Press release

Tomato Ketchup Manufacturing Plant DPR 2026, Machinery Cost, and Profit Analysis

The global condiments and processed foods industry stands firmly anchored by universally beloved products that transcend cultural boundaries, cuisines, and demographic segments. Among these essential food products, tomato ketchup represents one of the most recognizable, consistently consumed, and commercially successful condiments worldwide-serving as an indispensable table accompaniment, cooking ingredient, and flavor enhancer across household consumption, quick-service restaurants, institutional catering, and food processing applications globally. According to the India Brand Equity Foundation (IBEF), India has emerged as the world's fourth-largest economy and is expected to be the fastest-growing major G20 nation, with GDP growth projected at 6.9% in FY26, while the food processing sector is expected to expand to ₹65.2 lakh crore by 2028, reflecting strong and sustained growth momentum. As urbanization accelerates, convenience food consumption increases, fast-food chains proliferate, disposable incomes rise, and modern retail infrastructure expands globally, tomato ketchup manufacturing presents a strategically compelling investment opportunity for food entrepreneurs, agricultural processors, FMCG investors, and regional manufacturers seeking to capitalize on stable consumer demand, brand-building potential, and value-added agricultural processing serving food and beverage, quick-service restaurants, hotels and catering, institutional food supply, and retail FMCG sectors.Request for a Sample Report: https://www.imarcgroup.com/tomato-ketchup-manufacturing-plant-project-report/requestsample

Market Overview and Growth Potential

The global tomato ketchup market demonstrates solid growth trajectory supported by consistent consumer demand patterns. Valued at USD 20.74 Billion in 2025, the market is projected by IMARC Group to reach USD 26.65 Billion by 2034, exhibiting a steady CAGR of 2.8% from 2026 to 2034. This sustained expansion is primarily driven by rising consumption of convenience foods particularly in urban regions, expansion of quick-service restaurants and organized foodservice outlets creating significant demand for ketchup as a main condiment, urbanization accelerating processed food consumption patterns, and increasing demand for processed tomato products across household and commercial applications.

Tomato ketchup is a carefully processed condiment manufactured primarily from concentrated tomato pulp mixed with sweeteners, salt, vinegar, spices, and permitted food additives creating a distinctive flavor profile. Its defining characteristics include a smooth, uniform texture achieved through refining processes, a sweet-sour taste that is well-balanced appealing to diverse palates, a bright red color derived from natural lycopene in tomatoes, and a long shelf life enabling ambient temperature storage. Thermal processing is conducted on the product to guarantee microbiological safety and consistent quality across production batches. Natural lycopene from tomatoes provides color and nutritional benefits, organic acids ensure preservation preventing microbial growth, and stabilizers maintain viscosity consistency. This carefully balanced composition enables the product to be stored for extended periods under ambient conditions without refrigeration, making it a common, convenient condiment in homes and foodservice establishments worldwide.

The tomato ketchup market is experiencing steady growth driven by multiple converging consumer and industry trends. Increasing consumption of processed and convenience foods, particularly in urban regions with busy lifestyles and limited cooking time, creates fundamental demand for ready-to-use condiments. Fast-food restaurants and organized foodservice outlets generate significant institutional demand for ketchup as a primary accompaniment for burgers, fries, sandwiches, and fast-food items. Shifting trends toward healthier diets and increasing disposable incomes are influencing consumption of packaged foods with quality certifications and transparent ingredient labeling. Improved cold chain logistics and food processing infrastructure enable efficient sourcing and large-scale production of tomato-based products with consistent quality. Government initiatives supporting food processing industries and agricultural value addition encourage investment in ketchup manufacturing. The supportive policy environment and rapid expansion of India's food processing sector are expected to boost demand for value-added products like tomato ketchup significantly. As the food processing sector scales with expanded processing infrastructure, greater investment, and enhanced distribution networks, tomato ketchup manufacturers benefit from higher market penetration and increased sales opportunities. Manufacturers are focusing on product differentiation through reduced sugar formulations responding to health consciousness, organic and preservative-free variants appealing to premium segments, and region-specific flavor profiles catering to diverse consumer preferences. Technological advancements in food processing, aseptic packaging extending shelf life, and cold-chain logistics improving distribution efficiency position tomato ketchup as a resilient and continuously evolving segment within the global processed food industry.

Plant Capacity and Production Scale

The proposed tomato ketchup manufacturing facility is designed with an annual production capacity ranging between 20,000-50,000 MT, enabling substantial economies of scale in procurement, processing, and distribution while maintaining operational flexibility to accommodate seasonal tomato availability variations, diverse packaging format requirements, and multiple product variant production. This strategically calibrated capacity range positions manufacturers to effectively serve household retail segments requiring consumer-sized bottles and sachets, quick-service restaurant chains demanding bulk institutional packaging, food processing industries incorporating ketchup as an ingredient in sauces and ready meals, and institutional catering operations providing bulk supplies to hotels, cafeterias, airlines, railways, and catering services-ensuring steady production utilization, efficient raw material procurement directly from tomato processing facilities, and diversified revenue streams across retail FMCG channels, foodservice distribution, and industrial supply contracts.

Financial Viability and Profitability Analysis

The tomato ketchup manufacturing business demonstrates healthy profitability potential under normal operating conditions and stable tomato paste pricing environments. The financial projections reveal attractive investment economics with superior margins compared to many food processing segments:

Gross Profit Margins: 30-40%

Net Profit Margins: 12-18%

These solid margins are supported by stable and growing demand across household, foodservice, and institutional sectors ensuring consistent consumption, the universally accepted nature of tomato ketchup as a staple condiment ensuring year-round sales, value-added processing transforming agricultural tomatoes into shelf-stable consumer products commanding retail premiums, brand premium opportunities enabling differentiated pricing for quality and innovation, and diversified application base spanning table condiments, cooking ingredients, dips, and flavor bases reducing market concentration risk. The project demonstrates strong return on investment potential backed by proven thermal processing and pasteurization technologies ensuring food safety, established quality standards and regulatory frameworks supporting consumer confidence, growing fast-food and organized foodservice penetration driving institutional demand, expanding modern retail and online grocery platforms improving distribution reach, and opportunities for product innovation through reduced sugar variants, organic formulations, regional flavor profiles, and convenient packaging formats serving health-conscious consumers and premium market segments-making it a compelling proposition for food entrepreneurs, agricultural processors, FMCG investors, and regional manufacturers seeking participation in stable, brand-friendly consumer packaged goods markets with localization and export potential.

Buy Now: https://www.imarcgroup.com/checkout?id=7862&method=2175

Operating Cost Structure

Understanding the operating expenditure (OpEx) structure is critical for effective financial planning, raw material price risk management, and sustainable profitability. The cost structure for a tomato ketchup manufacturing plant is characterized by:

Raw Materials: 60-70% of total OpEx

Utilities: 10-15% of OpEx

Raw materials constitute the dominant portion of operating costs, with tomato paste or concentrate serving as the primary ingredient and most critical cost driver accounting for the majority of material expenditure. High-quality tomato paste with appropriate concentration levels, color characteristics, and lycopene content provides the base material for ketchup formulation. Additional materials include sugar or sweeteners balancing the natural acidity of tomatoes, vinegar providing preservation and tangy flavor notes, salt enhancing taste and acting as a preservative, spices including onion powder, garlic powder, and natural flavorings creating distinctive taste profiles, and permitted food additives including stabilizers maintaining viscosity and texture consistency. Packaging materials represent a significant cost component including bottles for retail packaging, sachets for single-serve foodservice applications, labels providing brand identification and regulatory information, caps ensuring product freshness, and corrugated cartons for distribution protection. Establishing reliable supply relationships with tomato processing facilities or concentrate suppliers, implementing effective procurement strategies to manage seasonal tomato price volatility, optimizing formulations to balance quality and cost efficiency, and developing flexible sourcing capabilities across different tomato-growing regions are absolutely essential for maintaining processing margins, ensuring production continuity, and managing the agricultural commodity price risk inherent in tomato-based product manufacturing.

Utility costs, representing 10-15% of operating expenses, encompass electricity for mixing, blending, and filling equipment operations, steam or thermal energy for cooking kettles and pasteurization processes ensuring microbiological safety, water for processing, cleaning, and cooling operations meeting food-grade standards, and compressed air for pneumatic filling and packaging systems. Additional operational expenses include skilled labor for process operation, quality control, and packaging line management, maintenance programs ensuring equipment reliability and food safety compliance, quality control testing validating microbiological safety, pH levels, viscosity, color, and sensory characteristics, transportation costs for inbound tomato paste and outbound finished product distribution, packaging material procurement for bottles, sachets, labels, and cartons, equipment depreciation on processing kettles, pasteurizers, filling machines, and packaging lines, applicable taxes including GST on finished goods sales, and food safety compliance costs including laboratory testing, sanitation programs, and regulatory certifications. Implementing energy-efficient cooking and pasteurization systems, optimizing batch sizes to reduce energy consumption per unit produced, maximizing packaging line efficiency through automation, developing comprehensive preventive maintenance schedules preventing costly breakdowns, and implementing robust quality management systems ensuring first-time-right production can significantly reduce overall operating costs while improving product safety, sensory quality, shelf life consistency, and customer satisfaction-critical factors in building brand loyalty and retail distribution success in the highly competitive condiments market.

Capital Investment Requirements

Establishing a tomato ketchup manufacturing plant requires substantial capital investment strategically distributed across several critical categories:

Land and Site Development: Selection of an optimal manufacturing location with strategic proximity to tomato paste suppliers or tomato processing facilities ensuring reliable, cost-effective feedstock supply and minimizing transportation costs for the primary raw material. The site must provide convenient access to major urban retail markets, foodservice distribution centers, and institutional buyers. Essential infrastructure requirements include reliable transportation networks for receiving bulk tomato paste deliveries and distributing finished ketchup to distributors and retail chains, dependable utility supplies including three-phase electrical power, steam generation capabilities or natural gas connections, and adequate water supply meeting food-grade quality standards, comprehensive waste management systems handling organic waste disposal and wastewater treatment compliance, and adequate warehousing facilities for temperature-controlled tomato paste storage, packaging material inventory, and finished product staging. The site selection process must carefully evaluate local zoning regulations applicable to food processing operations, environmental impact assessment requirements, food safety regulatory compliance obligations including FSSAI licensing in India or FDA requirements in export markets, and proximity to skilled food processing labor markets with experience in condiment manufacturing.

Machinery and Equipment: The largest portion of capital expenditure is allocated to specialized food processing equipment essential for tomato ketchup manufacturing operations. Key machinery includes:

• Tomato Washing and Sorting Line: Equipment for cleaning and grading fresh tomatoes if processing from raw tomatoes rather than paste

• Pulping and Refining Machines: Machinery for extracting tomato pulp and removing seeds and skins if starting from whole tomatoes

• Steam-Jacketed Kettles: Large cooking vessels with steam heating for mixing ingredients and cooking ketchup to proper consistency

• Mixing and Blending Tanks: Equipment for combining tomato paste, sweeteners, vinegar, salt, spices, and additives achieving uniform formulation

• Pasteurizers: Thermal processing equipment ensuring microbiological safety through controlled heating and holding

• Automatic Filling and Capping Machines: High-speed automated systems for filling bottles or pouches and applying caps ensuring hygiene

• Labeling and Packaging Units: Automated equipment applying labels, batch codes, and packaging finished products in cartons for distribution

Civil Works: Building construction including food-grade manufacturing halls meeting hygienic design principles with smooth, washable surfaces, production facility layout optimization designed to maintain product flow separation preventing cross-contamination from raw materials through processing to finished goods, dedicated warehousing facilities for temperature-controlled tomato paste storage, dry ingredient inventory, packaging material storage, and finished product warehousing enabling FIFO inventory management, quality control laboratories equipped with pH meters, viscometers, colorimeters, microbiological testing capabilities, and sensory evaluation facilities, administrative offices, and comprehensive utility infrastructure including electrical substations, steam boilers or thermal fluid heaters, food-grade water treatment systems, effluent treatment plants, and sanitation facilities designed to ensure complete food safety compliance, regulatory requirements adherence, and operational efficiency throughout all manufacturing operations following good manufacturing practices.

Other Capital Costs: Pre-operative expenses including comprehensive feasibility studies, detailed project planning and food processing engineering design, machinery installation and commissioning by specialized food equipment suppliers, operator training programs on thermal processing operations, hygienic manufacturing practices, quality control procedures, and food safety management systems, regulatory approvals including FSSAI licensing, environmental clearances, and food safety certifications, initial working capital requirements covering tomato paste inventory, sugar and ingredient stocks, packaging materials, and operational reserves supporting three months of operations, plus contingency provisions allocated for unforeseen circumstances, recipe optimization trials, process validation studies, or market-driven capacity adjustments during plant establishment and initial production ramp-up supporting successful market entry and brand building.

Major Applications and Market Segments

Tomato ketchup finds extensive and diverse applications demonstrating its versatility and universal appeal:

Household Consumption: Utilized as a table condiment accompanying meals, a cooking ingredient for homemade recipes, sauces, and marinades, and a versatile flavor enhancer for snacks including sandwiches, rolls, and fried foods in home kitchens globally.

Quick-Service Restaurants (QSRs): Serving as a major accompaniment for burgers, french fries, chicken nuggets, sandwiches, and fast-food items in global QSR chains and local fast-food outlets representing substantial institutional demand volumes.

Food Processing Industry: Included as an ingredient in manufactured sauces, marinades, ready-to-eat meals, snack seasonings, and processed food products where tomato ketchup provides flavor, color, and consistency to commercial food formulations.

Institutional Catering: Provided in bulk packaging to hotels, corporate cafeterias, educational institutions, airlines, railways, hospitals, and professional catering services supporting high-volume foodservice operations requiring consistent quality and food safety compliance.

End-use industries span food and beverage, quick-service restaurants, hotels and catering, institutional food supply, and retail FMCG sectors, all contributing to sustained and diversified demand that provides revenue stability, reduces dependency on single distribution channels, and creates multiple growth opportunities for ketchup manufacturers serving comprehensive consumer and commercial requirements across diverse consumption occasions and market segments.

Why Invest in Tomato Ketchup Manufacturing?

Several compelling strategic factors make tomato ketchup manufacturing an attractive and viable investment opportunity:

Consistent Consumer Demand: Tomato ketchup is a universally accepted condiment that enjoys sustained demand throughout the year from individuals, families, restaurants, and foodservice channels across all demographic segments, providing predictable revenue streams and stable business fundamentals.

Scalable and Brand-Friendly Business: The product caters to both mass market value segments and premium quality-focused consumers, enabling companies to grow through brand building, introducing new flavors and variants, developing organic product lines, and creating differentiated packaging formats appealing to diverse consumer preferences.

Alignment with Convenience Food Trends: Global ketchup consumption is fundamentally supported by the rising trend toward ready-to-eat foods, time-saving meal solutions, and convenient condiments eliminating home preparation effort-megatrends that show no signs of reversal in urbanizing economies.

Strong Retail and Foodservice Penetration: The growth of modern retail formats, organized supermarket chains, online grocery platforms with home delivery, and expanding fast-food restaurant chains are making distribution reach broader, market penetration deeper, and sales volumes larger for established and emerging ketchup brands.

Export and Localization Potential: Utilizing raw tomatoes or tomato paste from major agricultural regions for cost-efficient production creates opportunities for both domestic market supply and export to regional markets, while local manufacturing provides advantages in freight costs, freshness, and supply chain responsiveness compared to imported brands.

Industry Leadership

The global tomato ketchup manufacturing industry is led by established multinational companies with extensive production capabilities, global distribution networks, and diverse product portfolios. Key industry players include:

• Kagome

• Lee Kum Kee

• Unilever

• Bolton Group

• Nestle S.A.

• The Kraft Heinz Company

• Del Monte Foods, Inc.

• Conagra Brands, Inc.

• General Mills Inc.

• Campbell Soup Company

• Premier Foods Plc

These companies serve end-use sectors including food and beverage, quick-service restaurants, hotels and catering, institutional food supply, and retail FMCG, demonstrating the broad market applicability, commercial viability, and brand-building potential of tomato ketchup manufacturing across diverse geographical markets, distribution channels, and consumer segments worldwide.

Ask an Analyst: https://www.imarcgroup.com/request?type=report&id=7862&flag=C

Recent Industry Developments

August 2025: HEINZ partnered with Smoothie King to launch the world's first tomato ketchup-based smoothie, blending real fruits with HEINZ Simply tomato ketchup. Introduced during peak tomato harvest season, the limited-edition drink offers a sweet yet tangy flavor profile and is available at select Smoothie King outlets across the U.S., highlighting both brands' focus on quality ingredients and innovation.

June 2025: HEINZ introduced Heinz Tomato Ketchup Zero, a new formulation made with no added sugar or salt and containing 35% more tomatoes. The launch responds to rising consumer demand for healthier condiment options, aligning with wider UK industry efforts to reduce salt and sugar content in processed foods.

March 2025: FMCG major Adani Wilmar Ltd (AWL) announced its acquisition of GD Foods Manufacturing, the company behind the Tops brand, which offers a wide portfolio including sauces, pickles, and other food products, demonstrating continued industry consolidation and investment in the condiments sector.

March 2025: HEINZ launched an innovative potato chips dip format featuring HEINZ ketchup packaged in its iconic bottle alongside a wide-mouth glass dip jar, designed to offer consumers a more convenient and enjoyable snacking experience, reflecting ongoing packaging innovation in the category.

Browse Full Related Report:

• Solar-Powered Bilge Pumps Manufacturing Plant: https://industrytoday.co.uk/energy_and_environment/solar-powered-bilge-pumps-manufacturing-plant-setup-2025-technology-machinery-cost-and-business-plan

• Stainless Steel Pipe Manufacturing Plant: https://industrytoday.co.uk/manufacturing/stainless-steel-pipe-manufacturing-plant-setup-2025-project-details-machinery-and-cost-involved

• Tomato Puree Manufacturing Plant: https://industrytoday.co.uk/manufacturing/tomato-puree-manufacturing-plant-report-2025-setup-cost-and-machinery-requirements

• White Pepper Processing Plant: https://industrytoday.co.uk/manufacturing/white-pepper-processing-plant-setup-2025-business-plan-requirements-and-cost-involved

Conclusion

The tomato ketchup manufacturing sector presents a strategically positioned investment opportunity at the intersection of essential consumer staples, convenience food trends, and value-added agricultural processing. With attractive profit margins of 30-40% gross profit and 12-18% net profit, strong and diversified demand across household, foodservice, and institutional sectors, favorable market growth projections with 2.8% CAGR reaching USD 26.65 Billion by 2034, supportive policy environment with India's food processing sector expected to expand to ₹65.2 lakh crore by 2028, and proven manufacturing technologies with established food safety standards, establishing a tomato ketchup manufacturing plant offers significant potential for sustainable business success and attractive long-term returns. The combination of universally accepted condiment positioning ensuring year-round consumption, fast-food and QSR expansion driving institutional demand, modern retail and e-commerce growth improving distribution reach, brand-building opportunities through product innovation, scalable business model accommodating market entry and premium positioning, export potential leveraging agricultural resources, health-conscious product variants addressing evolving consumer preferences, and moderate entry barriers favoring committed quality-focused manufacturers creates a compelling value proposition for food entrepreneurs, agricultural processors, FMCG investors, and regional manufacturers committed to quality manufacturing, food safety excellence, brand development, and long-term participation in serving essential condiment requirements supporting global household consumption, foodservice operations, and institutional catering across diverse markets and consumption occasions.

About IMARC Group

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its clients' business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tomato Ketchup Manufacturing Plant DPR 2026, Machinery Cost, and Profit Analysis here

News-ID: 4373417 • Views: …

More Releases from IMARC Group

Decoding the USD 229.3 Billion Europe Furniture Market: Trends, Data & Projectio …

Market Overview

The Europe furniture market size was valued at USD 229.3 Billion in 2025 and is projected to reach USD 306.3 Billion by 2034, growing at a CAGR of 3.27% during the forecast period of 2026-2034. The market is expanding due to rising demand for sustainable and eco-friendly furniture, increased e-commerce retailing, the demand for modular and multifunctional furniture, growing interest in luxury furniture, and Scandinavian and minimalist designs.

Download a…

Canned Tuna Manufacturing Plant (DPR) 2026: Feasibility Study and Profit Analysi …

The global canned tuna manufacturing industry is witnessing robust growth driven by the rapidly expanding packaged food sector and increasing demand for convenient, protein-rich products. At the heart of this expansion lies a critical seafood processing segment: canned tuna. As consumer markets transition toward ready-to-eat meals and shelf-stable nutrition solutions, establishing a canned tuna manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and food processing investors seeking to…

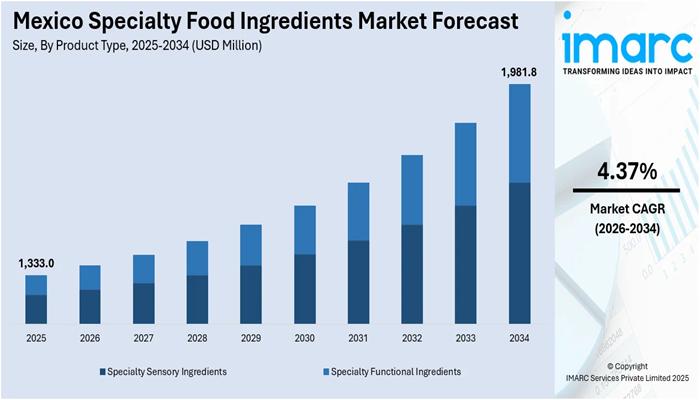

Mexico Specialty Food Ingredients Market Size to Surpass USD 1,981.8 Million by …

Market Overview

The Mexico specialty food ingredients market size reached USD 1,333.0 Million in 2025 and is anticipated to reach USD 1,981.8 Million by 2034, growing at a CAGR of 4.37% during the forecast period 2026-2034. This growth is driven by rising health awareness, demand for clean-label and fortified products, urban lifestyle changes, processed and functional foods expansion, and interest in natural flavors, plant proteins, and low-calorie ingredients.

Study Assumption Years

Base Year:…

Investment Outlook: Analyzing Europe Bancassurance Market Trajectory by 2033

Market Overview

The Europe bancassurance market was valued at USD 646.79 Billion in 2024 and is forecast to reach USD 971.75 Billion by 2033, growing at a CAGR of 4.40% during 2025-2033. Digital transformation and enhanced financial literacy are primary growth drivers. Partnerships between banks and insurers create integrated service offerings, expanding customer access to insurance.

Download a sample copy of the report: https://www.imarcgroup.com/europe-bancassurance-market/requestsample

Study Assumption Years

Base Year: 2024

Historical Years: 2019-2024

Forecast Period: 2025-2033

Europe…

More Releases for Tomato

Tomato Processing Market Size & Growth | Trends - 2034

The tomato processing market is poised for steady growth due to rising global demand for convenience foods, sauces, and packaged products. Increasing urbanization, changing dietary habits, and the popularity of ready-to-eat meals are driving the need for processed tomato products such as paste, puree, ketchup, and canned tomatoes. Technological advancements in food processing and preservation techniques are further supporting market expansion. Additionally, the foodservice industry's growth and expanding retail distribution…

Prominent Tomato Powder Market Trend for 2025: Advanced Product Development In T …

Which drivers are expected to have the greatest impact on the over the tomato powder market's growth?

The increasing preference for ready-to-eat and convenience foods is expected to drive the growth of the tomato powder market in the future. Ready-to-eat and convenience foods consist of fully prepared meals or food items requiring minimal effort before consumption, offering time-saving benefits for consumers. The demand for these foods is growing due to shifting…

Tomato Price Index: Tracking Trends and Insights

The Tomato Price Index serves as a crucial benchmark for understanding market dynamics, historical trends, and future price forecasts of tomatoes. This index is essential for stakeholders across the agricultural supply chain, from growers to retailers, as well as for market analysts and procurement professionals. With its comprehensive database and detailed insights, the index provides an invaluable tool for navigating the volatile tomato market.

Tomato Price Index Report: https://www.procurementresource.com/resource-center/tomato-price-trends

Prices: Latest Price…

Tomato Paste Market Size & Trends To 2030

The Tomato Paste Market 2024 Report makes available the current and forthcoming technical and financial details of the industry. It is one of the most comprehensive and important additions to the Prudent Markets archive of market research studies. It offers detailed research and analysis of key aspects of the global Tomato Paste market. This report explores all the key factors affecting the growth of the global Tomato Paste market, including…

Tomato Processing Market Set for More Growth| COFCO TUNHE Tomato, Xinjiang Chalk …

The latest research study released by AMA on the Tomato Processing Market offers over 181 pages of analysis on business strategies employed by key and emerging industry players. It provides insights into current market developments, landscape, technologies, drivers, opportunities, market outlook, and status. The market study is segmented by key regions driving market growth. The Tomato Processing study combines qualitative and quantitative market data, primarily collected and validated through primary…

Dried Tomato Powder Market Next Big Thing | Garlico Industries, Cham Foods, Dryt …

Advance Market Analytics published a new research publication on "Global Dried Tomato Powder Market Insights, to 2028" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study, you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market-associated stakeholders. The growth of the Dried Tomato Powder market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample…