Press release

Lithium-Sulfur Battery Manufacturing Plant DPR - 2026, Market Outlook, CapEx/OpEx and ROI Analysis

The global energy storage sector stands at a transformative inflection point as industries worldwide seek next-generation battery technologies capable of delivering superior energy density, extended operational lifetimes, and enhanced sustainability profiles. Lithium-sulfur batteries represent a revolutionary advancement in rechargeable battery technology, utilizing sulfur as the cathode material and lithium as the anode to achieve substantially higher theoretical energy density compared to conventional lithium-ion batteries. As increasing demand emerges from electric vehicles, renewable energy storage systems, and consumer electronics sectors, establishing a lithium-sulfur battery manufacturing plant presents an exceptionally compelling investment opportunity for visionary entrepreneurs and industrial investors seeking to capitalize on this rapidly expanding market poised to transform energy storage across multiple high-value applications.Request for a Sample Report: https://www.imarcgroup.com/lithium-sulfur-battery-manufacturing-plant-project-report/requestsample

Market Overview and Growth Potential

The global lithium-sulfur battery market demonstrates extraordinary growth momentum, valued at USD 53.00 Million in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach USD 415.23 Million by 2034, exhibiting a remarkable CAGR of 25.7% from 2026 to 2034. This exceptional expansion reflects the fundamental technological advantages and growing market acceptance of lithium-sulfur battery technology across multiple industrial applications.

A lithium-sulfur battery is a type of rechargeable battery that uses sulfur as the cathode material and lithium as the anode. These batteries are known for their higher theoretical energy density compared to conventional lithium-ion batteries, making them a promising option for electric vehicles, energy storage systems, and portable electronics. The battery offers a more sustainable solution due to the abundance of sulfur and its relatively low environmental impact. Lithium-sulfur batteries also have the potential to achieve higher charging cycles and lower production costs, making them a more efficient alternative to current battery technologies and positioning them as a transformative solution for next-generation energy storage applications.

Plant Capacity and Production Scale

The proposed lithium-sulfur battery manufacturing facility is designed with an annual production capacity ranging between 100 MWh to 1 GWh, enabling substantial economies of scale while maintaining operational flexibility to respond to market dynamics. This capacity range positions manufacturers to serve diverse market segments from electric vehicle applications and grid energy storage to consumer electronics and backup power systems, ensuring diversified revenue streams and strategic market positioning across multiple high-growth sectors.

Financial Viability and Profitability Analysis

The lithium-sulfur battery manufacturing business demonstrates exceptionally healthy profitability potential under normal operating conditions. The comprehensive financial projections reveal outstanding margins:

Gross Profit Margins: 40-50%

Net Profit Margins: 15-25%

These robust margin profiles are supported by stable and rapidly growing demand across electric vehicles, renewable energy storage, consumer electronics, and military applications. The financial projections have been developed based on realistic assumptions related to capital investment, operating costs, production capacity utilization, pricing trends, and demand outlook, providing a comprehensive view of project financial viability, return on investment potential, profitability trajectory, and long-term sustainability in this transformative technology sector.

Operating Cost Structure

Understanding the operating expenditure structure is crucial for effective financial planning and cost management. The cost structure is characterized by:

Raw Materials: 50-60% of total OpEx

Utilities: 15-20% of OpEx

Raw material consumption represents the dominant cost component, with the sulfur cathode accounting for approximately 50-60% of total operating expenses. Additional critical materials include lithium anode providing the energy storage mechanism, electrolyte enabling ion transport, and separator ensuring cell safety and performance. The relatively moderate utility costs reflect efficient manufacturing processes. In the first year of operations, operating costs are projected to be significant, covering raw materials, utilities, depreciation, taxes, packaging, transportation, and repairs and maintenance. By the fifth year, total operational costs are expected to increase substantially due to factors including inflation, market fluctuations, potential rises in key material costs, supply chain disruptions, rising consumer demand, and shifts in the global economic environment.

Buy Now: https://www.imarcgroup.com/checkout?id=17200&method=2175

Capital Investment Requirements

Establishing and operating a lithium-sulfur battery manufacturing plant involves various cost components requiring strategic planning. The total capital investment depends fundamentally on plant capacity, technology selection, and geographical location, covering land acquisition, site preparation, and necessary infrastructure.

Land and Site Development: The location must offer convenient access to key raw materials including sulfur cathode, lithium anode, electrolyte, and separator. Proximity to target markets minimizes distribution costs. The site must provide robust infrastructure including reliable transportation, utilities, and waste management systems, with compliance with local zoning laws and environmental regulations.

Machinery and Equipment: Machinery costs account for the largest portion of total capital expenditure. High-quality, corrosion-resistant machinery tailored for lithium-sulfur battery production must be selected. Essential equipment includes:

• Slurry mixers for electrode material preparation

• Precision electrode coaters for uniform material application

• Calendaring presses for electrode densification

• Vacuum drying ovens for moisture removal

• Cell assembly lines for stacking or winding operations

• Electrolyte filling systems for precise dosing

• Formation and aging cyclers for initial battery activation

• Final sealing and packaging stations for product finishing

All machinery must comply with rigorous industry standards for safety, efficiency, and reliability. The scale of production and automation level directly determine total machinery investment.

Civil Works: The layout should be optimized to enhance workflow efficiency, ensure workplace safety, and minimize material handling. Separate areas must be designated for raw material storage, production operations, quality control laboratories, and finished goods storage, with space for future expansion.

Major Applications and Market Segments

Lithium-sulfur batteries serve extensive applications across diverse market segments:

Electrode Fabrication: Used in current collectors, sulfur cathode frameworks, and conductive additives essential for high-performance battery construction.

Cell Assembly: Providing flexible interconnects, tabs, and internal wiring for pouch and cylindrical cell configurations.

Battery Pack Integration: Delivering module-level connections, grounding elements, and flexible connectors for complete battery system assembly.

Testing and Quality Control: High-precision leads, diagnostic connectors, and formation cycling interfaces ensuring battery performance validation and quality assurance.

Why Invest in Lithium-Sulfur Battery Manufacturing?

High Energy Density and Efficiency: Lithium-sulfur batteries offer significantly higher energy density compared to lithium-ion batteries, allowing for longer usage times, which is crucial for applications in electric vehicles and energy storage systems. This fundamental advantage positions Li-S technology as a transformative solution for next-generation energy applications.

Sustainability and Cost-Effectiveness: The use of sulfur, an abundant and inexpensive material, makes lithium-sulfur batteries a more cost-effective and sustainable option compared to other battery technologies, aligning with growing demand for eco-friendly and affordable energy storage solutions. The abundance of sulfur and its relatively low environmental impact provide substantial sustainability advantages.

Growing Market Demand for EVs and Renewable Energy Storage: The global sale of electric cars is expected to rise to over 20 million in 2025, making up over a quarter of cars sold globally according to the IEA's annual global EV outlook report. As the shift toward electric vehicles and renewable energy accelerates, there is increasing need for advanced batteries with higher energy density, which lithium-sulfur batteries are well-positioned to meet.

Technological Advancements: Ongoing research and development in lithium-sulfur battery technology are expected to improve battery performance, cycle life, and production costs, further driving market adoption. The lithium-sulfur battery market is likely to see significant developments in the near future to increase efficiency, extend cycle life, and lower production costs, creating continuous improvement opportunities.

Ask an Analyst: https://www.imarcgroup.com/request?type=report&id=17200&flag=C

Industry Leadership

Leading manufacturers in the global lithium-sulfur battery industry include several companies with extensive production capabilities and diverse application portfolios. Key players include:

• Oxis Energy

• Sion Power Corporation

• Univertical LLC

• Korea Zinc

• Panasonic Corporation

These industry leaders serve diverse end-use sectors including electric vehicles, renewable energy storage, consumer electronics, and military applications, demonstrating the broad market applicability and transformative potential of lithium-sulfur battery technology.

Recent Industry Developments

October 2024: Lyten announced plans to invest more than USD 1 Billion to build the world's first lithium-sulfur battery gigafactory. The facility will be located near Reno, Nevada, and will have the capability to produce up to 10 GWh of batteries annually at full scale, representing unprecedented scale in lithium-sulfur battery manufacturing.

October 2024: Li-S Energy announced that it had substantially improved the performance of its lithium-sulfur battery technology. From its Phase 3 automated pouch cell production facility, the company manufactured full-size 10Ah semi-solid-state cells delivering an energy density of 498Wh/kg on first discharge, and an industry-leading 456Wh/kg after formation cycling, with the cells continuing to cycle in ongoing testing, demonstrating significant technological breakthrough in battery performance.

Conclusion

The lithium-sulfur battery manufacturing sector presents an exceptionally positioned investment opportunity at the intersection of technological innovation, sustainability, and transformative energy storage capabilities. With extraordinary profit margins ranging from 40-50% gross profit and 15-25% net profit, remarkable market growth projected at 25.7% CAGR from USD 53.00 Million in 2025 to USD 415.23 Million by 2034, global electric vehicle sales expected to exceed 20 million units in 2025, and recent industry developments including Lyten's USD 1 Billion gigafactory investment and Li-S Energy's breakthrough achieving 498Wh/kg energy density, establishing a lithium-sulfur battery manufacturing plant offers significant potential for substantial long-term business success and sustainable returns. The convergence of superior energy density compared to lithium-ion technology, sustainability advantages through abundant sulfur utilization, accelerating demand from electric vehicles and renewable energy storage, continuous technological improvements in performance and cycle life, and industry-leading manufacturers demonstrating proven capabilities creates an exceptionally attractive value proposition for forward-thinking industrial investors committed to participating in the next generation of energy storage technology.

About IMARC Group

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its clients' business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Lithium-Sulfur Battery Manufacturing Plant DPR - 2026, Market Outlook, CapEx/OpEx and ROI Analysis here

News-ID: 4377499 • Views: …

More Releases from IMARC Group

India Telehealth Market to Reach $5,858.9 M by 2034 | CAGR 22.04% Growth

According to IMARC Group's report titled "India Telehealth Market Size, Share, Trends and Forecast by Component, Communication Technology, Hosting Type, Application, End User, and Region, 2026-2034", the report offers a comprehensive analysis of the industry, including India Telehealth market trends, share, growth, and regional insights.

How Big is the India Telehealth Industry?

The Telehealth market size in India was USD 911.9 Million in 2025. Looking forward, IMARC Group estimates the market to…

Green Hydrogen Production Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/O …

The global energy sector stands at an inflection point driven by the imperative to decarbonize industrial processes, reduce greenhouse gas emissions, and transition from fossil fuel dependence to sustainable, zero-emission energy carriers. At the forefront stands green hydrogen-a transformative fuel produced using renewable energy sources such as solar or wind power to split water into hydrogen and oxygen through electrolysis. Unlike conventional hydrogen production relying on fossil fuels through steam…

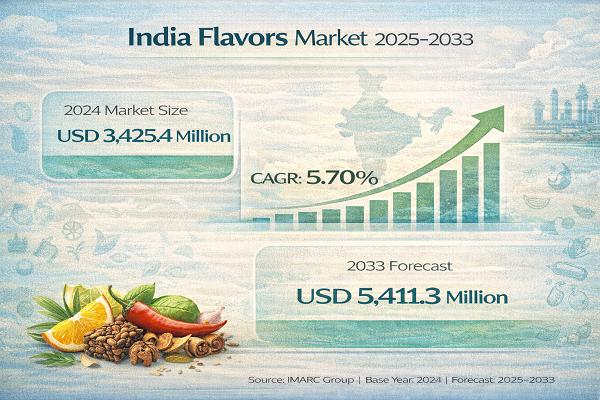

India Flavors Market on a Fast Growth Path, Reach at INR 8,512.5 Crore by 2033, …

India Flavors Market: Report Introduction

According to IMARC Group's report titled "India Flavors Market Size, Share, Trends and Forecast by Product Type, Form, Application, and Region, 2025-2033" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Note : We are in the process of updating our reports to cover the 2026-2034 forecast period. For the most recent data, insights, and industry updates, please click…

Intravenous (IV) Fluid Bag Manufacturing Plant DPR - 2026: Investment Cost, Mark …

The global intravenous (IV) fluid bag manufacturing industry is witnessing robust growth driven by the rapidly expanding healthcare sector and increasing demand for sterile fluid delivery systems. At the heart of this expansion lies a critical medical device: the intravenous fluid bag. As healthcare systems transition toward enhanced patient safety protocols and advanced infusion therapy methods, establishing an intravenous (IV) fluid bag manufacturing plant presents a strategically compelling business opportunity…

More Releases for USD

Bone Cement Market Outlook USD 1,871.10M-USD 3,512.31M

How Is the Bone Cement Market Supporting the Rise of Modern Orthopedic Surgery?

The Bone Cement Market plays a critical role in modern orthopedic and spinal procedures, acting as a foundational material for joint replacement, fracture fixation, and vertebral stabilization. Bone cement is widely used to anchor implants, restore bone structure, and improve patient mobility-making it an essential component of musculoskeletal care.

In 2025, the global bone cement market was valued at…

Autologous Cell Therapy Market Outlook USD 9.31B-USD 54.83B

How Is the Autologous Cell Therapy Market Redefining the Future of Precision Medicine?

The Autologous Cell Therapy Market is rapidly emerging as one of the most transformative areas in modern healthcare, offering highly personalized treatment options for complex and chronic diseases. By using a patient's own cells to repair, replace, or regenerate damaged tissues, autologous cell therapy minimizes immune rejection risks while maximizing therapeutic effectiveness.

In 2025, the global autologous cell therapy…

PACS Market USD 5.59B in 2025, USD 9.73B by 2035

Picture Archiving and Communication System (PACS) Market Expands as Digital Imaging Transforms Global Healthcare

Introduction: PACS at the Core of Modern Medical Imaging

The healthcare industry is undergoing a rapid digital transformation, with medical imaging playing a critical role in diagnosis, treatment planning, and patient monitoring. At the heart of this transformation lies the Picture Archiving and Communication System (PACS)-a technology that enables the storage, retrieval, management, and sharing of medical images…

Global HEOR Market USD 1.70B-USD 6.03B

Health Economics and Outcomes Research (HEOR) Market Accelerates as Value-Based Healthcare Redefines Global Decision-Making

Introduction: The Growing Importance of HEOR in Modern Healthcare

The global healthcare industry is undergoing a profound transformation, shifting from volume-driven care models to value-based healthcare systems that prioritize patient outcomes, cost efficiency, and real-world effectiveness. At the center of this transformation lies Health Economics and Outcomes Research (HEOR)-a discipline that evaluates the economic value, clinical outcomes, and…

Foam Tape Market Outlook 2035: Industry Growth from USD USD 4.89 Billion (2025) …

The Foam Tape Market plays a vital role in modern industrial and manufacturing ecosystems. Foam tapes are pressure-sensitive adhesive products manufactured using materials such as polyurethane, polyethylene, PVC, and acrylic foam. These tapes are widely used for bonding, sealing, insulation, cushioning, vibration damping, and noise reduction across multiple industries. Their ability to replace traditional mechanical fasteners like screws, bolts, and rivets has positioned foam tapes as a preferred solution in…

Chlorella Market Reach USD 465.85 Million USD by 2030

Market Growth Fueled by Increased Adoption of Plant-Based Proteins and Health Supplements

Global Chlorella Market size was valued at USD 303.75 Mn. in 2023 and the total Chlorella revenue is expected to grow by 6.3 % from 2024 to 2030, reaching nearly USD 465.85 Mn. . The growth of the market is majorly due to increase in the consumer awareness about health, the inclination towards plant-based food such as chlorella and…