Press release

Electric Vehicle Battery Manufacturing Plant DPR - 2026: CapEx/OpEx Analysis with Profitability Forecast

The global electric vehicle battery manufacturing industry is experiencing unprecedented growth driven by the electrification revolution, stringent emission regulations, and accelerating transition toward sustainable transportation. At the heart of this transformation lies a critical component-automotive lithium-ion batteries. As the automotive industry worldwide shifts from internal combustion engines to electric powertrains, establishing an electric vehicle battery manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and clean technology investors seeking to capitalize on this indispensable and rapidly expanding market.Market Overview and Growth Potential

The global automotive lithium-ion battery market demonstrates an exceptional growth trajectory, valued at USD 74.92 Billion in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach USD 455.24 Billion by 2034, exhibiting a robust CAGR of 22.2% from 2026-2034. This sustained expansion is driven by accelerating electric vehicle adoption worldwide, supportive government incentives and emission regulations, rapid advancements in battery technology and energy density, decreasing battery costs making EVs more affordable, growing demand for renewable energy storage solutions, expanding EV charging infrastructure, and strategic collaborations between automakers and battery manufacturers across developed and emerging economies.

Automotive lithium-ion batteries are high-performance rechargeable energy storage systems composed of lithium-based cathode materials, graphite anodes, electrolyte solutions, and sophisticated battery management systems. These batteries power electric vehicles by storing electrical energy and delivering high power output with exceptional energy density, extended cycle life, and fast-charging capabilities. Available primarily in three chemistries-lithium iron phosphate (LiFePO4), lithium nickel manganese cobalt oxide (NMC), and lithium titanium oxide (LTO)-these advanced batteries enable zero-emission transportation while providing superior driving range, performance, and reliability compared to traditional lead-acid automotive batteries.

The electric vehicle battery market is witnessing robust demand due to the global energy transition and decarbonization imperatives. Governments worldwide are implementing stringent emission standards, offering purchase incentives, and setting ambitious EV adoption targets to combat climate change. Major automotive manufacturers are committing billions of dollars to electrification strategies, launching multiple EV models, and phasing out internal combustion engine vehicles. According to the International Energy Agency, global EV sales exceeded 14 million units in 2023, representing 18% of total car sales, and are projected to reach 40 million units annually by 2030. This explosive growth trajectory creates unprecedented opportunities for battery manufacturers positioned to supply the automotive industry's insatiable demand for high-performance energy storage solutions.

Request for a Sample Report: https://www.imarcgroup.com/electric-vehicle-battery-manufacturing-plant-project-report/requestsample

Plant Capacity and Production Scale

The proposed electric vehicle battery manufacturing facility is designed with an annual production capacity ranging between 1-5 GWh (Gigawatt-hours), enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to cater to diverse market segments-from passenger electric vehicles and commercial electric trucks to electric buses, two-wheelers, and energy storage systems-ensuring steady demand and consistent revenue streams across multiple high-growth transportation and energy verticals.

Financial Viability and Profitability Analysis

The electric vehicle battery manufacturing business demonstrates attractive profitability potential under normal operating conditions. The financial projections reveal:

Gross Profit Margins: 20-30%

Net Profit Margins: 5-10%

These margins are supported by sustained demand from rapidly expanding EV production volumes, strategic importance in automotive supply chains, long-term supply agreements with major automakers providing revenue visibility, and critical enablement of global decarbonization goals. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established automotive suppliers looking to diversify their product portfolio in the high-growth electric mobility ecosystem.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for an electric vehicle battery manufacturing plant is primarily driven by:

Raw Materials: 70-80% of total OpEx

Utilities: 10-15% of OpEx

Other Expenses: Including labor, quality control, research and development, packaging, transportation, maintenance, depreciation, and taxes

Raw materials constitute the largest portion of operating costs, with critical materials including lithium compounds (lithium carbonate, lithium hydroxide), cathode materials (nickel, cobalt, manganese), graphite for anodes, electrolyte solvents and salts, copper foils, aluminum foils, and separator membranes. Establishing long-term supply agreements with reliable mining companies and materials processors helps mitigate price volatility and ensures consistent raw material supply, which is critical given that lithium and cobalt price fluctuations represent the most significant cost factors in battery manufacturing.

Speak to Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=22772&flag=C

Capital Investment Requirements

Setting up an electric vehicle battery manufacturing plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to automotive manufacturing clusters and raw material supply chains. Proximity to major automaker facilities will help minimize logistics costs and enable just-in-time delivery models. The site must have robust infrastructure, including high-capacity electrical power supply (battery manufacturing is energy-intensive), water resources for cooling systems, waste management capabilities, and transportation connectivity. Compliance with environmental regulations, hazardous material handling standards, and industrial safety requirements must also be ensured.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers specialized manufacturing equipment essential for production. Key machinery includes:

Mixing equipment for preparing cathode and anode slurries with precise material ratios

Coating machines for applying electrode materials onto metal foil substrates

Drying ovens for removing solvents from electrode coatings under controlled conditions

Calendering equipment for compressing and smoothing electrode surfaces to target density

Slitting and cutting machines for precision electrode sizing and tab attachment

Stacking and winding equipment for assembling electrode layers with separators

Electrolyte filling systems for injecting electrolyte solution into battery cells

Formation and aging equipment for initial charging cycles and cell conditioning

Testing and grading systems for quality control and performance verification

Module and pack assembly lines for integrating cells into complete battery systems

Battery management system (BMS) integration equipment for electronic controls

Environmental chambers for temperature cycling and accelerated life testing

Safety testing equipment for thermal runaway, short circuit, and abuse testing

Cleanroom facilities and contamination control systems for critical manufacturing zones

Waste treatment systems for managing chemical effluents and hazardous materials

Civil Works: Building construction, cleanroom facilities, factory layout optimization, and infrastructure development designed to enhance workflow efficiency, maintain stringent quality standards, and ensure workplace safety throughout the production process. The layout should be optimized with separate zones for raw material storage (temperature-controlled warehouses), electrode preparation area (mixing and coating), electrode drying and calendering section, cell assembly cleanroom (stacking/winding), electrolyte filling and sealing zone, formation and aging facility, testing and quality control laboratory, module and pack assembly line, finished goods warehouse, utility block with electrical substations, waste treatment and recycling area, research and development center, and administrative offices.

Other Capital Costs: Pre-operative expenses, machinery installation and commissioning costs, technology licensing fees from battery chemistry developers, regulatory compliance certifications (ISO 9001, IATF 16949, ISO 14001), initial working capital for raw material procurement, and contingency provisions for unforeseen circumstances during plant establishment.

Major Applications and Market Segments

Electric vehicle battery products find extensive applications across diverse transportation market segments, demonstrating their versatility and critical importance:

Passenger Electric Vehicles: Primary application in battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) where high energy density, extended driving range, fast charging capability, and long cycle life are essential for consumer adoption and market success.

Commercial Electric Vehicles: Critical applications in electric delivery vans, logistics trucks, municipal vehicles, and last-mile delivery fleets where total cost of ownership advantages, operational efficiency, and emission compliance drive rapid electrification.

Electric Buses: Specialized applications in urban transit buses, intercity coaches, and school buses where large battery packs enable all-day operation, reduce noise pollution, and eliminate diesel emissions in densely populated areas.

Two-Wheeler and Three-Wheeler EVs: Growing applications in electric motorcycles, scooters, rickshaws, and delivery vehicles particularly in Asian markets where affordability, convenience, and urban mobility solutions drive mass adoption.

Energy Storage Systems: Secondary applications in stationary battery energy storage for renewable energy integration, grid stabilization, commercial and industrial energy management, and residential solar plus storage systems.

Off-Highway Vehicles: Emerging applications in electric construction equipment, mining vehicles, agricultural machinery, and material handling equipment where electrification reduces emissions and operating costs.

End-use industries include automotive manufacturing, public transportation, logistics and delivery services, urban mobility solutions, energy utilities, and industrial equipment, all of which contribute to sustained market demand.

Why Invest in Electric Vehicle Battery Manufacturing?

Several compelling factors make electric vehicle battery manufacturing an attractive investment opportunity:

Electrification Megatrend: The irreversible global transition toward electric mobility creates unprecedented and sustained demand for automotive batteries, positioning battery manufacturing at the epicenter of the transportation revolution and climate action.

Government Support and Mandates: Comprehensive policy frameworks including purchase incentives, tax credits, emission standards, ICE vehicle phase-out timelines, domestic manufacturing subsidies, and strategic material support provide substantial tailwinds for battery production.

Automotive Industry Transformation: Major automakers committing tens of billions of dollars to electrification strategies, launching multiple EV platforms, and establishing long-term battery supply agreements create predictable demand and revenue visibility for battery manufacturers.

Supply Chain Localization: Growing emphasis on regional battery production to reduce import dependencies, enhance supply chain resilience, create domestic jobs, and capture value-added manufacturing positions new battery plants favorably for government support and automaker partnerships.

Technology Leadership Opportunity: Early movers in advanced battery technologies including solid-state batteries, silicon anodes, high-nickel cathodes, and manufacturing innovations can establish competitive advantages and premium market positioning.

Vertical Integration Benefits: Battery manufacturers can capture additional value through backward integration into materials processing, forward integration into pack assembly and system integration, and circular economy participation through battery recycling and material recovery.

Energy Storage Convergence: Battery manufacturing capabilities serve both transportation and stationary storage markets, enabling diversification, capacity utilization optimization, and participation in the broader energy transition beyond automotive applications.

Manufacturing Process Excellence

The electric vehicle battery manufacturing process involves several precision-controlled stages:

Electrode Material Preparation: Cathode materials (LiFePO4, NMC) and anode materials (graphite) are mixed with conductive additives, binders, and solvents to create homogeneous slurries with controlled viscosity and particle distribution

Electrode Coating: Slurries are uniformly coated onto metal foil substrates (aluminum for cathodes, copper for anodes) using precision coating machines with controlled thickness and coating speed

Drying and Calendering: Coated electrodes are dried in multi-zone ovens to remove solvents, then calendered (compressed) to achieve target density and optimize electrochemical performance

Slitting and Tab Attachment: Dried electrode sheets are precision-cut to size and current collection tabs are welded or attached for electrical connectivity

Cell Assembly: In cleanroom environments, cathodes, anodes, and separator membranes are either stacked (prismatic cells) or wound (cylindrical cells) to form cell assemblies with precise alignment

Cell Sealing and Electrolyte Filling: Assembled cells are placed in metal cases or pouch packages, then electrolyte solution is injected under vacuum conditions before hermetic sealing

Formation and Aging: Sealed cells undergo initial charging cycles (formation) to activate electrochemical reactions, followed by aging periods to stabilize performance and identify early failures

Testing and Grading: Cells are tested for capacity, voltage, impedance, and safety parameters, then graded and sorted based on performance characteristics for matched module assembly

Module and Pack Assembly: Selected cells are electrically connected in series and parallel configurations, integrated with thermal management systems, battery management systems, and mechanical enclosures to form complete battery packs

Final Testing and Quality Verification: Complete battery packs undergo comprehensive testing including functional validation, safety testing, and quality certification before shipment to automotive customers

Industry Leadership

The global electric vehicle battery industry is led by established manufacturers with extensive production capabilities and diverse technology portfolios. Key industry players include:

CATL

LG Chem

Panasonic

Samsung SDI

Tesla

These companies serve diverse automotive manufacturers including Tesla, Volkswagen, BMW, Mercedes-Benz, Ford, General Motors, Hyundai, and numerous other global and regional automakers, demonstrating the critical importance of battery supply relationships in the electric vehicle ecosystem.

Buy Now:

https://www.imarcgroup.com/checkout?id=22772&method=2175

Recent Industry Developments

September 2025: SK On expanded its presence in the U.S. battery energy storage sector by entering the lithium iron phosphate (LFP) battery market. The company entered into an agreement with energy development firm Flatiron to supply battery energy storage systems, covering deliveries of up to 7.2 GWh of storage capacity for Flatiron's projects across the United States and the Northeast region through 2030.

July 2025: Panasonic Energy Co., Ltd. officially inaugurated its new cylindrical lithium-ion battery manufacturing facility dedicated to electric vehicle applications. Situated in De Soto, near Kansas City, the plant represents one of the largest automotive battery production facilities in North America, significantly strengthening regional EV battery manufacturing capacity.

Conclusion

The electric vehicle battery manufacturing sector presents a strategically positioned investment opportunity at the intersection of transportation electrification, energy transition, and industrial transformation. With favorable profit margins ranging from 20-30% gross profit and 5-10% net profit, strong market drivers including accelerating EV adoption, stringent emission regulations, supportive government policies, declining battery costs enabling EV price parity, expanding charging infrastructure, automaker electrification commitments, and growing consumer acceptance of electric vehicles, establishing an electric vehicle battery manufacturing plant offers significant potential for long-term business success and sustainable returns. The combination of transportation decarbonization imperatives, technology advancement opportunities, supply chain localization strategies, vertical integration possibilities, and dual-market participation (automotive and energy storage) creates an attractive value proposition for serious clean technology investors committed to quality manufacturing, continuous innovation, and operational excellence in serving the electric mobility revolution.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers create a lasting impact. The company excels in understanding its clients' business priorities and delivering tailored solutions that drive meaningful outcomes. IMARC Group provides a comprehensive suite of market entry and expansion services, including market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Electric Vehicle Battery Manufacturing Plant DPR - 2026: CapEx/OpEx Analysis with Profitability Forecast here

News-ID: 4373597 • Views: …

More Releases from IMARC Group

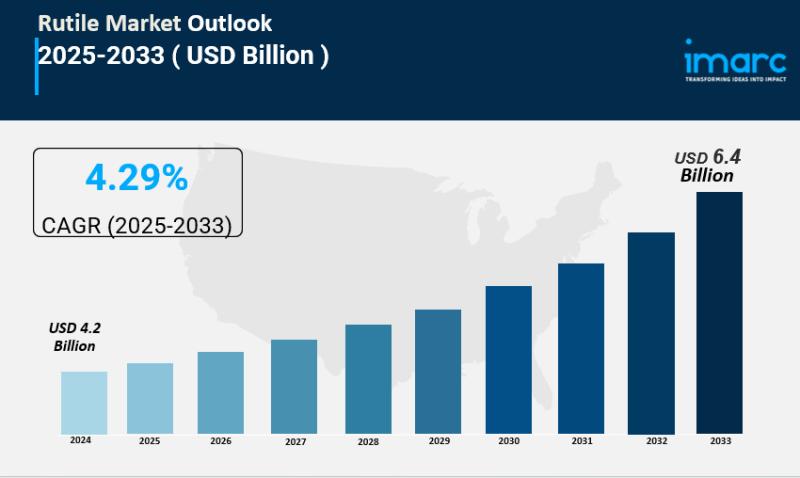

Rutile Market Size, Share, Analysis & Trends Report 2033

IMARC Group, a leading market research company, has recently released a report titled "Rutile Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End-User, and Region, 2025-2033." The study provides a detailed analysis of the industry, including the Rutile market size, share, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Market Overview

The global Rutile Market size…

Carbon Black Prices January 2026: Current Trends, Data Insights, and Outlook

Africa Carbon Black Prices Movement January 2026:

Carbon Black prices in Africa during January 2026 averaged USD 1.75/kg, recording a 1.7% increase. Demand from tire manufacturing and rubber processing industries supported consumption levels. Limited regional production and reliance on imports influenced availability. Energy and freight costs played a role in cost structures, while steady industrial activity helped sustain upward pricing during the month.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/carbon-black-pricing-report/requestsample

Note: The analysis can…

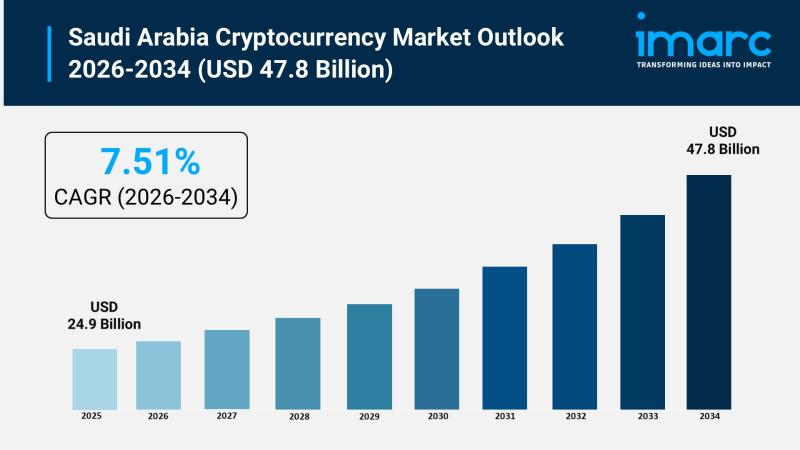

Saudi Arabia Cryptocurrency Market Size To Worth USD 47.8 Billion in 2034 | Grow …

Saudi Arabia Cryptocurrency Market Overview

Market Size in 2025: USD 24.9 Billion

Market Size in 2034: USD 47.8 Billion

Market Growth Rate 2026-2034: 7.51%

According to IMARC Group's latest research publication, "Saudi Arabia Cryptocurrency Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia cryptocurrency market size was valued at USD 24.9 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 47.8 Billion by 2034, exhibiting a…

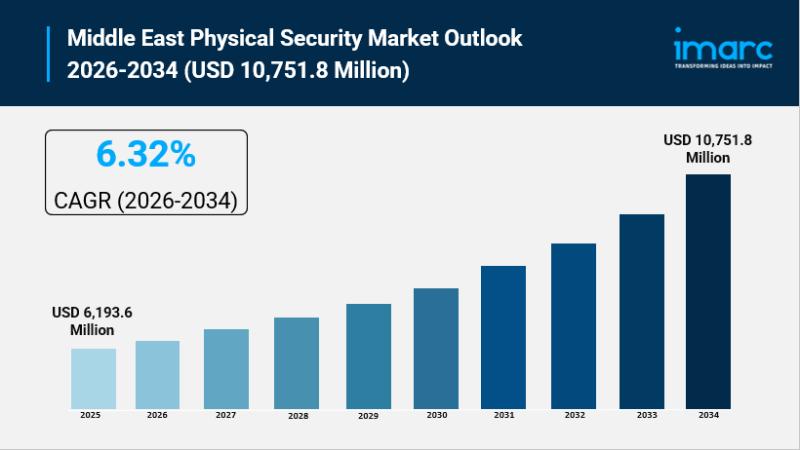

Middle East Physical Security Market Size to Hit USD 10,751.8 Million by 2034 | …

Middle East Physical Security Market Overview

Market Size in 2025: USD 6,193.6 Million

Market Size in 2034: USD 10,751.8 Million

Market Growth Rate 2026-2034: 6.32%

According to IMARC Group's latest research publication, "Middle East Physical Security Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", the Middle East physical security market size reached USD 6,193.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 10,751.8 Million by 2034, exhibiting…

More Releases for Electric

Electrical Isolators Market 2023: Mitsubishi Electric, Orient Electric, Schneide …

The Electrical Isolators Market size (volume and value) and industry chain structure published by The Insight Partners through its high quality database which is a valuable source of guidance and direction for companies and individual interested in the industry.

An electrical isolator is a material in which electric current does not flow freely. The atoms of the insulator have tightly bound electrons which cannot readily move. Other materials, semiconductors and conductors…

Electric Motors for Electric Vehicle Market by Manufacturers: Hitachi Automotive …

Electric Motors for Electric Vehicle Market research report analyzes and studies the Electric Motors for Electric Vehicle Market's production, value, financial status, and capacity. It also provides information about market share and development plans during the projected period. Moreover, the Electric Motors for Electric Vehicle Market research report provides data about key manufacturers and focuses on the market competition landscape by analyzing the market by application, product type, and region.

Click…

Thermal Overload Relay Market 2021 Precise Outlook - ABB, Schneider Electric, Ea …

Global Thermal Overload Relay Market Size, Status and Forecast 2021

The Global Thermal Overload Relay Market report offers in-depth information and comprehensive analysis of the market. It provides a complete overview of the market with detailed insights on key aspects including the current market situation, potential size, volume, and dynamics of the market. This research report makes a thorough assessment of the COVID-19 pandemic and its impact on the current market…

Global Electric Motors for Electric Vehicles Market 2025 | MAHLE GmbH, Protean E …

Researchmoz added Most up-to-date research on "Global Electric Motors for Electric Vehicles Market Insights, Forecast to 2025" to its huge collection of research reports.

This report presents the worldwide Electric Motors for Electric Vehicles market size (value, production and consumption), splits the breakdown (data status 2013-2018 and forecast to 2025), by manufacturers, region, type and application.

This study also analyzes the market status, market share, growth rate, future trends, market drivers, opportunities…

Yokogawa Electric, General Electric Profiled in Smart Factory Solutions Market 2 …

Global Smart Factory Solutions Market which focuses on effective strategies of the business framework. It highlights the recent market trends stringent energy regulations and growing pressure to conform to energy efficiency. The research methods and tools used to analyze the studies are both primary and secondary research.

This market research report on analyzes the growth prospects for the key vendors operating in this market space including Siemens, ABB, Honeywell International, Yokogawa…

Global Quartz Heat Lamps Market 2017 : Indu Electric Gerber, Schneider Electric, …

The Market Research Store report offers majority of the latest and newest industry data that covers the overall market situation along with future prospects for Quartz Heat Lamps market around the globe. The research study includes significant data and also forecasts of the global market which makes the research report a helpful resource for marketing people, analysts, industry executives, consultants, sales and product managers, and other people who are in…