering tailored PCR grades engineered for electronics applications. High-volume processors such as Foxconn and Kingfa compete through scale and rapid qualification support.

Market Outlook: Powering the Next Decade

Looking ahead, the market is poised to play a pivotal role in powering sustainable electronics production over the next decade. The rise of digital supplier management tools, real-time quality tracking systems, and integrated procurement analytics will enhance visibility across PCR material flows, enabling OEMs to synchronize sourcing decisions with product designs and compliance workflows. As recycled content targets tighten globally and ESG reporting becomes integral to brand reputation, structured procurement models that emphasize resilience, consistency, and risk management will be indispensable in stabilizing supply chains and driving adoption of high-quality PCR materials.

Key Players of Sustainable Materials Procurement

Major companies shaping this landscape include Apple (approved suppliers), HP, Dell, Bosch, BASF, Covestro, Foxconn, Kingfa, Panasonic, and Mitsubishi Chemical. These organizations are at the forefront of embedding certification standards, collaborative development frameworks, and traceable quality assurance into their sourcing strategies, setting new benchmarks for sustainable procurement excellence in electronics production.

Recent Strategic Developments

Recent moves in the sector highlight concerted efforts to optimize PCR material supply chains. Industry leaders are extending supplier qualification cycles, narrowing approved supplier lists, and structuring contracts around guaranteed volumes and indexed pricing to reduce variability risks. Co-development initiatives between OEMs and compounders are aligning material properties with OEM specifications, accelerating qualification timelines and ensuring consistent performance across complex electronics assemblies. As sustainability transitions from aspirational to operational, these developments underscore a key industry inflection point where procurement strategy becomes a competitive differentiator.

Purchase Full Report for Detailed Insights: https://www.futuremarketinsights.com/reports/oem-procurement-models-for-electronics-grade-pcr-materials-market

Why Choose FMI: https://www.futuremarketinsights.com/why-fmi

Explore More Related Studies Published by FMI Research:

Asia Pacific Plastic Additives Market https://www.futuremarketinsights.com/reports/asia-pacific-plastic-additives-market

Antimicrobial Additives Market https://www.futuremarketinsights.com/reports/global-antimicrobial-additives-market

Sheath Materials Market https://www.futuremarketinsights.com/reports/sheath-materials-market

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware - 19713, USA

T: +1-347-918-3531

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release OEM Procurement Models for Electronics-Grade PCR Materials Market Set to Soar from $1,980 Million in 2026 to $6,420 Million by 2036 at a 12.5% CAGR here

News-ID: 4384189 • Views: …

More Releases from Future Market Insight Inc

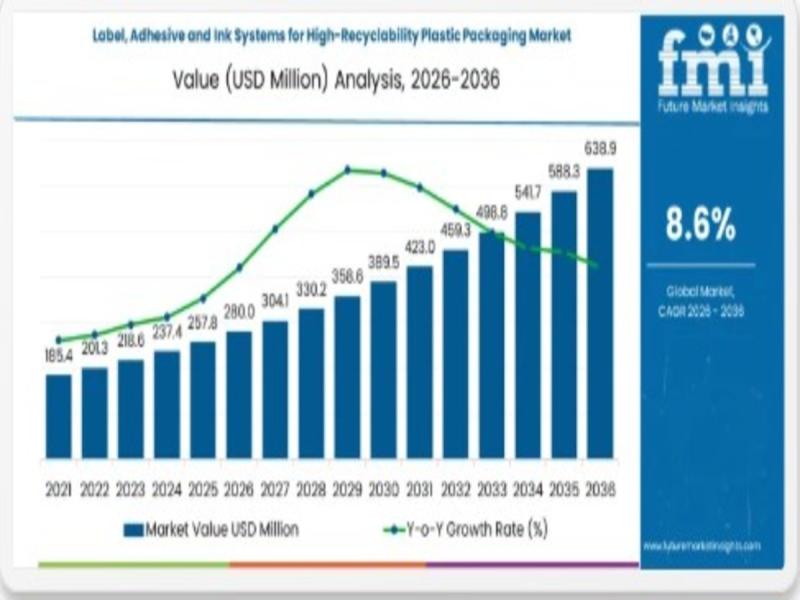

Label, Adhesive & Ink Systems Market Set to Hit USD 638.9 Million by 2036 | FMI …

The global Label, Adhesive and Ink Systems Market is projected to soar from an estimated USD 280.0 million in 2026 to USD 638.9 million by 2036, reflecting a compelling Compound Annual Growth Rate (CAGR) of 8.6% over the forecast period, as the industry accelerates toward sustainable, recycling-friendly packaging solutions. This data-driven outlook underscores a fundamental shift in how brands, converters, and material suppliers align with circular economy mandates and consumer…

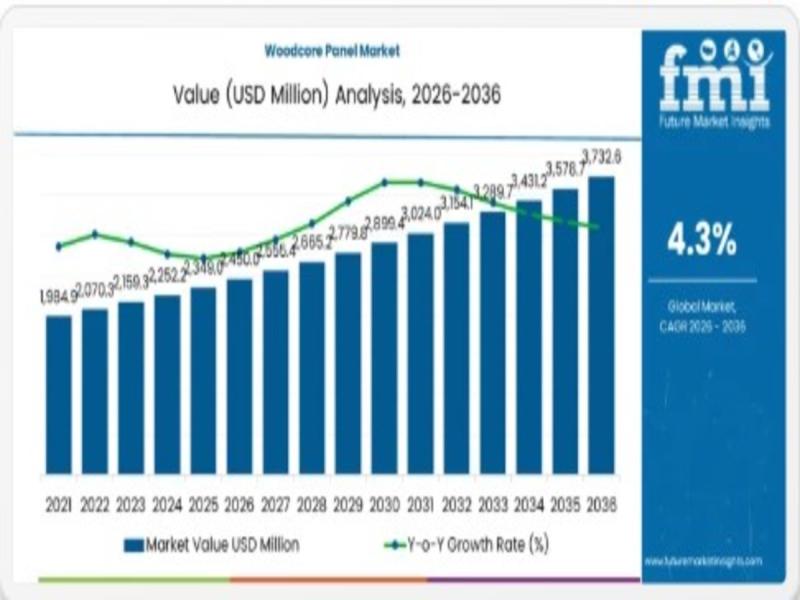

Woodcore Panel Market Set to Surge Past USD 3.7 Billion by 2036, Backed by Rapid …

The global woodcore panel market is poised for robust expansion in the coming decade, with the industry projected to grow from an estimated USD 2,450.0 million in 2026 to around USD 3,732.6 million by 2036, registering a steady compound annual growth rate (CAGR) of approximately 4.3%. This growth trajectory is underpinned by rising demand for versatile woodcore panels in furniture manufacturing, interior fit-outs, architectural applications, and modular construction, where dimensional…

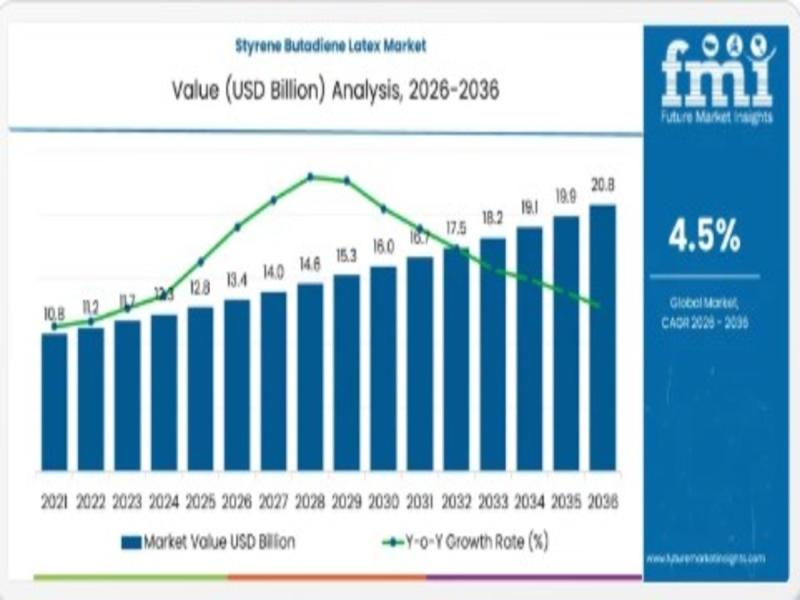

Styrene Butadiene Latex Market Set to Soar to Nearly $21B by 2036 - Driving Inno …

The global styrene butadiene latex market is on track to expand significantly, projected to grow from an estimated USD 13.4 billion in 2026 to USD 20.8 billion by 2036, reflecting a compound annual growth rate (CAGR) of 4.5% over the forecast period, driven by surging demand from core end-use sectors such as paper & paperboard coatings, adhesives, and construction materials. This growth underscores the material's indispensable role as a cost-effective,…

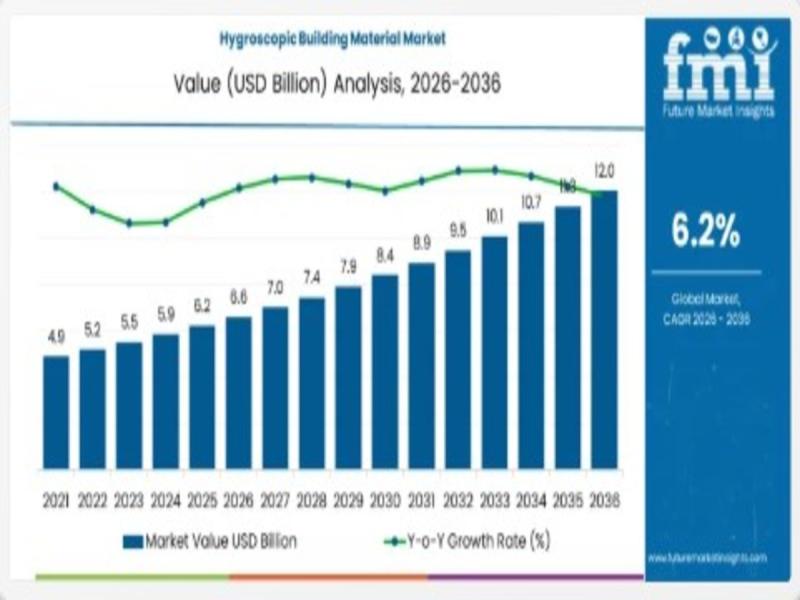

Hygroscopic Building Material Market Set to Double to $12 Billion by 2036, Drivi …

The global Hygroscopic Building Material Market - materials that absorb and release moisture to optimize indoor humidity and energy use - is projected to expand from an estimated USD 6.6 billion in 2026 to USD 12 billion by 2036, registering a robust CAGR of 6.2% during the forecast period. This dynamic growth reflects accelerating adoption of sustainability-focused construction practices that prioritize energy savings, improved indoor air quality, and long-term comfort…

More Releases for OEM

OEM Partnership Guide: Working with a Touch-free Automatic Kitchen Garbage Can O …

With increasing global demand for smart home solutions, Sinoware International Ltd, a top provider in household products industry, is pleased to unveil expanded OEM partnership initiatives.

Sinoware has established itself in Jiangmen--China's premier stainless steel industry zone--as an indispensable touch-free automatic kitchen garbage can OEM manufacturer for global brands seeking to incorporate high-tech sanitation solutions into their portfolios.

By combining their decades-old tradition of metal craftsmanship with cutting-edge infrared and…

Revolutionizing OEM Coatings With Sustainable Solutions Trend: A Crucial Influen …

Which drivers are expected to have the greatest impact on the over the oem coatings market's growth?

The surge in requirements from final consumer industries is forecasted to boost the expansion of the OEM coatings market. These coatings, referred to as OEM, are utilized during the integration of other firms' products into the substrate process or application. They prove to be beneficial for a variety of end-user sectors, including automotive and…

OEM Technology Partnerships Launches Brokerage Specializing in 100+ OEM Technolo …

San Francisco, California, USA - February 13, 2025 - OEM Technology Partnerships is thrilled to announce the launch of its specialized brokerage focused on connecting businesses with a comprehensive portfolio of over 100 Original Equipment Manufacturer (OEM) technologies. This new venture is poised to revolutionize how companies access and implement cutting-edge solutions across diverse industries.

Leveraging deep industry expertise and a vast network of OEM partners, OEM Technology Partnerships offers a…

OEM or ODM Watches? What's the Difference?

When searching for a watch manufacturer for your store or watch brand, you may come across the terms OEM and ODM. But do you truly understand the difference between them? In this article, we will delve into the distinctions between OEM and ODM watches to help you better grasp and choose the manufacturing service that suits your needs.

Image: https://www.naviforce.com/uploads/15a6ba3911.png

What's OEM / ODM Watches [https://www.naviforce.com/products/]

OEM (Original Equipment Manufacturer) watches are produced…

OEM Partnership with Extreme Networks

ComputerVault announces an OEM partnership with Extreme Networks and has certified its switches for use with ComputerVault enterprise software to deliver virtual desktop infrastructure (VDI).

Extreme Networks industry leading switches deliver ComputerVault Virtual Desktops at faster than PC speeds in the LAN and WAN.

“ComputerVault is very excited to work with Extreme Networks. Not only are their switches very reliable, but their exceptional performance guarantees a great user experience”, said Marc…

Humidity Measurement Module for OEM Applications

The EE1900 humidity module from E+E Elektronik is optimised for the measurement of relative humidity (RH) or dew point temperature (Td) in climate and test chambers. With outstanding temperature compensation across the working range from -70 °C to 180 °C (-94 °F to 356 °F) and the choice of stainless steel and plastic probes, the module is suitable for a wide range of applications.

High Accuracy in Harsh Environment

The excellent…