Press release

Steel Manufacturing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/OpEx, & ROI

The global steel industry stands as one of the most foundational pillars of modern economic development, underpinning virtually every major sector from construction and infrastructure to automotive manufacturing and energy production. As nations worldwide accelerate urbanization programs, expand transportation networks, and invest heavily in renewable energy infrastructure, the demand for high-quality steel continues to surge. Steel, an alloy of iron and carbon with carbon content between 0.02 and 2.1 percent by weight, offers unmatched tensile strength, recyclability, formability, and resistance to mechanical stress, making it indispensable for modern industrial economies. Establishing a steel manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and industrial investors seeking to capitalize on this expansive and resilient market.IMARC Group's report, "Steel Manufacturing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," offers a comprehensive guide for establishing a manufacturing plant. The steel manufacturing plant report offers insights into the manufacturing process, financials, capital investment, expenses, ROI, and more for informed business decisions.

Request for Sample Report: https://www.imarcgroup.com/steel-manufacturing-plant-project-report/requestsample

Market Overview and Growth Potential

The global steel market demonstrates a robust growth trajectory, valued at USD 5,130.60 Billion in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach USD 6,776.60 Billion by 2034, exhibiting a steady CAGR of 3.14% from 2026 to 2034. This sustained expansion is driven by rapid urbanization, large-scale infrastructure development, growth in automotive production, expansion of renewable energy installations, and rising demand from industrial machinery and construction sectors. Steel is produced in various grades, including carbon steel, alloy steel, stainless steel, and tool steel, with additional elements such as manganese, chromium, nickel, and molybdenum incorporated to deliver specific mechanical, thermal, or corrosion-resistant properties depending on end-use requirements.

The market is further supported by increasing automotive production, particularly electric vehicles, which drives demand for high-strength and lightweight steel grades. Growth in renewable energy installations such as wind and solar power further increases steel consumption for structural and transmission components. Government-led initiatives for industrialization and infrastructure modernization continue to stimulate steel demand globally, while technological advancements in energy-efficient furnaces and recycling-based steelmaking are improving production economics and sustainability compliance.

Plant Capacity and Production Scale

The proposed steel manufacturing facility is designed with an annual production capacity ranging between 1-3 million MT per year, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to cater to diverse market segments-from construction and infrastructure projects to automotive components, industrial machinery, energy systems, and appliance manufacturing-ensuring steady demand and consistent revenue streams across multiple industry verticals.

Financial Viability and Profitability Analysis

The steel manufacturing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

• Gross Profit Margins: 15-25%

• Net Profit Margins: 5-10%

These margins are supported by stable market demand across construction, automotive, and industrial sectors, value-added manufacturing capabilities, and the critical nature of steel in high-performance structural and engineering applications. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established industrial players looking to diversify their product portfolio in the metals and materials sector.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a steel manufacturing plant is primarily driven by:

• Raw Materials: 60-70% of total OpEx

• Utilities: 20-25% of OpEx

• Other Expenses: Including labor, packaging, transportation, maintenance, depreciation, and taxes

Raw materials constitute the largest portion of operating costs, with iron ore and coal being the primary input materials. Establishing long-term contracts with reliable suppliers helps mitigate price volatility and ensures consistent material supply, which is critical given that raw material price fluctuations represent the most significant cost factor in steel manufacturing. By the fifth year of operations, total operational costs are expected to increase substantially due to factors such as inflation, market fluctuations, supply chain disruptions, and rising consumer demand.

Capital Investment Requirements

Setting up a steel manufacturing plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to key raw materials such as iron ore and coal, target industrial markets, and robust infrastructure including reliable transportation networks, utilities, and waste management systems. The site selection process must also consider environmental impact assessments, compliance with local zoning laws, and environmental regulations.

Machinery and Equipment: Machinery costs account for the largest portion of total capital expenditure. Key equipment includes:

• Blast furnaces for primary iron smelting operations

• Basic oxygen furnaces for carbon content reduction and steel conversion

• Electric arc furnaces for steelmaking and specialty grades

• Continuous casters for solidifying molten steel into semi-finished forms

• Hot and cold rolling mills for shaping steel into plates, sheets, and coils

• Annealing furnaces for heat treatment and mechanical property enhancement

• Pickling lines for surface oxide removal and preparation

• Finishing and coating systems for final product quality and corrosion protection

Civil Works: Building construction, factory layout optimization, and infrastructure development designed to enhance workflow efficiency, ensure workplace safety, and minimize material handling complexities throughout the production process.

Other Capital Costs: Pre-operative expenses, machinery installation costs, regulatory compliance certifications, initial working capital requirements, and contingency provisions for unforeseen circumstances during plant establishment.

Buy Now: https://www.imarcgroup.com/checkout?id=18810&method=2175

Major Applications and Market Segments

Steel finds extensive applications across diverse industrial sectors, demonstrating its versatility and critical importance:

Automotive: Structural components, exhaust systems, chassis frames, and safety reinforcements for conventional and electric vehicles supporting the global transition to sustainable transportation.

Machinery & Equipment: Industrial machines, tools, gears, and load-bearing components requiring superior strength and durability for heavy engineering applications.

Construction: Structural beams, rebar, columns, roofing systems, and reinforcement materials forming the backbone of residential, commercial, and industrial building projects.

Energy & Infrastructure: Pipelines, transmission towers, railways, and power plant components essential for energy generation, distribution, and transportation networks.

End-use industries include construction, infrastructure, automotive, industrial machinery, and appliance manufacturing, all of which contribute to sustained market demand.

Why Invest in Steel Manufacturing?

Several compelling factors make steel manufacturing an attractive investment opportunity:

Foundation of Industrial & Infrastructure Development: Steel products form the backbone of construction, transportation, energy, automotive, machinery, and heavy engineering sectors-making steel an indispensable material for economic growth, urbanization, and industrial reliability.

Moderate but Defensible Entry Barriers: While capital-intensive, steel manufacturing benefits from high barriers such as scale requirements, process expertise, quality certifications, energy efficiency standards, environmental compliance, and long-term customer approvals-favoring established and well-managed producers with consistent quality and cost control.

Strong Megatrend Alignment: Fast urbanization, infrastructure development, the adoption of electric mobility, renewable energy projects, rail development, defense productions, and automation of various sectors drive sustained demand for structural, alloy, and specialty steels across multiple industry verticals.

Policy & Infrastructure Push: Government-oriented investments in transport corridors, smart cities, and focused sectors like renewables, defense, and manufacturing incentives such as Make in India and PLI schemes in steel-intensive sectors have a direct and indirect bearing on growing steel consumption.

Localization and Supply Chain Security: OEMs, EPC contractors, and infrastructure developers increasingly prefer reliable domestic steel suppliers to reduce import dependence, manage price volatility, ensure timely delivery, and comply with local sourcing norms-creating strong opportunities for regional and integrated steel manufacturers.

Technology Integration: Modern steel manufacturing incorporates advanced processes including hot rolling, annealing, and galvanizing, alongside energy-efficient furnaces and recycling-based steelmaking techniques that enhance production economics and sustainability compliance.

Speak to an Analyst for Customized Report: https://www.imarcgroup.com/request?type=report&id=18810&flag=C

Industry Leadership

The global steel industry is led by established manufacturers with extensive production capacities and diverse application portfolios. Key industry players include:

• ArcelorMittal

• China Baowu Steel Group

• Nippon Steel Corporation

• POSCO

• Tata Steel

These companies serve diverse end-use sectors including construction, infrastructure, automotive, industrial machinery, and appliance manufacturing, demonstrating the broad market applicability of steel products.

Recent Industry Developments

August 2025: JSW Steel and POSCO Group signed a non-binding Heads of Agreement (HoA) to jointly explore setting up a 6 million tonnes per annum integrated steel plant in India, signaling strong corporate confidence in the steel manufacturing sector and its long-term growth trajectory.

July 2025: Tata Steel and Australia's InQuik Group signed a Memorandum of Understanding (MoU) to introduce modular bridge construction technology to India. This collaboration meets the evolving needs of India's communities and ushers in a new era in the country's infrastructure development by combining InQuik's technology with Tata Steel's industrial capabilities.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Steel Manufacturing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/OpEx, & ROI here

News-ID: 4378567 • Views: …

More Releases from IMARC Group

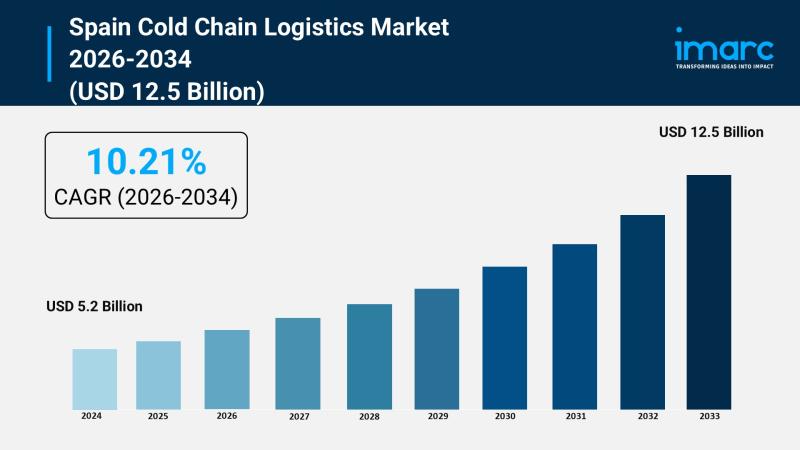

Spain Cold Chain Logistics Market Industry Dynamics and Future Outlook, 2026-203 …

Market Overview

The Spain cold chain logistics market size reached USD 5.2 Billion in 2025 and is projected to reach USD 12.5 Billion by 2034. The market is expected to grow at a CAGR of 10.21% during the 2026-2034 forecast period. This growth is primarily driven by the rising demand for fresh produce and pharmaceuticals, technological advancements in refrigeration and logistics, and stringent food safety regulations enhancing the logistics infrastructure in…

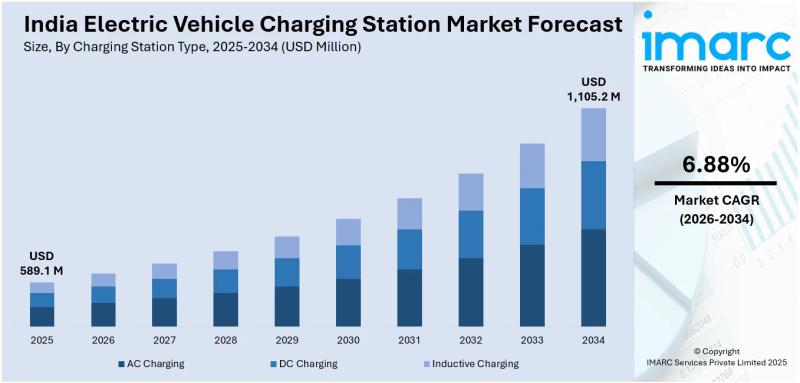

India Electric Vehicle Charging Station Market Size to Reach USD 1,105.2 Million …

Introduction

According to IMARC Group's report titled "India Electric Vehicle Charging Station Market Size, Share, Trends and Forecast by Charging Station Type, Vehicle Type, Installation Type, Charging Level, Connector Type, Application, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Electric Vehicle Charging Station Market Overview:

The India electric vehicle charging station market size was valued at USD 589.1 Million in…

India Lithium-Ion Battery Market Insights 2026-2034: EV Demand, Storage Applicat …

Introduction

According to IMARC Group's report titled "India Lithium-Ion Battery Market Size, Share, Trends and Forecast by Product Type, Power Capacity, Application, and Region, 2025-2033" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Lithium-ion Battery Market Overview:

The India lithium-ion battery market size was valued at USD 3.59 Billion in 2025. The market is projected to reach USD 9.79 Billion by 2034,…

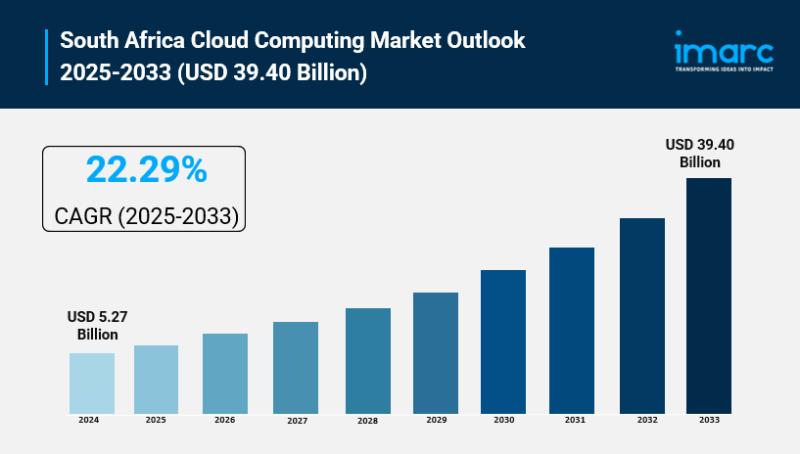

South Africa Cloud Computing Market Size to Hit USD 39.40 Billion by 2033 | Grow …

South Africa Cloud Computing Market Overview

Market Size in 2024: USD 5.27 Billion

Market Size in 2033: USD 39.40 Billion

Market Growth Rate 2025-2033: 22.29%

According to IMARC Group's latest research publication, "South Africa Cloud Computing Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the South Africa cloud computing market size reached USD 5.27 Billion in 2024. Looking forward, the market is expected to reach USD 39.40 Billion by 2033, exhibiting a…

More Releases for Steel

Steel Beams Market is Booming Worldwide with Steel Dynamics, JSW Steel, JFE Stee …

HTF MI just released the Global Steel Beams Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major Giants in Steel Beams Market are:

ArcelorMittal (Luxembourg), Nippon Steel (Japan),…

Special Ball Bearing Steel Market : Eminent Players - Nippon Steel, Suzhou Steel …

Market Description -

Los Angeles, (United States) - The information made available in the Special Ball Bearing Steel report will definitely facilitate to increase the knowledge and decision-making skills of the business, thus providing an immense opportunity for growth. This will at last increase the return rate and drive the competitive edge within. Being a custom market report, it provides services tailored to the exact challenge. Whether it is survey work,…

Miscellaneous Steel Detailing | Steel Detailer | Steel Detailing Services

We provide the highest quality of finished projects in the industry. Boasting unmatched turnaround times, and superb accuracy. WorldSteel Detailings has onboard team of experienced steel detailers and engineers with a wide range of experience from industrial and commercial projects to high rise buildings. By using innovative technologies and latest softwares, our structural steel detailing team provides accurate services as per your requirements based on country standards.Our steel detailing professionals…

What's driving the Structural Steel Market trends? ArcelorMittal, Tata Steel, Ni …

A detailed study on ‘Structural Steel market’ formulated by Market Study Report, LLC, puts together a concise analysis of the growth factors impacting the current business scenario across assorted regions. Significant information pertaining to the industry’s size, share, application, and statistics are also summed in the report in order to present an ensemble prediction. In addition, this report undertakes an accurate competitive analysis illustrating the status of market majors in…

What's driving the Structural Steel Market trends? ArcelorMittal, Tata Steel, Ni …

A detailed study on ‘Structural Steel market’ formulated by Market Study Report, LLC, puts together a concise analysis of the growth factors impacting the current business scenario across assorted regions. Significant information pertaining to the industry’s size, share, application, and statistics are also summed in the report in order to present an ensemble prediction. In addition, this report undertakes an accurate competitive analysis illustrating the status of market majors in…

What's driving the Structural Steel Market trends? ArcelorMittal, Tata Steel, Ni …

A detailed study on ‘Structural Steel market’ formulated by Market Study Report, LLC, puts together a concise analysis of the growth factors impacting the current business scenario across assorted regions. Significant information pertaining to the industry’s size, share, application, and statistics are also summed in the report in order to present an ensemble prediction. In addition, this report undertakes an accurate competitive analysis illustrating the status of market majors in…