Press release

Accounts Payable Automation Market : Opportunity Analysis and Industry Forecast, 2023 - 2032

Allied Market Research published a report, titled, "Accounts Payable Automation Market by Component (Solution and Service), Deployment Mode (On-Premise and Cloud), Enterprise Size (Large Enterprises and Small and Medium-sized Enterprises), and Industry Vertical (BFSI, Consumer Goods and Retail, IT and Telecom, Healthcare, Government, and Other): Global Opportunity Analysis and Industry Forecast, 2024-2032". According to the report, the "accounts payable automation market" was valued at $5,378.58 million in 2023, and is estimated to reach $17,047.16 million by 2032, growing at a CAGR of 13.9% from 2024 to 2032.Get a Sample Copy of this Report : https://www.alliedmarketresearch.com/request-sample/A53548

Prime determinants of growth

Accounts payable automation enhances the quality of data, assisting the operator in developing a sustainable business model to meet the demands that have increased the need for accounts payable automation software. In addition, an increase in the adoption of accounting software for improving the efficiency of the business is driving the growth of the market. However, the possibility of losing crucial accounting data and the expensive initial cost of software are the factors limiting industry expansion. Moreover, the availability of trained professionals is expected to create lucrative opportunities for the market in upcoming years. Moreover, a rise in development and initiatives toward accounts payable automation is anticipated to provide a potential growth opportunity for the market.

The solution segment maintained its leadership status during the forecast period.

By component, the solution segment held the highest market share in 2023, accounting for three-fifths of the global online payday loan market revenue, This is attributed to the fact that software developers and vendors are predicting future consumption trends, benchmarking usage across facilities, and gaining insights into alternative business models utilizing statistics, artificial intelligence, and machine learning approaches. Furthermore, businesses are implementing IoT-based analytical solutions for financial accounting and invoicing. However, the solution segment is projected to attain the highest CAGR of 17% from 2024 to 2032, offer easy integration with multiple platforms will appeal to businesses seeking to streamline their operations without disrupting existing infrastructure, which boosts the global market.

The cloud segment to maintain its leadership status during the forecast period

By deployment mode, the on-premise segment held the highest market share in 2023, accounting for more than three-fifths of the global online payday loan market revenue. This is attributed to rapid economic growth and the digitization of business processes boom the adoption of accounts payable automation solutions. However, the cloud segment is projected to attain the highest CAGR of 15.0% from 2023 to 2032, as it enables remote access, real-time data processing, and automatic updates, enhancing efficiency and reducing IT overhead costs.

The small and medium-sized enterprises segment to maintain its leadership status during the forecast period

By enterprise size, the large enterprise size segment held the highest market share in 2023, accounting for more than two-thirds of the global online payday loan market revenue. This is attributed to rise in need for operational efficiency and cost reduction. Large organizations face significant administrative overheads in managing manual accounts payable processes. However, the small and medium-sized segment is projected to manifest the highest CAGR of 20% from 2023 to 2032, increasing pressure to enhance operational efficiency and reduce costs. SMEs often face tight profit margins and cannot afford the inefficiencies associated with manual AP processes.

The IT and telecom segment to maintain its leadership status during the forecast period

By industry verticals, the BFSI segment held the highest market share in 2023, accounting for more than two-thirds of the global online payday loan market revenue. This is attributed to reduced manual errors, enhanced data accuracy, and real-time visibility into payables, allowing financial institutions to streamline operations, improve cash flow management, and ensure compliance with stringent financial regulations. However, the IT and telecom segment is projected to attain the highest CAGR of 17.3% from 2023 to 2032. The integration of artificial intelligence (AI) and machine learning (ML) enhances the capabilities of AP automation systems, enabling intelligent data extraction, predictive analytics, and fraud detection.

Asia-Pacific maintain its dominance by 2032

Region-wise, North America held the highest market share in terms of revenue in 2022, accounting for more than one-third of the global online payday loan market revenue due to several factors. as users in the region are seeking accounting systems tailored to their specific needs, as opposed to generic accounting applications. Furthermore, companies in the region are continuously developing their software and applications to match current digitization. However, the Asia-Pacific region is expected to witness the fastest CAGR of 12.5% from 2023 to 2032 and is likely to dominate the market during the forecast period, Several factors contribute to this trend, including the region's strong economic growth, the presence of large enterprises boost the market.

Leading Market Players: -

SAP Ariba,

Sage Group plc,

Tipalti Inc.,

Zycus Inc.,

FIS, Bottomline Technologies, Inc.,

Comarch SA, FinancialForce,

AvidXchange

Procurify Technologies Inc

The report provides a detailed analysis of these key players of the global Online payday loan market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

➡️Enquire Before Buying

: https://www.alliedmarketresearch.com/purchase-enquiry/A53548

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the accounts payable automation market analysis from 2023 to 2032 to identify the prevailing accounts payable automation market opportunity.Â

The market research is offered along with information related to key drivers, restraints, and opportunities.Â

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.Â

In-depth analysis of the accounts payable automation market segmentation assists to determine the prevailing accounts payable automation market forecast.Â

Major countries in each region are mapped according to their revenue contribution to the global accounts payable automation market outlook.Â

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.Â

The report includes the analysis of the regional as well as global accounts payable automation market trends, key players, market segments, application areas, and market growth strategies.

Buy Now @ https://bit.ly/41LciAl

Accounts Payable Automation Market Report Highlights

Aspects Details

By Component

Solution

Service

By Deployment Mode

On-Premise

Cloud

By Enterprise Size

Small and Medium-sized Enterprises

Large Enterprises

By Industry Vertical

BFSI

Consumer Goods and Retail

IT and Telecom

Healthcare

Government

Other

By Region

North America (U.S., Canada)

Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific)

Latin America (Brazil, Argentina, Rest of Latin America)

Middle East and Africa (Gcc Countries, South Africa, Reast Of Middle East And Africa)

Trending Reports:

Medical Loans Market https://www.alliedmarketresearch.com/medical-loans-market-A323693

Financial Auditing Professional Services Market https://www.alliedmarketresearch.com/financial-auditing-professional-services-market-A122228

Southeast Asia Travel Insurance Market https://www.alliedmarketresearch.com/southeast-asia-travel-insurance-market-A324610

Europe Aviation Insurance Market https://www.alliedmarketresearch.com/europe-aviation-insurance-market-A324609

Biometric Payment Card Market https://www.alliedmarketresearch.com/biometric-payment-card-market-A192413

US B2C Payment Market https://www.alliedmarketresearch.com/u-s-b2c-payment-market-A316932

Note Sorter Market https://www.alliedmarketresearch.com/note-sorter-market

Accounts Payable Automation Market https://www.alliedmarketresearch.com/accounts-payable-automation-market-A53548

Pet Insurance Market https://www.alliedmarketresearch.com/pet-insurance-market

Insurance Third Party Administrator Market https://www.alliedmarketresearch.com/insurance-third-party-administrator-market-A12542

Travel Insurance Market https://www.alliedmarketresearch.com/travel-insurance-market

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients in making strategic business decisions and achieving sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of the domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Accounts Payable Automation Market : Opportunity Analysis and Industry Forecast, 2023 - 2032 here

News-ID: 4380896 • Views: …

More Releases from Allied Market Research

API Banking Market to Soar to $217.3 Billion by 2032, Growing at 24.7% CAGR

Allied Market Research published a report, titled, "API Banking Market by Component (Solution and Service), Deployment (On-premise and Cloud), and Enterprise Size (Large Enterprises and Small and Medium-sized Enterprises): Global Opportunity Analysis and Industry Forecast, 2022-2032". According to the report, the global API banking industry generated $24.7 billion in 2022, and is anticipated to generate $217.3 billion by 2032, witnessing a CAGR of 24.7% from 2023 to 2032.

➡️Download Research Report…

Debit Card Market to Reach $151.1 Billion Globally by 2032, Growing at 5.5% CAGR

The global debit card market was valued at $95.7 billion in 2023, and is projected to reach $151.1 billion by 2032, growing at a CAGR of 5.5% from 2024 to 2032.

The debit card industry has been impacted significantly by the rise of digital transformation in the financial services industry. Digital technologies are changing how consumers use debit cards, thereby driving innovation in security features, transaction processes, and integration with digital…

Secured Personal Loans Market by Type, Age Group, and Distribution Channel: Glob …

Allied Market Research published a report, titled, "Secured Personal Loans Market by Type (P2P marketplace lending and Balance sheet lending), Age (Less than 30, 30-50 and More than 50), and Distribution Channel (Banks, Credit Unitions, Online Lenders and Peer-to-Peer Lending): Global Opportunity Analysis and Industry Forecast, 2024-2032". According to the report, the secured personal loans market was valued at $34.2 billion in 2023, and is estimated to reach $386.0 billion…

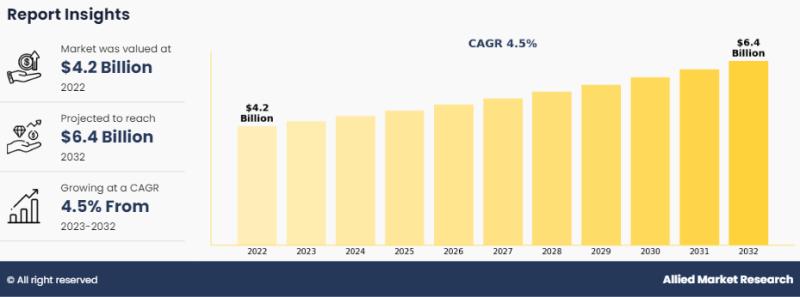

Aircraft Paint Market Trend 2026 to 2032, Growing at a CAGR of 4.5%

Allied Market Research has recently published a report, titled, "Aircraft Paint Market Size, Share, Competitive Landscape and Trend Analysis Report by Application, by Type, by Aircraft Type, by End-User: Global Opportunity Analysis and Industry Forecast, 2023-2032." According to the report, the global aircraft paint market generated $4.2 billion in 2022, and is anticipated to generate $6.4 billion by 2032, rising at a CAGR of 4.5% from 2023 to 2032. …

More Releases for Enterprise

Why SMBs Deserve Enterprise-Level IT - Without the Enterprise Price Tag

Small and mid-sized businesses (SMBs) often operate under the misconception that enterprise-level IT solutions are reserved only for large corporations with unlimited budgets. Yet in today's digital-first economy, SMBs face many of the same risks and operational demands as their larger counterparts: cybersecurity threats, regulatory compliance, and the need for efficient, reliable technology to support growth. A managed IT services provider, Cortavo [https://cortavo.com/what-is-cortavo], has demonstrated that enterprise-level IT does not…

OpenPayd's Ozan Ozerk Named Enterprise Entrepreneur at 2025 Enterprise Awards

London, 19 June 2025 - Dr. Ozan Ozerk, founder of OpenPayd, has been named "Enterprise Entrepreneur" at this year's Enterprise Awards, an event that celebrates the UK's most impactful technology founders. The ceremony took place at Drapers' Hall on the evening of 18 June, bringing together leaders from across the innovation and investment landscape.

The recognition comes after a period of substantial growth for OpenPayd. In the past 12 months, the…

Redefining Enterprise Connectivity: Enterprise VSAT Market Poised for Remarkable …

Enterprise VSAT's market was estimated to be worth US$ 4,324.5 Mn in 2022, and by the end of 2033, it is anticipated to have increased to US$ 8,110.5 Mn. In 2023, the market for corporate VSAT is anticipated to be worth $4,514.8 Mn USD. From 2023 to 2033, the enterprise VSAT market is anticipated to expand at a 6.0% CAGR.

Businesses in industries like retail and consumer goods, healthcare, BFSI, media…

Enterprise WLAN Market Awareness Overview 2025 | , Hewlett-Packard Enterprise, H …

Global Enterprise WLAN Market: Snapshot

The global enterprise WLAN is registering a significant rise in its valuation, thanks to the increasing penetration of Internet across the world. The rapidly rising market for enterprise WLAN technology is anticipated to boost the cloud technology and the Internet of Things (IoT) industries as well, inducing intense competitiveness. Moreover, the continual technological advancements are projected to increase WLAN applications in a number of industry sectors…

Enterprise Mobility Market - Generating an Increasing Demand for Enterprise Mobi …

Geographically-spread enterprises are constantly faced with scenarios that require the convergence of a large number of communication channels and inclusion of foreign computing devices in the central network.

With a vast rise in mobile devices that need to be integrated with enterprise networks, mostly owing to the increasing trend of policies such as bring-your-own-device and choose-your-own-device, and diversely located workplaces and employees, the need for adopting enterprise mobility solution has…

Enterprise Mobility Market - Generating an Increasing Demand for Enterprise Mobi …

Geographically-spread enterprises are constantly faced with scenarios that require the convergence of a large number of communication channels and inclusion of foreign computing devices in the central network. With a vast rise in mobile devices that need to be integrated with enterprise networks, mostly owing to the increasing trend of policies such as bring-your-own-device and choose-your-own-device, and diversely located workplaces and employees, the need for adopting enterprise mobility solution has…