Press release

Top 30 Indonesian Stainless Steel Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)PT Krakatau Steel Tbk

PT Steel Pipe Industry of Indonesia Tbk

PT Gunung Raja Paksi Tbk

PT Gunawan Dianjaya Steel Tbk

PT Betonjaya Manunggal Tbk

PT Pelat Timah Nusantara Tbk

PT Saranacentral Bajatama Tbk

PT Lionmesh Prima Tbk

PT Super Iron & Steel Tbk

PT Indo Kordsa Tbk

PT Surya Esa Perkasa Tbk

PT Indah Kiat Pulp & Paper

PT KRAH Grand Kartech Tbk

PT Keyprint Tbk

PT Singaraja Putra Tbk

PT Prima Alloy Steel Tbk

PT Akebono Brake Astra Indonesia

PT Megah Surya Metal Tbk

PT Delta Steel & Engineering

PT Prima Steel Tubular Industries

PT Kapuas Prima Coal

PT Astra International

PT Indocement

PT Krakatau POSCO

PT Krakatau Nitrogen & Steel

PT Cakra Multi Steel

PT BISI International

PT KMI Wire & Cable

PT Daya Steel Pipe

PT Jakarana Tama Tbk

2) Revenue results of major public companies in Indonesia summarized (per company)

PT Krakatau Steel Tbk (KRAS) - PT Krakatau Steel delivered a net profit of approximately USD 22.17 million through Q3 2025 on revenues of about USD 706 million, marking a turnaround from significant losses in the previous year. The recovery was supported by higher sales volume, operational efficiencies, and restructuring relief, leading to a notable improvement in bottom-line performance.

PT Steel Pipe Industry of Indonesia Tbk (ISSP)- PT Steel Pipe Industry of Indonesia posted a net profit of around Rp 369 billion (USD 22 million+) for the nine months ended Q3 2025, with revenue near Rp 4,163 billion. The company maintain profitability despite slight year-over-year revenue contraction, benefiting from steady demand for steel pipe products in construction and infrastructure segments.

PT Gunung Raja Paksi Tbk (GGRP) - Gunung Raja Paksi recorded a net loss of about Rp 581.8 billion (approx. USD 34.9 million) in Q3 2025, reversing from previous profitable periods. This loss mainly reflects weak steel demand and pricing pressures that hurt margins, impacting the companys overall financial results.

PT Gunawan Dianjaya Steel Tbk (GDST) - Gunawan Dianjaya Steel remained profitable in Q3 2025 with a net profit of about Rp 65 billion (~USD 4 million). Revenue was roughly Rp 1,788 billion, and though results were softer relative to prior periods, the company continued to sustain positive earnings amid tougher market conditions.

PT Pelat Timah Nusantara Tbk (NIKL) - Pelat Timah Nusantara achieved a small net profit of roughly Rp 356.7 million (~USD 24 thousand) in Q3 2025, showing an early recovery from earlier losses. With about Rp 1,580.5 billion in revenue over the first nine months, this outcome indicates stabilization for this steel/tin-plate producer.

PT Betonjaya Manunggal Tbk - Betonjaya Manunggal, operating in steel and concrete products, typically reported modest earnings in line with broader steel sector trends.

PT Saranacentral Bajatama Tbk - Saranacentral Bajatama, active in steel and construction product markets, reflected earnings aligned with sector constraints.

PT Lionmesh Prima Tbk - Lionmesh Prima, part of niche steel components and fabrication sectors.

PT Super Iron & Steel Tbk - Super Iron & Steel, a small-to-mid-cap player, The segments earnings remained subdued relative to larger producers.

PT Prima Alloy Steel Tbk - Prima Alloy Steel, a niche producer focused on specialty alloys and steel, The companys performance tracked broader steel demand patterns amid mixed economic signals.

3) Key trends & insights from Q3 2025

Steel Demand Softening - Domestic construction and infrastructure slowdowns suppressed steel and stainless steel consumption, pressuring realizations across producers.

Profitability Divergence - Large producers like Krakatau Steel managed to return to profitability via operational efficiency and debt restructuring. Smaller players saw narrow margins or losses due to weaker pricing and higher costs.

Global Pricing & Input Costs - International steel pricing volatility and elevated input costs (energy, iron ore) continued to influence Indonesian earnings disproportionately in Q3.

Product Mix Matters - Companies producing higher-value or diversified steel products, including pipes and specialty alloys, generally showed better resilience than commodity plate producers.

4) Outlook for Q4 2025 and beyond

Gradual Demand Recovery - Expect modest recovery in domestic steel demand tied to renewed infrastructure spending and industrial investment but growth will likely be uneven.

Cost Management Focus - Companies will emphasize cost control, operational optimization, and downstream product strategies to safeguard margins.

Export Trends - Global steel balance and export demand will remain key; Indonesian producers targeting Asia Pacific markets may outperform those dependent on slower domestic segments.

Environmental & Policy Drivers - Sustainability trends and tariff policies could reshape competitive positioning for select exporters and downstream producers.

5) Conclusion

The Q3 2025 earnings landscape for Indonesian steel and stainless steel-related public companies reflects a sector in transition:

Turnarounds (e.g., Krakatau Steel) demonstrate that structural adjustments can restore profitability.

Divergent results across large and smaller producers underscore demand and margin pressures.

Future performance depends on domestic demand recovery, export competitiveness, and cost efficiency strategies.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top 30 Indonesian Stainless Steel Public Companies Q3 2025 Revenue & Performance here

News-ID: 4377771 • Views: …

More Releases from QY Research

Sustainable Beauty Packaging: Deep Dive into Global Pressed Powder Refill Pans

Pressed powder refill pans are replaceable cosmetic pans designed for use in refillable makeup compacts enabling consumers to replace just the powder pan rather than the entire case.

This market sits within the broader beauty packaging and cosmetics accessories sector, driven by sustainability trends, refillable packaging adoption, and increasing cosmetic consumption globally.

The global market size in 2025 stands at USD 551 million

Market Size in 2032: USD 827…

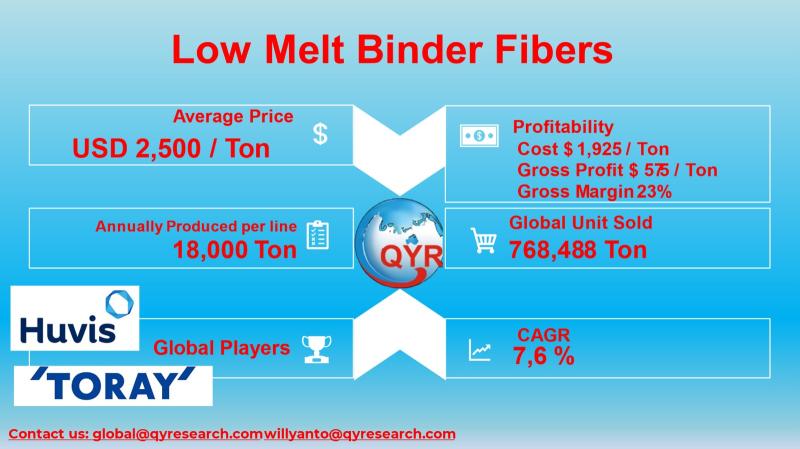

Sustainable Nonwovens Surge Drives Record Demand for Low Melt Binder Fibers

Low Melt Binder Fibers (LMBF) are thermoplastic synthetic fibers engineered with a lower melting sheath or core that bonds other fibers under heat, eliminating chemical adhesives and improving recyclability.

Widely used in nonwovens, automotive insulation, mattresses, filtration, hygiene, construction panels, and geotextiles, LMBF improves structural integrity, weight reduction, and production efficiency.

Demand is rising as industries shift toward solvent-free bonding technologies, sustainability, and automated thermal bonding lines.

Increasing adoption across Asia and Southeast…

Functional Fiber Frontier: Oat β-Glucan Industry Report with Strategic Regional …

Oat β-Glucan is a functional food ingredient widely used in food, beverage, nutraceutical, and cosmetic products due to its cholesterol-lowering, glycemic control, and gut-health benefits.

It is predominantly extracted from oat kernels and formulated into powder and liquid forms for downstream applications including fortified foods, supplements, functional beverages, and skincare formulations.

Driven by rising health awareness, clean-label trends, and preventive healthcare spending, the global market has matured into a core…

Top 30 Indonesian Light Bulbs Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

Signify (Euronext: LIGHT) global lighting leader with presence in Indonesia (Philips brand).

PT Maspion Holdings Corporation Tbk Conglomerate with electronics/LED potential.

PT Sat Nusapersada Tbk Electronics/assembly supplier.

PT Supreme Cable Manufacturing & Commerce Tbk Electrical cable maker (components).

PT KMI Wire and Cable Tbk Wire and cable supplier.

PT Voksel Electric Tbk Cable/electrical parts.

PT Erajaya Swasembada Tbk…

More Releases for Tbk

Indonesia Textile Industry Market Valuation Expected to Hit USD 28.57 billion by …

USA, New Jersey: According to Verified Market Research analysis, the global Indonesia Textile Industry Market size was valued at USD 21.7 Billion in 2023 and is projected to reach USD 28.57 Billion by 2031, growing at a CAGR of 3.50% from 2024 to 2031

How AI and Machine Learning Are Redefining the future of Indonesia Textile Industry Market?

AI-powered production planning systems optimize yarn selection, fabric blends, and loom utilization, improving output…

Infrastructure Market 2021 Strategic Assessments - PT. Acset Indonusa Tbk.., Pt. …

The Infrastructure Market report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The Infrastructure sector in Indonesia is…

Indonesia Telecom Tower Market Demand, Size, Share, Scope & Forecast To 2025 |To …

The Indonesia telecom tower market accounted to US$ 557.9 Mn in 2017 and is expected to grow at a CAGR of 27.1% during the forecast period 2018 – 2025, to account to US$ 3,695.5 Mn by 2025.

Get Sample Copy of this Indonesia Telecom Tower Market research report at - https://www.businessmarketinsights.com/sample/TIPRE00004113

The Business Market Insights provides you regional research analysis on “Indonesia Telecom Tower Market” and forecast to 2025. The research report…

Coal Mining in Indonesia Market 2022| PT Bumi Resources Tbk, PT Adaro Energy Tbk …

Researchmoz added Most up-to-date research on "Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption" to its huge collection of research reports.

Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption

Summary

GlobalData's "Coal Mining in Indonesia to 2022", provides a comprehensive coverage on Indonesias coal industry. It provides historical and forecast data on coal production by grade, reserves, consumption and exports by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes

Summary

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by type; exports, exports by type and exports by country. Detailed analysis of the…