Press release

Recycled Copper Manufacturing Plant (DPR) 2026: Plant Setup Economics and Financial Outlook

The global recycled copper manufacturing industry is witnessing robust growth driven by the rapidly expanding circular economy and increasing demand for sustainable metal resources. At the heart of this expansion lies a critical secondary metal production sector: recycled copper manufacturing. As industrial regions transition toward resource conservation and environmental sustainability, establishing a recycled copper manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and metal industry investors seeking to capitalize on this growing and essential market.Market Overview and Growth Potential

The global recycled copper market demonstrates strong growth trajectory, valued at USD 50.47 Billion in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach USD 124.98 Billion by 2034, exhibiting a robust CAGR of 10.6% from 2026-2034. This sustained expansion is driven by rapidly expanding electronics and electrical industries, increasing demand for sustainable metal production, rising adoption of circular economy practices, and expanding infrastructure development requirements across developing economies.

Recycled copper is a high-quality metal recovered from waste materials including electrical wires, cables, plumbing fixtures, electronic waste, industrial equipment, and construction debris. Through advanced processing techniques, copper waste is transformed into refined copper products with purity levels comparable to virgin copper. Recycled copper contains the same excellent electrical conductivity, thermal properties, and corrosion resistance as primary copper, making it an efficient and sustainable alternative for manufacturing applications. The recycling process consumes significantly less energy compared to primary copper extraction, reduces environmental impact, and conserves natural resources while maintaining product quality standards.

The recycled copper market is witnessing robust demand due to the rising need for sustainable metal production that supports circular economy principles. Industrial sectors increasingly transitioning toward resource conservation-particularly in electronics manufacturing, electrical infrastructure, construction, automotive, and renewable energy are driving large-scale adoption. According to industry analysis, copper recycling saves up to 85% of the energy required for primary production and reduces greenhouse gas emissions significantly. Government-led environmental protection programs, incentives for waste management systems, and resource conservation initiatives further strengthen market prospects.

Request for a Sample Report: https://www.imarcgroup.com/recycled-copper-manufacturing-plant-project-report/requestsample

Plant Capacity and Production Scale

The proposed recycled copper manufacturing facility is designed with an annual production capacity ranging between 30,000 MT per year, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to cater to diverse market segments from electrical and electronics industries to construction, automotive, telecommunications, and renewable energy sectors-ensuring steady demand and consistent revenue streams across multiple industry verticals.

Financial Viability and Profitability Analysis

The recycled copper manufacturing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

Gross Profit Margins: 5-12%

Net Profit Margins: 3-8%

These margins are supported by stable demand across industrial and construction sectors, value-added sustainable metal positioning, and the critical nature of recycled copper in green manufacturing applications. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established metal manufacturers looking to diversify their product portfolio in the sustainable materials sector.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a recycled copper manufacturing plant is primarily driven by:

Raw Materials (Copper waste): 85-92% of total OpEx

Utilities (Energy and Water): 5-8% of OpEx

Other Expenses: Including labor, transportation, maintenance, depreciation, and taxes

Raw materials constitute the largest portion of operating costs, with copper waste procurement being the primary input material. Establishing long-term contracts with reliable waste collection networks, electronic waste recyclers, demolition contractors, and industrial waste suppliers helps ensure consistent raw material supply. Given that copper waste prices fluctuate with global copper market trends, effective procurement strategies represent the most significant cost management factor in recycled copper manufacturing.

Capital Investment Requirements

Setting up a recycled copper manufacturing plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to copper waste collection centers and end-use industries. Proximity to major industrial zones, construction hubs, and transportation networks will help minimize logistics costs. The site must have robust infrastructure, including reliable power supply, water resources, and waste management systems. Compliance with local zoning laws and environmental regulations must also be ensured.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers specialized processing equipment essential for production. Key machinery includes:

• Shredding and size reduction equipment for breaking down mixed copper waste

• Magnetic separation systems for removing ferrous contaminants

• Granulation machines for producing copper granules from wire and cable waste

• Sorting and classification systems for separating different copper grades

• Smelting furnaces for melting copper waste under controlled conditions

• Refining equipment for achieving required purity specifications

• Continuous casting machines for producing copper rods, billets, or ingots

• Rolling mills for manufacturing copper sheets, strips, or wire products

• Quality control laboratory equipment for composition analysis and purity testing

• Effluent treatment systems for managing process water and ensuring environmental compliance

• Air pollution control equipment for managing emissions from smelting operations

Civil Works: Building construction, factory layout optimization, and infrastructure development designed to enhance workflow efficiency, ensure workplace safety, and minimize material handling complexities throughout the production process. The layout should be optimized with separate areas for waste receiving and sorting, size reduction unit, separation zone, smelting and refining section, casting area, quality control laboratory, finished goods warehouse, utility block, effluent treatment facility, and administrative block.

Other Capital Costs: Pre-operative expenses, machinery installation costs, regulatory compliance certifications, environmental clearances, initial working capital requirements, and contingency provisions for unforeseen circumstances during plant establishment.

Major Applications and Market Segments

Recycled copper products find extensive applications across diverse market segments, demonstrating their versatility and critical importance:

Electrical and Electronics: Primary use in manufacturing electrical wires, cables, transformers, motors, generators, printed circuit boards, and electronic components where high electrical conductivity is essential. The electronics industry represents the largest consumer segment.

Construction Industry: Applications in plumbing systems, roofing materials, architectural features, HVAC systems, and building wiring where durability, corrosion resistance, and thermal properties are critical.

Automotive Sector: Utilized in wiring harnesses, radiators, brake tubes, starter motors, and electric vehicle components where reliability and conductivity standards must meet strict specifications.

Telecommunications: Essential for communication cables, networking equipment, data transmission systems, and 5G infrastructure development.

Renewable Energy: Growing applications in solar panels, wind turbines, energy storage systems, and electric vehicle charging infrastructure where sustainable materials align with environmental objectives.

Industrial Manufacturing: Used in machinery manufacturing, industrial equipment, heat exchangers, and various fabrication applications requiring high-quality copper materials.

End-use industries include electrical and electronics, construction, automotive, telecommunications, renewable energy, and general manufacturing, all of which contribute to sustained market demand.

Buy now: https://www.imarcgroup.com/checkout?id=7432&method=2175

Why Invest in Recycled Copper Manufacturing?

Several compelling factors make recycled copper manufacturing an attractive investment opportunity:

Essential Sustainable Materials Segment: Recycled copper serves as a critical sustainable resource supporting circular economy practices, resource conservation, and environmental protection, making it indispensable for modern industries focused on sustainability and corporate responsibility.

Rising Circular Economy Adoption: Industrial sectors increasingly transitioning toward waste reduction and resource recovery-particularly in electronics, construction, and automotive manufacturing-are driving large-scale adoption of recycled metals like copper.

Energy Efficiency Advantages: Copper recycling consumes approximately 85% less energy compared to primary copper production from ore, offering significant cost advantages and environmental benefits that position recycled copper favorably against virgin materials.

Resource Security: With growing concerns about resource scarcity and supply chain vulnerabilities, recycled copper provides a stable, domestically available material source that reduces dependence on imported primary copper and mining operations.

Government Support: Government-led waste management programs, extended producer responsibility regulations, incentives for recycling industries, and environmental protection initiatives further strengthen market prospects and support industry growth.

Import Substitution Opportunities: Emerging economies such as India, China, Southeast Asian nations, and African countries are expanding local recycling capacity as part of their strategy to reduce dependence on imported copper, creating opportunities for domestic producers.

Green Manufacturing Alignment: Corporate sustainability goals, ESG compliance requirements, and increasing demand for environmentally certified materials are expected to enhance long-term growth opportunities for recycled copper products.

Price Competitiveness: Recycled copper typically trades at discounts compared to primary copper while maintaining equivalent quality standards, providing cost advantages to manufacturers and ensuring consistent demand.

Manufacturing Process Excellence

The recycled copper manufacturing process involves several precision-controlled stages:

• waste Collection and Sorting: Copper-bearing materials are collected from various sources and sorted by grade and contamination level

• Size Reduction: Large waste pieces are shredded or cut into manageable sizes for processing

• Separation and Cleaning: Magnetic separation, air classification, and washing remove contaminants like plastics, rubber, and other metals

• Smelting: Cleaned copper waste is melted in furnaces at controlled temperatures (approximately 1,085°C)

• Refining: Molten copper undergoes refining processes to remove impurities and achieve target purity levels (typically 99.9%+)

• Casting: Refined copper is cast into desired forms such as ingots, billets, rods, or continuous cast products

• Further Processing: Depending on end-use requirements, cast products may undergo rolling, drawing, or other fabrication processes

• Quality Testing: Final products undergo rigorous testing for composition, purity, conductivity, and physical properties

• Packaging and Dispatch: Products are packaged according to customer specifications for storage and transport

Industry Leadership

The global recycled copper industry is led by established metal manufacturers with extensive processing capabilities and diverse application portfolios. Key industry players include:

• Aurubis AG

• Boliden Group

• Mitsubishi Materials Corporation

• Glencore International

• Hindalco Industries Limited

These companies serve diverse end-use sectors including electrical and electronics, construction, automotive, telecommunications, and renewable energy, demonstrating the broad market applicability of recycled copper products.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=7432&flag=C

Recent Industry Developments

September 2024: European copper recyclers reported capacity expansions driven by increased availability of electronic waste and stricter EU regulations on waste management. New processing facilities incorporating advanced separation technologies were commissioned to handle complex e-waste streams.

July 2024: Major automotive manufacturers announced commitments to increase recycled copper content in electric vehicle production, with targets ranging from 30-50% recycled content by 2030, driving significant demand growth in the automotive recycling sector.

May 2024: India's Ministry of Environment launched the Extended Producer Responsibility framework for electronics, mandating collection and recycling targets that are expected to significantly increase copper waste availability and recycling rates.

Conclusion

The recycled copper manufacturing sector presents a strategically positioned investment opportunity at the intersection of circular economy, sustainable manufacturing, and resource conservation. With favorable profit margins ranging from 5-12% gross profit and 3-8% net profit, strong market drivers including rising adoption of sustainable materials, growing electronic waste generation, expanding renewable energy infrastructure, and supportive government policies promoting recycling and waste management, establishing a recycled copper manufacturing plant offers significant potential for long-term business success and sustainable returns. The combination of energy efficiency advantages, environmental benefits, consistent raw material availability from growing waste streams, expanding industrial demand, and alignment with global sustainability trends creates an attractive value proposition for serious metal industry investors committed to quality manufacturing and operational excellence in the sustainable materials sector.

About IMARC Group

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its clients' business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201-971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Recycled Copper Manufacturing Plant (DPR) 2026: Plant Setup Economics and Financial Outlook here

News-ID: 4373560 • Views: …

More Releases from IMARC Group

Skid Steer Loader Market to Grow at a CAGR of 2.11% during 2025-2033, Driven by …

Market Overview

The global skid steer loader market was valued at USD 2.5 Billion in 2024 and is projected to reach USD 3.0 Billion by 2033, growing at a CAGR of 2.11% during the forecast period of 2025-2033. The Asia Pacific region controls market leadership because its cities experience rapid urban growth and there is an increase in infrastructure work and companies spend substantial funds on building projects and developing countries…

Cement Price Trend Analysis 2026 | Index, Chart & Forecast

The global Cement Prices landscape in 2026 reflects shifting construction demand, energy cost volatility, and supply-side adjustments across major regions. The Cement Price Index highlights how fuel prices, freight rates, and infrastructure spending have directly influenced the price of Cement worldwide. Market participants are closely tracking the Cement price trend analysis to understand near-term fluctuations and long-term Cement future price expectations amid policy-driven infrastructure growth and capacity rationalization.

Cement Recent Price…

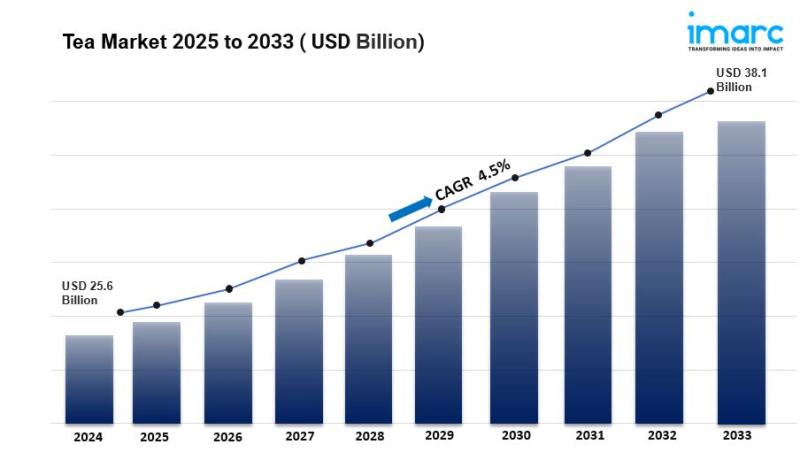

Global Tea Market Size to Surpass USD 39.4 Billion by 2034 | At CAGR 4.40%

Tea Market Overview:

The global tea market size was valued at USD 26.7 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 39.4 Billion by 2034, exhibiting a CAGR of 4.40% from 2026-2034. China currently dominates the market, holding a tea market share of over 14.3% in 2025. Growing consumer awareness about health benefits, rising demand for specialty and premium teas, and expanding café culture are driving…

Fruit Pulp Processing Plant (DPR) 2026: Technical Requirements, Cost Structure a …

The global fruit pulp processing industry is witnessing robust growth driven by the rapidly expanding food and beverage sector and increasing demand for natural, healthy ingredients. At the heart of this expansion lies a critical product: fruit pulp. As consumers transition toward natural ingredients and nutritious food products, establishing a fruit pulp processing plant presents a strategically compelling business opportunity for entrepreneurs and food industry investors seeking to capitalize on…

More Releases for Recycled

Recycled TPEs Introduction

QY Research Inc. (Global Market Report Research Publisher) announces the release of 2025 latest report "Recycled TPEs- Global Market Share and Ranking, Overall Sales and Demand Forecast 2026-2032". Based on current situation and impact historical analysis (2020-2024) and forecast calculations (2026-2032), this report provides a comprehensive analysis of the global Recycled TPEs market, including market size, share, demand, industry development status, and forecasts for the next few years.

The global market…

Top Trends Transforming the Recycled Asphalt Market Landscape in 2025: Enhancing …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

What Will the Recycled Asphalt Industry Market Size Be by 2025?

In recent times, the recycled asphalt market has been experiencing significant growth. The market, which was valued at $7.82 billion in 2024, is expected to increase to $8.25 billion in 2025, reflecting a compound annual growth rate (CAGR)…

Recycled Glass Sales Market Size Analysis by Application, Type, and Region: Fore …

USA, New Jersey- According to Market Research Intellect, the global Recycled Glass Sales market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The recycled glass sales market is showing steady growth, driven by rising environmental awareness and increasing demand for sustainable materials across various industries. With…

Recycled Plastic Market: Rising Demand for Eco-Friendly Products Driving Recycle …

[100+ Pages Report] | Global "Recycled Plastic Market" research report provides Innovative Insights on the Strategies adopted by Major Global in the worldwide industry. This valuable information offers businesses and investors a clear understanding of the market's Competitive Landscape, Growth Potential, and Impending Opportunities. The modern report highlights Latest Mergers, Achievements, Revenue Offshoring, R & D, Development Plans, Progression Growth, and Collaborations.

The global recycled plastic market is projected to grow…

Recycled Elastomers Market | J. Allcock & Sons Limited, RubberForm Recycled Prod …

Global Recycled Elastomers Market: Overview

The report details an exhaustive account of the global recycled elastomers market along with numerous associated factors. Some of these factors that are included in the report are drivers, restraints, competitive analysis, latest trends and opportunities, geographical outlook, and many other aspects. The study covered in the report spans a forecast period from 2018 to 2028. From an…

Recycled Elastomers Market - Transformation Survey 2028 | J. Allcock & Sons Limi …

Global Recycled Elastomers Market: Overview

The report details an exhaustive account of the global recycled elastomers market along with numerous associated factors. Some of these factors that are included in the report are drivers, restraints, competitive analysis, latest trends and opportunities, geographical outlook, and many other aspects. The study covered in the report spans a forecast period from 2018 to 2028. From an…