Press release

PCB (Printed Circuit Board) Manufacturing Plant DPR 2026: Machinery Requirement, Setup Cost and Profit Margin

The PCB (Printed Circuit Board) industry stands at the heart of modern electronics supply chains, serving as the foundational substrate that interconnects and mechanically supports electronic components across diverse devices. According to the IMARC Group report, the global PCB market was valued at USD 75.51 Billion in 2025, with strong projections indicating continued expansion in the coming decade.Printed circuit boards are essential in virtually every electronic system, enabling electrical connectivity and stability across products ranging from smartphones and laptops to automotive control units, telecommunications equipment, and industrial automation hardware. Their broad utility underscores their critical role in supporting the massive surge in global electronics consumption.

Increasing emphasis on digital transformation, electrification of transportation systems, and the proliferation of smart connected devices illustrate the vast market potential for well-positioned PCB manufacturers. Consumer electronics, automotive electronics, telecom infrastructure, and industrial applications collectively contribute to consistent demand growth.

For investors and manufacturing entrepreneurs, setting up a PCB manufacturing plant represents a high-value opportunity tied directly to the expansion of global electronic systems. This report guide draws exclusively from project data to provide a compelling, data-driven narrative for stakeholders considering entry into this dynamic industry.

Market Overview and Growth Potential

The printed circuit board market continues to scale in line with rising global demand for electronic devices and digital technologies. According to available industry insights, the global PCB market was estimated at USD 75.51 Billion in 2025.

The market is projected to expand further across the next decade, with estimates indicating potential growth toward USD 101.14 Billion by 2034, representing a compound annual growth rate (CAGR) of 3.3% from 2026 to 2034.

Several key drivers underpin this growth trajectory: the increasing content of electronics in consumer devices, rapid integration of electronic systems in automotive and industrial applications, expansion of global telecommunications infrastructure, and heightened adoption of automation technologies.

Consumer demand for compact, high-performance electronics and the evolution of multi-layer and high-density PCB designs are shaping industry trends, pushing manufacturers to adopt advanced production technologies. These factors together enhance the attractiveness of investments in PCB manufacturing facilities capable of satisfying growing global and regional demand.

Request for a Sample Report: https://www.imarcgroup.com/pcb-manufacturing-plant-project-report/requestsample

Plant Capacity and Production Scale

A PCB manufacturing facility designed for commercial success should aim for high production throughput. Based on project data, a proposed PCB plant configuration typically targets an annual production capacity of around 6-10 million square meters of PCB output.

This capacity range enables manufacturers to leverage economies of scale by optimizing fixed cost absorption, reducing unit costs, and increasing operational flexibility across market demand cycles.

By servicing broad market segments - including consumer electronics, automotive, telecommunications, industrial electronics, and medical systems - such a production scale ensures diversified revenue streams and enhances resilience to demand fluctuations within specific sectors.

Financial Viability and Profitability Analysis

Financial projections reveal that PCB manufacturing presents a profitable opportunity under realistic operational conditions. Based on available report data, gross profit margins are projected in the range of 30-35%, indicating solid revenue retention after direct costs.

Net profitability also remains attractive with net profit margins typically between 12-20%, reflecting healthy operational leverage and efficient cost absorption strategies.

These margin profiles are supported by sustained demand and the value-addition inherent in advanced PCB products. Although detailed break-even and ROI timelines are not publicly disclosed within the source URL, the combination of competitive margins and production scale suggests favorable investor returns, especially where high plant utilization and strategic market segmentation are achieved.

The financial viability of PCB manufacturing depends on careful management of operating expenses, production efficiency, pricing alignment with demand, and ongoing innovation in process technology. Projected profitability reinforces the sector's attractiveness, especially for investors seeking steady returns from a high-volume electronics component manufacturing business.

Speak to Analyst for Customized Report: https://www.imarcgroup.com/request?type=report&id=9086&flag=C

Operating Cost Structure

Operating costs for PCB manufacturing are dominated by a few key components, with raw materials accounting for approximately 40-50% of total operating expenditure (OpEx).

Copper is the primary raw material, as it forms the conductive traces on PCBs and significantly influences cost dynamics. Managing copper procurement through long-term supply contracts and strategic supplier relationships can mitigate price volatility and support consistent production quality.

Utilities also constitute a significant portion of operating expenses, contributing 20-25% of OpEx due to energy-intensive processes such as lamination, etching, and plating.

A comprehensive cost structure also includes transportation, packaging, labor, maintenance, depreciation, and regulatory compliance expenditures. While specific percentages for these categories are not detailed in the source, managing these costs through optimization and process efficiencies remains crucial for maintaining healthy operating margins.

By focusing on raw material cost control, utility efficiency measures, and investments in automation, PCB manufacturers can maintain cost competitiveness while maximizing output and profitability.

Capital Investment Requirements

Capital investment in PCB manufacturing encompasses several major components:

Land and Site Development: Initial land acquisition and site preparation, including regulatory compliance, boundary creation, and environmental planning.

Machinery and Equipment: PCB production relies on specialized equipment tailored to precision tasks. Essential machinery includes lamination presses, CNC drilling units, imaging and exposure systems, etching and plating lines, automated optical inspection (AOI) systems, and electrical testing equipment.

Civil Works: Construction of plant buildings, production halls, quality control labs, storage areas, and administrative offices must align with workflow efficiency and future expansion potential.

Infrastructure Requirements: Reliable electricity, water, waste management, and logistics infrastructure are critical to seamless operations.

While precise cost figures for these capital categories are not publicly disclosed within the report page, it is noted that machinery costs form the largest portion of total capital expenditures.

Strategic allocation of capital investment toward advanced, reliable production equipment not only supports product quality and yield rates but also enhances long-term operational efficiency. Such investments play a decisive role in establishing a competitive, technology-driven manufacturing footprint capable of serving global and regional electronics markets.

Major Applications and Market Segments

PCB products serve a broad range of end-use industries, reflecting the ubiquitous nature of these critical components:

• Consumer Electronics: Including smartphones, laptops, TVs, wearables, and home appliances.

• Automotive Electronics: PCBs are integral to engine control units, infotainment, advanced driver assistance systems (ADAS), and battery management.

• Telecommunications: Used in routers, switches, base stations, optical transmission systems, and network interface modules.

• Industrial Electronics: Including PLCs, motor drives, robotics, sensors, and automation systems.

• Healthcare and Medical Devices: Critical for imaging systems, monitoring devices, and diagnostic equipment.

These wide-ranging applications ensure that PCB manufacturing facilities can serve multiple high-growth segments, enhancing market stability.

Buy Now: https://www.imarcgroup.com/checkout?id=9086&method=2175

Why Invest in PCB Manufacturing

PCB manufacturing remains a strategic investment for several compelling reasons:

1. Indispensable Electronics Component: PCBs are fundamental to modern electronic systems, enabling mechanical support and electrical connectivity across devices.

2. Moderate Entry Barriers: While production requires precision equipment and adherence to strict quality standards, experienced manufacturers with proper investment can achieve competitive advantages.

3. Alignment with Industry Megatrends: Global growth in electric vehicles, Internet of Things (IoT) devices, industrial automation, and green energy solutions continues to propel PCB demand.

4. Government Policy Support: Incentive programs such as Make in India and electronics production schemes encourage localized PCB manufacturing, improving cost structures and supply chain resilience.

5. Localization Benefits: Domestic production reduces lead times, enhances supply chain reliability for OEMs, and supports rapid response to market dynamic changes.

6. Technology Advantages: Investments in automated production lines, quality inspection systems, and advanced manufacturing technologies contribute to higher yields, reduced waste, and improved cost efficiency.

These strategic advantages collectively make PCB manufacturing a highly attractive industry for producers seeking long-term growth, diversified customer bases, and stable returns.

Industry Leadership

Key global PCB manufacturers include multinational companies with expansive production portfolios, such as:

• Jabil Inc.

• Ibiden Co., Ltd.

• Jiva Materials

• Advanced Circuits

• TTM Technologies Inc.

These players serve diverse segments including consumer electronics, automotive, telecom, and industrial systems, setting benchmarks for quality, capacity, and technological innovation.

Conclusion

The PCB manufacturing sector offers a compelling investment proposition grounded in strong global demand, diversified end-use applications, and attractive profit margins. With an estimated global market value of USD 75.51 Billion in 2025 and continued expansion through 2034, the industry presents robust growth potential for strategic investors.

High production capacity, favorable margin profiles, and supportive policy environments combine to create an ecosystem conducive to operational success for well-capitalized ventures. While capital investment in specialized machinery and infrastructure is significant, the ability to serve multiple high-growth sectors enhances revenue resilience and long-term sustainability.

For entrepreneurs and manufacturing leaders seeking to capitalize on electronics industry growth, establishing a PCB manufacturing plant remains a data-backed, impactful pursuit with far-reaching market relevance.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excel in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release PCB (Printed Circuit Board) Manufacturing Plant DPR 2026: Machinery Requirement, Setup Cost and Profit Margin here

News-ID: 4377491 • Views: …

More Releases from IMARC Group

India Digital Health Market is Expected to Reach USD 84,076.5 Million by 2034 | …

Introduction

According to IMARC Group's report titled "India Digital Health Market Size, Share, Trends and Forecast by Type, Component, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including India digital health market share, growth, trends, and regional insights.

How Big is the India Digital Health Market?

The India digital health market size reached USD 19,145.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 84,076.5…

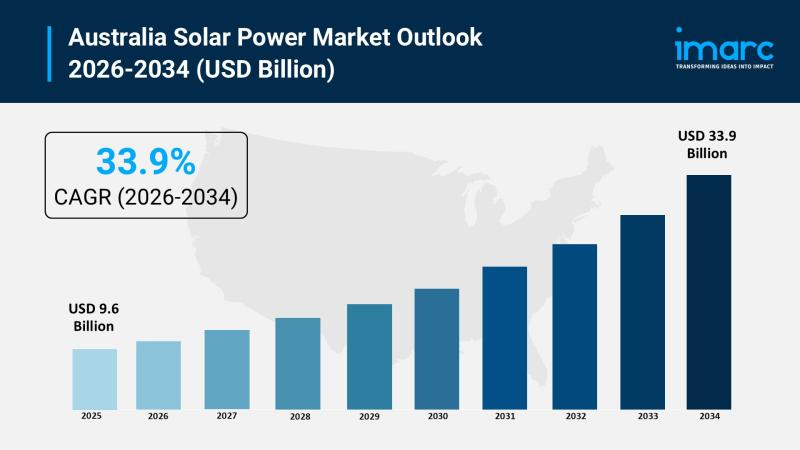

Australia Solar Power Market 2026 | Projected to Reach USD 33.9 Billion by 2034

Market Overview

The Australia solar power market reached USD 9.6 Billion in 2025 and is forecast to grow to USD 33.9 Billion by 2034. The market exhibits a robust growth rate of 15.00% during the forecast period 2026-2034. This expansion is driven by supportive government policies, technological advancements, and increasing adoption across residential, commercial, and utility sectors, positioning solar energy as a cornerstone of Australia's clean energy future.

Grab a sample PDF…

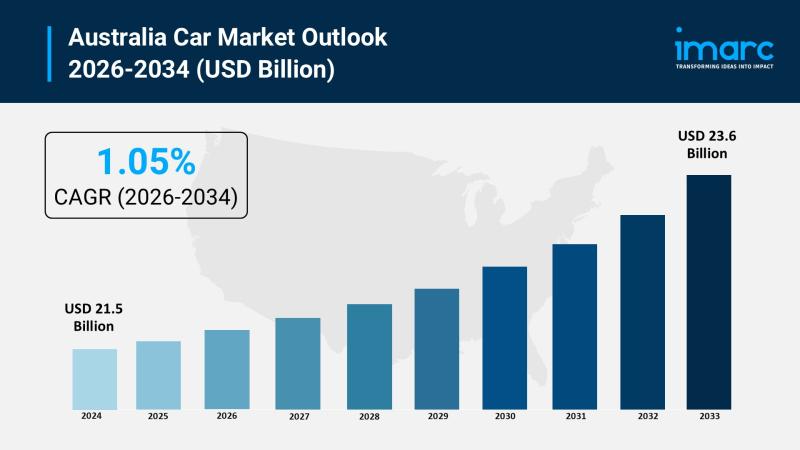

Australia Car Market 2026 | Surge to Grow to USD 23.6 Billion by 2034

Market Overview

The Australia car market reached a size of USD 21.5 Billion in 2025 and is forecasted to grow to USD 23.6 Billion by 2034. The market is expected to expand at a CAGR of 1.05% throughout the forecast period from 2026 to 2034. Growth is driven primarily by increasing demand for electric vehicles, SUVs, and connected car technologies, spurred by environmental awareness, lifestyle changes, and technological innovation toward sustainable…

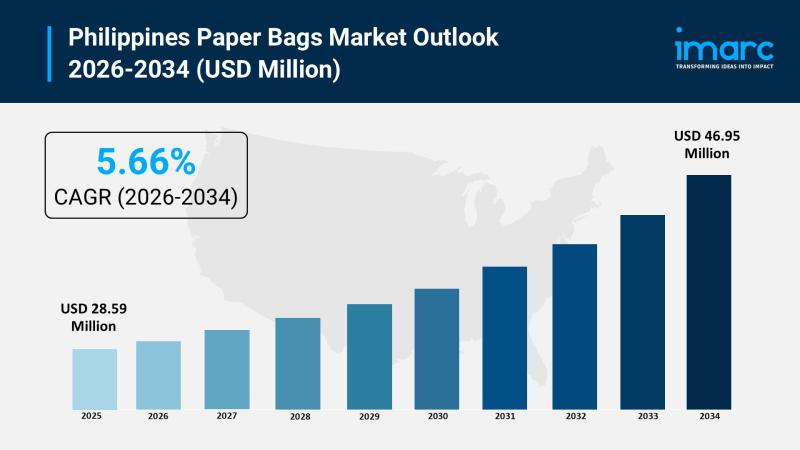

Philippines Paper Bags Market 2026 | Expected to Reach USD 46.95 Million by 2034

Market Overview

The Philippines paper bags market size was valued at USD 28.59 Million in 2025 and is expected to reach USD 46.95 Million by 2034, with a growth rate of 5.66% CAGR from 2026 to 2034. This growth is driven by increasing environmental concerns, government bans on single-use plastics, and rising adoption by retailers and foodservice providers. The expanding food and beverage sector, coupled with heightened awareness of plastic pollution,…

More Releases for PCB

Victory PCB Showcases High-Quality Double-Sided PCB Solutions for Modern Electro …

Victory PCB highlights the performance, flexibility, and cost-effectiveness of its double-sided printed circuit boards, designed to meet the demands of mid-complexity electronic systems.

Victory PCB, a professional printed circuit board manufacturer, continues to support modern electronics development through its high-quality double-sided PCB manufacturing solutions [https://www.victorypcb.com/products-category/double-sided-pcbs.html]. Designed to balance performance, reliability, and cost efficiency, Victory PCB's double-sided printed circuit boards are widely used across industries that require greater circuit density without the…

Victory PCB Expands Global Reach with Industry-Leading PCB Manufacturing & Assem …

Image: https://www.abnewswire.com/upload/2025/06/aa56d146ab76e34a4f335137dad3dd49.jpg

Victory PCB [https://www.victorypcb.com/], a global leader in printed circuit board (PCB) manufacturing and assembly, continues to set new benchmarks in high-quality PCB production, fast delivery, and customer service excellence. With a legacy of 19 years of innovation and precision manufacturing, Victory PCB is powering the next generation of industries, from automotive and medical equipment to aerospace and advanced communication devices.

Located in the heart of Shenzhen's modern Industrial Park, Victory…

Victory PCB: Pioneering Excellence in Global PCB Manufacturing and Assembly

Image: https://www.abnewswire.com/upload/2025/01/fabf105f8930f331e50cb1ca439637fe.jpg

Victory PCB [https://www.victorypcb.com/] is a renowned global manufacturer of PCBs and assembly services, recognized worldwide for its exceptional precision, innovation, and commitment to quality. With a client base exceeding thousands across various sectors, including automotive, aerospace, medical, industrial automation, and communication technologies, PCB solutions are tailored to meet each client's needs.

With centers covering as much as 30,000 square meters, Victory PCB employs over 450 staff dedicated to producing high-quality…

Victory PCB: Redefining Global Excellence in PCB Manufacturing and Assembly

Image: https://www.abnewswire.com/upload/2025/01/986e29984b844645f2a99a0a5e93a4c8.jpg

Having almost 20 years of expertise in producing and assembling printed circuit boards (PCBs), Victory PCB has established a solid reputation for providing high quality products, creative solutions, and consistent customer satisfaction. Victory PCB [https://www.victorypcb.com/], located in a contemporary 30,000-square-meter facility within Shenzhen's tech district, merges deep expertise with cutting-edge technology to manufacture products that bolster top industries worldwide. Relying on more than 1,000 clients and 80% of its…

Victory PCB Emerges as a Global Leader in PCB Manufacturing

Victory PCB has been delivering custom PCB solutions to global customers since 2005.

Image: https://www.abnewswire.com/uploads/3daf3e2d61300e7406f7fb61c56726fc.png

Victory PCB [https://www.victorypcb.com/], a professional printed circuit board (PCB) manufacturer established in 2005, is setting new standards in the global electronics industry with its commitment to top-quality, high-precision, and high-density PCB solutions. The solutions offered by Victory PCB, which exports 80% of its products worldwide, bridge the gap between concept and reality for clients in a variety…

PCB Ceramic Substrate Market Size, Share and Forecast By Key Players-Panda PCB T …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- According to the MRI Team's Market Research Intellect, the global PCB Ceramic Substrate market is anticipated to grow at a compound annual growth rate (CAGR) of 13.62% between 2024 and 2031. The market is expected to grow to USD 21.58 Billion by 2024. The valuation is expected to reach USD 52.73 Billion by 2031.

The PCB ceramic substrate market is experiencing robust growth, fueled by the rising demand…