Press release

Canned Tuna Manufacturing Plant (DPR) 2026: Feasibility Study and Profit Analysis

The global canned tuna manufacturing industry is witnessing robust growth driven by the rapidly expanding packaged food sector and increasing demand for convenient, protein-rich products. At the heart of this expansion lies a critical seafood processing segment: canned tuna. As consumer markets transition toward ready-to-eat meals and shelf-stable nutrition solutions, establishing a canned tuna manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and food processing investors seeking to capitalize on this growing and essential market.Market Overview and Growth Potential

Canned tuna is a shelf-stable, protein-rich seafood product produced by processing fresh tuna fish through cleaning, cooking, canning, and sterilization. It appears as packed tuna meat in oil, brine, or water with high nutritional value and extended shelf life. Canned tuna contains both lean protein and omega-3 fatty acids, making it an efficient nutrition source used primarily in household cooking, food service, and emergency food supplies. Due to its convenience and long storage capability, it serves diverse meal applications from sandwiches to salads. Its high protein content, ready-to-eat format, and compatibility with various recipes make it a preferred option in modern food consumption patterns and emergency preparedness planning.

The canned tuna market is witnessing robust demand due to the rising need for convenient protein sources that support busy lifestyles and health-conscious eating. Consumer segments increasingly transitioning toward ready-to-eat meals particularly in urban areas, working professionals, and health-focused demographics are driving large-scale adoption. According to market research, seafood consumption continues to rise globally as consumers seek healthier protein alternatives to red meat. Government-led food security programs, support for seafood processing industries, and nutrition awareness initiatives further strengthen market prospects.

Request for a Sample Report: https://www.imarcgroup.com/canned-tuna-manufacturing-plant-project-report/requestsample

Plant Capacity and Production Scale

The proposed canned tuna manufacturing facility is designed with an annual production capacity ranging between 10,000-20,000 metric tons per year, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to cater to diverse market segments from retail and food service to export markets, institutional catering, and private label production, ensuring steady demand and consistent revenue streams across multiple distribution channels.

Financial Viability and Profitability Analysis

The canned tuna manufacturing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

Gross Profit Margins: 25-35%

Net Profit Margins: 10-15%

These margins are supported by stable demand across retail and institutional sectors, value-added product positioning, and the essential nature of canned tuna in convenient nutrition applications. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established food processors looking to diversify their product portfolio in the seafood processing sector.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a canned tuna manufacturing plant is primarily driven by:

Raw Materials: 70-80% of total OpEx

Utilities: 10-15% of OpEx

Other Expenses: Including labor, packaging, transportation, maintenance, depreciation, and taxes

Raw materials constitute the largest portion of operating costs, with fresh or frozen tuna and cans being the primary input materials. Establishing long-term contracts with reliable fishing suppliers and tuna traders helps mitigate price volatility and ensures consistent raw material supply, which is critical given that tuna price fluctuations represent the most significant cost factor in canned tuna manufacturing.

Capital Investment Requirements

Setting up a canned tuna manufacturing plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to fishing ports and tuna suppliers. Proximity to target consumer markets will help minimize distribution costs. The site must have robust infrastructure, including reliable cold chain facilities, utilities, and wastewater treatment systems. Compliance with local zoning laws and food safety regulations must also be ensured.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers specialized processing equipment essential for production. Key machinery includes:

• Fish receiving and cold storage systems for maintaining freshness

• Washing and cleaning equipment for initial fish preparation

• Precooking retorts or continuous cookers for thermal processing

• Cooling systems for cooked fish handling

• Cleaning and filleting machines for meat preparation

• Can washing and sterilization equipment

• Automatic filling machines for precise portioning

• Vacuum seaming machines for hermetic sealing

• Retort sterilizers for thermal processing and shelf stability

• Labeling and packaging lines for finished products

• Quality control laboratory equipment for microbiological and chemical testing

• Wastewater treatment systems for managing processing effluents and ensuring environmental compliance

Civil Works: Building construction, factory layout optimization, and infrastructure development designed to enhance workflow efficiency, ensure food safety standards, and minimize cross-contamination risks throughout the production process. The layout should be optimized with separate areas for raw material receiving, cold storage, precooking zone, cleaning and filleting section, canning line, sterilization unit, cooling area, quality control laboratory, finished goods warehouse, utility block, wastewater treatment area, and administrative block.

Other Capital Costs: Pre-operative expenses, machinery installation costs, food safety certifications (HACCP, FDA, BRC), initial working capital requirements, and contingency provisions for unforeseen circumstances during plant establishment.

Major Applications and Market Segments

Canned tuna products find extensive applications across diverse market segments, demonstrating their versatility and critical importance:

Retail Grocery: Primary distribution through supermarkets, grocery stores, and convenience outlets serving household consumers for meal preparation, sandwiches, salads, and quick protein sources.

Food Service: Supplied to restaurants, cafeterias, fast-food chains, and catering operations where ready-to-use protein ingredients are essential for menu offerings and operational efficiency.

Institutional Supply: Large-scale provision to schools, hospitals, military installations, and government facilities where shelf-stable nutrition and cost-effective protein sources are critical requirements.

Export Markets: International distribution to countries with high seafood consumption, limited fishing capacity, or strong demand for imported packaged foods.

Emergency Supplies: Critical applications in disaster relief programs, emergency food reserves, and survival food kits where long shelf life and nutritional density are essential.

End-use sectors include retail, food service, institutional catering, export markets, and emergency preparedness, all of which contribute to sustained market demand.

Buy now: https://www.imarcgroup.com/checkout?id=12577&method=2175

Why Invest in Canned Tuna Manufacturing?

Several compelling factors make canned tuna manufacturing an attractive investment opportunity:

Essential Protein Source: Canned tuna serves as a critical convenient protein supporting busy lifestyles, health-conscious eating, and emergency food security, making it indispensable for modern consumer food systems focused on nutrition and convenience.

Rising Health Consciousness: Consumer segments increasingly transitioning toward lean protein and omega-3 fatty acids-particularly in fitness, wellness, and preventive health demographics-are driving large-scale adoption of canned tuna products.

Convenience Factor: The product's ready-to-eat format, long shelf life, and versatility in meal applications, combined with its portable packaging, offers significant consumer advantages and positions it favorably against fresh seafood requiring preparation.

Food Security Solutions: The product's shelf stability and nutritional density make it essential for emergency preparedness, disaster relief, and food security programs, especially across developing nations and regions with limited refrigeration infrastructure.

Government Support: Government-led food safety programs, support for seafood processing industries, and nutrition improvement initiatives further strengthen market prospects and support industry growth.

Export Opportunities: Developed markets such as the US, Europe, Japan, and Middle Eastern countries maintain strong demand for quality canned tuna, creating opportunities for export-oriented producers with proper certifications.

Value Addition Potential: The growing demand for flavored varieties, premium albacore products, and organic/sustainable options creates opportunities for product differentiation and premium pricing strategies.

Manufacturing Process Excellence

The canned tuna manufacturing process involves several precision-controlled stages:

• Fish Reception: Fresh or frozen tuna is received, weighed, and inspected for quality specifications

• Thawing (if frozen): Frozen tuna is thawed under controlled conditions to maintain quality

• Cleaning and Washing: Fish is thoroughly cleaned and washed to remove impurities

• Precooking: Tuna is cooked at controlled temperatures to facilitate meat separation and reduce moisture

• Cooling: Cooked fish is cooled to safe handling temperatures

• Cleaning and Filleting: Skin, bones, and dark meat are removed; clean meat is prepared

• Can Filling: Tuna meat is portioned and filled into cleaned cans

• Liquid Addition: Oil, brine, or water is added based on product specifications

• Vacuum Sealing: Cans are sealed hermetically to prevent contamination

• Retort Sterilization: Sealed cans undergo thermal processing for microbial safety

• Cooling and Drying: Processed cans are cooled and dried

• Labeling and Packaging: Products are labeled, coded, and packaged for distribution

Industry Leadership

The global canned tuna industry is led by established food processors with extensive production capabilities and diverse market reach. Key industry players include:

• Thai Union Group

• Dongwon Industries

• StarKist Co.

• Bumble Bee Foods

• Century Pacific Food

These companies serve diverse market segments including retail, food service, institutional supply, and export markets, demonstrating the broad consumer applicability of canned tuna products.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=12577&flag=C

Recent Industry Developments

2024: Major canned tuna producers are increasingly adopting sustainable fishing certifications such as Marine Stewardship Council (MSC) and Dolphin Safe standards. These certifications are designed to ensure responsible fishing practices, improve consumer confidence through traceability, and meet growing retailer requirements for sustainable sourcing, as well as reduce environmental impact of commercial fishing operations.

2024: Leading manufacturers are launching plant-based tuna alternatives and clean-label products to meet evolving consumer preferences for sustainable protein sources and transparent ingredient lists, expanding their product portfolios beyond traditional tuna offerings.

Conclusion

The canned tuna manufacturing sector presents a strategically positioned investment opportunity at the intersection of convenient nutrition, seafood processing, and sustainable food systems. With favorable profit margins ranging from 25-35% gross profit and 10-15% net profit, strong market drivers including rising demand for convenient protein sources, growing health consciousness among consumers, expanding urban populations with busy lifestyles, and supportive government policies promoting food security and seafood industry development, establishing a canned tuna manufacturing plant offers significant potential for long-term business success and sustainable returns. The combination of nutritional benefits, ready-to-eat convenience, critical role in emergency food supplies, expanding retail distribution networks, and export opportunities in developed markets creates an attractive value proposition for serious food processing investors committed to quality manufacturing and operational excellence.

About IMARC Group

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its clients' business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201-971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Canned Tuna Manufacturing Plant (DPR) 2026: Feasibility Study and Profit Analysis here

News-ID: 4373375 • Views: …

More Releases from IMARC Group

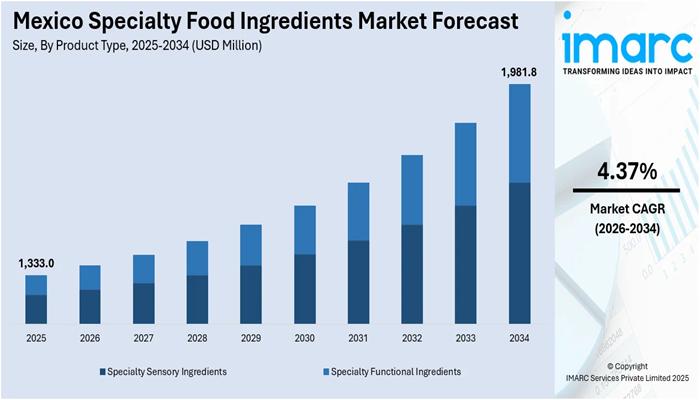

Mexico Specialty Food Ingredients Market Size to Surpass USD 1,981.8 Million by …

Market Overview

The Mexico specialty food ingredients market size reached USD 1,333.0 Million in 2025 and is anticipated to reach USD 1,981.8 Million by 2034, growing at a CAGR of 4.37% during the forecast period 2026-2034. This growth is driven by rising health awareness, demand for clean-label and fortified products, urban lifestyle changes, processed and functional foods expansion, and interest in natural flavors, plant proteins, and low-calorie ingredients.

Study Assumption Years

Base Year:…

Investment Outlook: Analyzing Europe Bancassurance Market Trajectory by 2033

Market Overview

The Europe bancassurance market was valued at USD 646.79 Billion in 2024 and is forecast to reach USD 971.75 Billion by 2033, growing at a CAGR of 4.40% during 2025-2033. Digital transformation and enhanced financial literacy are primary growth drivers. Partnerships between banks and insurers create integrated service offerings, expanding customer access to insurance.

Download a sample copy of the report: https://www.imarcgroup.com/europe-bancassurance-market/requestsample

Study Assumption Years

Base Year: 2024

Historical Years: 2019-2024

Forecast Period: 2025-2033

Europe…

Non-Melanoma Skin Cancer Treatment Market to Grow at a CAGR of 4.31% during 2025 …

The global non-melanoma skin cancer treatment market was valued at USD 588.8 Million in 2024 and is projected to reach USD 878.0 Million by 2033, growing at a CAGR of 4.31% during the forecast period of 2025-2033. North America will lead the market because of its high skin cancer rates and advanced medical infrastructure and presence of major pharmaceutical and medical device manufacturers and high research and development funding and…

Ready Mix Concrete Manufacturing Plant Cost 2026: Industry Overview, DPR and Fin …

The global ready mix concrete manufacturing industry stands as a fundamental pillar of modern construction infrastructure, positioned at the intersection of large-scale urbanization, infrastructure development imperatives, and evolving construction technology demands. As a highly engineered construction material produced through centralized batching facilities and delivered fresh to construction sites via specialized transit mixers, ready mix concrete has emerged as an indispensable component of contemporary building practices, offering superior quality control, construction…

More Releases for Canned

Canned Fruits & Vegetables and Canned Seafood Market Revenue Share, Insights & F …

Canned Fruits & Vegetables and Canned Seafood Market Size, Forecast, and Trends 2031

The global Canned Fruits & Vegetables and Canned Seafood market was valued at US$ x million in 2024 and is projected to reach US$ x million by 2031, growing at a CAGR of x% during the forecast period.

North America and Asia-Pacific are key regions contributing to market growth due to increasing consumer preference for convenient, ready-to-eat, and shelf-stable…

Organic Canned Tomatoes And Sustainable Farming Innovations Drive Growth In Cann …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

Canned Vegetable Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

Over the past few years, the canned vegetable market has witnessed robust growth. The market size is set to expand from $23.06 billion in 2024 to $24.34 billion in 2025 at a compound annual growth…

Evolving Market Trends In The Canned Vegetable Industry: Organic Canned Tomatoes …

The Canned Vegetable Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Canned Vegetable Market Size During the Forecast Period?

The canned vegetable market has seen strong growth in recent years. It will increase from $23.06 billion in 2024 to $24.34 billion in…

Canned Meat Market Report 2024 - Canned Meat Market Share, Growth, And Forecast

"The Business Research Company recently released a comprehensive report on the Global Canned Meat Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Canned Vegetable Market Report 2024 - Canned Vegetable Market Growth And Share

"The Business Research Company recently released a comprehensive report on the Global Canned Vegetable Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

According to The Business Research Company's, The canned vegetable market size…

Canned Salmon Market 2019 analysis with Top Key Players and Major Types Farmed C …

Canned Salmon Market

Salmon is the common name for fishes belonging to the family of Salmonidae. It is available from both wild and farmed sources. It is estimated that nearly 60% of the world's salmon production is farmed. Salmon farming started in the beginning of 1960s. Atlantic salmon is the most common type of salmon that is farmed. Major part of Atlantic salmon available around the globe are farmed commercially.

To Access…