Press release

Insurance Telematics Market Size, Growth Trends & Forecast to 2035

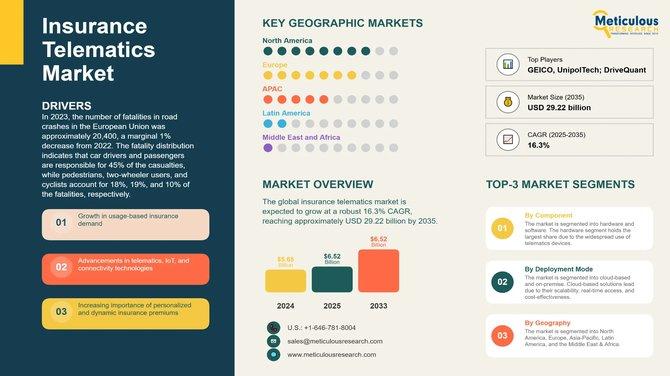

Insurance telematics market grows on AI, UBI, and connected vehicles, reaching USD 29.22B by 2035 up

This expansion is primarily driven by the rapid evolution of mobility patterns, rising road safety concerns, and insurers' shift toward real-time, data-driven underwriting models. According to recent European Union road safety statistics, approximately 20,400 fatalities were recorded in road accidents in 2023, underscoring the need for proactive risk mitigation strategies. Insurance telematics enables continuous monitoring of driving behavior, allowing insurers to deploy preventive interventions and incentivize safer driving.

Download Sample Report Here : https://www.meticulousresearch.com/download-sample-report/cp_id=6225

Market Dynamics Driving Growth

The growing adoption of usage-based insurance (UBI) models remains a key growth catalyst. Programs such as Pay-How-You-Drive (PHYD) and Pay-As-You-Drive (PAYD) are gaining widespread acceptance as consumers increasingly demand personalized and transparent insurance pricing. Telematics solutions enable insurers to achieve improved loss ratios and operational efficiency by aligning premiums with actual driving behavior. Advancements in AI-driven risk analytics and fraud detection are further strengthening market momentum. Machine learning models are increasingly deployed to identify anomalous driving patterns, detect fraudulent claims, and reduce loss exposure. Industry estimates suggest AI-enabled telematics solutions can reduce insurance fraud losses by up to 40%, delivering measurable returns on investment. Additionally, the convergence of AI, IoT, and 5G technologies is transforming connected vehicle ecosystems. Real-time data processing, low-latency connectivity, and enhanced sensor integration are expanding the scope of telematics applications across passenger and commercial vehicles.

Competitive Landscape and Strategic Developments

The insurance telematics market is characterized by strong competition among established insurers, telematics specialists, and technology providers. Key players including GEICO, AXA SA, Octo Telematics, Cambridge Mobile Telematics, Allstate Insurance, MiX Telematics, and Progressive are actively investing in smartphone-based telematics platforms, advanced analytics, and AI-powered driver behavior models. Strategic collaborations between automotive OEMs and insurance technology providers are enabling seamless telematics integration directly into vehicles. These partnerships are accelerating innovation while reducing hardware dependency and improving user adoption. Recent industry developments highlight this trend. In January 2024, Targa Telematics strengthened its insurance digitization capabilities through the acquisition of Earnix's telematics division, enabling advanced AI-driven driver analytics. Earlier, in October 2023, PowerFleet and MiX Telematics announced a strategic business combination aimed at creating a globally scaled mobile asset IoT SaaS provider.

Browse in Depth: https://www.meticulousresearch.com/product/insurance-telematics-market-6225

Regional Insights

North America continues to dominate the global insurance telematics market, accounting for approximately 35-40% of total market share in 2024. High penetration of connected vehicles, strong regulatory support for UBI programs, and early adoption of advanced telematics solutions underpin regional leadership, particularly in the United States. The Asia-Pacific region is projected to register the fastest growth through 2035, driven by rapid digitalization, supportive government policies, expanding vehicle ownership, and increased adoption of smartphone-based telematics solutions. Countries such as China and India are emerging as high-growth markets due to national AI strategies, expanding EV adoption, and strong fintech-insurance convergence.

Segmental Trends

On the basis of usage, the Pay-How-You-Drive (PHYD) segment holds the largest market share, supported by insurers' focus on behavior-based premium modeling. By vehicle type, passenger vehicles dominate telematics adoption, driven by connected car technologies, EV growth, and rising consumer preference for personalized insurance products.

Buy the Complete Report with an Impressive Discount: https://www.meticulousresearch.com/view-pricing/1542

Outlook

Despite strong growth prospects, the market faces challenges related to data privacy, cybersecurity, and consumer resistance to continuous tracking. However, ongoing advancements in data protection frameworks, anonymization technologies, and transparent consent models are expected to mitigate these concerns over the forecast period. With insurers increasingly prioritizing predictive risk modeling, connected vehicle intelligence, and digital transformation, insurance telematics is set to become a cornerstone of next-generation insurance ecosystems worldwide.

Related Reports:

Video Analytics Market: https://www.meticulousresearch.com/product/video-analytics-market-5274

Automotive Cybersecurity Market: https://www.meticulousresearch.com/product/automotive-cybersecurity-market-5480

About Us:

We are a trusted research partner for leading businesses worldwide, empowering Fortune 500 organizations and emerging enterprises with actionable market intelligence tailored to drive revenue transformation and strategic growth. Our insights reveal forward-looking revenue opportunities, providing our clients with a competitive edge through a diverse suite of research solutions-syndicated reports, custom research, and direct analyst engagement.

Each year, we conduct over 300 syndicated studies and manage 60+ consulting engagements across eight key industry sectors and 20+ geographic markets. With a focus on solving the complex challenges facing global business leaders, our research enables informed decision-making that propels sustainable growth and operational excellence. We are dedicated to delivering high-impact solutions that transform business performance and fuel innovation in the competitive global marketplace.

Contact Us:

Meticulous Market Research Pvt. Ltd.

1267 Willis St, Ste 200 Redding,

California, 96001, U.S.

Email- sales@meticulousresearch.com

USA: +1-646-781-8004

Europe: +44-203-868-8738

APAC: +91 744-7780008

Visit Our Website: https://www.meticulousresearch.com/

For Latest Update Follow Us:

LinkedIn- https://www.linkedin.com/company/meticulous-research

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Telematics Market Size, Growth Trends & Forecast to 2035 here

News-ID: 4379377 • Views: …

More Releases from Meticulous Research®

Fog Computing Market Size to Reach USD 5.41B by 2035 | CAGR 28.5%

The global fog computing market is gaining strong momentum as enterprises increasingly seek low-latency, decentralized data processing architectures to support real-time digital operations. Valued at USD 448 million in 2024, the market is projected to grow from USD 582 million in 2025 to USD 5.41 billion by 2035, registering a robust CAGR of 28.5% during the forecast period.

Fog computing-positioned between cloud and edge environments-enables real-time analytics, reduced network congestion, and…

Enterprise Mobility Management Market to Reach USD 226.2B by 2035

The global Enterprise Mobility Management (EMM) Market is experiencing rapid expansion as enterprises increasingly adopt secure, scalable mobility solutions to support hybrid and remote work environments. The market was valued at USD 20.75 billion in 2024 and is estimated to reach USD 25.23 billion in 2025, before surging to USD 226.2 billion by 2035, registering a strong compound annual growth rate (CAGR) of 24.5% during the forecast period.

Enterprise Mobility Management…

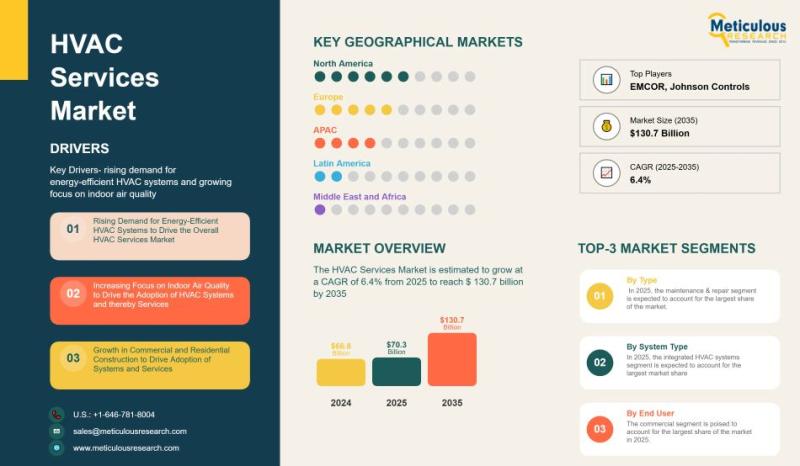

Global HVAC Services Market Analysis 2025-2035: Trends, Drivers, and Growth Oppo …

The global HVAC services market, valued at USD 66.8 billion in 2024, is set to nearly double over the next decade, reaching an estimated USD 130.7 billion by 2035. This represents a steady growth rate of 6.4% per year from 2025 to 2035. Several factors are contributing to this expansion, including the growing demand for energy-efficient heating, ventilation, and air conditioning systems, heightened attention to indoor air quality, an increase…

Global Cooling Tower Market Outlook 2025-2035: Trends, Drivers, and Opportunitie …

The global cooling tower market is growing steadily and is expected to reach USD 6.90 billion by 2035, up from USD 4.31 billion in 2025, representing a CAGR of 4.8%. In 2024, the market was valued at USD 3.84 billion. This growth is being driven by a combination of industrial expansion, rising power generation needs, and the increasing focus on energy-efficient solutions in both industrial and commercial settings. At the…

More Releases for UBI

Usage Based Insurance (Ubi) Market: A Comprehensive Overview

The Usage-Based Insurance (UBI) Market was valued at USD 43.38 billion in 2023 and is expected to grow to approximately USD 87.0 billion by 2033, reflecting a CAGR of about 7.2% from 2024 to 2033.

Usage Based Insurance (Ubi) Market Overview

The Usage-Based Insurance (UBI) Market is experiencing significant growth, driven by advancements in telematics and the increasing adoption of connected vehicles. UBI models, such as Pay-As-You-Drive (PAYD) and Pay-How-You-Drive (PHYD), utilize…

Usage Based Insurance (Ubi) Market Size Unlocking New Opportunities for Success

The global Usage-Based Insurance (UBI) Market was valued at approximately USD 33.27 billion in 2023 and is projected to reach around USD 232.94 billion by 2032, growing at a compound annual growth rate (CAGR) of 24.14% from 2024 to 2032.

Usage Based Insurance (Ubi) Market Overview

Usage-Based Insurance (UBI) is an innovative auto insurance model that determines premiums based on individual driving behaviors, such as distance traveled, speed, braking patterns, and time…

Usage-based Insurance (UBI) Market Revenue Sizing Outlook Appears Bright

Global Usage-based Insurance (UBI) Market Report from Market Insights Report highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans and make informed decisions…

Usage-based Insurance (UBI) Market Will Generate Record Revenue by 2029

The global UBI market is anticipated to grow at a CAGR of 27.9% during the forecast period. Due to the increasing demand for usage-based insurance for automotive continues, along with the strong ecosystem is getting created around connected automotive services. This ecosystem involves participants such as automotive IoT and insurance platform providers, data platform and analytics companies, automotive insurance black box and telematics providers, big data companies, and cloud service providers. For…

Usage-based Insurance (UBI) Market to Witness Growth Acceleration by 2029

The global UBI market is anticipated to grow at a CAGR of 27.9% during the forecast period. Due to the increasing demand for usage-based insurance for automotive continues, along with the strong ecosystem is getting created around connected automotive services. This ecosystem involves participants such as automotive IoT and insurance platform providers, data platform and analytics companies, automotive insurance black box and telematics providers, big data companies, and cloud service providers. For…

Usage-Based Insurance (UBI) Market by Policy Type [Pay-As-You-Drive Insurance (P …

UBI Market Size

The global usage-based insurance market size was valued at $28.7 billion in 2019, and is projected to reach $149.2 billion by 2027, growing at a CAGR of 25.1% from 2020 to 2027. Usage-based insurance is expected to grow rapidly in the coming years. Key drivers of the usage-based insurance market include the growing adoption of telematics technology in the automotive insurance space.

Download Free Sample: https://reports.valuates.com/request/sample/ALLI-Auto-0U87/Usage_Based_Insurance

Trends Influencing the Global…