Press release

Outlook on the Artificial Intelligence (AI) Market for Personal Finance: Major Segments, Strategic Developments, and Leading Companies

The artificial intelligence (AI) sector is rapidly transforming personal finance by offering innovative tools and personalized services. This market is set to experience remarkable growth as more consumers and financial institutions turn to AI-driven solutions to manage their finances more effectively. Let's explore the projected market size, key players, emerging trends, and detailed segments shaping the future of AI in personal finance.Forecasted Market Value and Growth Rate of the Artificial Intelligence for Personal Finance Market

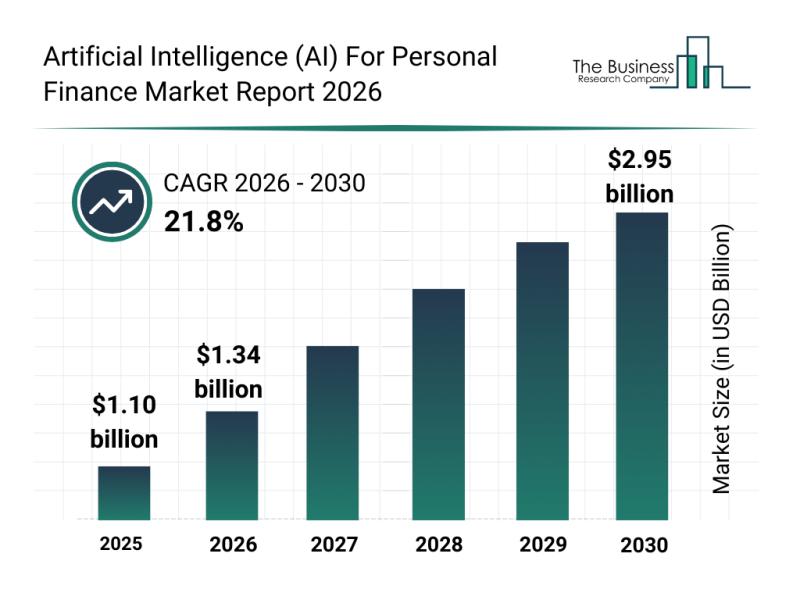

The AI for personal finance market is anticipated to grow significantly, reaching a valuation of $2.95 billion by 2030. This expansion corresponds to a robust compound annual growth rate (CAGR) of 21.8%. Factors contributing to this surge include heightened demand for highly customized financial insights, increased use of generative AI in advisory tools, wider smartphone adoption in developing countries, the growth of open banking frameworks improving data availability, and the rising necessity for automated credit score and investment management.

Download a free sample of the artificial intelligence (ai) for personal finance market report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=30506&type=smp

Key Drivers Behind Growth in the AI for Personal Finance Market

One of the main drivers is the rising consumer expectation for personalized financial guidance, which is fueling interest in AI-powered solutions capable of tailoring advice to individual needs. Additionally, the growing integration of generative AI technologies in financial planning tools provides more dynamic and interactive user experiences, further driving market expansion.

Another significant influence is the enhanced accessibility to financial data through open banking initiatives, which opens up new possibilities for innovative AI-driven personal finance applications. The widespread smartphone penetration in emerging economies also supports higher adoption rates of these mobile AI tools, making financial management more convenient and accessible to a broader audience.

View the full artificial intelligence (ai) for personal finance market report:

https://www.thebusinessresearchcompany.com/report/artificial-intelligence-ai-for-personal-finance-market-report

Top Companies Leading the Artificial Intelligence for Personal Finance Market

Several prominent companies are actively shaping this market, including Rocket Money Inc., Revolut Ltd., NerdWallet Inc., MoneyLion Inc., Betterment LLC, Cleo AI Ltd., Albert Corporation, Stash Invest LLC, Plum Fintech Ltd., Monarch Money Inc., Origin Financial Inc., Copilot Money Inc., PocketGuard Inc., Empower Advisory Group LLC, PocketSmith Ltd., Magnifi Inc., Parthean Inc., ET Money Ltd., CRED Finance Ltd., Wallet AI Inc., and Snoop Ltd.

A significant development occurred in October 2026 when OpenAI, a US-based AI research and deployment company, acquired Roi-AI, a startup specializing in conversational AI for multi-asset portfolio management. This acquisition aims to enhance OpenAI's personalized consumer AI offerings, leveraging Roi's technology designed to manage investments across stocks, real estate, cryptocurrencies, and other digital assets through an interactive assistant.

Emerging Trends Paving the Way Forward for AI in Personal Finance

Leading players in this market are investing heavily in next-generation AI platforms that boost productivity, deliver tailored advice, and enhance client engagement. These advanced financial AI solutions combine machine learning, data analytics, and contextual financial modeling to offer advisors actionable insights, risk assessments, and personalized recommendations at scale.

For instance, in August 2025, UK-based wealth management platform FNZ Limited introduced FNZ Advisor AI. This innovative tool is integrated within the platform to aid financial institutions by automating meeting preparations, providing client-specific insights during conversations, transcribing and analyzing discussions, and recommending follow-up tasks. The solution helps advisors manage more clients efficiently while lowering administrative workload and improving personalized service.

Detailed Segmentation of the Artificial Intelligence for Personal Finance Market

This market can be categorized across multiple dimensions:

1) Insurance Type: Life Insurance, Health Insurance, Property and Casualty Insurance, Commercial Insurance, Travel and Microinsurance, and Other Insurance Types

2) Deployment Mode: On-Premise and Cloud-Based (SaaS)

3) Technology Stack: Cognitive Agents, Autonomous Decision Engines, Multi-Agent Systems, LLM Integration (with Guardrails), Explainable AI (XAI), and Other Technologies

4) Applications: Underwriting Automation, Claims Management, Customer Engagement, Product Personalization, Compliance and Governance, and More

5) End-Users: Insurance Carriers, InsurTech Firms, Third-Party Administrators (TPAs), Brokers and Agencies, Reinsurers, and Other Users

Further subcategories include:

- Life Insurance tools like automated policy recommendation and AI-driven risk scoring

- Health Insurance solutions such as claims triage and pre-authorization automation

- Property and Casualty Insurance technologies involving computer vision-based damage assessment and fraud detection

- Commercial Insurance innovations including business risk profiling and regulatory automation

- Travel and Microinsurance applications like AI travel risk assessments and instant microinsurance issuance

- Other areas covering pet insurance AI, cyber risk evaluation, agricultural insurance models, and specialized policy automation.

This comprehensive segmentation highlights how AI is penetrating various aspects of the personal finance and insurance industries, offering tailored solutions across diverse needs and user types.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/,

Americas +1 310-496-7795,

Europe +44 7882 955267,

Asia & Others +44 7882 955267 & +91 8897263534,

Email us at info@tbrc.info.

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Outlook on the Artificial Intelligence (AI) Market for Personal Finance: Major Segments, Strategic Developments, and Leading Companies here

News-ID: 4375709 • Views: …

More Releases from The Business Research Company

Leading Companies Spearheading Innovation and Growth in the Artificial Intellige …

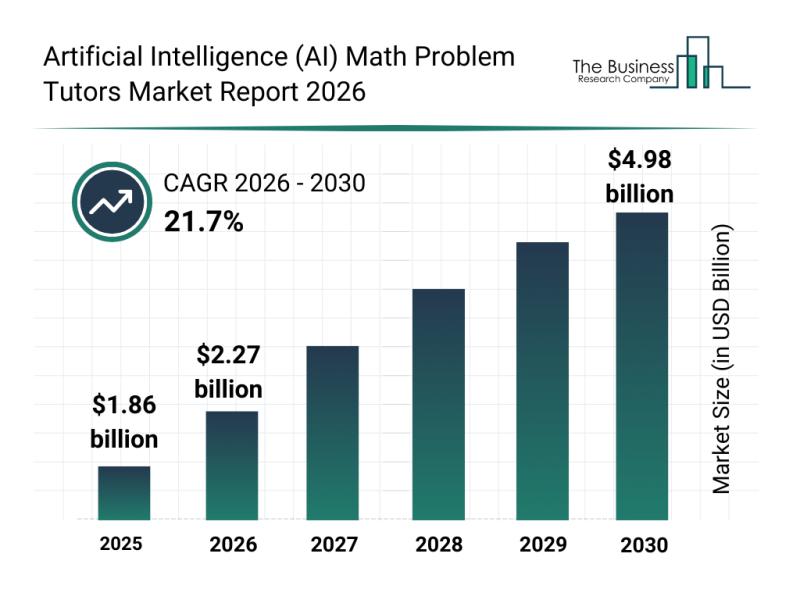

The artificial intelligence (AI) math problem tutors market is poised for remarkable expansion as educational technology continues to evolve rapidly. Increasing adoption of AI tools in learning environments and the growing emphasis on STEM education are key factors driving this surge. Let's explore the current market size, key players, emerging trends, and segmentation that define this vibrant sector.

Projected Market Size and Growth of the AI Math Problem Tutors Market …

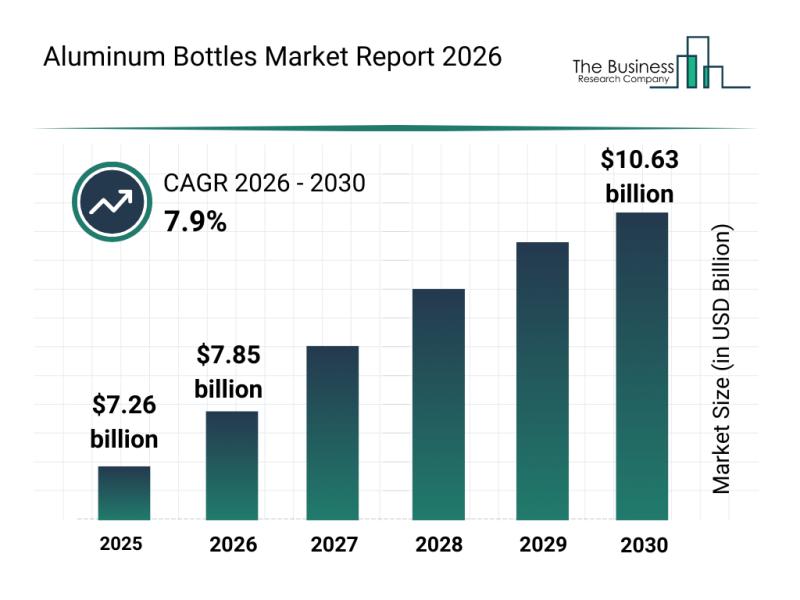

Analysis of Segments and Primary Growth Areas in the Aluminum Bottles Market

The aluminum bottles market is poised for significant expansion over the coming years, driven by evolving consumer preferences and industry innovations. As sustainability and convenience continue to influence packaging choices, this sector is attracting increased attention from manufacturers and end-users alike. Here's an in-depth look at market size projections, key players, emerging trends, and product segmentation shaping the aluminum bottles industry.

Forecasting the Aluminum Bottles Market Size Through 2030

The…

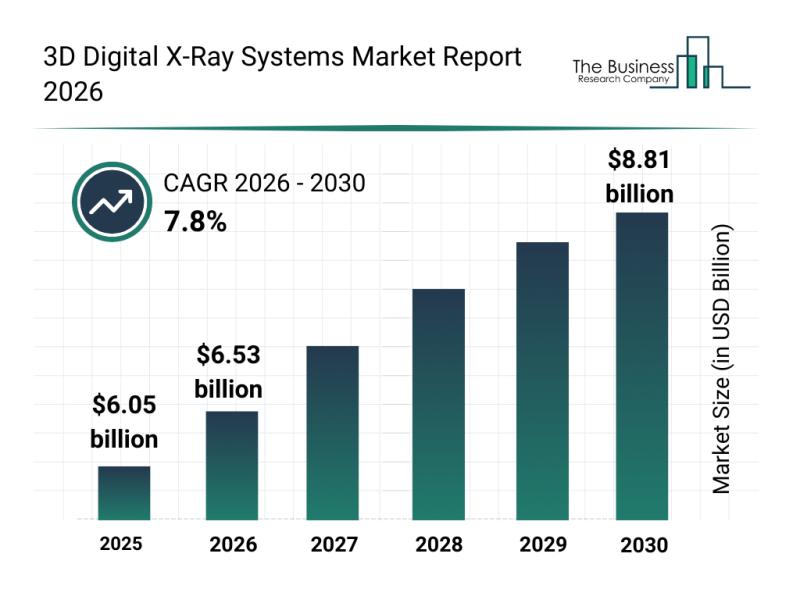

Key Strategic Developments and Emerging Changes Shaping the 3D Digital X-Ray Sys …

The 3D digital X-ray systems market is on track for significant expansion in the coming years. Driven by technological advancements and increasing clinical needs, this sector is expected to witness substantial growth, transforming diagnostic imaging and healare delivery worldwide. Let's explore the market size projections, key players, emerging trends, and leading segments shaping this evolving industry.

Projected Growth Trajectory of the 3D Digital X-Ray Systems Market

The market for 3D…

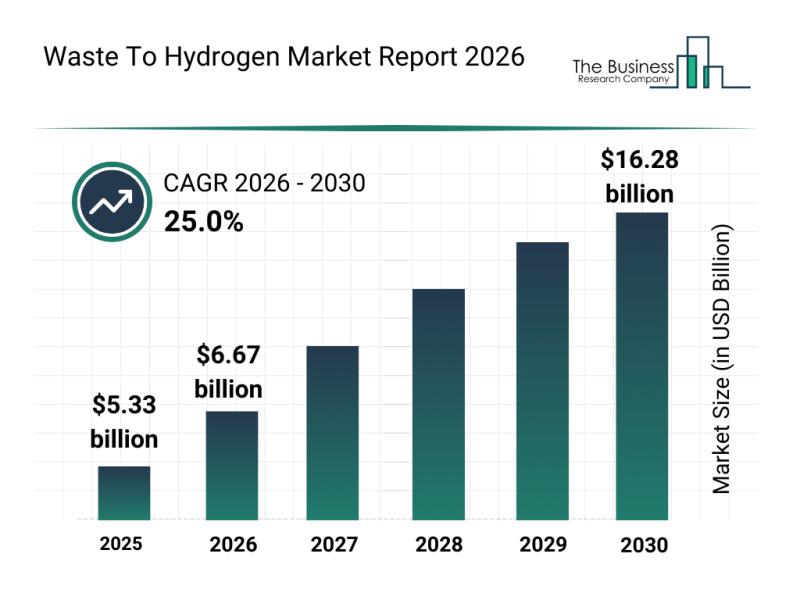

Leading Companies Advancing Innovation and Growth in the Waste to Hydrogen Marke …

The waste to hydrogen market is rapidly gaining attention as a promising solution for sustainable energy and waste management. With increasing environmental concerns and the global push toward greener alternatives, this sector is set to experience remarkable growth. Let's explore the current market size, key players, emerging trends, and the main segments driving this dynamic industry forward.

Waste to Hydrogen Market Size and Projected Growth Trajectory

The waste to hydrogen…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…