Press release

Top 30 Indonesian Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)PT Chandra Asri Pacific Tbk

PT Barito Pacific Tbk

AKR Corporindo Tbk

PT Lautan Luas Tbk

PT Polychem Indonesia Tbk

PT Aneka Gas Industri Tbk

Lotte Chemical Titan Tbk

PT Surya Biru Murni Acetylene Tbk

PT Indo Acidatama Tbk

PT Tridomain Performance Materials Tbk

PT Unggul Indah Cahaya Tbk

PT Emdeki Utama Tbk

Madusari Murni Indah Tbk

Colorpak Indonesia Tbk

OBM Drilchem Tbk

PT Duta Pertiwi Nusantara Tbk

PT Ekadharma International Tbk

PT Indopoly Swakarsa Industry Tbk

PT Saraswanti Anugerah Makmur Tbk

PT Kusuma Kemindo Sentosa Tbk

PT Eterindo Wahanatama Tbk

PT Bintang Mitra Semestaraya Tbk

PT Argha Karya Prima Industry Tbk

Nusa Palapa Gemilang Tbk

Chemstar Indonesia Tbk

Asiaplast Industries Tbk

Budi Starch & Sweetener

PT AKR Aruk Chemical Terminals

BASF Indonesia

Lotte Chemical

2) Revenue results of major public companies in Indonesia summarized (per company)

PT Chandra Asri Pacific Tbk (TPIA): Q3 2025 Net Profit: USD 1.30 billion

Revenue: USD 5.1 billion. A return to strong profitability driven by petrochemical margin recovery, higher polymer volumes, exports growth, and operational integration. This marked one of the most significant turnarounds in the sector.

PT Barito Pacific Tbk (BRPT): Q3 2025 Net Profit: USD 583.6 million. A diversified industrial holding with petrochemical and energy affiliates. Earnings were supported by improving chemical and polymer-related margins.

AKR Corporindo Tbk (AKRA): Q3 2025 Net Profit: USD 99.2 million. Performance improved due to higher chemical distribution throughput, better utilization of terminals and logistics assets serving polymer flows.

PT Lautan Luas Tbk (LTLS): Q3 2025 Net Profit: USD 7.2 million Distributor of chemicals and polymer products. Revenue growth continued.

PT Polychem Indonesia Tbk (ADMG): Q3 2025 Net Profit: USD 1.05 million. Reported return to profitability, marking a turnaround from prior structural losses with improved demand for polyester chips & specialty resins.

PT Aneka Gas Industri Tbk (AGII): Earnings not fully disclosed publicly but remains a critical supplier of industrial gases essential to polymer and plastics processing.

Lotte Chemical Titan Tbk (FPNI): Financials generally reported under petrochemical segments; exposure to polyethylene/polypropylene products aligns it with polymer films and packaging chains.

PT Surya Biru Murni Acetylene Tbk (SBMA): Industrial gas & basic chemical supplier, supporting polymer and plastics operations.

PT Indo Acidatama Tbk (SRSN): Provides basic chemical feedstocks into polymer value chains. Performance indicators reflect underlying industry demand.

PT Indopoly Swakarsa Industry Tbk (IPOL): Linked to polymer feedstocks and industrial coatings.

3) Key trends & insights from Q3 2025

Margin Recovery at Integrated Petrochemical Producers: Large integrated players such as Chandra Asri saw substantial margin recovery in olefins/polyolefins, reversing the prior weaker profitability cycle. Higher export volumes and product mix optimization were cited as key drivers.

Split Performance Across Value Chain: While upstream and integrated companies posted robust profits, mid-tier and distributor segments such as Lautan Luas and Polychem experienced tighter margins due to competitive pricing and input cost pressures.

Supply Chain Enablers Maintaining Relevance: Industrial gas suppliers (AGII, SBMA) and chemical distributors (AKRA) remained strategically important, supporting polymer processing and packaging industries even where headline earnings were moderate.

Sustainability and Technical Polymer Demand: Segments like specialty materials and adhesives continue to gain focus, driven by packaging demand and growing interest in sustainability, recycling, and advanced polymer films.

4) Outlook for Q4 2025 and beyond

Positive Demand Signals: Economic and industry indicators signal continued manufacturing expansion, with domestic and ASEAN export demand likely supporting polymer and packaging markets into Q4 2025.

Feedstock Price Volatility: Global olefin and polymer input costs remain a risk factor; firms with higher integrated production are expected to better withstand volatility.

ESG & Circular Economy Focus: Regulatory pressures and corporate ESG agendas are expected to accelerate investment in recycled plastics, biodegradable films, and emissions reductions across Indonesias polymer sectors.

Capacity Investments: Strategic expansions (e.g., petrochemical downstream plants) foreshadow a shift toward greater local polymer self-sufficiency and upward movement into high-value film and specialty segments.

5) Conclusion

The Q3 2025 financial performance of Indonesias polymer films and broader polymer public companies highlights a divergent yet evolving landscape. Integrated petrochemical leaders such as Chandra Asri and diversified holdings like Barito Pacific posted exceptional earnings and margin expansion. Mid-tier producers and distributors delivered steady yet modest returns, while more specialized polymer and industrial films segments continue to develop toward higher-value products and sustainability-driven offerings.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top 30 Indonesian Public Companies Q3 2025 Revenue & Performance here

News-ID: 4382938 • Views: …

More Releases from QY Research

Unlocking Chemical Concentrates: Market Size, Profit Margins, and Key Players

Mono Concentrate refers to industrial chemical concentrate products used as precursors, additives, or intermediates in downstream chemical manufacturing (e.g., chemical intermediates like mono ethylene glycol, color masterbatch concentrates, polymer additives).

These intermediates enter broad applications such as polyester fibers, PET packaging, automotive coolants, coatings, textiles, adhesives, and plastics.

The industry supports global polymer chains, specialty chemicals, and bulk industrial output, heavily linked to petrochemical and downstream manufacturing capacity.

Global Industry Overview

2025 market size:…

Beyond PPE: Smart, Sustainable Lab Safety Clothing Driving Global Expansion

Lab safety clothing includes protective garments designed to protect laboratory personnel from chemical, biological, and physical hazards such as splashes, spills, contamination, and particulate exposure.

This category spans lab coats, coveralls, chemical-resistant suits, disposable gowns, aprons, and accessories used in research, diagnostic, industrial, and educational lab environments.

Demand is driven by stringent workplace safety regulations, rapid expansion of pharmaceutical and biotechnology R&D, and greater institutional focus on worker safety and contamination control.

Global…

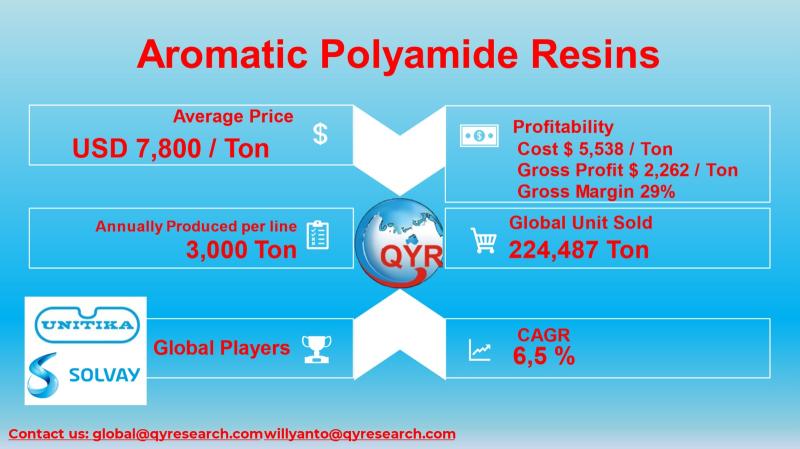

Industry Deep Dive Aromatic Polyamide Resins: Price, Production, Profitability & …

Industry Definition Aromatic polyamide resins are high-performance polymers with a benzene ring in their backbone, offering superior thermal resistance, strength, and chemical stability widely used in automotive, aerospace, industrial machinery, electronics, and high-performance application segments.

Core Value Proposition Combines durability, heat resistance, and mechanical resilience vs. conventional polyamides; often used when enhanced material performance justifies premium pricing.

Global Context Part of the broader aromatic polyamide and specialty polymer landscape which…

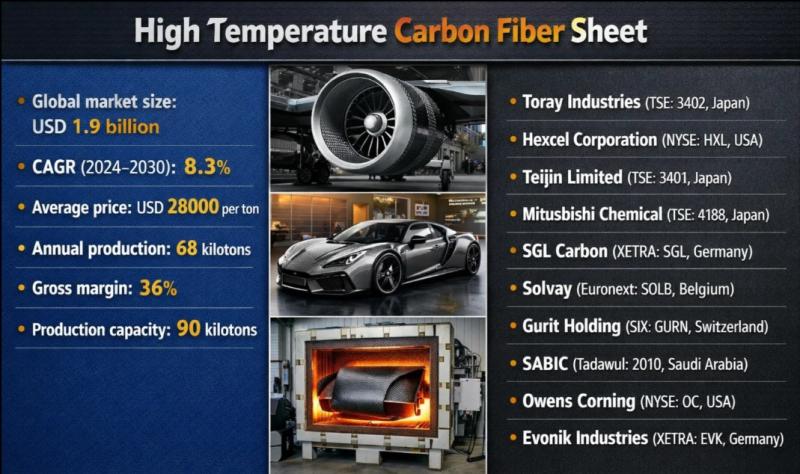

Market Overview - High Temperature Carbon Fiber Sheet

QY Research has recently published a comprehensive market study on High Temperature Carbon Fiber Sheet, a class of advanced composite materials engineered to maintain mechanical strength, dimensional stability, and structural integrity under extreme thermal environments. These sheets are widely used in aerospace, defense, semiconductor equipment, energy systems, and high-temperature industrial applications where conventional metals or polymers fail.

The market is shifting from standard carbon fiber laminates toward high-purity, high-modulus, and thermally…

More Releases for Tbk

Indonesia Textile Industry Market Valuation Expected to Hit USD 28.57 billion by …

USA, New Jersey: According to Verified Market Research analysis, the global Indonesia Textile Industry Market size was valued at USD 21.7 Billion in 2023 and is projected to reach USD 28.57 Billion by 2031, growing at a CAGR of 3.50% from 2024 to 2031

How AI and Machine Learning Are Redefining the future of Indonesia Textile Industry Market?

AI-powered production planning systems optimize yarn selection, fabric blends, and loom utilization, improving output…

Infrastructure Market 2021 Strategic Assessments - PT. Acset Indonusa Tbk.., Pt. …

The Infrastructure Market report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The Infrastructure sector in Indonesia is…

Indonesia Telecom Tower Market Demand, Size, Share, Scope & Forecast To 2025 |To …

The Indonesia telecom tower market accounted to US$ 557.9 Mn in 2017 and is expected to grow at a CAGR of 27.1% during the forecast period 2018 – 2025, to account to US$ 3,695.5 Mn by 2025.

Get Sample Copy of this Indonesia Telecom Tower Market research report at - https://www.businessmarketinsights.com/sample/TIPRE00004113

The Business Market Insights provides you regional research analysis on “Indonesia Telecom Tower Market” and forecast to 2025. The research report…

Coal Mining in Indonesia Market 2022| PT Bumi Resources Tbk, PT Adaro Energy Tbk …

Researchmoz added Most up-to-date research on "Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption" to its huge collection of research reports.

Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption

Summary

GlobalData's "Coal Mining in Indonesia to 2022", provides a comprehensive coverage on Indonesias coal industry. It provides historical and forecast data on coal production by grade, reserves, consumption and exports by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes

Summary

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by type; exports, exports by type and exports by country. Detailed analysis of the…