Press release

Bio-CNG Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Project Cost

The global energy landscape is undergoing a fundamental transformation as nations and industries worldwide seek cleaner, more sustainable alternatives to conventional fossil fuels. Bio-CNG (compressed natural gas), a renewable fuel derived from organic waste through advanced anaerobic digestion and biogas upgrading processes, represents a critical solution in this energy transition. This comprehensive investment guide examines the compelling opportunity of establishing a bio-CNG manufacturing facility, drawing on market intelligence, financial projections, and technical specifications to provide investors with actionable insights for making informed decisions in this rapidly expanding sector.IMARC Group's report, "Bio-CNG Manufacturing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," offers a comprehensive guide for establishing a plant. The Bio-CNG manufacturing plant setup report offers insights into the process, financials, capital investment, expenses, ROI, and more for informed business decisions.

Market Overview and Growth Potential

The bio-CNG industry is experiencing robust expansion driven by converging forces of environmental necessity, energy security concerns, and supportive regulatory frameworks. The global bio-CNG market size was valued at USD 29.82 Billion in 2025, and according to IMARC Group estimates, the market is expected to reach USD 47.29 Billion by 2034, exhibiting a CAGR of 5.3% from 2026 to 2034.

This impressive growth trajectory reflects multiple powerful market drivers.

Increasing concerns about air pollution and greenhouse gas emissions are compelling governments worldwide to implement policies supportive of bio-CNG production, including subsidies and blending targets. The technology's alignment with circular economy principles makes it particularly attractive for cities and industries seeking to convert waste into valuable energy resources.

The feedstock availability for bio-CNG production is substantial, with the U.S. Environmental Protection Agency estimating that over 70 million tons of wet organic waste amenable to anaerobic digestion are produced annually in the United States alone. This abundant raw material base, combined with rising fuel prices and energy security challenges, is propelling the adoption of domestically produced renewable fuels, particularly for transportation and industrial applications.

Request Sample: https://www.imarcgroup.com/bio-cng-manufacturing-plant-project-report/requestsample

The expanding compressed natural gas (CNG) infrastructure and the growing demand for cleaner fuels in public transportation further strengthen market fundamentals. Additionally, bio-CNG production offers dual benefits beyond energy generation-reducing landfill waste while producing organic fertilizer as a valuable by-product, significantly enhancing project economics.

Plant Capacity and Production Scale

The proposed manufacturing facility is designed with a production capacity of 5 tons per day, enabling economies of scale while maintaining operational flexibility. This capacity level represents an optimal balance between capital efficiency and market responsiveness, allowing operators to serve diverse market segments effectively.

The production scale supports multiple end-use applications across transportation, industrial heating, power generation, and residential cooking sectors. This diversification capability provides revenue stability and reduces market concentration risk, critical factors for long-term investment viability.

Financial Viability and Profitability Analysis

The bio-CNG manufacturing sector demonstrates exceptional profitability potential under normal operating conditions, supported by stable demand patterns and value-added applications.

• Gross Profit: 40-60%

• Net Profit: 25-40%

These healthy margin profiles reflect the premium value proposition of bio-CNG as a clean fuel alternative, combined with relatively stable production costs. The financial projections for bio-CNG facilities are developed using realistic assumptions encompassing capital investment requirements, operating costs, manufacturing capacity utilization rates, pricing trends, and demand outlook. These comprehensive projections provide investors with clear visibility into the project's financial viability, return on investment potential, profitability trajectory, and long-term sustainability.

The strong profitability metrics position bio-CNG manufacturing as an attractive investment opportunity for stakeholders seeking exposure to the renewable energy sector while maintaining commercial viability and competitive returns.

Operating Cost Structure

Understanding the operating expense framework is essential for assessing project economics and long-term competitiveness. Raw materials, particularly organic waste including cattle dung, press mud, and food waste, account for approximately 10-20% of total operating expenses (OpEx). This relatively modest raw material cost component reflects the Bio-CNG nature of bio-CNG production, where feedstock often carries negative or minimal cost.

Utilities represent 15-20% of operating expenses, covering essential requirements including electricity for compression equipment, water for process operations, and steam for various manufacturing stages. The remaining operational costs encompass transportation, packaging, labor, maintenance, quality control, and environmental compliance.

The key raw materials utilized in bio-CNG production include various forms of organic waste-cattle dung, press mud, and food waste-along with water for process requirements. Establishing long-term supply contracts with reliable organic waste providers helps mitigate price volatility while ensuring consistent material availability to maintain uninterrupted production schedules.

Effective cost management strategies focus on optimizing feedstock procurement, enhancing process efficiency, and implementing preventive maintenance programs to minimize downtime and maximize equipment longevity.

Speak to an Analyst: https://www.imarcgroup.com/request?type=report&id=29280&flag=C

Capital Investment Requirements

Establishing a bio-CNG manufacturing facility requires comprehensive capital expenditure planning across multiple categories. The total capital investment encompasses land acquisition, site development, and necessary infrastructure to support operations. Machinery costs represent the largest portion of total capital expenditure, reflecting the sophisticated equipment required for biogas production and upgrading.

Essential equipment for bio-CNG production includes anaerobic digesters for biogas generation, biogas upgrading systems to purify methane content, compression units to pressurize the gas to CNG standards, storage tanks for intermediate and final product storage, transportation vehicles for product distribution, and comprehensive quality control systems to ensure product specifications meet regulatory requirements.

Land and site development costs encompass charges for land registration, boundary development, and related site preparation expenses, forming a substantial portion of the overall investment. Civil works costs cover construction of processing facilities, administrative buildings, storage areas, and supporting infrastructure.

All machinery must comply with industry standards for safety, efficiency, and reliability, with equipment selection prioritizing corrosion-resistant materials suitable for the biogas production environment. The scale of manufacturing operations and level of automation significantly influence total machinery costs, with higher automation levels typically commanding premium investment but delivering enhanced operational efficiency and reduced long-term labor costs.

Infrastructure requirements include robust transportation access, reliable utility connections for electricity and water, and comprehensive waste management systems to handle process byproducts in compliance with environmental regulations.

Major Applications and Market Segments

Bio-CNG serves diverse end-use applications across multiple industry sectors, providing revenue diversification and market resilience. In the transportation sector, bio-CNG is increasingly adopted as an alternative fuel for CNG-powered vehicles, including buses, trucks, and private vehicles, benefiting from existing CNG infrastructure while delivering superior environmental performance compared to conventional fossil fuels.

Industrial and commercial applications represent significant demand drivers, with bio-CNG utilized extensively in heating, drying, and cooking processes. The fuel's clean-burning characteristics and competitive pricing make it attractive for industrial facilities seeking to reduce their carbon footprint while managing energy costs effectively.

In power generation, bio-CNG fuels gas turbines and combined heat and power (CHP) systems for electricity production, supporting distributed generation strategies and grid stability requirements. The fuel's renewable nature makes it particularly valuable for utilities and independent power producers pursuing renewable energy portfolio standards.

Residential and commercial cooking applications continue expanding, particularly in regions where bio-CNG is promoted as an alternative cooking fuel for households and commercial kitchens, replacing traditional LPG or natural gas with a locally produced renewable option.

The Bio-CNG sector represents a foundational application, where bio-CNG production directly addresses waste management challenges while generating valuable energy, creating dual value streams that enhance project economics.

Why Invest in Bio-CNG Manufacturing?

Bio-CNG manufacturing presents compelling strategic advantages for investors seeking exposure to the renewable energy transition. The sector's renewable and sustainable foundation positions it favourably in policy environments increasingly focused on greenhouse gas reduction. Bio-CNG is produced from renewable organic materials and offers a significant reduction in greenhouse gas emissions when compared to fossil fuels, establishing it as a clean, sustainable energy source that helps mitigate climate change and reduce carbon footprints.

The circular economy alignment creates powerful synergies between waste management and energy production. Bio-CNG production helps in Bio-CNG processes, converting organic waste materials such as agricultural residues, food waste, and sewage sludge into valuable energy, promoting sustainable waste management while reducing landfill waste.

Economic benefits strengthen the investment case significantly. Bio-CNG can be more cost-effective than fossil-based natural gas, especially when produced from local organic waste sources. Government incentives and subsidies for renewable energy production are driving down production costs, making Bio-CNG more accessible to both consumers and industries.

Energy security considerations provide additional strategic value, particularly for nations with substantial agricultural activity. Bio-CNG offers countries and regions a way to diversify their energy sources, reducing reliance on imported natural gas. Countries with significant agricultural activity, such as India, the U.S., and Brazil, have the potential to become major producers of Bio-CNG, ensuring energy independence and sustainability.

Entry barriers in the sector include technological expertise requirements, regulatory compliance obligations, and capital intensity, which favor established players with technical capabilities and financial resources. Market trends strongly align with bio-CNG growth, including accelerating clean energy transitions, tightening emissions regulations, expanding Bio-CNG initiatives, and rising CNG vehicle adoption.

Policy support mechanisms continue strengthening across major markets, with governments implementing favorable blending mandates, production subsidies, and carbon credit programs that enhance project economics. Localization benefits include reduced transportation costs, improved supply chain control, and enhanced community relations through local waste utilization. Technology advantages in anaerobic digestion and biogas upgrading continue advancing, improving efficiency and reducing costs while expanding applicable feedstock types.

Buy Now: https://www.imarcgroup.com/checkout?id=29280&method=2175

Industry Leadership

The global bio-CNG industry features several leading manufacturers with extensive production capabilities and diverse application portfolios.

• Clean Energy Fuels

• Verbio SE

• Shell

• Neste

• IFPEN

• Biokraft International AB

These industry leaders demonstrate the commercial viability and scalability of bio-CNG production while establishing operational best practices and technology standards that benefit emerging players entering the market.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Bio-CNG Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Project Cost here

News-ID: 4378669 • Views: …

More Releases from IMARC Group

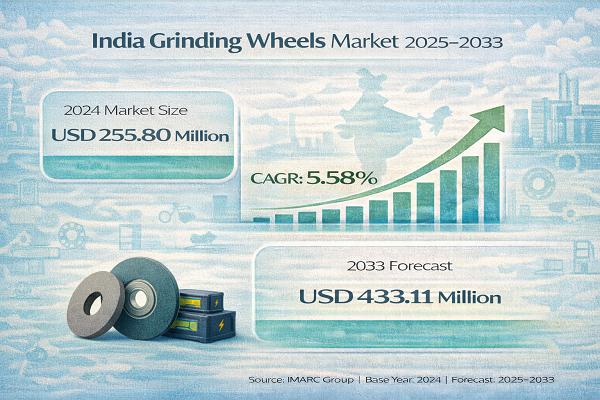

India Grinding Wheels Market Set for Steady Expansion, Forecast to Hit USD 433.1 …

India Grinding Wheels Market - Report Introduction

According to IMARC Group's report titled "India Grinding Wheels Market Size, Share, Trends, and Forecast by Type, Material, and Region, 2025-2033" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Note : We are in the process of updating our reports to cover the 2026-2034 forecast period. For the most recent data, insights, and industry updates, please…

Disposable Syringe Manufacturing Plant Cost 2026: Feasibility Study and Profitab …

The global disposable syringe market represents a compelling investment opportunity driven by surging demand for safe and hygienic delivery of drugs, expansion in healthcare infrastructure, and growing demand for standardized, single-use medical devices. Disposable syringes are single-use medical injection devices that are presterilized, manufactured from medical plastic components comprising a graduated barrel, plunger, and needle. They are designed for the safe and controlled administration of precise fluid, vaccine, or medication…

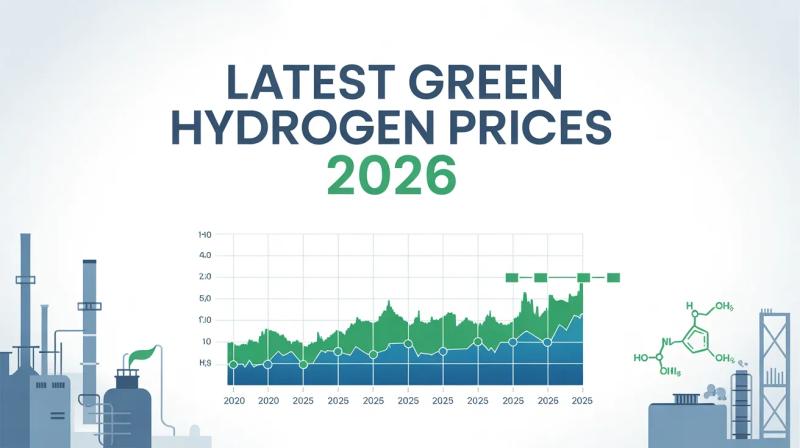

Green Hydrogen Prices 2026: Trend Analysis, Fluctuations & Forecast

Global Green Hydrogen Prices have been closely monitored as the sector grows rapidly with the energy transition. The Green Hydrogen Price Index reflects evolving costs influenced by renewable energy availability, electrolyzer efficiency, and regional market demand. Rising adoption in industrial, transportation, and clean energy applications has intensified interest in price trends, historical data, and future forecasts, making reliable pricing intelligence essential for investors, producers, and buyers worldwide.

Green Hydrogen Current Price…

Southeast Asia Luxury Travel Market to Reach USD 193.6 Billion by 2033, Growing …

South East Asia Luxury Travel Market : Report Introduction

According to IMARC Group's report titled "South East Asia Luxury Travel Market Research Report and Industry Forecast" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Note : We are in the process of updating our reports to cover the 2026-2034 forecast period. For the most recent data, insights, and industry updates, please click on…

More Releases for CNG

CNG Refueling Stations Market to Eyewitness Huge Growth by 2030: Galileo Technol …

Advance Market Analytics published a new research publication on "CNG Refueling Stations Market Insights, to 2028" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the CNG Refueling Stations market was mainly driven by the increasing R&D spending across the world. Some of the key…

Vehicle CNG Tank CNG Cylinder Market Industry Trends, Opportunities And Overview …

Xcellent Insights has recently added a novel report on "Global Vehicle CNG TankCNG Cylinder Market, Size, Share, Growth Analysis, By Type, Application and Region" to its database that offers a comprehensive analysis of the global Vehicle CNG TankCNG Cylinder industry. The report offers details about current and historical status, market volume, market share, size, drivers, restraints, growth opportunities and prime challenges.

The aim of this report is to help users, investors…

Global CNG Tank (CNG Cylinder) Market Expected to Witness a Sustainable Growth o …

Market Research Report Store offers a latest published report on CNG Tank (CNG Cylinder) Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report.

According to this study, over the next five years the CNG Tank (CNG Cylinder) market will register a 3.3% CAGR in terms of revenue, the global market size will reach US$ 926.1 million by 2024, from US$ 812.7…

CNG Tank (CNG Cylinder) Market Is Booming Worldwide | Sintez-CIP, JFE, Jiangsu T …

A latest study released by HTF MI on Global CNG Tank (CNG Cylinder) Market covering key business segments and wide scope geographies to get deep dive analysed market data. The study is a perfect balance bridging both qualitative and quantitative information of CNG Tank (CNG Cylinder) market. The study provides historical data (i.e. Volume** & Value) from 2013 to 2018 and forecasted till 2025*. Some are the key & emerging…

Global CNG Tank (CNG Cylinder) Market – Demand, Sales Forecasts, Share and Siz …

CNG Tank Refers to the Tank for storing compressed natural gas

Scope of the Report:

This report focuses on the CNG Tank in global market, especially in North America, Europe and Asia-Pacific, South America, Middle East and Africa. This report categorizes the market based on manufacturers, regions, type and application.

Emerging trends, which have a direct impact on the dynamics of the industry, include the increase in green fleet and development of type…

Global CNG Tank (CNG Cylinder) Market Expected to Witness a Sustainable Growth o …

New report published by Market Research Report Store (MRRS) which offers insights on the global CNG Tank (CNG Cylinder) market.

CNG Tank/Cylinder is made using the cylinder shape with a semi-spherical shape covering each end. The cylinder and semi-spherical shapes provide the strongest structural shape because the circular and spherical shapes provide for equal distribution of stresses throughout the inner area of the tank producing the highest safety available for high-pressure…