Press release

Carbon Credits Market Trends Driving Climate Action Worldwide

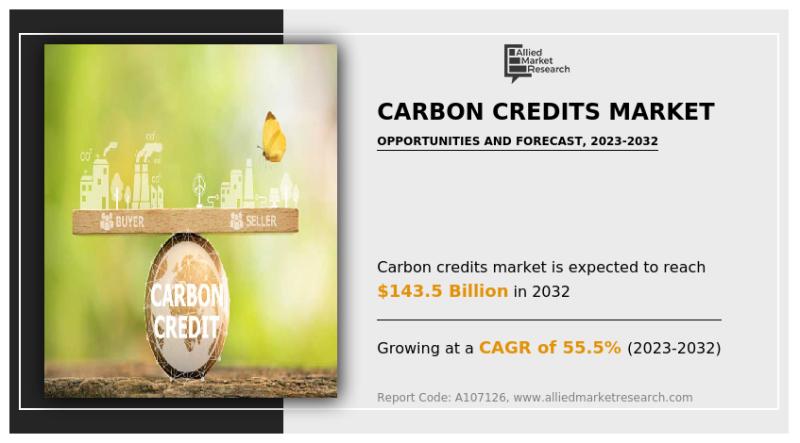

According to a new report published by Allied Market Research, the carbon credits market was valued at $2 billion in 2022 and is projected to reach $143.5 billion by 2032, growing at a remarkable CAGR of 55.5% from 2023 to 2032. The rapid expansion of climate regulations, corporate sustainability initiatives, and voluntary emission reduction commitments is significantly driving the growth of the global carbon credits market.Download PDF Brochure: https://www.alliedmarketresearch.com/request-sample/107610

Understanding the Carbon Credits Market

Carbon credits are tradable certificates that represent the reduction or removal of one metric ton of carbon dioxide or its equivalent greenhouse gas from the atmosphere. These credits can be bought and sold in regulated and voluntary carbon markets. Companies, governments, and individuals purchase carbon credits to offset their emissions and achieve sustainability targets.

The carbon credits market plays a vital role in encouraging emission reductions by assigning economic value to carbon mitigation. Transactions are often facilitated through specialized exchanges or trading platforms, ensuring transparency and accountability. As global pressure to reduce greenhouse gas emissions intensifies, the importance of carbon credits continues to grow across industries.

Net-Zero Targets Driving Market Growth

To meet global climate goals, greenhouse gas emissions must be reduced by nearly 50% by 2030 and reach net-zero by 2050. Achieving these ambitious targets requires a combination of emission reduction strategies, renewable energy adoption, and carbon offset mechanisms. Purchasing carbon credits enables organizations to address emissions that are difficult or costly to eliminate immediately.

Participation in voluntary carbon markets allows companies to demonstrate climate leadership beyond regulatory compliance. By investing in carbon reduction projects, organizations support clean energy, reforestation, and sustainable development initiatives. These factors are expected to strongly drive the carbon credits market forecast during the coming years.

Corporate Sustainability and Innovation

An increasing number of companies are integrating carbon credits into their environmental, social, and governance (ESG) strategies. Voluntary participation in the carbon credits market helps organizations strengthen brand reputation, attract environmentally conscious investors, and meet stakeholder expectations.

Moreover, involvement in carbon markets encourages innovation in clean technologies and sustainable practices. Companies are increasingly investing in low-carbon solutions while leveraging carbon credits to balance residual emissions, further supporting the expansion of the carbon credits market.

Market Challenges and Price Volatility

Despite strong growth prospects, the carbon credits market faces certain challenges. One of the major concerns is price volatility, which can be influenced by policy changes, economic conditions, and market speculation. Fluctuating prices create uncertainty for market participants, making long-term emission reduction planning more complex.

Additionally, variations in regulatory frameworks across regions can create inconsistencies in credit valuation and market participation. These factors are expected to moderately hamper carbon credits market growth during the forecast period.

Role of Organizations and Market Frameworks

The growing involvement of public and private organizations supporting environmental sustainability is expected to boost demand in the carbon credits market. International frameworks such as the International Emissions Trading Association (IETA) play a crucial role in standardizing carbon trading mechanisms and promoting market-based approaches to climate change mitigation.

IETA includes leading corporations from all stages of the carbon trading value chain and provides reliable data on market activity. Such organizations contribute significantly to building trust, transparency, and efficiency within the global carbon credits market.

Buy This Report (280 Pages PDF with Insights, Charts, Tables, and Figures): https://www.alliedmarketresearch.com/carbon-credits-market/purchase-options

Carbon Credits Market Segmentation

The carbon credits market share is segmented based on type, system, end-use industry, and region.

By Type

Based on type, the market is classified into regulatory and voluntary carbon credits. The regulatory segment dominated the market in 2022, driven by government-mandated emission reduction schemes. Meanwhile, the voluntary segment is anticipated to witness the fastest growth as corporate climate commitments increase globally.

By System

By system, the market is divided into cap-and-trade and baseline-and-credit mechanisms. The cap-and-trade system emerged as the leading segment in 2022 due to its widespread adoption in regulated markets. The baseline-and-credit system is expected to grow rapidly, supported by flexible emission reduction frameworks.

By End-Use Industry

Based on end-use industry, the carbon credits market is segmented into aviation, energy, industrial, petrochemical, and others. The industrial segment accounted for the largest market share in 2022 and is projected to grow at a strong pace due to high emission intensity and increasing regulatory scrutiny.

By Region

Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific dominated the carbon credits market in 2022 and is expected to maintain its leadership, driven by rapid industrialization, expanding emission trading systems, and government-led climate initiatives.

Impact of COVID-19 on the Carbon Credits Market

The COVID-19 pandemic negatively impacted the carbon credits market due to economic slowdowns, travel restrictions, reduced energy consumption, and temporary shutdowns of industrial operations. Government focus shifted toward economic recovery, resulting in reduced investments in emission reduction and sustainability projects.

Budget constraints also limited the ability of small and medium-sized enterprises to purchase carbon credits. Additionally, fluctuations in energy prices and uncertainties in economic recovery disrupted carbon market activities. However, post-pandemic recovery has renewed momentum toward climate commitments, supporting long-term carbon credits market opportunities.

Competitive Landscape

The global carbon credits market is moderately fragmented, with several players focusing on expanding project portfolios and digital trading platforms. Key companies operating in the market include South Pole, 3Degrees, EKI Energy Services Ltd, TerraPass, NATUREOFFICE, Moss.Earth, Climate Impact Partners, Carbon Credit Capital LLC, CarbonBetter, and NativeEnergy.

These players are actively engaged in developing verified carbon offset projects, enhancing market transparency, and supporting global decarbonization efforts.

Get a Customized Research Report: https://www.alliedmarketresearch.com/request-for-customization/A107126

Conclusion

In conclusion, the carbon credits market is poised for exponential growth, supported by global net-zero targets, rising corporate sustainability initiatives, and expanding carbon trading frameworks. While challenges such as price volatility and regulatory complexity persist, continued innovation and international collaboration are expected to unlock substantial growth opportunities across regions and industries.

Trending Reports in Energy and Power Industry:

Carbon Credit Trading Platform Market

https://www.alliedmarketresearch.com/carbon-credit-trading-platform-market-A145082

Carbon Credits Market

https://www.alliedmarketresearch.com/carbon-credits-market-A107126

Renewable Energy Market

https://www.alliedmarketresearch.com/renewable-energy-market

U.S. Clean Energy Market

https://www.alliedmarketresearch.com/us-clean-energy-market-A325461

Carbon Capture and Sequestration Market

https://www.alliedmarketresearch.com/carbon-capture-and-sequestration-market-A129862

Decarbonization Market

https://www.alliedmarketresearch.com/decarbonization-market-A325581

Bioenergy With CCS Market

https://www.alliedmarketresearch.com/bioenergy-with-ccs-market-A325513

Low Carbon Building Market

https://www.alliedmarketresearch.com/low-carbon-building-market-A325511

Carbon Capture and Storage (CCS) in Power Generation Market

https://www.alliedmarketresearch.com/carbon-capture-and-storage-in-power-generation-market-A212152

Carbon Capture, Utilization, and Storage (CCUS) Market

https://www.alliedmarketresearch.com/carbon-capture-and-utilization-market-A12116

Carbon Capture Technology Market

https://www.alliedmarketresearch.com/carbon-capture-technology-market-A191506

Carbon Capture Market

https://www.alliedmarketresearch.com/carbon-capture-market-A175658

Renewable Energy Certificates Market

https://www.alliedmarketresearch.com/renewable-energy-certificates-market

Waste to Energy Market

https://www.alliedmarketresearch.com/waste-to-energy-market

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

Web: www.alliedmarketresearch.com

Allied Market Research Blog:

https://blog.alliedmarketresearch.com

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

Pawan Kumar, the CEO of Allied Market Research, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Carbon Credits Market Trends Driving Climate Action Worldwide here

News-ID: 4382174 • Views: …

More Releases from Allied Analytics LLP

Hazardous Waste Management Market Growth Driven by Regulations and Technology

According to a new report published by Allied Market Research, the hazardous waste management market was valued at $16.3 billion in 2022 and is projected to reach $28.6 billion by 2032, growing at a CAGR of 5.8% from 2023 to 2032. The market growth is driven by stringent environmental regulations, rising industrial waste generation, and increasing awareness regarding human health and environmental protection.

Download PDF Brochure: https://www.alliedmarketresearch.com/request-sample/54184

Understanding Hazardous Waste Management

Hazardous waste…

Thin Film Battery Market to Witness Rapid Growth Driven by Wearables and IoT Exp …

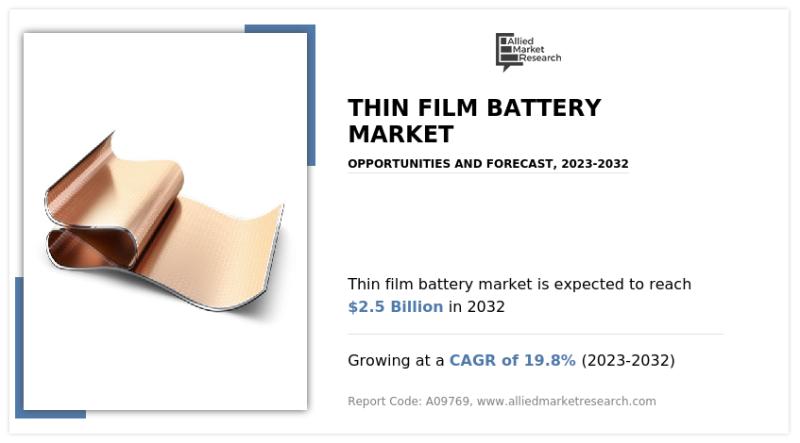

According to a new report published by Allied Market Research, the thin film battery market was valued at $0.4 billion in 2022 and is projected to reach $2.5 billion by 2032, registering a strong CAGR of 19.8% from 2023 to 2032. The market growth is primarily driven by rising demand for compact, lightweight, and high-performance energy storage solutions across consumer electronics, healthcare, industrial sensors, and IoT applications.

Download PDF Brochure: https://www.alliedmarketresearch.com/request-sample/10134

Overview…

Battery Swapping Market Poised for Rapid Growth Driven by EV Adoption and Urban …

According to a new report published by Allied Market Research, the battery swapping market size was valued at $120.3 million in 2022 and is projected to reach $642.7 million by 2032, growing at a robust CAGR of 18.3% from 2023 to 2032. The rapid expansion of electric vehicles (EVs), rising concerns over charging time, and the emergence of battery-as-a-service (BaaS) models are key factors fueling market growth globally.

Download PDF Brochure:…

Lithium-Ion Battery Market Witnesses Rapid Growth Amid EV and Renewable Energy S …

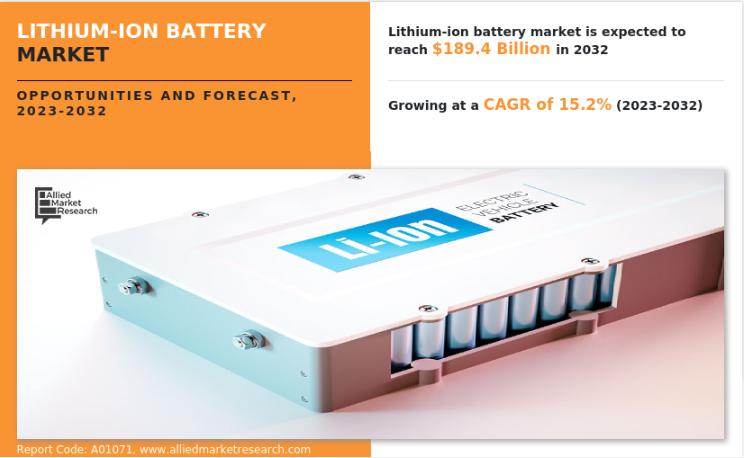

According to a new report published by Allied Market Research, the lithium-ion battery market size was valued at $46.2 billion in 2022 and is projected to reach $189.4 billion by 2032, growing at a robust CAGR of 15.2% from 2023 to 2032. This remarkable expansion is driven by rising demand for energy storage systems, electric vehicles, renewable energy integration, and advanced military applications.

Download PDF Brochure: https://www.alliedmarketresearch.com/request-sample/1380

Overview of Lithium-Ion Batteries

Lithium-ion batteries…

More Releases for Carbon

Carbon-Carbon Composite Market to Reach $3.31 Billion by 2031 | SGL Carbon, Toyo …

NEW YORK, (UNITED STATES) - QY Research latest 'Carbon-Carbon Composite Market 2025 Report' offers an unparalleled, in-depth analysis of the industry, delivering critical market insights that empower businesses to enhance their knowledge and refine their decision-making processes. This meticulously crafted report serves as a catalyst for growth, unlocking immense opportunities for companies to boost their return rates and solidify their competitive edge in an ever-evolving market. What sets this report…

Carbon Black Market Next Big Thing | Cabot, Tokai Carbon, Jiangxi Black Carbon, …

Market Research Forecast published a new research publication on "Global U.S. U.S. Carbon Black Market Insights, to 2030" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study, you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market-associated stakeholders. The growth of the U.S. U.S. Carbon Black Market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive…

Carbon-Carbon Composite Material Market Size, Share 2024, Impressive Industry Gr …

Report Description: -

QY Research's latest report 'Carbon-Carbon Composite Material Market 2024 Report' provides a comprehensive analysis of the industry with market insights will definitely facilitate to increase the knowledge and decision-making skills of the business, thus providing an immense opportunity for growth. Finally, this will increase the return rate and strengthen the competitive advantage within. Since it's a personalised market report, the services are catered to the particular difficulty. The…

Carbon Black Market Scenario & Industry Applications 2020-2025 | Phillips Carbon …

The global carbon black market size is projected to surpass USD 18 billion by 2025. Carbon black act as a reinforcement material for tires and rubber, and possess electrical conductive properties. Carbon black provide pigmentation, conductivity, and UV protection for a number of coating applications along with toners and printing inks for specific color requirements. Its multiple application across various end product along with rising economic outlook has significantly enhanced…

Global Carbon-Carbon Composite Market 2020-2026 SGL Carbon, Toyo Tanso, Tokai Ca …

Global Carbon-Carbon Composite Market 2020-2026 analysis Report offers a comprehensive analysis of the market. It will therefore via depth Qualitative insights, Historical standing and verifiable projections regarding market size. The projections featured inside the report square measure derived victimisation verified analysis methodologies and assumptions. Report provides a progressive summary of the Carbon-Carbon Composite business 2020 together with definitions, classifications, Carbon-Carbon Composite market research, a decent vary of applications and Carbon-Carbon…

Global Carbon Black Market to 2026| Cabot, Orion Engineered Carbons, Birla Carbo …

Albany, NY, 10th January : Recent research and the current scenario as well as future market potential of "Carbon Black Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2018 - 2026" globally.

Carbon Black Market - Overview

Carbon black (CB) is manufactured through partial combustion of heavy hydrocarbons under controlled temperature and pressure to obtain fine particles and aggregates having a wide range of structure and surface properties. This…