Press release

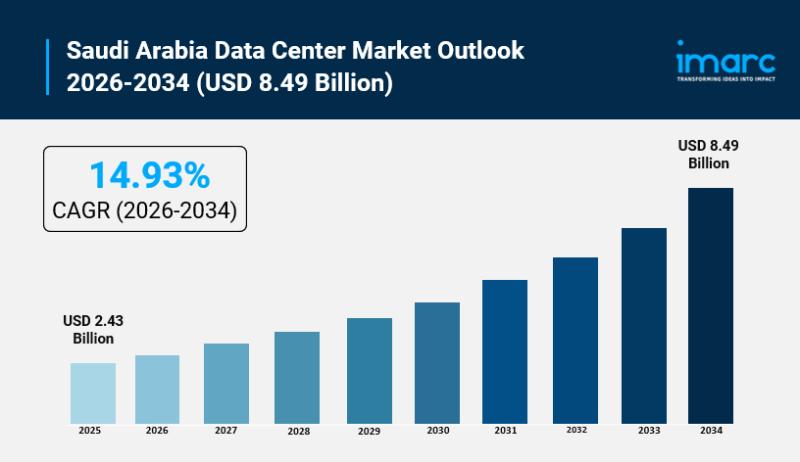

Saudi Arabia Data Center Market Set to Surge to USD 8.49 Billion by 2034 at 14.93% CAGR

Saudi Arabia Data Center Market OverviewMarket Size in 2025: USD 2.43 Billion

Market Forecast in 2034: USD 8.49 Billion

Market Growth Rate 2026-2034: 14.93%

According to IMARC Group's latest research publication, "Saudi Arabia Data Center Market Size, Share, Trends and Forecast by Data Center Size, Tier Type, Absorption, and Region, 2026-2034", the Saudi Arabia data center market size was valued at USD 2.43 Billion in 2025 and is projected to reach USD 8.49 Billion by 2034, growing at a compound annual growth rate of 14.93% from 2026-2034.

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-data-center-market/requestsample

How AI and Digital Transformation is Reshaping the Future of Saudi Arabia Data Center Market

● AI is fueling massive investments in Saudi Arabia's data centers through Vision 2030, with the Public Investment Fund committing $40 billion to build AI hubs and advanced infrastructure, boosting digital economy growth and innovation across sectors.

● Partnerships like HUMAIN's $10 billion deal with NVIDIA are transforming data centers into AI factories, enabling high-performance computing for local models and attracting global talent to the kingdom's tech scene.

● Government schemes such as SDAIA's national AI strategy are optimizing data centers with over $5.3 billion from AWS, focusing on cloud regions that support secure, efficient AI workloads for businesses and public services.

● The push for AI-ready data centers is evident in projects like the Google Cloud-PIF collaboration, investing $10 billion to create specialized facilities that handle massive datasets and drive economic diversification beyond oil.

● Emerging trends include sustainable AI data centers with 1.9 gigawatts capacity planned by HUMAIN, backed by Qualcomm partnerships, enhancing energy efficiency and positioning Saudi Arabia as a regional leader in tech infrastructure.

Saudi Arabia Data Center Market Trends & Drivers:

Saudi Arabia's data center market is booming thanks to Vision 2030, the massive government push turning the Kingdom into a digital powerhouse. This initiative pours billions into digital infrastructure, with projects like NEOM and smart cities demanding huge computing power for everything from AI analytics to real-time IoT sensors. Riyadh already holds 26.68% of the nation's installed capacity, acting as the central hub for banks and government ops, while Dammam surges ahead in the east, fueled by energy giants diversifying into tech. Big players like STC and Mobily are expanding Tier 3 facilities there, supporting data localization rules that keep sensitive info onshore. Hyperscalers such as AWS, Google, and Microsoft are jumping in with cloud regions, drawn by cheap energy and fiber backbones-Riyadh's proximity to ministries makes it perfect for low-latency enterprise needs. It's not just talk; these builds handle AI workloads for healthcare records and fintech transactions, making Saudi a MENA data gateway. Overall, Vision 2030 isn't optional-it's the engine propelling reliable, sovereign infrastructure that businesses crave.

Another key factor is the exploding demand for AI and cloud services, as businesses and the government ramp up digital transformation. With AI expected to add significant value to the GDP, investments are pouring in, like the $5.3 billion from Amazon Web Services to expand cloud regions and data centers across the KSA. Companies are leveraging this for real applications, such as smart city projects in NEOM that rely on high-performance computing for IoT and big data analytics. Statistics show a 30% spike in cloud service usage thanks to government digital initiatives, driving the need for scalable storage and processing. It's all about handling the surge in data from e-commerce and 5G networks, where low-latency edge computing is becoming essential, helping sectors like healthcare and finance operate smoother and innovate quicker.

AI workloads and 5G rollout are the hot new trends exploding demand, with nationwide fiber and edge nodes handling massive traffic spikes from smart apps. AI needs high-density racks-think training models for oil exploration or personalized banking-and Saudi's energy abundance keeps costs low, drawing giants like Google for dedicated zones. Dammam's 15.50% capacity jump ties into eastern industrial AI pilots, where Pure Data Centres builds for renewable-tied grids. Real-world wins? LEAP events showcase Mobily's AI platforms crunching healthcare data for faster diagnostics. Plus, 5G backbones boost edge facilities for low-latency gaming and autonomous vehicles in Riyadh trials. Regulations now favor green cooling tech, aligning with diversification goals. This combo positions Saudi as the region's AI hub, where startups plug into hyperscaler pipes for instant scale-it's practical innovation meeting real business needs head-on.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=16106&flag=E

Saudi Arabia Data Center Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Data Center Size:

● Large

● Massive

● Medium

● Mega

● Small

Breakup by Tier Type:

● Tier 1 and 2

● Tier 3

● Tier 4

Breakup by Absorption:

● Non-Utilized

● Utilized

Breakup by Region:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Competitive Landscape:

● Detecon Al Saudia DETASAD Co. Ltd.

● Electronia

● Gulf Data Hub

● Mobily

● NashirNet

● NourNet

● Sahara Net

● Shabakah Integrated Technology

● Systems of Strategic Business Solutions

Recent News and Developments in Saudi Arabia Data Center Market

● February 2026: Neom megaproject shifts focus to become a major data center hub with water-cooled infrastructure, leveraging renewable energy and land advantages to attract AI investors and support industrial applications amid Vision 2030 goals.

● January 2026: Saudi Arabia breaks ground on the Hexagon data center in Riyadh, a 480MW Tier IV facility spanning over 30 million square feet, claimed as the world's largest government-owned data center to strengthen national data sovereignty and AI capabilities.

● January 2026: HUMAIN and partners advance AI data center builds, including up to 250MW capacity financing from Infra, targeting GPU-dense setups for high-performance AI workloads and positioning the kingdom as a global AI infrastructure leader.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Data Center Market Set to Surge to USD 8.49 Billion by 2034 at 14.93% CAGR here

News-ID: 4378145 • Views: …

More Releases from IMARC Group

Global Procurement Software Market Size, Share, Trends & Forecast Report 2025-20 …

The global procurement software market size reached USD 8.2 Billion in 2024 and is expected to grow to USD 17.5 Billion by 2033, with a CAGR of 8.38% during the forecast period of 2025 to 2033. Growth is driven by the need for lean operations, quality and compliance assurance, data-driven decision-making, and increasing global supply chain complexities.

Study Assumption Years

Base Year: 2024

Historical Year/Period: 2019-2024

Forecast Year/Period: 2025-2033

Procurement Software Market Key Takeaways

The…

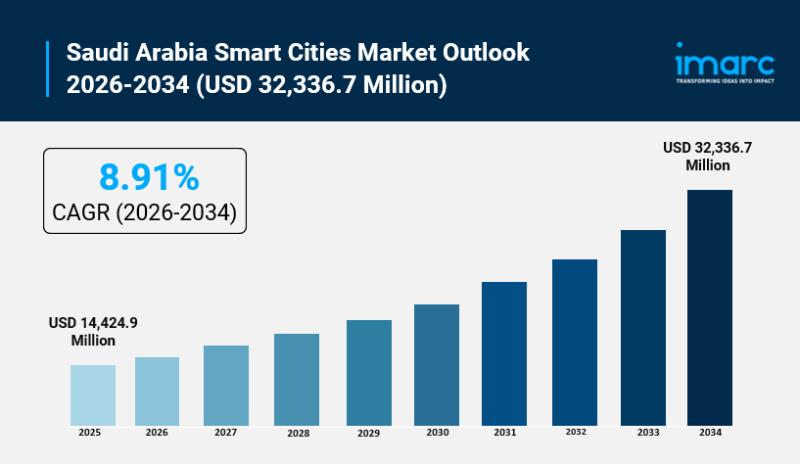

Saudi Arabia Smart Cities Market Size to Worth USD 32,336.7 Million by 2034 Grow …

Saudi Arabia Smart Cities Market Overview

Market Size in 2025: USD 14,424.9 Million

Market Forecast in 2034: USD 32,336.7 Million

Market Growth Rate 2026-2034: 8.91%

According to IMARC Group's latest research publication, "Saudi Arabia Smart Cities Market Report by Focus Area (Smart Transportation, Smart Buildings, Smart Utilities, Smart Citizen Services), and Region 2026-2034", Saudi Arabia smart cities market size reached USD 14,424.9 Million in 2025. The market is projected to reach USD 32,336.7 Million…

Global Lime Market Report 2025-2033: Growth, Demand, and Industry Analysis

The global lime market size reached USD 47.8 Billion in 2024. It is expected to grow to USD 64.8 Billion by 2033, exhibiting a CAGR of 3.43% during 2025-2033. Growth is driven by rapid development in the construction industry, increased focus on sustainable building practices, higher investments in infrastructure projects, and technological advancements improving lime production.

Study Assumption Years

Base Year: 2024

Historical Year/Period: 2019-2024

Forecast Year/Period: 2025-2033

Lime Market Key Takeaways

The lime market…

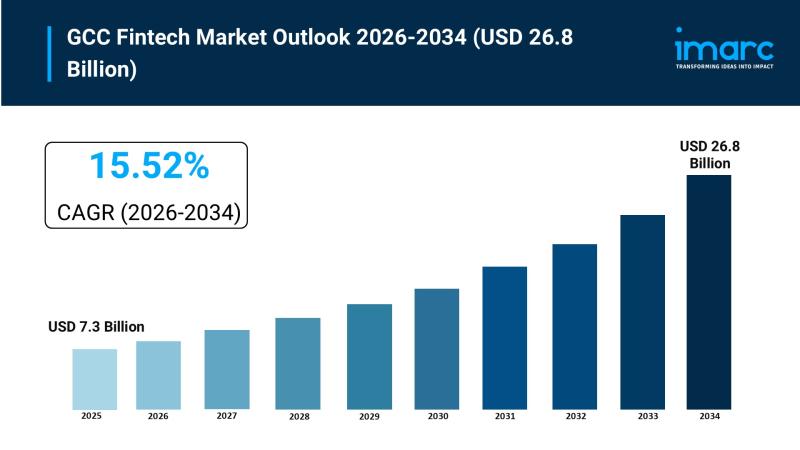

GCC Fintech Market Size is Expected to Reach USD 26.8 Billion By 2034 | CAGR: 15 …

GCC Fintech Market Overview

Market Size in 2025: USD 7.3 Billion

Market Size in 2034: USD 26.8 Billion

Market Growth Rate 2026-2034: 15.52%

According to IMARC Group's latest research publication, "GCC Fintech Market Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The GCC fintech market size reached USD 7.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 26.8 Billion by 2034, exhibiting a growth rate (CAGR) of 15.52%…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…