Press release

Energy Trading and Risk Management (ETRM) Market Growth Analysis, Market Share, and Forecast Period 2026-2032

Market Overview and Research Scope -QY Research Inc., A global market research and consulting firm, has announced the release of its latest 2026 report titled "Energy Trading and Risk Management (ETRM) - Global Market Share and Ranking, Overall Sales and Demand Forecast 2026-2032." The report provides a data-driven analysis of the global Energy Trading and Risk Management (ETRM) market, integrating historical insights from 2020-2025 with forward-looking forecasts through 2032. It covers market size, competitive landscape, demand trends, and industry development, offering strategic insights for stakeholders navigating this rapidly evolving sector.

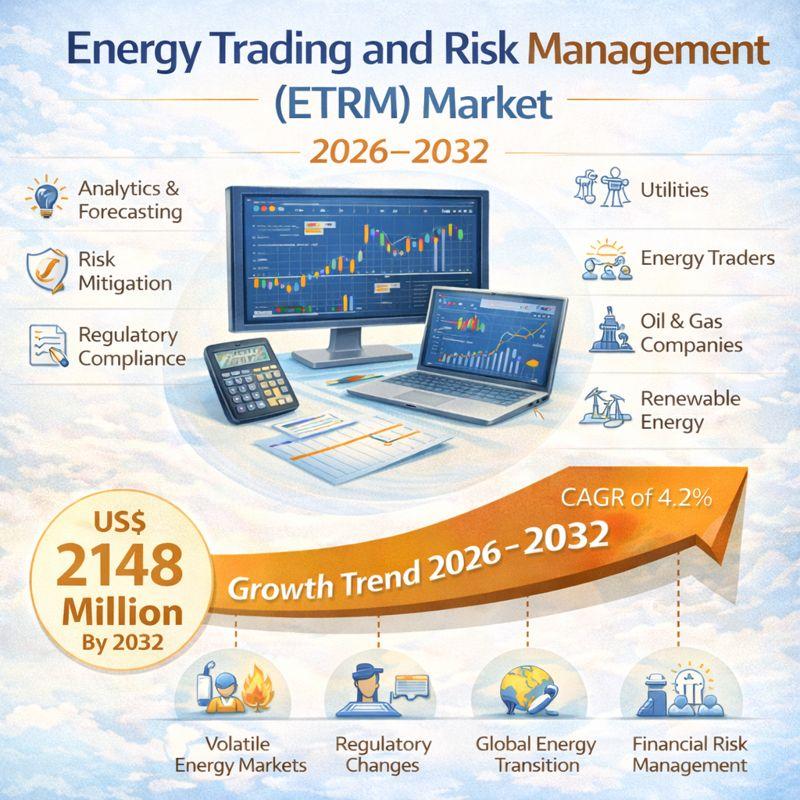

The global Energy Trading and Risk Management (ETRM) market was valued at US$ 1617 million in 2025 and is anticipated to reach US$ 2148 million by 2032, witnessing a CAGR of 4.2% during the forecast period 2026-2032.

The report analyzes historical market performance alongside detailed forecasts, offering clarity on competitive intensity, growth catalysts, structural challenges, and emerging trends. With extensive coverage of market segmentation, regional developments, and leading company profiles, the study serves as a dependable strategic reference for organizations seeking to strengthen their position in the global Energy Trading and Risk Management (ETRM) market.

Get Full PDF Sample Copy of the Report: (Including Full TOC, Tables & Charts): https://qyresearch.in/request-sample/service-software-global-energy-trading-and-risk-management-etrm-market-insights-industry-share-sales-projections-and-demand-outlook-2026-2032

Energy trading and risk management (ETRM) is a commercial decision making and market execution tool in an integrated system that enables data exchange among traders and retailers, generators, and operations, contract, and accounting functions. The ETRM system covers complex trading requirements of a liberalized energy market and helps market participants to trade in the full range of contracts across the globe. The ETRM system also entails comprehensive risk management strategies and policies, event and trade identification, and scheduling and settlement execution. It provides consulting services for market monitoring, price transparency, and regulatory compliance.

ETRM systems can be implemented to manage the entire value chain of the energy business. These systems are installed to understand the real risks involved in the value chain and provide the best options to overcome these risks. Major global firms engaged in the energy business adopt ETRM solutions widely to maximize profitability and manage the risks in the best possible manner. Oil and gas, coal, power, and biofuel industries are the prominent energy sectors that require energy trading and risk management services.

Energy Trading and Risk Management (ETRM) is an integrated business and technology framework for trading, managing, and settling energy products-power, gas, oil, emissions, and renewables. ETRM platforms orchestrate front-to-back workflows: trade capture, portfolio optimization, scheduling and dispatch of physical assets (generation, storage, pipelines), settlement and accounting, and multi-dimensional risk measurement (market, credit, volumetric). Modern ETRM solutions provide real-time risk analytics, scenario stress-testing, regulatory reporting, data governance, and decision-grade visualization, functioning as the operational and analytical "nerve center" for utilities, traders, and large energy consumers operating in volatile and increasingly regulated markets.

What Is the Energy Trading and Risk Management (ETRM) Market?

The Energy Trading and Risk Management (ETRM) Market refers to software platforms and solutions designed to support energy trading operations, portfolio optimization, and risk control across electricity, natural gas, oil, LNG, renewables, and related energy commodities. ETRM systems are used by utilities, energy producers, traders, independent power producers (IPPs), oil & gas companies, and large energy consumers.

ETRM platforms typically manage functions such as trade capture, scheduling, contract management, pricing, market analytics, credit risk, regulatory compliance, and settlement. These systems enable organizations to manage complex energy portfolios while responding to volatile prices and evolving market regulations.

Why the ETRM Market Is Important?

The importance of the ETRM market is driven by increasing energy price volatility, market liberalization, and growing complexity in global energy trading. Energy markets are influenced by geopolitical events, supply-demand imbalances, weather variability, and regulatory changes, making risk management critical for profitability and stability.

ETRM solutions help organizations identify, quantify, and mitigate financial, operational, and market risks, while ensuring transparency and compliance with regulatory requirements. As energy companies diversify portfolios across conventional fuels and renewables, ETRM systems play a key role in optimizing trading strategies and balancing risk exposure.

Additionally, the shift toward renewable energy integration, carbon trading, and emissions management is increasing the need for advanced ETRM capabilities that can handle multi-commodity portfolios and complex contractual structures.

How the ETRM Market Is Evolving?

The ETRM market is evolving through digital transformation, cloud adoption, and advanced analytics integration. Modern ETRM platforms increasingly leverage cloud-based architectures to improve scalability, flexibility, and real-time data access across global trading operations.

Integration of advanced analytics, artificial intelligence, and machine learning is enhancing forecasting accuracy, scenario modeling, and decision support. ETRM systems are also expanding to incorporate renewable energy forecasting, carbon pricing, and sustainability reporting, reflecting changes in energy market structures.

There is growing demand for modular and interoperable ETRM solutions that can integrate with ERP systems, market data feeds, and regulatory reporting tools. From a regional perspective, adoption is expanding across North America and Europe, while Asia-Pacific and emerging markets are seeing increased uptake as energy markets liberalize and trading activities expand.

Market Drivers and Challenges -

The energy transition and net-zero agendas are reshaping market structures: higher shares of renewables, more complex spot and derivative markets, and new business models such as storage and Virtual Power Plants (VPPs) all increase demand for granular, real-time trading and risk management. Regulatory reforms that raise transparency and settlement robustness (including electricity market redesigns and emissions compliance frameworks) are driving firms to modernize governance and control through ETRM investments-creating sustained, policy-backed demand.

Key challenges include frequent market rule changes requiring costly platform adaptations, cross-jurisdictional legal/tax complexity, long implementation cycles with internal change management friction that delay ROI, and regulatory/political shifts that can abruptly alter trading patterns. Data source or exchange disruptions pose immediate risks to price discovery and position control.

Downstream demand is broadening from traditional traders to utilities, IPPs, storage operators, and large industrial consumers, with twin needs for low-latency risk monitoring/automated hedging and robust ESG/compliance capabilities (e.g., VPPAs, renewable certificate accounting). Upstream "single-line capacity" for an ETRM delivery-comprising market data ingestion, clearing interfaces, risk engines, cloud compute and validated models-determines how rapidly and repetitively vendors can deploy solutions; data governance and model validation are the bottlenecks that most influence delivery speed and product scalability.

Competitive Landscape Analysis -

The report provides an in-depth evaluation of the competitive environment within the global Energy Trading and Risk Management (ETRM) market, focusing on recent developments, expansion strategies, and long-term growth initiatives adopted by key market participants. It profiles nearly all major companies operating in the industry and examines critical business parameters such as production capacity, geographic footprint, product offerings, and strategic direction.

Each company is assessed using key performance indicators including market share, growth rate, revenue, production volume, earnings, and overall company scale. This competitive benchmarking enables stakeholders to understand relative market positioning, identify strategic gaps, and uncover opportunities for differentiation and expansion.

OpenLink

FIS

Sapient

Trayport

Allegro

ABB

Triple Point

SAP

Amphora

Eka Software

Market Segmentation -

By Type

Vendor License and Service

SaaS or Hosted Service

By Application

Power

Natural Gas

Oil and Products

Other

The report provides valuable insights into the key segments of the global Energy Trading and Risk Management (ETRM) market, with a strong focus on CAGR, market size, market share, and future growth potential. The market is comprehensively segmented by product type, application, and region, with each segment thoroughly analyzed to identify growth prospects, demand patterns, and emerging trends. This detailed segmental analysis plays a crucial role in uncovering high-growth and high-return opportunities across the market. By offering precise data on product- and application-level demand, the report enables businesses to prioritize profitable segments and develop targeted strategies within the global Energy Trading and Risk Management (ETRM) market.

Regional Insights -

This research study covers key geographic regions including North America, Europe, Asia Pacific, Central and South America, and the Middle East & Africa. The analysis includes regional growth opportunity mapping and comprehensive SWOT assessments, considering political and legal, economic, and technological factors. Readers are provided with regional and country-level sales and revenue forecasts for the period starting in 2026. Additionally, this section presents key regional sales statistics segmented by type and application through 2032.

Why Purchase This Report?

This report delivers a comprehensive, evidence-based overview of the Energy Trading and Risk Management (ETRM) market to support informed strategic planning and investment decisions. It includes free customization options, such as country-level analysis for up to five selected countries and a detailed segment-wise competitive revenue assessment of leading players.

By offering deep insights into market trends, growth drivers, challenges, competitive dynamics, and emerging opportunities, the report equips manufacturers, investors, and decision-makers with actionable intelligence to identify high-growth segments, optimize operations, and maintain a sustainable competitive advantage.

Recent Industry Developments -

The study highlights recent strategic activities undertaken by major players in the global Energy Trading and Risk Management (ETRM) market. It covers mergers and acquisitions, partnerships, joint ventures, product launches, technological innovations, and ongoing research and development initiatives. This analysis provides a clear view of how leading companies are strengthening their market presence, accelerating innovation, and responding to evolving industry demands.

Key Benefits for Stakeholders -

✔ Enables executives, policymakers, product managers, and sales leaders to make informed strategic decisions

✔ Provides global, regional, and country-level revenue analysis to assess market share and identify new growth markets

✔ Offers detailed segmentation by type, application, technology, and end-use to support product and financial planning

✔ Helps investors evaluate market scope, risks, and expansion opportunities

✔ Supports competitive benchmarking through in-depth analysis of key players and their strategies

Key Questions Addressed in the Report -

✯ What is the overall market size and projected growth rate across global and regional segments?

✯ How does the market size and growth outlook vary across major countries?

✯ Which region or market sub-segment is anticipated to dominate growth during the forecast period?

✯ What are the primary factors expected to drive market expansion, and what challenges may restrain growth?

✯ Which emerging technologies and market trends are shaping the future landscape?

✯ What are the most significant opportunities available in the market?

✯ Who are the leading manufacturers actively participating in the global market?

✯ Which company currently holds the largest share of the market?

✯ What are the potential growth avenues for new entrants in the global market?

Benefits of purchasing QYResearch report:

Competitive Analysis:

QYResearch provides in-depth Energy Trading and Risk Management (ETRM) analysis, including information on key company profiles, new entrants, acquisitions, mergers, large market shear, opportunities, and challenges. These analyses provide clients with a comprehensive understanding of market conditions and competitive dynamics, enabling them to develop effective market strategies and maintain their competitive edge.

Industry Analysis:

QYResearch provides Energy Trading and Risk Management (ETRM) comprehensive industry data and trend analysis, including raw material analysis, market application analysis, product type analysis, market demand analysis, market supply analysis, downstream market analysis, and supply chain analysis and trend analysis. These analyses help clients understand the direction of industry development and make informed business decisions.

Market Size:

QYResearch provides Energy Trading and Risk Management (ETRM) market size analysis, including capacity, production, sales, production value, price, cost, and profit analysis. This data helps clients understand market size and development potential, and is an important reference for business development.

Request for Pre-Order / Enquiry Link: https://qyresearch.in/pre-order-inquiry/service-software-global-energy-trading-and-risk-management-etrm-market-insights-industry-share-sales-projections-and-demand-outlook-2026-2032

Chapter Outline:

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of Energy Trading and Risk Management (ETRM) manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of Energy Trading and Risk Management (ETRM) in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

QY Research - Similar & Related Reports -

https://www.openpr.com/news/4367113/utv-utility-terrain-vehicle-market-size-to-hit-us-13-81

https://www.openpr.com/news/4367124/roofing-underlying-materials-market-set-to-reach-us-23-86

https://www.openpr.com/news/4367128/solder-ball-market-2026-industry-size-competitive-landscape

https://www.openpr.com/news/4367137/color-sorter-market-trends-market-size-share-and-global

About Us:

QYResearch established as a research firm in 2007 and have since grown into a trusted brand amongst many industries. Over the years, we have consistently worked toward delivering high-quality customized solutions for wide range of clients ranging from ICT to healthcare industries. With over 50,000 satisfied clients, spread over 80 countries, we have sincerely strived to deliver the best analytics through exhaustive research methodologies.

Contact Us:

Arshad Shaha | Marketing Executive

QY Research, INC.

315 Work Avenue, Raheja Woods,

Survey No. 222/1, Plot No. 25, 6th Floor,

Kayani Nagar, Yervada, Pune 411006, Maharashtra

Tel: +91-8669986909

Emails - arshad@qyrindia.com

Web - https://www.qyresearch.in

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Energy Trading and Risk Management (ETRM) Market Growth Analysis, Market Share, and Forecast Period 2026-2032 here

News-ID: 4375587 • Views: …

More Releases from QYResearch.Inc

Digital Radiography Market Research Study 2026-2032 : Size, Share, and Growth Op …

Market Overview and Research Scope -

QY Research Inc., A global market research and consulting firm, has announced the release of its latest 2026 report titled "Digital Radiography - Global Market Share and Ranking, Overall Sales and Demand Forecast 2026-2032." The report provides a data-driven analysis of the global Digital Radiography market, integrating historical insights from 2020-2025 with forward-looking forecasts through 2032. It covers market size, competitive landscape, demand trends, and…

Anti Acne Cleanser Market Growth Analysis, Market Share, and Forecast Period 202 …

Market Overview and Research Scope -

QY Research Inc., A global market research and consulting firm, has announced the release of its latest 2026 report titled "Anti Acne Cleanser - Global Market Share and Ranking, Overall Sales and Demand Forecast 2026-2032." The report provides a data-driven analysis of the global Anti Acne Cleanser market, integrating historical insights from 2020-2025 with forward-looking forecasts through 2032. It covers market size, competitive landscape, demand…

Ethyl Polysilicate Market Report 2026 : Emerging Trends, Key Growth Drivers, and …

Market Overview and Research Scope -

QY Research Inc., A global market research and consulting firm, has announced the release of its latest 2026 report titled "Ethyl Polysilicate - Global Market Share and Ranking, Overall Sales and Demand Forecast 2026-2032." The report provides a data-driven analysis of the global Ethyl Polysilicate market, integrating historical insights from 2020-2025 with forward-looking forecasts through 2032. It covers market size, competitive landscape, demand trends, and…

Electro-fusion Coupler Market Share, Size, Trend, Demand, Analysis by Top Leadin …

Market Overview and Research Scope -

QY Research Inc., A global market research and consulting firm, has announced the release of its latest 2026 report titled "Electro-fusion Coupler - Global Market Share and Ranking, Overall Sales and Demand Forecast 2026-2032." The report provides a data-driven analysis of the global Electro-fusion Coupler market, integrating historical insights from 2020-2025 with forward-looking forecasts through 2032. It covers market size, competitive landscape, demand trends, and…

More Releases for ETRM

Intellimachs Offers Targeted ETRM Services and Training Solutions for Energy Mar …

Image: https://www.globalnewslines.com/uploads/2025/11/1762411878.jpg

Intellimachs is a technology services company that supports businesses across software development, along with artificial intelligence and enterprise systems. The company works with energy trading firms and risk management teams that need reliable systems to track trades and manage exposure. Intellimachs focuses on delivering solutions that reduce complexity and help teams make better decisions faster. The company has built its reputation by solving real problems for organizations that cannot…

Global CTRM-ETRM Software Market Size, Share and Forecast By Key Players-Openlin …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- According to the Market Research Intellect, the global CTRM-ETRM Software market is projected to grow at a robust compound annual growth rate (CAGR) of 12.05% from 2024 to 2031. Starting with a valuation of 10.56 Billion in 2024, the market is expected to reach approximately 20.9 Billion by 2031, driven by factors such as CTRM-ETRM Software and CTRM-ETRM Software. This significant growth underscores the expanding demand for…

Energy Trading and Risk Management (ETRM) Market Size

According to a new market research report published by Global Market Estimates, the Global Energy Trading and Risk Management (ETRM) Market is projected to grow at a CAGR of 6.5% from 2023 to 2028.

Allegro Development Corporation, Amphora Inc., Triple Point Technology Inc., Openlink LLC., Eka Software Solutions, SAP, Sapient, Ventyx and Trayport among others, are some of the key players in the global energy trading and risk management (ETRM) market.…

INPEX ENERGY TRADING SINGAPORE PTE. LTD. selects ENTRADE® for ETRM

Singapore (November 2020) — Enuit, LLC announced today that INPEX ENERGY TRADING SINGAPORE PTE. LTD. (IETS) has begun implementing its flagship product, ENTRADE® to manage their trading risk and derivatives for crude oil.

INPEX CORPORATION (INPEX), the ultimate parent company of IETS, is a leading energy company that proactively undertakes oil & gas exploration, development and production activities to contribute to a stable and efficient supply of energy. INPEX is currently…

Energy Trading and Risk Management (ETRM) Market Trends, Insights, Analysis, For …

"Energy Trading and Risk Management (ETRM) Market Scope

“Energy Trading and Risk Management (ETRM) Market is expected to see huge growth opportunities during the forecast period, i.e., 2020 – 2027”, Says Decisive Markets Insights.

The report covers market size and forecast, market share, market share of the key players in the global market, current growth trends and future trends, market segmentation, value chain analysis, market dynamics which includes market drivers, restraints and…

Energy Trading and Risk Management (ETRM) Market 2020 Real Time Analysis And For …

This report studies the Energy Trading and Risk Management (ETRM) Market with many aspects of the industry like the market size, market status, market trends and forecast, the report also provides brief information of the competitors and the specific growth opportunities with key market drivers. Find the complete Energy Trading and Risk Management (ETRM) Market analysis segmented by companies, region, type and applications in the report.

“The final report will add…