Press release

Intravenous (IV) Fluid Bag Manufacturing Plant DPR - 2026: Investment Cost, Market Growth and Machinery

The global intravenous (IV) fluid bag manufacturing industry is witnessing robust growth driven by the rapidly expanding healthcare sector and increasing demand for sterile fluid delivery systems. At the heart of this expansion lies a critical medical device: the intravenous fluid bag. As healthcare systems transition toward enhanced patient safety protocols and advanced infusion therapy methods, establishing an intravenous (IV) fluid bag manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and medical device investors seeking to capitalize on this growing and essential market.Market Overview and Growth Potential

Intravenous (IV) fluid bags are sterile, flexible containers designed to deliver fluids, medications, electrolytes, and nutritional solutions directly into a patient's bloodstream through intravenous administration. They appear as transparent, durable medical-grade plastic containers with high purity and controlled fluid delivery properties. IV fluid bags contain various solutions including crystalloids, colloids, blood products, and parenteral nutrition, making them essential medical devices used primarily in hospitals, surgical centers, emergency care, and home healthcare settings. Due to their sterile nature and reliable performance, they help maintain patient hydration, deliver critical medications, and prevent contamination during medical procedures. Their flexible design, compatibility with infusion systems, and single-use safety features make them a preferred option in modern healthcare and critical care medicine.

The intravenous (IV) fluid bag market is witnessing robust demand due to the rising need for sterile medical devices that support advanced patient care and infection prevention protocols. Healthcare facilities increasingly transitioning toward disposable medical supplies-particularly in critical care, surgical procedures, and chronic disease management-are driving large-scale adoption. According to the American Hospital Association's 2024 assessment, hospitals across the United States utilize over 300 million IV bags for hydration, medication delivery, and emergency care. Government-led healthcare modernization programs, subsidies for medical device manufacturing, and patient safety enhancement initiatives further strengthen market prospects.

Request for a Sample Report: https://www.imarcgroup.com/intravenous-iv-fluid-bag-manufacturing-plant-project-report/requestsample

Plant Capacity and Production Scale

The proposed intravenous (IV) fluid bag manufacturing facility is designed with an annual production capacity ranging between 50-100 Million bags, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to cater to diverse market segments-from hospitals and surgical centers to home healthcare and emergency medical services-ensuring steady demand and consistent revenue streams across multiple healthcare verticals.

Financial Viability and Profitability Analysis

The intravenous (IV) fluid bag manufacturing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

Gross Profit Margins: 30-35%

Net Profit Margins: 10-18%

These margins are supported by stable demand across healthcare and medical sectors, value-added medical device positioning, and the critical nature of IV fluid bags in patient care applications. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established medical device manufacturers looking to diversify their product portfolio in the essential healthcare products sector.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for an intravenous (IV) fluid bag manufacturing plant is primarily driven by:

Raw Materials: 45-55% of total OpEx

Utilities: 10-15% of OpEx

Other Expenses: Including labor, packaging, transportation, maintenance, depreciation, and taxes

Raw materials constitute the largest portion of operating costs, with medical-grade polypropylene (PP), polyvinyl chloride (PVC), and non-PVC materials being the primary input materials. Establishing long-term contracts with reliable polymer and medical-grade plastic suppliers helps mitigate price volatility and ensures consistent raw material supply, which is critical given that polymer price fluctuations represent the most significant cost factor in IV fluid bag manufacturing.

Capital Investment Requirements

Setting up an intravenous (IV) fluid bag manufacturing plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to medical-grade polymer suppliers and healthcare distribution networks. Proximity to target hospital markets will help minimize distribution costs. The site must have robust infrastructure, including reliable transportation, utilities, and waste management systems. Compliance with local zoning laws and environmental regulations must also be ensured.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers specialized manufacturing equipment essential for production. Key machinery includes:

• Blow molding or extrusion equipment for bag film formation from medical-grade polymers

• Automated welding and sealing systems for creating hermetic seals on bag chambers

• Port attachment machinery for affixing injection ports and outlet connections

• Sterilization equipment using gamma radiation, ethylene oxide, or autoclave methods

• Quality control laboratory equipment for leak testing, sterility testing, and particulate analysis

• Filling lines for pre-filled IV solution bags (if producing filled products)

• Cleanroom facilities with HEPA filtration and controlled environmental conditions

• Packaging lines for sterile overwrapping and protective packaging

• Effluent treatment systems for managing manufacturing waste and ensuring environmental compliance

Civil Works: Building construction, factory layout optimization, and infrastructure development designed to enhance workflow efficiency, ensure workplace safety, and minimize contamination risks throughout the production process. The layout should be optimized with separate areas for raw material storage, cleanroom manufacturing zone, extrusion and molding section, sealing and welding area, sterilization chamber, quality control laboratory, finished goods warehouse (temperature-controlled), utility block, waste treatment area, and administrative block.

Other Capital Costs: Pre-operative expenses, machinery installation costs, regulatory compliance certifications (FDA, ISO 13485, GMP), initial working capital requirements, and contingency provisions for unforeseen circumstances during plant establishment.

Major Applications and Market Segments

Intravenous (IV) fluid bag products find extensive applications across diverse market segments, demonstrating their versatility and critical importance:

Hospitals: Primary use as sterile fluid delivery containers for hydration therapy, medication administration, blood transfusions, and parenteral nutrition in inpatient settings, emergency departments, intensive care units, and surgical suites where controlled fluid delivery is essential.

Surgical Centers: Specialized applications in ambulatory surgical centers and operating rooms for intraoperative fluid management, anesthesia drug delivery, and post-surgical recovery care where precise fluid administration and patient safety are critical for optimal outcomes.

Emergency Medical Services: Utilized for rapid fluid resuscitation and emergency medication delivery in pre-hospital care, trauma treatment, and critical care transport where immediate intravenous access and portable fluid delivery are critical for patient stabilization.

Home Healthcare: Applications in home infusion therapy for chronic disease management, antibiotic administration, and nutritional support where patients require ongoing intravenous treatment outside hospital settings.

Dialysis Centers: Specialized industrial applications in peritoneal dialysis and renal care facilities where IV fluid bags provide critical support for kidney disease patients requiring regular fluid therapy.

End-use industries include hospitals, surgical centers, emergency medical services, home healthcare, and dialysis centers, all of which contribute to sustained market demand.

Buy now: https://www.imarcgroup.com/checkout?id=16236&method=2175

Why Invest in Intravenous (IV) Fluid Bag Manufacturing?

Several compelling factors make intravenous (IV) fluid bag manufacturing an attractive investment opportunity:

Essential Medical Device Segment: IV fluid bags serve as critical medical devices supporting patient care, emergency medicine, and chronic disease management, making them indispensable for modern healthcare operations focused on safety and therapeutic efficacy.

Rising Healthcare Infrastructure Development: Healthcare facilities increasingly expanding across emerging markets-particularly in hospital construction, surgical center development, and emergency care networks-are driving large-scale adoption of sterile medical supplies like IV fluid bags.

Patient Safety and Infection Control: The product's sterile single-use design and contamination prevention capabilities offer significant clinical advantages, positioning it favorably against reusable glass bottles and reducing healthcare-associated infection risks.

Chronic Disease Burden: The effectiveness of IV fluid bags in supporting chronic disease management, including diabetes care, cancer treatment, and kidney disease therapy, positions them as preferred medical devices in regions with aging populations, especially across North America, Europe, and Asia-Pacific countries.

Government Support: Government-led healthcare modernization programs, subsidies for medical device manufacturing, and regulatory harmonization initiatives further strengthen market prospects and support industry growth.

Supply Chain Resilience Opportunities: Recent disruptions from natural disasters affecting major IV fluid production facilities in the United States have highlighted the critical importance of diversified manufacturing capacity, creating opportunities for new producers to address supply security concerns.

Shift to Non-PVC Materials: The growing demand for environmentally sustainable and DEHP-free IV bags made from polyolefins and other biocompatible materials is expected to enhance long-term growth opportunities for manufacturers adopting advanced material technologies.

Manufacturing Process Excellence

The intravenous (IV) fluid bag manufacturing process involves several precision-controlled stages:

• Raw Material Preparation: Medical-grade polymers (PP, PVC, or non-PVC materials) are received, tested for purity, and prepared for processing

• Film Extrusion or Blow Molding: Polymer resins are melted and formed into thin, flexible film or bag shapes using extrusion or blow molding equipment under controlled temperature

• Bag Formation and Sealing: Film layers are cut, aligned, and heat-sealed to create multi-chamber or single-chamber bag structures with precise dimensions

• Port Attachment: Injection ports, medication ports, and outlet connections are attached using ultrasonic welding or adhesive bonding techniques

• Leak Testing: Each bag undergoes pressure testing or vacuum testing to ensure hermetic seal integrity and prevent fluid leakage

• Sterilization: Bags are sterilized using gamma radiation, ethylene oxide gas, or autoclave methods to achieve sterility assurance level (SAL) of 10−6

• Quality Control Testing: Sterility testing, particulate analysis, biocompatibility testing, and physical property verification ensure product compliance

• Packaging: Sterile bags are overwrapped in protective packaging materials and labeled for storage and distribution

Industry Leadership

The global intravenous (IV) fluid bag industry is led by established medical device manufacturers with extensive production capabilities and diverse application portfolios. Key industry players include:

• Baxter International Inc.

• B. Braun Melsungen AG

• Fresenius Kabi AG

• ICU Medical Inc.

• Otsuka Pharmaceutical Co., Ltd.

• Grifols, S.A.

• Terumo Corporation

• Sippex IV Bag Solutions

These companies serve diverse end-use sectors including hospitals, surgical centers, emergency medical services, home healthcare, and dialysis centers, demonstrating the broad market applicability of intravenous (IV) fluid bag products.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=16236&flag=C

Recent Industry Developments

November 2025: Terumo Corporation announced a major investment in its production facility in the United States to increase IV fluid bag production capacity by 50%. This expansion is in response to growing demand for IV fluids, particularly following supply chain disruptions caused by natural disasters.

December 2024: Endo International plc revealed the introduction of its ADRENALIN (epinephrine in 0.9% sodium chloride injection) ready-to-use premixed bag, the first and only manufacturer-prepared, U.S. Food and Drug Administration-approved epinephrine premixed intravenous (IV) bag.

October 2024: Following Hurricane Helene's impact on major IV fluid production facilities, B. Braun Medical and Fresenius Medical Care significantly increased production capacity at their California and international manufacturing sites to address critical supply shortages affecting U.S. healthcare systems.

Conclusion

The intravenous (IV) fluid bag manufacturing sector presents a strategically positioned investment opportunity at the intersection of essential healthcare infrastructure, patient safety advancement, and medical device innovation. With favorable profit margins ranging from 30-35% gross profit and 10-18% net profit, strong market drivers including rising healthcare infrastructure development, growing demand for sterile medical devices, expanding chronic disease prevalence, and supportive government policies promoting healthcare modernization and infection control, establishing an intravenous (IV) fluid bag manufacturing plant offers significant potential for long-term business success and sustainable returns. The combination of critical role in patient care, expanding home healthcare applications, increasing surgical procedure volumes, and supply chain diversification opportunities in emerging economies creates an attractive value proposition for serious medical device investors committed to quality manufacturing and operational excellence.

About IMARC Group

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its clients' business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201-971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Intravenous (IV) Fluid Bag Manufacturing Plant DPR - 2026: Investment Cost, Market Growth and Machinery here

News-ID: 4377472 • Views: …

More Releases from IMARC Group

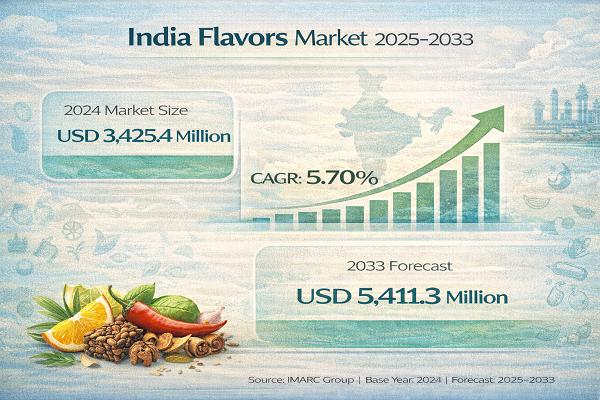

India Flavors Market on a Fast Growth Path, Reach at INR 8,512.5 Crore by 2033, …

India Flavors Market: Report Introduction

According to IMARC Group's report titled "India Flavors Market Size, Share, Trends and Forecast by Product Type, Form, Application, and Region, 2025-2033" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Note : We are in the process of updating our reports to cover the 2026-2034 forecast period. For the most recent data, insights, and industry updates, please click…

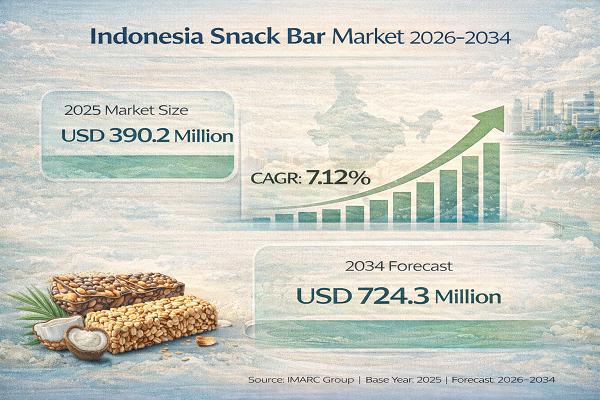

Indonesia Snack Bar Market Set for Robust Growth, Market to Reach USD 724.3 Mill …

Introduction of Indonesia Snack Bar Market Report

According to IMARC Group's report titled "Indonesia Snack Bar Market Size, Growth and Report 2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Download your free sample PDF for fresh data and expert insights: https://www.imarcgroup.com/indonesia-snack-bar-market/requestsample

Overview of Indonesia Snack Bar Market (2026-2034)

The Indonesia snack bar market size reached USD 390.2 Million in 2025. It is projected…

Solar Panel Manufacturing Plant DPR 2026: Investment Cost, Market Growth & ROI

The global energy landscape is undergoing a transformative shift toward renewable power, with solar panels emerging as the most viable segment of clean energy. These photovoltaic modules convert sunlight into electricity using semiconductor materials such as crystalline silicon, offering high strength, long-life operation, low maintenance costs, and emission-free performance across utility-scale, rooftop, and distributed generation systems.

According to the Ministry of Power, electricity generation during 2022-23 reached 1,624.158 billion units (BU),…

Mattress Manufacturing Plant DPR 2026: Cost Structure, Production Process & ROI

The global mattress industry represents one of the most resilient and consistently growing segments within the consumer goods and bedding sector. Mattresses, designed as rectangular comfort products using layered materials such as foams, springs, fibers, and natural components, are essential for supporting the human body during sleep and rest. Modern mattresses are engineered with advanced features including motion isolation, temperature control, anti-microbial components, and varying degrees of firmness, catering to…

More Releases for Bag

Cotton Bag Market Is Booming Worldwide | Bag Makers, Central Bag, Aaltex Interna …

Market Intellix has introduced a new report on the Cotton Bag Market, offering detailed insights into industry trends, growth opportunities, and the market outlook for 2025-2032. The report outlines the scope of the Cotton Bag industry and evaluates its current status while analyzing regional segments that are shaping global adoption. With consistent developments and rising demand, the Cotton Bag Market is gaining momentum and steadily establishing a stronger international footprint.

Market…

Nylon Bag Filters: Capturing Growth in a Crucial Bag Filter Market

The bag filter market is experiencing consistent growth, driven by stringent environmental regulations and the increasing need for efficient filtration across various industries. Within this market, the nylon segment stands out as a high-opportunity area, offering a compelling combination of versatility, durability, and cost-effectiveness.

Market Dynamics and Growth Drivers

Nylon bag filters, known for their strength, flexibility, and chemical resistance, are widely used for liquid filtration in diverse applications. Their ability to…

Introducing Tianhou Bag: Cambodia bag factory

We are a professional factory specializing in making bag collections from 2008. Currently, we have a own factory with a building of 5100 square meters in Henan, China.The mainly producing various types of bags. Starting from 2025, we will prepare factories in Cambodia to expand our production capacity and provide better prices and good services to our customers. We appreciate for all the customers' support and Thanks for working with…

EMERGENCY SLEEPING BAG REVIEW 2023: DOES EMERGENCY SLEEPING BAG REALLY WORKS?

In the world of outdoor adventures, preparedness is paramount. Whether you're an avid hiker, camper, or simply someone who enjoys the thrill of the great outdoors, one thing you should never underestimate is the power of a reliable emergency sleeping bag. These versatile and compact tools are designed to be your lifeline when the unexpected strikes. An emergency sleeping bag is not just a convenient addition to your outdoor gear;…

Reusable Shopping Bag Market Next Big Thing | Major Giants Command Packaging, Gr …

Advance Market Analytics published a new research publication on "Reusable Shopping Bag Market Insights, to 2028" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Reusable Shopping Bag market was mainly driven by the increasing R&D spending across the world.

Access Sample Report + All…

Know Everything About Disposable Blood Bag: Importance of Disposable Blood Bag

Systems for collecting, storing, transporting, and transfusing human blood and products obtained from it are available as disposable biomedical goods called blood bag systems. Hospitals, blood banks, government initiatives, and NGOs all use disposable blood bags to store blood donations that have been received.

To reduce the importation of blood components from Western nations, government-funded programs in some Asian countries are concentrating on developing blood separation technology. The need for blood…