Press release

Soya Chunks Manufacturing Plant (DPR) 2026: Raw Materials Cost and Unit Setup

The global food industry is witnessing a transformative shift toward plant-based protein sources, with soya chunks emerging as a cornerstone product in this evolving landscape. As consumers increasingly prioritize affordable, nutritious, and sustainable food options, soya chunks have positioned themselves as a vital protein alternative across diverse market segments.Soya chunks are extrusion-cooked, textured vegetable protein products produced from de-oiled soybean meal. They exhibit high protein content, low fat levels, excellent water absorption capacity, and upon hydration, deliver a meat-like texture that appeals to health-conscious consumers. Rich in essential amino acids, dietary fiber, calcium, and iron, soya chunks have become shelf-stable, easy to store, and suitable for extended consumption periods. Their neutral taste profile allows them to absorb flavors effectively, making them highly versatile across various culinary applications and industrial food formulations.

IMARC Group's report, "Soya Chunks Manufacturing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," offers a comprehensive guide for establishing a plant. The soya chunks manufacturing plant setup report offers insights into the process, financials, capital investment, expenses, ROI, and more for informed business decisions.

Market Overview and Growth Potential

The soya chunks industry presents compelling investment fundamentals backed by robust market dynamics. The global soya chunks market was valued at USD 2,079.17 Million in 2025 and is projected to reach USD 3,887.25 Million by 2034, exhibiting a healthy CAGR of 7.2% from 2026 to 2034.

This growth trajectory is propelled by several key market drivers including rising demand for affordable plant-based protein, increasing vegetarian and vegan populations globally, expanding food processing industries, and growing awareness regarding protein malnutrition, particularly in developing economies. The processed food sector's expansion and institutional food supply programs further support market momentum. According to the Ministry of Food Processing Industries, India's processed food exports totaled USD 10.09 billion in 2024-2025, demonstrating the sector's significant scale and export potential.

Urbanization and evolving dietary habits have accelerated acceptance of meat alternatives among health-conscious consumers. Government-supported nutrition initiatives and school feeding programs are encouraging bulk procurement of soy-based proteins, creating sustained institutional demand.

Grab a sample PDF of this report: https://www.imarcgroup.com/soya-chunks-manufacturing-plant-project-report/requestsample

Plant Capacity and Production Scale

The proposed soya chunks manufacturing facility is designed with an annual production capacity ranging between 10,000 - 20,000 MT, enabling optimal economies of scale while maintaining operational flexibility. This production scale positions investors to effectively serve multiple market segments simultaneously.

The capacity range allows manufacturers to capture opportunities across food processing companies requiring bulk supplies, nutritional product manufacturers seeking high-protein ingredients, institutional catering operations including hostels, schools, hospitals, and canteens, as well as retail and FMCG companies marketing packaged consumer products.

Financial Viability and Profitability Analysis

The soya chunks manufacturing project demonstrates attractive profitability potential under normal operating conditions, presenting a compelling investment case for prospective stakeholders.

Gross profit margins typically range between 25-35%, supported by stable demand patterns and diverse value-added application opportunities. Net profit margins are projected at 10-15%, reflecting a sustainable business model with healthy returns on investment.

Financial projections have been developed based on realistic assumptions related to capital investment, operating costs, production capacity utilization, pricing trends, and demand outlook. These projections provide comprehensive visibility into project viability, ROI potential, profitability metrics, and long-term sustainability, enabling informed investment decisions.

Operating Cost Structure

The operating cost structure of a soya chunks manufacturing plant is primarily driven by raw material consumption. Defatted soy flour, the primary feedstock, accounts for approximately 70-80% of total operating expenses (OpEx), making raw material procurement and supplier relationships critical success factors.

Utilities represent 10-15% of OpEx, covering electricity, water, and steam requirements essential for extrusion and drying operations. Additional operational costs include transportation, packaging, salaries and wages, depreciation, taxes, and miscellaneous expenses.

Effective cost management strategies center on securing long-term contracts with reliable defatted soy flour suppliers to mitigate price volatility and ensure consistent material quality. Proximity to raw material sources during site selection can significantly reduce logistics costs and enhance supply chain reliability.

Speak to an Analyst: https://www.imarcgroup.com/request?type=report&id=9092&flag=C

Capital Investment Requirements

Establishing a soya chunks manufacturing plant requires strategic capital allocation across several key areas:

Land and Site Development: Investment covers land acquisition, site preparation, boundary development, registration charges, and necessary infrastructure development to support safe and efficient operations.

Machinery and Equipment: This represents the largest portion of capital expenditure. Essential equipment includes:

• High-speed mixers for ingredient blending

• Twin-screw extruders for texturization

• Drying ovens for moisture control

• Cutting and shaping units for product uniformity

• Flavor-coating systems for product enhancement

• Industrial dehydrators for final processing

• Automated packaging lines for efficient output handling

Civil Works: Construction costs for production facilities, storage areas, quality control laboratories, and administrative buildings.

Other Capital Costs: Include utility connections, waste management systems, quality assurance equipment, and working capital requirements.

Major Applications and Market Segments

Soya chunks serve diverse end-use applications, creating multiple revenue streams:

• Food Processing: Production for domestic and commercial consumption markets

• Nutritional Products: High-protein ingredients for health foods and dietary supplements

• Institutional Catering: Bulk supply for hostels, schools, hospitals, and canteens

• Retail & FMCG: Packaged products for supermarkets and direct consumer markets

• Meat Alternatives: Plant-based protein solutions for flexitarian and vegetarian consumers

• Ready-to-Eat Meals: Convenient protein additions for prepared food products

• Animal Feed: Protein-enriched formulations for pet and livestock applications

Why Invest in Soya Chunks Manufacturing?

Essential Protein Food Product: Soya chunks represent a vital, affordable source of high-quality plant protein, widely consumed across households, food services, and institutional catering. This positions them as a staple product in nutrition-focused and value-conscious markets.

Moderate but Defensible Entry Barriers: While not prohibitively capital-intensive, successful manufacturing demands consistent raw material quality, precise extrusion technology, food safety compliance with standards like FSSAI, and robust distribution networks-creating competitive advantages for quality-driven producers.

Megatrend Alignment: Rising health awareness, increasing vegetarian and vegan populations, protein supplementation trends, and growing demand for meat alternatives are driving sustained growth in soya-based foods, with plant-protein markets expanding at strong global and domestic growth rates.

Policy and Food Security Support: Government initiatives promoting nutrition, protein sufficiency, mid-day meal schemes, public distribution systems, and domestic food processing support demand for soya chunks and value-added soy products.

Localization and Supply Chain Reliability: Food distributors, institutions, and retail companies increasingly prefer local, reliable manufacturers to ensure quality, minimize costs, and reduce delivery times-creating significant opportunities for domestic producers.

Technology Advantages: Advancements in extrusion technology have improved production efficiency, enabling consistent quality output and scalable manufacturing operations.

Industry Leadership

Leading manufacturers in the global soya chunks industry include:

• Ruchi Soya Industries Limited

• Nutrela (Patanjali Foods)

• Vippy Industries Ltd.

• Shree Renuka Sugars (Soy Division)

• Sonic Biochem Ltd.

These established players serve end-use sectors including food service, retail, meat alternatives, ready-to-eat meals, nutritional supplements, and animal feed markets.

Buy Now: https://www.imarcgroup.com/checkout?id=9092&method=2175

In recent industry developments, Annapurna Swadisht Limited agreed in January 2026 to acquire a 75% stake in Andri Agro Foods, expanding its product line into soya-based foods while seeking broader domestic and international market reach.

Conclusion

The soya chunks manufacturing sector presents a strategically attractive investment opportunity characterized by strong market fundamentals, favourable growth projections, and healthy profitability metrics. The combination of 25-35% gross margins, 10-15% net margins, and scalable production capacities of 10,000-20,000 MT annually creates a compelling value proposition. As consumer preferences continue shifting toward affordable, nutritious, and sustainable protein sources, soya chunks manufacturing represents a timely investment aligned with enduring megatrends in global food consumption.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Soya Chunks Manufacturing Plant (DPR) 2026: Raw Materials Cost and Unit Setup here

News-ID: 4373295 • Views: …

More Releases from IMARC Group

Wine Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Project Co …

Wine represents one of the most enduring and sophisticated segments within the global alcoholic beverages industry. As the result of regulated fermentation processes involving yeast and grapes, wine's taste, aroma, color, and mouthfeel are determined by its constituents, which include water, ethanol, organic acids, sugars, phenolic compounds, and aromatic compounds. The type of grape, terroir, fermentation method, and aging process all have a significant impact on the final product characteristics.…

Global Liquid Soap Market to Grow at a CAGR of 5.20% during 2026-2034, Driven by …

Market Overview

The global liquid soap market was valued at USD 23.3 Billion in 2025 and is projected to reach USD 36.7 Billion by 2034, growing at a CAGR of 5.20% during the forecast period of 2026-2034. Asia Pacific is expected to be the largest market because a rapidly growing population, rising urbanization and disposable income levels, increasing awareness about hygiene and sanitation, COVID, 19 pandemic impact on hygiene consciousness, and…

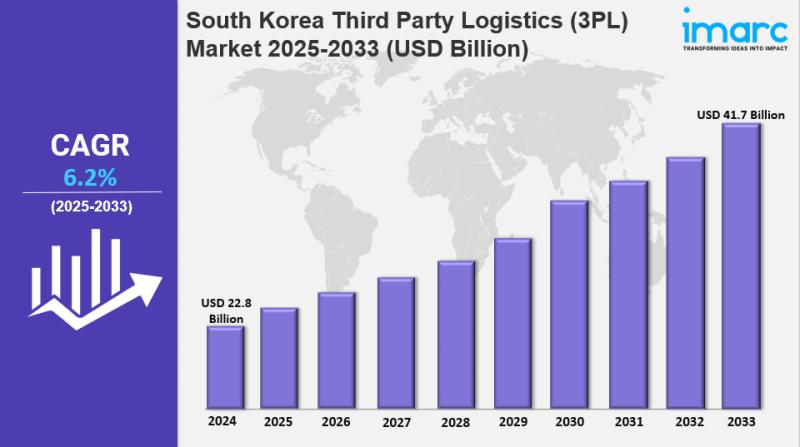

South Korea Third Party Logistics (3PL) Market Size, Share, Industry Overview, T …

IMARC Group has recently released a new research study titled "South Korea Third Party Logistics (3PL) Market Report by Service (Domestic Transportation Management, International Transportation Management, Value-added Warehousing and Distribution), End User (Manufacturing and Automotive, Oil, Gas and Chemicals, Distributive Trade (Wholesale and Retail trade including e-commerce), Pharma and Healthcare, Construction, and Others), and Region 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive…

Contract Lifecycle Management Software Market Analysis Highlights Expanding Ente …

Market Overview

The global contract lifecycle management software market reached a size of USD 2.3 Billion in 2024 and is projected to reach USD 5.4 Billion by 2033, growing at a CAGR of 9.7% during 2025-2033. This growth is driven by increasing contract complexity involving multiple stakeholders and variables, alongside a growing emphasis on streamlining contract-related tasks to improve productivity and cost efficiency. For detailed insights, visit the Contract Lifecycle Management…

More Releases for Soy

Soy Food Products Market Players Gaining Attractive Investments| Northern Soy, N …

Advance Market Analytics published a new research publication on "Soy Food Products Market Insights, to 2032" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Soy Food Products market was mainly driven by the increasing R&D spending across the world. Some of the key…

Soy Protein Ingredients Market by Type (Soy Protein Concentrates, Soy Protein Is …

The global soy protein ingredients market is estimated to be valued at USD 7.7 billion in 2022. It is projected to reach USD 10.8 billion by 2027, recording a CAGR of 7.0% during the forecast period.

Soy protein ingredients are produced by processing soymeal to obtain ingredients with higher protein concentrations, which can be used as a protein source in a range of food and animal feed applications. The demand…

Soy Food Products Market to See Huge Growth by 2027 |ADM,Cargill,DuPont,Northern …

Worldwide Market Reports is one of the leading organizations, specializing in conducting high-end research by understanding the market strategies, key players, major trends, and several other aspects of the industry. The recently developed report on "Global Soy Food Products Market Outlook 2020-2027" focuses on business developments, collaborative strategies, and answers all questions related to the key affiliations.

Market Overview -

The Soy Food Products market report provides a detailed analysis of global…

Global Soy Sauce Market 2018 - Bluegrass Soy Sauce, Okonomi, Maggi

Accord Market, recently published a detailed market research study focused on the “Soy Sauce Market” across the global, regional and country level. The report provides 360° analysis of “Soy Sauce Market” from view of manufacturers, regions, product types and end industries. The research report analyses and provides the historical data along with current performance of the global PP Pipe industry, and estimates the future trend of Soy Sauce on the…

2017-2022 Soy Milk Report on Global and United States Market - Silk, West Soy

This report studies the Soy Milk market status and outlook of global and United States, from angles of players, regions, product types and end industries; this report analyzes the top players in global and United States market, and splits the Soy Milk market by product type and applications/end industries.

The global Soy Milk market is valued at XX million USD in 2016 and is expected to reach XX million USD by…

Soy & Milk Protein Ingredients Market Driven by Numerous Health Benefits of Soy …

Global Soy and Milk Protein Ingredients Market: Brief Account

The worldwide soy and milk protein ingredients market is envisaged to invite radical growth prospects on the back of the snowballing awareness about several health benefits. Apart from an estimated 38.0% protein content, soy contains all the nine essential amino acids in just the right proportion that is ideal for human health. Vendors could look to extend their presence in the…