Press release

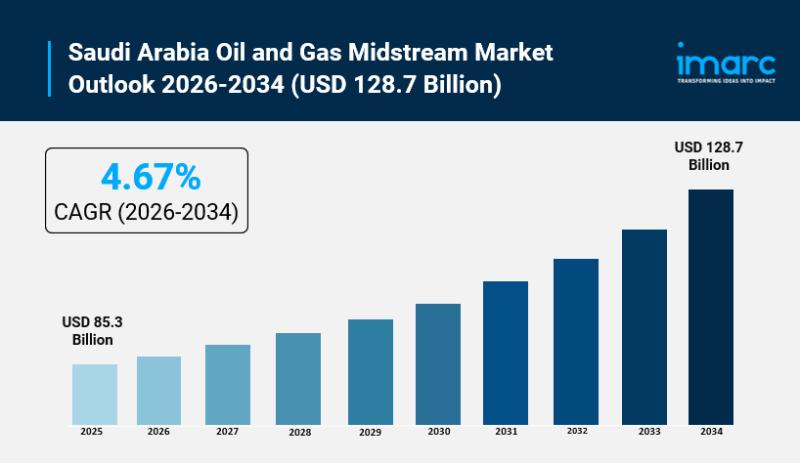

Saudi Arabia Oil and Gas Midstream Market Size to Expand USD 128.7 Billion by 2034 at 4.67% CAGR

Saudi Arabia Oil and Gas Midstream Market OverviewMarket Size in 2025: USD 85.3 Billion

Market Forecast in 2034: USD 128.7 Billion

Market Growth Rate 2026-2034: 4.67%

According to IMARC Group's latest research publication, "Saudi Arabia Oil and Gas Midstream Market Size, Share, Trends and Forecast by Type, and Region, 2026-2034", The Saudi Arabia oil and gas midstream market size was valued at USD 85.3 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 128.7 Billion by 2034, exhibiting a CAGR of 4.67% from 2026-2034.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-oil-gas-midstream-market/requestsample

How AI is Reshaping the Future of Saudi Arabia Oil and Gas Midstream Market

● AI-powered predictive maintenance slashes pipeline downtime by 30%, with Aramco deploying sensor networks across 5,000 km of midstream lines for real-time leak detection and repairs.

● Aramco's new AI division optimizes gas flows in Jafurah midstream, boosting throughput 25% via machine learning that predicts blockages before they hit.

● Vision 2030 funds $11 billion Jafurah midstream deal with BlackRock, integrating AI for automated routing that cuts transport costs 20% on gas pipelines.

● Digital twins from AI simulate midstream ops at NEOM hubs, reducing flaring 40% and helping Aramco handle 2 bcfd surges efficiently.

● Government-backed AI platforms monitor 600,000 bpd via drones and analytics, speeding compliance checks 50% under national energy resilience programs.

Saudi Arabia Oil and Gas Midstream Market Trends & Drivers:

One big driver shaking up the Saudi Arabia oil and gas midstream market right now is the massive push for pipeline infrastructure expansion. With Saudi Aramco pouring USD 25 billion into the Jafurah shale program, they're adding about 1,500 kilometers of gathering and transmission lines to handle 2.2 trillion cubic feet of recoverable gas, making transport way more efficient. On top of that, the Master Gas System Phase 3 is rolling out another 3,000 kilometers of domestic pipelines, easing the strain on existing ones that are humming at 85% utilization. This isn't just about moving more oil and gas-it's backed by Vision 2030's focus on building a tougher energy chain, linking upstream finds to refineries and petrochemical spots. These upgrades are cutting bottlenecks in real-world ops, like getting products to export terminals faster, and drawing in foreign partners with USD 15 billion in fresh capital for high-tech designs. It's all about keeping the flow steady in a market that's always on the move.

Another key trend fueling growth is the ramp-up in exploration and production activities, especially around natural gas, which is opening new doors for midstream ops. Saudi Arabia's teaming up with global players to pump more into E&P, like the alliances boosting large-scale energy setups. Take the Fadhili Gas Plant expansion-it's cranking up LNG handling, meeting the spike in domestic industrial demand for cleaner fuels. Vision 2030 is the backbone here, pushing for gas self-sufficiency and cutting oil reliance for power, which means more midstream needs like storage and transport. In practice, this shows up in projects capturing flared gas in Iraq-style efforts, but tailored to Saudi's scene, preserving crude for exports while feeding local industries. Companies like SABIC are jumping in, expanding downstream ties that rely on reliable midstream links, making the whole sector more interconnected and resilient to global swings.

Finally, emerging digital tech and sustainability moves are transforming how the midstream market operates in Saudi Arabia, making it smarter and greener. Digital-twin tech is being rolled out across 2,000 kilometers of key assets, slashing unplanned downtime by 25% and stretching out inspection times for better efficiency. This ties into the Saudi Green Initiative, where carbon-capture trunk lines and blue-hydrogen corridors are getting fast-tracked with government grants. Real-world wins include Pall Corporation's new filtration plant in Dammam, teaming with locals to supply high-performance gear for refineries, keeping contaminants in check under tough conditions. Vision 2030 amps this up by funding AI and automation in logistics, helping operators like Saudi Aramco adapt to stricter enviro rules while boosting export capacities. It's not just buzz-it's cutting costs and aligning with global energy shifts, like turning to LNG for a cleaner edge in the market.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=13236&flag=E

Saudi Arabia Oil and Gas Midstream Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

● Transportation

● Storage

● LNG Terminals

Regional Insights:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia Oil and Gas Midstream Market

● December 2025: Aramco reveals 2026 LNG and AI midstream plans, targeting efficiency gains through new tech integrations in pipeline networks.

● October 2025: Aramco finalizes $11 billion Jafurah midstream deal with GIP-led consortium, securing leaseback for gas plants and boosting capacity via innovative financing.

● August 2025: Aramco signs $11 billion Jafurah midstream pact with BlackRock's Global Infrastructure Partners, unlocking funds for 2 bscfd gas expansion.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Oil and Gas Midstream Market Size to Expand USD 128.7 Billion by 2034 at 4.67% CAGR here

News-ID: 4376835 • Views: …

More Releases from IMARC Group

Brazil Lithium-ion Battery Market Report 2026, Share, Growth, Trends and Forecas …

The Brazil lithium-ion battery market was valued at USD 1,295.94 Million in 2025 and is projected to reach USD 3,218.70 Million by 2034, growing at a CAGR of 10.64% during 2026-2034. This growth is propelled by accelerating electric vehicle adoption, renewable energy storage expansions, and strong consumer electronics demand. Favorable government policies, foreign investments, and increasing environmental awareness are driving market expansion.

Sample Request Link: https://www.imarcgroup.com/brazil-lithium-ion-battery-market/requestsample

Study Assumption Years

Base Year: 2025

Historical Period:…

Foreign Exchange Market: Digital Trading Platforms, Liquidity Flows and Global C …

Market Overview

The global foreign exchange market was valued at USD 861 Billion in 2024 and is projected to reach USD 1,535 Billion by 2033, growing at a CAGR of 6.64% during 2025-2033. North America held the largest share at 25.8% in 2024, driven by technological adoption and globalization of businesses. Key market drivers include interest rates, inflation, geopolitical events, and central bank policies. For detailed insights visit the Foreign Exchange…

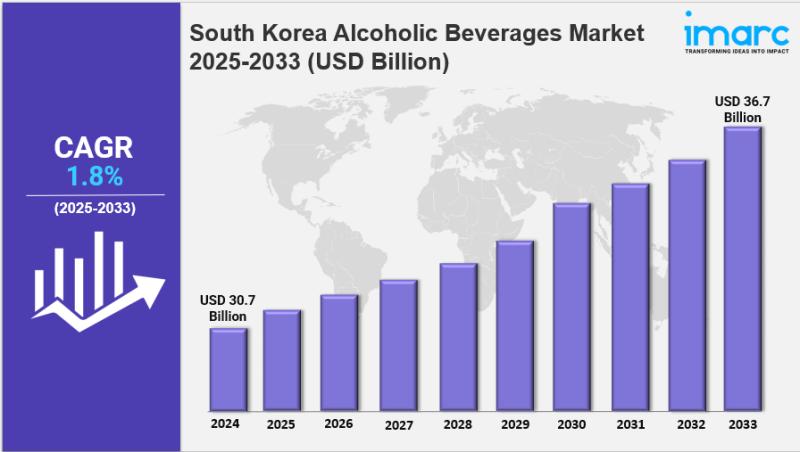

South Korea Alcoholic Beverages Market Size, Share, Industry Overview, Trends an …

IMARC Group has recently released a new research study titled "South Korea Alcoholic Beverages Market Report by Product Type (Beer, Wine, Spirits, and Others), Alcoholic Content (High, Medium, Low), Flavour (Unflavored, Flavored), Packaging Type (Glass Bottles, Tins, Plastic Bottles, and Others), Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Speciality Stores, Department Stores, and Others), and Region 2025-2033" This report offers a detailed analysis of the market drivers, segmentation, growth opportunities,…

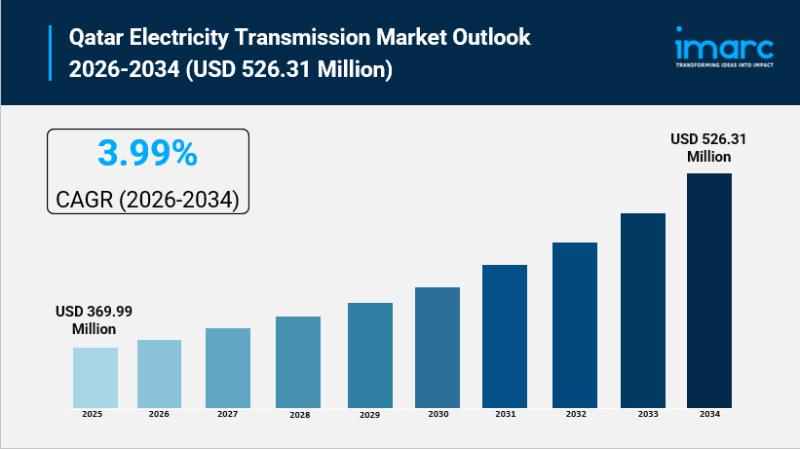

Qatar Electricity Transmission Market Size to Hit USD 526.31 Million by 2034 | W …

Qatar Electricity Transmission Market Overview

Market Size in 2025: USD 369.99 Million

Market Size in 2034: USD 526.31 Million

Market Growth Rate 2026-2034: 3.99%

According to IMARC Group's latest research publication, "Qatar Electricity Transmission Market: Size, Share, Trends and Forecast by Type, Service Offering, Purpose of Visit, Booking Type, and Region, 2026-2034", the Qatar electricity transmission market size reached USD 369.99 Million in 2025. The market is projected to reach USD 526.31 Million by…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…