Press release

E&P Software Market Set to Surge as Digital Intelligence Reshapes Upstream Oil & Gas

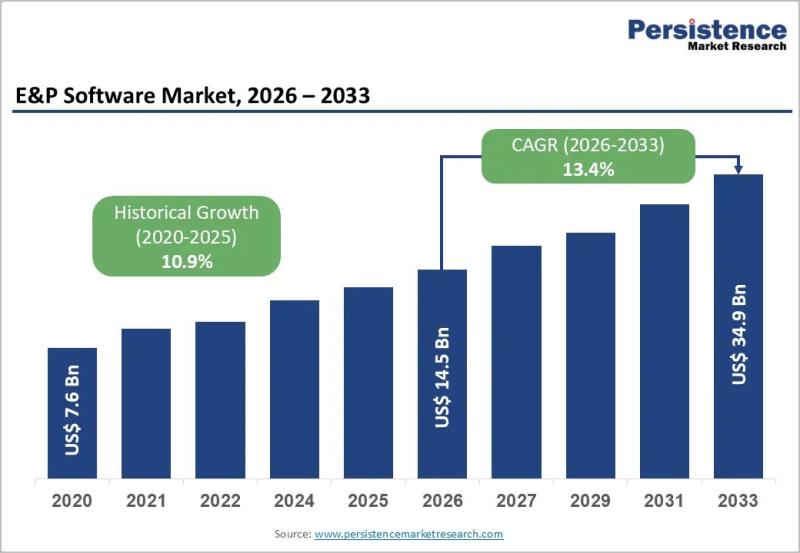

The E&P software market is undergoing a decisive transformation as upstream oil and gas operators accelerate their shift toward data-driven and digitally optimized operations. Exploration and production activities have become significantly more complex, with operators dealing with unconventional reservoirs, deeper offshore fields, and tighter regulatory oversight. E&P software plays a critical role in managing seismic interpretation, reservoir modeling, drilling optimization, production analytics, and compliance reporting, enabling companies to reduce uncertainty and enhance decision-making across the asset lifecycle.In 2026, the global E&P software market is projected to be valued at US$14.5 billion, and it is forecast to expand to US$34.9 billion by 2033, growing at a robust CAGR of 13.4%. This growth reflects strong investments in shale oil, tight gas, and offshore projects, coupled with mounting pressure to control costs and maximize recovery rates. North America leads the market due to its mature shale ecosystem, while seismic processing and imaging remains the dominant software module owing to its importance in minimizing drilling risks and improving subsurface accuracy.

Elevate your business strategy with comprehensive market data. Request a sample report now https://www.persistencemarketresearch.com/samples/33061

Market Statistics and Growth Landscape

The market's growth trajectory highlights a clear shift from traditional, siloed workflows toward integrated digital platforms that unify geoscience, engineering, and operations data. Between 2020 and 2025, the market expanded at a CAGR of 10.9%, indicating steady adoption even during periods of commodity price volatility. From 2026 onward, adoption is accelerating as operators embrace advanced analytics, AI-driven reservoir modeling, and real-time production monitoring.

Seismic processing and imaging software dominates the product landscape with more than 22% market share in 2026, valued at over US$3.2 billion, due to its critical role in exploration accuracy. On the deployment side, on-premises solutions account for over 60% share, reflecting the industry's emphasis on data security and operational continuity. However, cloud-based platforms are gaining momentum rapidly, supported by IoT integration, remote collaboration, and lower infrastructure costs.

Key Highlights from the Report

• The global E&P software market is projected to grow from US$14.5 billion in 2026 to US$34.9 billion by 2033.

• Seismic processing and imaging remains the largest software module due to its role in subsurface accuracy.

• Risk management and compliance tools are the fastest-growing segment, expanding at a 17.1% CAGR.

• On-premises deployment dominates in 2026, while cloud-based solutions show the strongest growth outlook.

• National oil companies represent the largest end-user segment due to extensive upstream asset portfolios.

• North America leads the market, while Asia Pacific records the fastest growth rate through 2033.

Market Segmentation Analysis

The E&P software market is segmented by software module, deployment mode, operation type, and end-user category. By software module, seismic processing and imaging leads the market as operators prioritize accurate geological interpretation and risk mitigation during exploration. Reservoir modeling, drilling optimization, and production management software follow closely, supporting enhanced recovery rates and optimized well performance across both conventional and unconventional assets.

By deployment model, on-premises solutions dominate due to legacy system integration, cybersecurity concerns, and uninterrupted performance in remote or offshore environments. However, cloud-based E&P software is gaining traction as operators seek scalable platforms that support real-time analytics, collaborative workflows, and predictive maintenance. In terms of end users, national oil companies hold the largest share, while independent E&P companies represent the fastest-growing segment as they adopt cost-efficient, modular software solutions to remain competitive.

Regional Insights and Market Dynamics

North America holds over 36% of the global market share in 2026, driven by the United States' extensive shale reserves, advanced offshore projects in the Gulf of Mexico, and early adoption of digital oilfield technologies. The region benefits from a mature ecosystem of service providers, strong R&D investments, and widespread use of AI and machine learning in upstream operations.

Asia Pacific is the fastest-growing region, expanding at a CAGR of 18.2%, fueled by increasing exploration activities in China, Indonesia, Vietnam, and Thailand. Governments and national oil companies across the region are modernizing legacy systems to improve efficiency and resource recovery. Europe maintains a significant share, supported by North Sea production, stringent environmental regulations, and alignment with energy transition and digital compliance initiatives.

Secure Your Full Report - Proceed to Checkout: https://www.persistencemarketresearch.com/checkout/33061

Market Drivers Shaping Industry Growth

One of the primary drivers of the E&P software market is the growing complexity of upstream operations. Unconventional reservoirs, deepwater drilling, and enhanced recovery techniques require advanced modeling, simulation, and real-time data analysis. E&P software enables operators to reduce geological uncertainty, optimize drilling plans, and improve production efficiency, directly impacting project economics.

Another critical driver is the industry-wide push for cost reduction and operational efficiency. Volatile oil prices have forced operators to maximize asset performance while minimizing downtime and non-productive time. Digital solutions that integrate predictive analytics, automation, and performance monitoring are becoming indispensable tools for achieving these objectives.

Market Restraints Limiting Adoption

Despite strong growth prospects, the E&P software market faces several challenges. High upfront implementation costs and complex integration with legacy systems can slow adoption, particularly among smaller operators. Customization requirements and long deployment timelines may also deter companies with limited IT resources or capital budgets.

Data security and cybersecurity concerns remain another key restraint, especially as cloud-based deployments gain traction. Upstream operators manage highly sensitive geological and production data, making them cautious about migrating critical workflows to external platforms. Regulatory uncertainty in certain regions further complicates software deployment and standardization.

Emerging Opportunities Across the Market

The integration of artificial intelligence, machine learning, and advanced analytics presents significant growth opportunities for E&P software providers. AI-driven seismic interpretation, automated drilling optimization, and predictive maintenance solutions are enabling operators to extract deeper insights from complex datasets and make faster, more accurate decisions.

Additionally, the rise of digital twins and real-time asset monitoring is creating new avenues for value creation. As operators focus on extending asset life and improving sustainability metrics, software solutions that support emissions tracking, regulatory compliance, and energy transition initiatives are expected to see increasing demand.

Do You Have Any Query Or Specific Requirement? Request Customization of Report: https://www.persistencemarketresearch.com/request-customization/33061

Reasons to Buy the Report

✔ Gain detailed insights into market size, growth forecasts, and emerging trends through 2033

✔ Understand key drivers, restraints, and opportunities shaping the E&P software industry

✔ Analyze market segmentation by software module, deployment, operation, and end user

✔ Identify high-growth regions and investment hotspots across global markets

✔ Access competitive intelligence and recent developments from leading market players

Frequently Asked Questions (FAQs)

How Big is the E&P Software Market globally in 2026 and beyond?

Who are the Key Players in the Global Market for E&P Software?

What is the Projected Growth Rate of the E&P Software Market during the forecast period?

What is the Market Forecast for the E&P Software Market in 2032-2033?

Which Region is Estimated to Dominate the Industry through the Forecast Period?

Company Insights

Schlumberger Limited

Halliburton Company

Baker Hughes Company

Emerson Electric Co.

Aspen Technology, Inc.

IBM Corporation

Oracle Corporation

SAP SE

Weatherford International

CGG SA

Recent Developments:

Schlumberger has expanded its AI-powered digital platform portfolio to enhance real-time reservoir modeling and production optimization for unconventional assets. Meanwhile, Halliburton has strengthened its cloud-based E&P software offerings through strategic partnerships aimed at improving data integration and remote collaboration for offshore projects.

Related Reports:

Harbor Management Software Market https://www.persistencemarketresearch.com/market-research/harbor-management-software-market.asp

Top 10 Emerging Technologies Redefining Outdoor Visuals in 2026 https://www.persistencemarketresearch.com/blog/outdoor-led-display-market.asp

Postal Automation System Market https://www.persistencemarketresearch.com/market-research/postal-automation-system-market.asp

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

Contact Us:

Persistence Market Research

Second Floor, 150 Fleet Street,

London, EC4A 2DQ, United Kingdom

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release E&P Software Market Set to Surge as Digital Intelligence Reshapes Upstream Oil & Gas here

News-ID: 4376706 • Views: …

More Releases from Persistence Market Research

How Natural Language Understanding Is Transforming Intelligent Automation Worldw …

The Natural Language Understanding (NLU) market has emerged as a critical pillar of the broader artificial intelligence ecosystem, enabling machines to comprehend, interpret, and respond to human language with contextual accuracy. Unlike basic language processing, NLU focuses on meaning, intent, sentiment, and semantics, making it indispensable for advanced automation and decision-making. Enterprises across industries are rapidly embedding NLU into customer-facing and internal systems to improve efficiency and intelligence.

From a market…

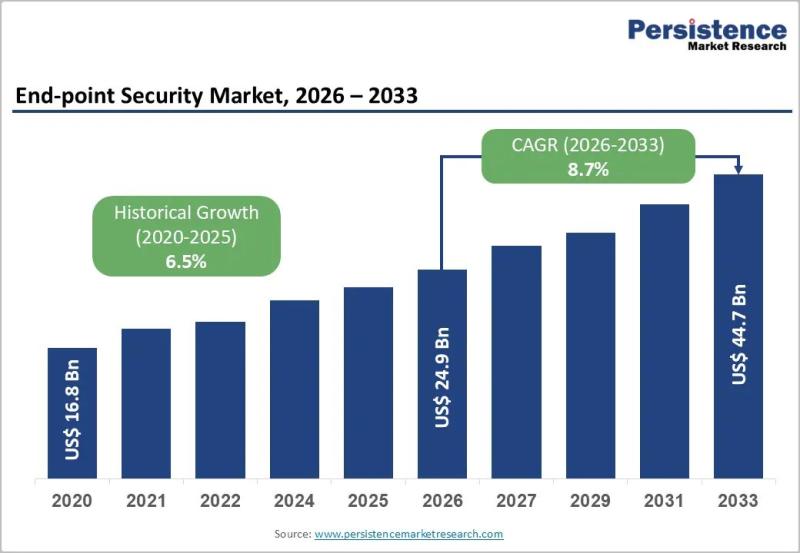

End-point Security Market Growth Trends Shaping the Future of Enterprise Cyber D …

The End-point Security Market has emerged as a cornerstone of modern cybersecurity strategies as organizations grapple with an expanding digital attack surface. Endpoints-ranging from traditional workstations and servers to mobile devices, IoT assets, and remote laptops-have become prime targets for cybercriminals due to their direct access to enterprise networks and sensitive data. As digital transformation accelerates, endpoint protection is no longer a standalone IT function but a critical component of…

Serverless Computing Market Set to Triple as Cloud-Native Adoption Accelerates

The global serverless computing market is undergoing a fundamental shift as enterprises increasingly abandon traditional infrastructure-heavy IT models in favor of cloud-native, event-driven architectures. In 2026, the market is estimated to be valued at US$ 26.4 billion and is projected to reach US$ 83.6 billion by 2033, expanding at a robust CAGR of 17.9% during the forecast period. This growth reflects the rising demand for scalable, cost-efficient, and agile application…

Video Surveillance Industry Outlook 2033 Fueled by AI Analytics and Smart Monito …

The video surveillance market has evolved from basic analog recording systems into an intelligent, software-driven security ecosystem that actively supports prevention, prediction, and response. Today's solutions go far beyond passive monitoring, integrating artificial intelligence, edge computing, cloud platforms, and IoT connectivity to deliver real-time insights. This transformation is positioning video surveillance as a strategic asset across commercial, residential, industrial, and public infrastructure environments.

From a market size perspective, the global video…

More Releases for E&P

Exploration and Production (E&P) Software Market 2022 | Detailed Report

The Exploration and Production (E&P) Software research report provides a detailed picture of the market by way of study, synthesis, and summation of data from multiple sources. The data thus presented is reliable, comprehensive and the result of extensive research both primary and secondary. The analysts have presented the various facets of the market with a particular focus on identifying the key industry influencers. Moreover, the data underlines the primary…

Surging E&P Activities in Arctic Driving Well Cementing Services Demand

Well cementing refers to the service that helps in preventing the movement of fluid from the reservoir to the wellbore. Cementing of wells also supports and protects the well casing. Oilfield service companies offer well cementing services for completing new wells and sealing lost circulation areas or zones where there is an absence of fluid movement or less fluid flow within the well. These companies offer remedial, primary, and other…

Exploration & Production (E&P) Software – Global Market Outlook (2018-2025)

Global Exploration & Production (E&P) Software Industry

New Study On “2018-2025 Exploration & Production (E&P) Software Market Global Key Player, Demand, Growth, Opportunities and Analysis Forecast” Added to Wise Guy Reports Database

This report focuses on the global Exploration & Production (E&P) Software status, future forecast, growth opportunity, key market and key players. The study objectives are to present the Exploration & Production (E&P) Software development in United States, Europe and China.

The…

Well Intervention Market: Subsea E&P Activities to Trigger Adoption

Development of new oilfields coupled with rising demand for energy have remained instrumental in driving the need for well intervention. With a large contribution from the energy and power sector, the well intervention market is expected to remain optimistic throughout the period of forecast, 2018-2026, reveals a new report on well intervention market. This extensive research report titled “Well Intervention Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast…

Fenoxaprop-P-e: Global Product Intelligence (2015-2020)

ReportsWorldwide has announced the addition of a new report title Fenoxaprop-P-e: Global Product Intelligence (2015-2020) to its growing collection of premium market research reports.

The report “Fenoxaprop-P-e: Global Product Intelligence” provides market intelligence on the different market segments, based on type, application, and geography. Market size and forecast (2011-2020) has been provided in the report.

The report “Fenoxaprop-P-e: Global Product Intelligence (2015-2020)” provides market intelligence on the different segments of the agrochemical,…

Exploration & Production (E&P) Software Market Industry Prediction 2024

Global Exploration and Production Software Market: Overview

The report provides analysis of the Exploration & Production (E&P) Software market for the period 2014–2024, wherein the years from 2016 to 2024 is the forecast period and 2015 is considered as the base year. The report covers all the major trends and technologies playing a major role in the Exploration & Production (E&P) Software market growth over the forecast period. It highlights the…