Press release

Wall Putty Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Project Cost

Wall putty has become an indispensable component of the modern construction industry, serving as a critical finishing material applied to interior and exterior walls before painting. Manufactured from white cement or acrylic bases, wall putty creates a smooth, protective layer that fills minor cracks, gaps, and surface imperfections, significantly enhancing paint adhesion, coverage, and longevity. With its ability to resist moisture penetration and prevent coating deterioration, wall putty is now considered essential rather than optional across residential, commercial, institutional, and industrial construction projects.IMARC Group's report, "Wall Putty Manufacturing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," offers a comprehensive guide for establishing a plant. The wall putty manufacturing plant setup report offers insights into the process, financials, capital investment, expenses, ROI, and more for informed business decisions.

The market for this product continues to expand, driven by surging construction activity, growing demand for high-quality surface finishing materials, and rapid growth in both residential and commercial real estate developments. The India wall putty market was valued at USD 41.18 Million in 2025 and is projected to reach USD 63.89 Million by 2034, growing at a CAGR of 5.0% from 2026 to 2034. This robust growth trajectory presents a highly attractive investment opportunity for entrepreneurs and established manufacturers alike.

Market Overview and Growth Potential

The wall putty industry is experiencing sustained growth fueled by residential housing expansion, commercial construction development, and accelerating infrastructure projects across both emerging and developed economies. Consumer awareness regarding proper surface preparation and durable paint finishes has elevated wall putty from an optional add-on to a fundamental building material.

Government initiatives continue to strengthen this momentum - for instance, India's Union Budget 2025-26 outlined plans to connect 120 new airports over the coming decade, while January 2025 approvals covered 56 watershed projects valued at INR 700 crore.

Such expanding infrastructure and construction activity directly supports rising demand for wall putty across residential and public works segments. Additionally, urban redevelopment initiatives, renovation projects, and government housing programs are creating new growth avenues. Advances in formulation technology have further enhanced product performance, delivering improved moisture resistance, superior workability, and greater durability.

Plant Capacity and Production Scale

The proposed wall putty manufacturing facility is designed with an annual production capacity of 50,000 MT, providing significant economies of scale while maintaining operational flexibility. This capacity enables the plant to serve multiple market segments, from residential construction and commercial real estate to infrastructure development and renovation services. The scalable manufacturing process allows for incremental capacity expansion with relatively modest additional capital investment, positioning the facility to capture growing market share as demand increases across both domestic and export markets.

Request Sample: https://www.imarcgroup.com/wall-putty-manufacturing-plant-project-report/requestsample

Financial Viability and Profitability Analysis

The wall putty manufacturing project demonstrates exceptionally attractive profitability potential under standard operating conditions, with margins well above many comparable building material segments. Financial projections are built on realistic assumptions covering capital investment, operating costs, capacity utilization, pricing dynamics, and demand outlook.

• Gross Profit Margins: Typically range between 30-40%, underpinned by stable demand and the high value-addition nature of the product.

• Net Profit Margins: Estimated at 15-22%, reflecting strong bottom-line returns that compare favorably with many construction material manufacturing operations.

These projections offer a comprehensive view of the project's financial viability, return on investment, and long-term sustainability, making wall putty manufacturing a compelling proposition for both new entrants and diversifying construction material companies.

Operating Cost Structure

The operating cost structure of a wall putty manufacturing plant is predominantly influenced by raw material procurement.

• Raw Materials: 60-70% of OpEx

• Utilities: 5-10% of OpEx

Other key raw materials include calcium carbonate, polymers (redispersible polymer powder/RDP), and cellulose ether. The remaining operational expenditure covers transportation, packaging, salaries and wages, depreciation, taxes, repairs and maintenance, and miscellaneous expenses. Establishing long-term procurement agreements with dependable suppliers of white cement and other critical inputs is vital for managing price volatility and ensuring uninterrupted production. Strategic sourcing from geographically proximate suppliers further helps minimize logistics costs and strengthens supply chain resilience.

Speak to an Analyst: https://www.imarcgroup.com/request?type=report&id=7700&flag=C

Capital Investment Requirements

Setting up a wall putty manufacturing plant requires a structured capital investment plan covering several critical cost categories. The total capital expenditure varies based on plant capacity, technology selection, and geographic location. The primary CapEx components include:

• Land and Site Development: Encompasses land acquisition, site preparation, boundary development, registration charges, and foundational infrastructure. This allocation establishes the physical base for safe and efficient manufacturing operations.

• Machinery and Equipment: Constitutes the largest share of total CapEx. Essential machinery includes crushers, pulverizers, ribbon blenders, dust collection systems, storage silos, automated packaging machines, and quality inspection systems. The degree of automation and production scale directly influence the overall machinery investment.

• Civil Works: Covers construction of the manufacturing facility, raw material and finished goods storage areas, quality control laboratories, and administrative offices.

• Other Capital Costs: Includes infrastructure and utility installations such as electrical systems, water supply, steam generation, environmental compliance equipment, and effluent treatment facilities.

Major Applications and Market Segments

Wall putty serves a broad spectrum of end-use applications, offering manufacturers diversified revenue streams across the construction value chain:

• Residential Construction: Serves as an essential finishing material in housing projects, delivering smooth wall surfaces and long-lasting paint protection for homes and apartments.

• Commercial and Institutional Buildings: Provides offices, hospitals, educational institutions, and retail spaces with high-quality surface finishing and efficient long-term maintenance capabilities.

• Infrastructure and Public Works: Government institutions and large-scale infrastructure projects utilize wall putty to enhance building aesthetics while protecting exterior surfaces against weathering and environmental degradation.

• Renovation and Repainting Services: Functions as a critical material in refurbishment and surface restoration activities, serving the consistent demand generated by maintenance and repainting cycles.

Why Invest in Wall Putty Manufacturing?

• Growth in Construction Activity: Expanding urban areas and increasing infrastructure development projects are driving heightened demand for premium wall finishing products, with government housing schemes and real estate development providing additional momentum.

• High Value Addition: Wall putty significantly enhances paint performance and surface quality, enabling manufacturers to achieve attractive profit margins that outperform many other construction material categories.

• Consistent Demand Across Cycles: Beyond new construction, ongoing maintenance, renovation, and repainting activities generate recurring demand, providing revenue stability even during cyclical construction downturns.

• Scalable Manufacturing Process: The production process requires relatively modest initial capital and can be expanded incrementally, allowing manufacturers to scale operations in line with market growth.

• Strong Distribution Potential: The product's applicability across both residential and commercial segments creates multiple effective distribution pathways, from retail dealer networks to institutional procurement channels.

Industry Leadership

The global wall putty industry is supported by several established manufacturers with extensive production capacities and diversified application portfolios.

• ABC Phil Inc.

• Aditya Birla Management Corp. Pvt. Ltd.

• Akzo Nobel NV

• Arkema Group

• Asian Paints Ltd.

These companies serve end-use sectors spanning residential, commercial, infrastructure, and renovation segments, setting industry benchmarks for product quality, innovation, and market reach. Recent strategic developments include Aditya Birla Group's April 2025 acquisition of 100% equity in Wonder WallCare at an enterprise value of up to INR 235 crore, gaining access to a 6 lac MT wall putty plant at Rajsamand Nathdwara, Rajasthan. Additionally, Walplast Products launched its HomeSure retail campaign in July 2024, reinforcing its leadership position through technology-led, sustainable solutions.

Buy Now: https://www.imarcgroup.com/checkout?id=7700&method=2175

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Wall Putty Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Project Cost here

News-ID: 4384033 • Views: …

More Releases from IMARC Group

India B2B Events Market: Industry Trends & Growth Forecast by 2034

The India B2B events market size was valued at USD 1,688.72 Million in 2025 and is expected to reach USD 2,750.10 Million by 2034, growing at a compound annual growth rate (CAGR) of 5.57% from 2026 to 2034. The market growth is driven by increasing corporate spending on marketing, networking initiatives, and brand-building across industries, supported by government development of world-class MICE infrastructure and adoption of digital and hybrid event…

India Cold Chain Logistics Market to Reach USD 27.00 Bn by 2033 at 8.90% CAGR Am …

Source: IMARC Group | Category: Transportation and Logistics

Report Introduction

According to IMARC Group's latest report titled "India Cold Chain Logistics Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033", this study offers a granular analysis of the country's developing temperature-controlled supply chain. The study offers a profound analysis of the industry, encompassing market share, size, growth factors, key trends, and regional insights. The report covers critical market dynamics,…

India Plastic Packaging Market is set to reach USD 17.3 Billion by 2034 | Indust …

The India plastic packaging market size reached USD 13.2 Billion in 2025. The market is expected to reach USD 17.3 Billion by 2034, growing at a CAGR of 3.10% from 2026-2034. The market is majorly driven by the advancements in plastic materials and technologies, development of lightweight packaging solutions, creation of flexible packaging options, and innovation in barrier-enhanced packaging that extends shelf life and improves product performance.

Key Highlights in India…

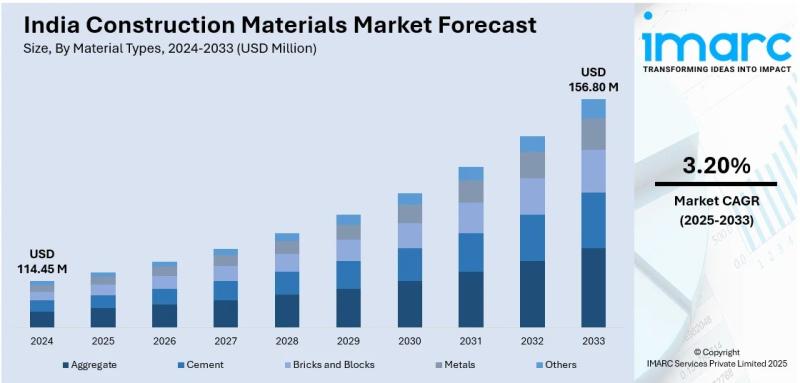

India Construction Materials Market to Hit USD 156.80 Mn by 2033 at 3.20% CAGR D …

Source: IMARC Group | Category: Chemical & Materials

Report Introduction

According to IMARC Group's latest report titled "India Construction Materials Market Size, Share, Trends and Forecast by Material Type, End User, and Region, 2025-2033", this study offers a granular analysis of the country's booming construction sector. The study offers a profound analysis of the industry, encompassing market share, size, growth factors, key trends, and regional insights. The report covers critical market…

More Releases for Wall

Custom Wall Coverings Experts Launch Custom Wall Graphics Resource

Image: https://www.globalnewslines.com/uploads/2026/01/1768290275.jpg

Tree Towns Digital Solutions, a custom wall coverings provider, has updated and optimized its wall graphics pages with new FAQs, client testimonials, and enhanced visual formatting to improve the customer experience and SEO.

Elmhurst, Illinois - January 13, 2026 - Tree Towns Digital Solutions, a leading provider of personalized wall graphics and coverings [https://www.treetowns.com/], recently enhanced its digital presence by updating its Custom Wall Coverings [https://www.treetowns.com/wall-coverings/] service pages. These updates…

Innovative Wall Art By WPC Wall Panels Welcomes Consumers

Innovative Wall Art By WPC Wall Panels [https://www.sxrfoamboard.com/wpc-board/]Welcome To As people get more into quality of life and space beauty, wood-plastic composite wall panels have become a new favorite for modern home and commercial space decoration for their unique design idea, plus good performance, and unmatched effect in decoration. Our company is entirely dedicated to research and the high-end manufacturing of wall decoration materials. This makes us create environmentally friendly,…

Supreme Wall Prints: Elevating Spaces with Exquisite Wall Art

In the heart of sunny Sydney, a new player in the wall art market is making waves with its commitment to quality and style. Supreme Wall Prints has quickly established itself as a go-to destination for art enthusiasts looking to transform their living and working spaces.

Sydney, Australia - In the heart of sunny Sydney, a new player in the wall art market is making waves with its commitment to quality…

Multi-Depth Corrugated Box Market is Segmentation By Board Type - Single Wall, D …

Corrugated material is manufactured of 3 different layers of paper such as outside liner, inside liner and fluting that is fixed in between these two liners. The corrugated medium also known as container board provides strength to the box.

A recently released report on global multi-depth corrugated box market offered by Future Market Insights delivers key insights on the market over the forecast period. The global market is anticipated to grow at 6.6%…

Decorative Wall Tiles Market Study 2015-2025, by Segment (Ceramic Wall Tiles,Vin …

Offering 15% Discount on this Report

Decorative Wall Tiles Market Report ,Reports Intellect resents the detail analysis of the parent market based on elite players, present, past and futuristic data which will offer as a profitable guide for all the Decorative Wall Tiles industry competitors.The overall analysis of the Decorative Wall Tiles markets covers an overview of the industry policies that impact the Decorative Wall Tiles market significantly, the cost…

Wall Art Market Report 2018: Segmentation by Product (Canvas, Wood, Metal, Other …

Global Wall Art market research report provides company profile for Dupenny, Fine Art Tileworks, HACEKA B.V., Hisbalit, Overmantels, Mercury Mosaics, Paristic, Studio Art, Arezia, Cerabati, Art & Form, Bongio, Christopher Guy, Brillux and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR…