Press release

Micro Investing Platforms Market Surges as Fractional Investing Redefines Personal Finance

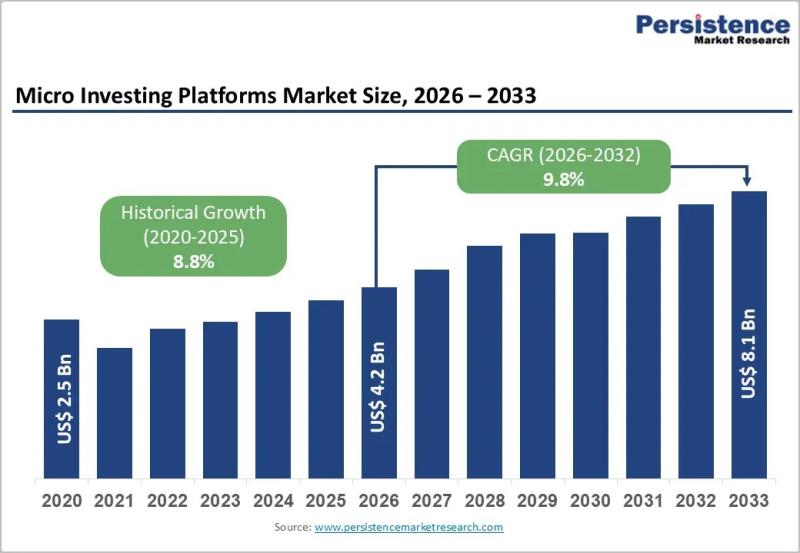

The Micro Investing Platforms Market has emerged as one of the most transformative segments within the global fintech ecosystem, reshaping how individuals participate in capital markets. These platforms allow users to invest small sums of money-often spare change from everyday transactions-into diversified portfolios, stocks, ETFs, or thematic funds. By lowering traditional entry barriers such as high minimum investment requirements, micro investing platforms are democratizing access to wealth creation for first-time and underserved investors.In 2026, the global micro investing platforms market was valued at US$ 2.5 billion, and it is projected to reach US$ 8.1 billion by 2033, expanding at a CAGR of 9.8% during the forecast period from 2026 to 2033. This steady growth trajectory reflects a fundamental shift in investor behavior, particularly among Millennials and Gen Z, who prefer digital-first, mobile-centric financial services over conventional brokerage firms.

Market expansion is being fueled by the convergence of rising smartphone penetration, improved digital payment infrastructure, and growing financial literacy. Fractional share trading has played a pivotal role in enabling users to invest in high-value stocks with minimal capital, making investing more inclusive and accessible. Additionally, gamified interfaces, intuitive dashboards, and real-time portfolio tracking have made investing less intimidating and more engaging for younger demographics.

Elevate your business strategy with comprehensive market data. Request a sample report now: https://www.persistencemarketresearch.com/samples/33656

Market Statistics, Key Growth Drivers, and Leadership Snapshot

From a statistical perspective, the micro investing platforms market has maintained consistent momentum over the past decade, with historical growth of 8.8% between 2020 and 2025, signaling strong underlying demand. The projected acceleration to a 9.8% CAGR highlights the increasing mainstream acceptance of micro investing as a viable financial tool rather than a niche offering.

Key growth drivers include the democratization of finance, where fintech innovations remove traditional barriers such as high fees and account minimums. The widespread adoption of smartphones and mobile internet has further amplified market growth, enabling seamless access to investment platforms anytime and anywhere. Moreover, the rising popularity of digital wallets and instant payment systems has simplified the process of funding investment accounts, encouraging frequent and habitual investing.

In terms of market leadership, mobile-based platforms dominate with approximately 78% market share, reflecting user preference for on-the-go accessibility and real-time engagement. North America leads the global market, accounting for over 40% share, driven by high disposable incomes, advanced fintech ecosystems, and strong regulatory support. Meanwhile, Asia Pacific stands out as the fastest-growing region, supported by rapid digitalization and a young, tech-savvy population entering investment markets for the first time.

Key Highlights from the Micro Investing Platforms Market Report

• The global micro investing platforms market is expected to reach US$ 8.1 billion by 2033.

• Market growth is driven by rising adoption of fractional share trading and spare-change investing models.

• Mobile-based platforms account for nearly 78% of total market revenue.

• North America remains the largest regional market with over 40% share.

• Asia Pacific is the fastest-growing region due to smartphone and fintech adoption.

• AI-powered robo-advisory tools present a high-impact growth opportunity for platform providers.

Micro Investing Platforms Market Segmentation Analysis

The micro investing platforms market is segmented based on platform type, end-user category, investment type, and functionality, each influencing adoption patterns and revenue generation. By platform type, the market is primarily divided into mobile-based and web-based platforms. Mobile platforms dominate the landscape, supported by intuitive app interfaces, real-time notifications, and seamless integration with digital wallets and payment applications.

Web-based platforms, while holding a smaller share, continue to serve users seeking more detailed analytics and portfolio management tools. However, their growth is comparatively slower as investor preferences increasingly shift toward mobile-first experiences. The dominance of mobile platforms underscores the importance of user-centric design and frictionless onboarding processes in driving adoption.

Based on end-user segmentation, individual investors represent the fastest-growing segment, fueled by early adoption among Millennials and Gen Z. These users are drawn to ultra-low investment thresholds, automated recurring investments, and gamified features such as progress tracking and rewards. Institutional participation remains limited, as micro investing platforms primarily cater to retail investors seeking entry-level exposure to financial markets.

Another important segmentation criterion is investment type, which includes stocks, ETFs, mutual funds, cryptocurrencies, and thematic portfolios. Fractional stock and ETF investments dominate due to their simplicity and diversification benefits. As platforms continue to expand their product offerings, the inclusion of alternative assets and AI-driven portfolio recommendations is expected to further diversify revenue streams.

Regional Insights: Micro Investing Platforms Market

North America dominates the global micro investing platforms market, supported by a mature fintech ecosystem, high levels of financial awareness, and strong consumer trust in digital financial services. The presence of established fintech players and favorable regulatory frameworks has encouraged innovation and large-scale user adoption across the United States and Canada.

Asia Pacific is the fastest-growing regional market, driven by rapid smartphone penetration, expanding digital payment infrastructure, and a growing middle class. Countries such as India, China, and Southeast Asian nations are witnessing a surge in first-time investors, many of whom are entering capital markets through micro investing apps rather than traditional brokerages.

Europe represents a steadily growing market, benefiting from increasing fintech adoption and supportive regulatory initiatives promoting financial inclusion. Latin America and the Middle East & Africa are emerging markets with long-term growth potential, driven by rising mobile connectivity and efforts to bring unbanked populations into the formal financial system.

Market Drivers Accelerating Adoption

One of the most significant drivers of the micro investing platforms market is the democratization of investing, which allows individuals with limited capital to participate in wealth creation. By eliminating high minimum investment requirements, these platforms empower users to start investing with minimal financial risk.

The rapid rise in smartphone penetration and mobile internet access has further accelerated adoption, particularly in emerging economies. Mobile-first platforms offer convenience, accessibility, and real-time engagement, making investing a habitual activity rather than an occasional decision.

Additionally, growing financial literacy among younger generations has played a crucial role in market expansion. Millennials and Gen Z investors actively seek transparent, easy-to-use platforms that align with their digital lifestyles, driving sustained user growth and engagement.

Secure Your Full Report - Proceed to Checkout: https://www.persistencemarketresearch.com/checkout/33656

Market Restraints Impacting Growth

Despite strong growth prospects, the micro investing platforms market faces certain challenges. Low average transaction values can limit revenue generation, requiring platforms to scale user bases significantly to achieve profitability. This puts pressure on companies to continuously innovate and enhance user retention.

Regulatory uncertainty across different regions also poses a restraint, as compliance requirements vary widely and can increase operational complexity. Data privacy and cybersecurity concerns further impact user trust, particularly as platforms handle sensitive financial information.

Moreover, intense competition within the fintech landscape has led to pricing pressures and high customer acquisition costs, which can impact margins for new and smaller players.

Emerging Market Opportunities and Future Outlook

The integration of AI-powered robo-advisory services represents one of the most promising opportunities in the micro investing platforms market. These tools enable personalized investment recommendations, automated portfolio rebalancing, and improved user engagement, ultimately increasing ARPU and long-term retention.

Another key opportunity lies in expanding financial education and gamification features, which can deepen user understanding and encourage consistent investing behavior. Platforms that successfully combine education with intuitive design are likely to gain a competitive edge.

Furthermore, partnerships with digital payment providers, employers, and e-commerce platforms can unlock new distribution channels, enabling micro investing to become a seamless part of everyday financial transactions.

Company Insights: Key Players in the Micro Investing Platforms Market

• Acorns Grow Inc.

• Stash Financial Inc.

• Robinhood Markets Inc.

• Betterment LLC

• Wealthsimple

• Public.com

• SoFi Invest

Recent Developments:

Several leading platforms have recently introduced AI-driven portfolio personalization features to enhance user engagement and retention. Additionally, strategic expansions into Asia Pacific markets have been observed, targeting first-time investors through localized mobile applications and digital payment integrations.

Do You Have Any Query Or Specific Requirement? Request Customization of Report: https://www.persistencemarketresearch.com/request-customization/33656

Reasons to Buy the Micro Investing Platforms Market Report

✔ Gain in-depth insights into market size, growth trends, and forecasts through 2033

✔ Understand key drivers shaping the democratization of global investing

✔ Analyze competitive dynamics and strategies of leading fintech players

✔ Identify high-growth regions and emerging investment opportunities

✔ Support strategic planning with reliable, data-driven market intelligence

Frequently Asked Questions (FAQs)

How Big is the Micro Investing Platforms Market globally?

Who are the Key Players in the Global Market for Micro Investing Platforms Market?

What is the Projected Growth Rate of the Micro Investing Platforms Market?

What is the Market Forecast for the Micro Investing Platforms Market for 2033?

Which Region is Estimated to Dominate the Industry through the Forecast Period?

Conclusion

The Micro Investing Platforms Market is redefining personal finance by making investing accessible, affordable, and engaging for a new generation of investors. With strong growth driven by mobile adoption, financial democratization, and technological innovation, the market is poised for sustained expansion through 2033. As platforms continue to evolve with AI-driven personalization and integrated financial ecosystems, micro investing is set to become a cornerstone of global retail investment strategies.

Related Reports:

Bulk Acoustic Wave (BAW) Filters Market https://www.persistencemarketresearch.com/market-research/bulk-acoustic-wave-filter-market.asp

Cognitive Computing Market https://www.persistencemarketresearch.com/market-research/cognitive-computing-market.asp

Flash-Based Array Market https://www.persistencemarketresearch.com/market-research/flash-based-array-market.asp

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

Contact Us:

Persistence Market Research

Second Floor, 150 Fleet Street,

London, EC4A 2DQ, United Kingdom

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Micro Investing Platforms Market Surges as Fractional Investing Redefines Personal Finance here

News-ID: 4375232 • Views: …

More Releases from Persistence Market Research

Asia Pacific Gas Leak Detectors Market Set to Reach US$ 3.2 Bn by 2033 | Persist …

The Asia Pacific gas leak detectors market is expected to witness steady expansion over the forecast period, driven by growing industrialization, stricter safety regulations, and increased awareness regarding workplace hazards. The market size is projected to be valued at US$ 2.1 billion in 2026 and is anticipated to reach US$ 3.2 billion by 2033, registering a CAGR of 6.4% between 2026 and 2033. Gas leak detectors are critical safety devices…

Low Voltage Motor Control Center Market Projected to Reach US$6.6 Billion by 203 …

The low voltage motor control center (MCC) market is witnessing steady growth as industries increasingly adopt centralized motor management systems to improve operational efficiency, safety, and energy performance. Low voltage motor control centers are essential components in industrial power distribution systems, designed to control, protect, and monitor electric motors operating at low voltage levels. These systems are widely used in manufacturing facilities, oil and gas operations, water treatment plants, power…

Shiplifts Transfer Systems Market Projected to Reach US$1.7 Billion by 2033 - Pe …

The shiplifts transfer systems market plays a vital role in modern shipyard operations, enabling efficient lifting, maintenance, and transfer of vessels between water and land-based facilities. Shiplifts and transfer systems are critical components of marine infrastructure, allowing shipbuilders, naval bases, and repair yards to handle vessels of various sizes with precision and safety. These systems are widely used for ship repair, construction, inspection, and dry docking operations. The global shiplifts…

Switzerland Sports Nutrition Market to Reach US$ 390.3 Million by 2033 Driven by …

The Switzerland sports nutrition market is poised for sustained and steady growth, reflecting the country's strong fitness culture, rising health consciousness, and expanding adoption of performance-enhancing dietary solutions. The market is expected to be valued at US$ 261.3 million in 2026 and is projected to reach US$ 390.3 million by 2033, registering a compound annual growth rate (CAGR) of 5.8% between 2026 and 2033. This upward trajectory highlights the increasing…

More Releases for Platforms

Best Link Building Platforms

The number and quality of backlinks have a substantial impact on a website's ranking in search engines. Outreach, or guest posting, is one of the most effective ways to strengthen your backlink profile. The only challenge is finding reliable platforms for collaboration, and that's where link-building platforms come in. They save you the time you'd otherwise spend searching for suitable websites, analyzing their metrics, and negotiating placements. Link-building marketplaces become…

Bioinformatics Platforms Market Size Analysis by Application, Type, and Region: …

According to Market Research Intellect, the global Bioinformatics Platforms market under the Internet, Communication and Technology category is expected to register notable growth from 2025 to 2032. Key drivers such as advancing technologies, changing consumer behavior, and evolving market dynamics are poised to shape the trajectory of this market throughout the forecast period.

The bioinformatics platforms market is witnessing robust growth, fueled by the rising demand for advanced data analytics in…

Mock Interview Platforms Market

According to Market Research Intellect, the global Mock Interview Platforms market under the Internet, Communication and Technology category is expected to register notable growth from 2025 to 2032. Key drivers such as advancing technologies, changing consumer behavior, and evolving market dynamics are poised to shape the trajectory of this market throughout the forecast period.

The mock interview platforms market is expanding rapidly, driven by the increasing emphasis on career readiness and…

Global Photosharing Platforms Market Size by Application, Type, and Geography: F …

USA, New Jersey- According to Market Research Intellect, the global Photosharing Platforms market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The market for photosharing platforms is expanding quickly due to the rise in social media usage and the demand for visual material. The need for…

Get The Best Trading Platforms In The UK Here At Trading Platforms UK!

Trading Platforms UK (https://tradingplatformsuk.com/) is dedicated to providing traders with information and resources about the best day trading platforms UK wide. This resource offers an extensive list of trading platforms along with expert advice and tips on how to use them effectively.

Whether someone's a seasoned trader or just starting out, it's important to find the right trading platform. That's why Trading Platforms UK is here to help! They offer…

Aerial Work Platforms Market

The global AERIAL WORK PLATFORMS market report offers the complete market share, size, and the growth rate of different segments at both the country and regional levels. It provides an in-depth study of the market subtleties such as the current trends, drivers, opportunities, and even the restraining factors. The report also highlights the qualitative aspects in the study. Additionally, the unit takes in the key findings, in terms of market…