Press release

Frozen Vegetable Processing Plant Cost 2026: Comprehensive Project Report, Machinery Requirements and Investment Scope

The global frozen vegetable processing industry stands at the forefront of modern food preservation technology, positioned at the intersection of agricultural value addition, nutritional preservation innovation, and evolving consumer lifestyle demands. As a sophisticated process that captures vegetables at peak ripeness and preserves their nutritional integrity through controlled freezing, frozen vegetable production has emerged as an indispensable component of global food security infrastructure, offering year-round access to nutritious produce while supporting agricultural economies and addressing food waste challenges. This comprehensive guide provides an authoritative exploration of the technical, financial, and strategic dimensions of establishing a frozen vegetable processing plant, leveraging current market intelligence and industry insights to support informed investment decision-making in this strategically vital and rapidly expanding food processing sector.Market Overview and Growth Potential

The frozen vegetable processing sector is experiencing robust and sustained growth driven by powerful, interconnected market forces that reflect fundamental transformations in consumer behavior, dietary preferences, and food supply chain dynamics. The industry's expansion is propelled by several critical factors:

• Increasing consumer preference for ready-to-cook, healthy food options

• Growing demand for processed foods with extended shelf life

• Rising adoption of plant-based diets and clean-label products

• Expansion of foodservice sector relying on convenient ingredient solutions

• Technological advancements in freezing preservation maintaining nutritional value

• Year-round product availability independent of seasonal harvesting constraints

The global frozen vegetable market was valued at USD 5.81 Billion in 2025, establishing a substantial foundation for sector growth. According to comprehensive market analysis, the industry is projected to reach USD 9.06 Billion by 2034, exhibiting a strong CAGR of 5.06% during 2026-2034. This impressive growth trajectory significantly outpaces general food industry expansion, reflecting frozen vegetables' strategic importance in addressing modern dietary needs, convenience demands, and nutritional accessibility.

The market expansion is fundamentally driven by profound lifestyle changes and evolving consumer priorities. The rising preference for convenient, healthy, ready-to-cook food options is significantly driving demand for frozen vegetables, as modern consumers seek nutritious meal solutions compatible with busy schedules and time constraints. The trend toward plant-based diets and clean-label products is also boosting market growth, as frozen vegetables offer transparent ingredient profiles and support sustainable dietary patterns without preservatives or artificial additives.

According to the Plant Based Products Council, in 2025, 71% of Americans said they were familiar with plant-based products, reflecting a multi-year increase and signaling that plant-based materials have firmly entered the mainstream. This consumer awareness creates favorable market conditions for frozen vegetable products positioned as healthy, sustainable, and convenient alternatives to fresh produce requiring immediate consumption or canned alternatives with diminished nutritional profiles.

The growing trend of cooking at home has also led to a surge in frozen vegetable consumption, as consumers seek convenient ingredients enabling nutritious meal preparation without the food waste associated with fresh produce spoilage. Additionally, demand from the foodservice sector, which relies heavily on frozen vegetables for convenience, cost-effectiveness, consistent quality, and reliable year-round supply, is expected to remain strong across restaurants, hotels, catering operations, and institutional food service applications.

IMARC Group's report, "Frozen Vegetable Processing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," offers a comprehensive guide for establishing a plant. The frozen vegetable processing plant cost report offers insights into the process, financials, capital investment, expenses, ROI, and more for informed business decisions.

Plant Capacity and Production Scale

A frozen vegetable processing plant operates as a sophisticated food preservation facility transforming fresh agricultural produce into frozen products maintaining nutritional value, flavor, and texture through controlled preservation processes. The production methodology represents a technically intensive operation involving careful harvesting timing, rapid processing minimizing quality degradation, precise temperature control throughout preservation, and stringent quality monitoring ensuring food safety compliance.

The proposed processing facility is designed with an annual production capacity of approximately 20,000 Metric Tons, enabling economies of scale while maintaining operational flexibility to accommodate diverse vegetable varieties and seasonal harvest patterns. This capacity level supports efficient large-scale operations while allowing product diversification across multiple vegetable types and end-use applications.

The facility produces frozen vegetables for multiple

application categories and end-use sectors:

• Retail consumer products: Packaged frozen vegetable products for household consumption (peas, corn, mixed vegetables, specialty blends)

• Foodservice applications: Bulk frozen vegetables for restaurants, hotels, catering operations, and institutional food service

• Industrial food processing: Frozen vegetable ingredients for ready meals, soups, sauces, and processed food manufacturing

Production capacity planning must account for seasonal harvest patterns requiring surge processing capabilities during peak agricultural seasons, cold chain infrastructure maintaining continuous temperature control from receiving through storage, food safety compliance meeting stringent regulatory standards (HACCP, GMP), quality preservation systems ensuring nutritional value and organoleptic properties, and flexible product mix accommodating diverse vegetable varieties with different processing requirements.

Request for a Sample Report: https://www.imarcgroup.com/frozen-vegetable-processing-plant-project-report/requestsample

Financial Viability and Profitability Analysis

The frozen vegetable processing business presents compelling financial characteristics rooted in the transformation of seasonal agricultural commodities into value-added preserved products commanding premium pricing relative to commodity vegetables. The project demonstrates healthy profitability potential under normal operating conditions, with gross profit margins typically ranging between 20-30% and net profit margins of 8-15%, supported by stable demand, value-added processing, and established market channels.

The financial projections developed for this project incorporate comprehensive analysis of capital investment requirements across land acquisition near agricultural production regions, specialized facility construction meeting food safety and cold chain requirements, significant equipment procurement including washing systems, blanchers, industrial freezers (IQF tunnel or blast), packaging lines, and substantial cold storage infrastructure, utilities infrastructure supporting high electricity consumption for refrigeration, and working capital for raw material procurement during harvest seasons and finished goods inventory.

Operating cost modeling addresses raw material expenses dominated by fresh vegetable procurement (typically 60-70% of operating costs), representing the single largest cost component requiring careful supplier relationships and harvest season planning. Utilities constitute 25-30% of operating expenses, with electricity consumption for industrial freezing equipment, blast freezers, cold storage maintenance, and refrigerated distribution representing substantial ongoing costs inherent to frozen food operations.

Additional operating costs encompass labor expenses for processing line operations, quality control, and packaging, packaging materials including poly bags and cartons for retail and foodservice applications, transportation costs for both fresh vegetable receiving and frozen product distribution requiring refrigerated logistics, maintenance of sophisticated freezing and refrigeration equipment, food safety compliance costs including laboratory testing and regulatory certifications, and waste management for vegetable trimmings and processing byproducts.

These detailed financial models provide stakeholders with transparent visibility into project economics, including comprehensive capital expenditure (CapEx) breakdowns, operating expenditure (OpEx) structures with particular emphasis on raw material procurement strategies and utility cost management, income projections across retail, foodservice, and industrial customer segments, expected return on investment (ROI), net present value (NPV) calculations, payback period analysis, and long-term profitability trajectories under various agricultural supply and market pricing scenarios.

Operating Cost Structure

Understanding the operating cost structure is fundamental to effective business planning and margin management in frozen vegetable processing. The cost architecture reflects agricultural commodity intensity, substantial energy requirements for freezing and cold storage, and the food safety-intensive nature of operations.

Key Raw Materials Include:

• Fresh vegetables: Peas, corn, carrots, beans, spinach, broccoli, and mixed vegetable varieties procured during optimal harvest periods

• Packaging materials: Poly bags for consumer packaging, cartons for foodservice applications, labels meeting food safety requirements

• Process chemicals: Food-grade sanitizers, cleaning compounds, quality maintenance additives

Utilities and Process Requirements:

Substantial utility consumption reflects the energy-intensive nature of industrial freezing and continuous cold chain maintenance, covering electricity for industrial freezing equipment (IQF tunnels, blast freezers representing the dominant energy consumer), cold storage facilities maintaining frozen product inventory, refrigerated processing areas, pumps, conveyors, and processing equipment, water for vegetable washing, blanching operations, and sanitation procedures, and steam or hot water for blanching operations preparing vegetables for freezing.

Additional operating costs encompass:

• Transportation: Fresh vegetable delivery from agricultural suppliers (often requiring rapid processing post-harvest) and refrigerated distribution of frozen products to retail, foodservice, and industrial customers

• Packaging: Substantial costs for consumer retail packaging, bulk foodservice packaging, and labeling meeting food safety information requirements

• Salaries and wages: Processing line operators, quality control technicians, cold storage personnel, maintenance staff, and food safety compliance specialists

• Depreciation: On substantial capital investments in freezing equipment, cold storage infrastructure, and processing systems

• Food safety compliance: Laboratory testing, regulatory certifications, sanitation programs, and quality assurance systems

• Insurance: Premiums addressing food safety liability, product recalls, and refrigeration equipment breakdown

• Waste management: Vegetable trimmings, processing water treatment, and organic waste disposal

Raw material procurement strategies represent the most critical success factor given fresh vegetables' dominant cost position (60-70% of OpEx) and seasonal availability patterns. Strategic considerations include establishing direct relationships with agricultural producers or cooperatives ensuring consistent quality and reliable supply, implementing contract farming arrangements providing price stability and harvest scheduling coordination, maintaining diversified supplier networks managing weather-related supply disruptions, optimizing processing schedules matching harvest seasons maximizing freshness and minimizing storage time, and exploring organic and specialty vegetable varieties commanding premium pricing in retail markets.

Capital Investment Requirements

Establishing a frozen vegetable processing plant requires substantial capital investment reflecting the cold chain infrastructure, food safety systems, and specialized processing equipment essential for high-quality frozen food production.

Capital Expenditure Components:

• Land and Site Development Costs: Significant land acquisition near agricultural production regions (minimizing transportation time from harvest to processing), site preparation, utilities connection

• Civil Works Costs: Specialized facility construction including refrigerated processing areas, cold storage warehouses, quality control laboratories, sanitation facilities

• Machinery Costs: Largest portion of CapEx representing sophisticated freezing and processing technology

• Other Capital Costs: Food safety systems, quality testing equipment, initial packaging materials inventory, regulatory permits and certifications

Site Selection Considerations:

Strategic location selection must evaluate several critical factors:

• Easy access to key raw materials including fresh vegetables from nearby agricultural regions, minimizing time from harvest to processing (critical for quality preservation) and transportation costs for bulk agricultural commodities

• Proximity to target markets particularly major urban centers, retail distribution networks, foodservice customer concentrations, and industrial food processing facilities minimizing refrigerated distribution costs

• Robust infrastructure including reliable transportation networks (facilitating both agricultural receiving and refrigerated distribution), utilities (particularly high-capacity electrical service supporting substantial refrigeration loads), and water supply supporting washing, blanching, and sanitation

• Compliance with local zoning laws and environmental regulations governing food processing facilities, wastewater discharge standards, and cold storage warehouses

• Labor availability supporting shift operations for processing line workers, quality control technicians, and maintenance specialists with food industry experience

• Space for future expansion accommodating additional processing lines, increased cold storage capacity, or new vegetable varieties

Essential Machinery Requirements:

High-quality, food-grade equipment represents the technical foundation:

• Receiving hoppers: Bulk vegetable receiving systems with washing capabilities removing field dirt and debris

• Mechanical washers: Industrial washing systems ensuring thorough cleaning meeting food safety standards

• Blanchers: Steam or hot water blanching equipment inactivating enzymes preventing quality degradation during frozen storage

• Industrial freezers: IQF (Individual Quick Freezing) tunnel freezers or blast freezers achieving rapid temperature reduction preserving cellular structure, texture, and nutritional value

• Sorting and inspection belts: Automated or manual quality inspection removing defective pieces ensuring uniform product quality

• Packaging machines: Automated bagging, sealing, and cartoning equipment for retail and foodservice packaging formats

• Cold storage systems: Large-capacity refrigerated warehouses maintaining frozen product inventory at optimal temperatures (-18°C or below)

Civil works costs encompass substantial facility construction with insulated processing areas minimizing heat gain, refrigerated processing zones maintaining product quality, dedicated cold storage warehouses with controlled temperature zones, quality control and food safety laboratories, sanitation facilities and employee changing areas meeting food processing requirements, and administrative offices. Other capital costs include comprehensive food safety systems and certifications (HACCP, GMP, organic certifications if applicable), environmental permits addressing wastewater discharge and refrigerant management, initial packaging materials inventory supporting production startup, and contingency reserves addressing construction or equipment procurement delays.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=14199&flag=C

Manufacturing Process Overview

The frozen vegetable processing operation involves sophisticated sequential unit operations designed to preserve fresh vegetables at peak nutritional quality through controlled freezing:

Unit Operations Involved:

• Harvesting: Vegetables harvested at optimal maturity ensuring peak nutritional content, flavor, and texture

• Receiving and storage: Rapid receiving minimizing time from harvest to processing, temporary refrigerated storage if immediate processing capacity unavailable

• Washing: Mechanical washing systems removing field dirt, debris, and surface contaminants

• Sorting and inspection: Manual or automated sorting removing defective, damaged, or substandard pieces ensuring uniform quality

• Size reduction: Cutting, dicing, or slicing to specified dimensions for different product formats

• Blanching: Brief steam or hot water treatment inactivating enzymes that would otherwise cause color changes, texture degradation, and nutritional losses during frozen storage

• Cooling: Rapid cooling post-blanching preventing overcooking and preparing vegetables for freezing

• Freezing: Individual Quick Freezing (IQF) or blast freezing achieving rapid temperature reduction to -18°C or below, preserving cellular structure and minimizing ice crystal formation

• Quality inspection: Post-freezing quality checks verifying proper freezing, absence of defects, and meeting specifications

• Packaging: Automated or semi-automated packaging into retail consumer packs or bulk foodservice containers

• Cold storage: Frozen product storage at -18°C or below maintaining quality until distribution

Quality Assurance Criteria:

Comprehensive quality control systems must monitor raw material quality upon receiving assessing maturity, freshness, and absence of defects, process parameters throughout blanching and freezing operations, final product quality through temperature verification, microbiological testing, and organoleptic evaluation, and cold chain integrity throughout storage and distribution ensuring continuous temperature maintenance.

Technical Tests:

Laboratory analysis includes microbiological testing ensuring food safety and absence of pathogens, nutritional analysis verifying vitamin and mineral retention, temperature monitoring throughout processing and storage, texture and color assessment confirming quality preservation, and pesticide residue testing ensuring agricultural input compliance.

Major Applications and Market Segments

Frozen vegetable processing serves multiple essential applications across diverse commercial and consumer categories:

Primary Applications:

• Retail consumer products: Packaged frozen vegetables for household consumption offering convenience and year-round availability

• Foodservice sector: Bulk frozen vegetables for restaurants, hotels, catering, and institutional food service providing consistent quality and reduced preparation labor

• Industrial food processing: Frozen vegetable ingredients for ready meals, soups, sauces, frozen dinners, and processed food manufacturing

• Specialty applications: Organic frozen vegetables, specialty ethnic vegetable varieties, premium vegetable medleys

End-Use Industries:

• Retail: Supermarkets, grocery stores, specialty food retailers distributing consumer packages

• Foodservice: Restaurants, hotels, catering operations, institutional cafeterias, hospitals, schools

• Industrial food processing: Ready meal manufacturers, soup producers, sauce manufacturers, frozen dinner companies

The diversity of applications creates multiple revenue opportunities and market positioning strategies, from value-oriented commodity frozen vegetables to premium organic or specialty products commanding higher margins in differentiated market segments.

Why Invest in Frozen Vegetable Processing?

Multiple strategic factors converge to make frozen vegetable processing an exceptionally attractive investment proposition:

✓ Growing Consumer Demand: Rising preference for convenient, healthy, ready-to-cook food options is significantly driving demand for frozen vegetables, with 71% of Americans familiar with plant-based products in 2025, reflecting mainstream acceptance supporting market expansion.

✓ Cost-effective & High Yield: Freezing vegetables helps minimize food waste and ensures longer shelf life, reducing spoilage risk. Processing large volumes during peak harvest seasons ensures cost-effectiveness and product availability year-round, supporting stable revenues independent of seasonal constraints.

✓ Environmental Sustainability: Frozen vegetable processing is considered more sustainable as it reduces need for long-distance fresh produce transportation, decreasing carbon emissions and waste while supporting local agricultural economies and reducing food waste throughout the supply chain.

✓ Technological Advancements: Innovations in freezing technology, particularly Individual Quick Freezing (IQF), have significantly improved texture and quality of frozen vegetables, enhancing consumer acceptance and expanding market opportunities beyond traditional commodity applications.

✓ Government Support: Various governments promote food processing as part of agricultural policy, providing subsidies, grants, infrastructure support, and favorable tax treatment enhancing project economics and reducing investment risk.

✓ Stable Long-term Demand: Frozen vegetables represent essential food category with consistent baseline demand from retail, foodservice, and industrial customers, providing revenue stability supporting long-term business planning.

✓ Diversification Opportunities: Processing capabilities enable diverse product portfolios across multiple vegetable varieties, organic and conventional options, retail and foodservice formats, and premium specialty products supporting market segmentation and margin optimization.

✓ Year-round Revenue Generation: Unlike seasonal fresh produce operations, frozen vegetable processing generates revenues throughout the year through continuous distribution of frozen inventory, smoothing cash flows and supporting operational efficiency.

✓ Value Addition to Agriculture: Processing creates premium value from agricultural commodities, supporting rural economic development and providing reliable markets for farmers encouraging agricultural investment and productivity improvements.

Industry Leadership

The global frozen vegetable processing industry features several established leaders with extensive manufacturing capacities:

Leading Frozen Vegetable Processors:

• Green Giant

• Birds Eye

• Bonduelle

• Ardo

• McCain Foods

These major processors operate large-scale facilities serving end-use sectors including retail consumer markets, foodservice applications, and industrial food processing across global markets. Their market presence demonstrates the scalability and profitability potential of professional frozen vegetable processing operations supporting diverse product portfolios and international distribution networks.

Buy Now: https://www.imarcgroup.com/checkout?id=14199&method=2175

Latest Industry Developments

The frozen vegetable sector continues to experience strategic partnerships and product innovation:

• October 2025: Birds Eye and Tefal announced new strategic partnership united by shared mission to create 'A Better Everyday' for UK households. By combining Birds Eye's trusted frozen food brands with Tefal's smart, energy-saving cooking appliances, the companies are working together to make everyday life easier, more enjoyable, and more delicious.

• April 2024: McCain Foods announced strengthened partnership with Strong Roots, the Dublin-based frozen food producer. The brands previously declared strategic partnership in 2021, with McCain investing to expand product offerings, bringing vegetable forward, environmentally responsible food choices to more consumers around the world.

These developments underscore industry trends toward strategic partnerships enhancing consumer value propositions, combining frozen vegetable products with complementary technologies supporting convenient meal preparation, and expanding plant-based, environmentally responsible product portfolios aligned with evolving consumer preferences and sustainability priorities.

Conclusion

The frozen vegetable processing sector presents an exceptionally compelling investment opportunity characterized by strong market fundamentals, favorable consumer trends supporting convenient and healthy eating, technological capabilities preserving nutritional quality, and attractive profitability potential supported by value-added transformation of agricultural commodities

For entrepreneurs and businesses seeking to participate in the essential food processing infrastructure supporting modern dietary needs, convenience demands, and nutritional accessibility, frozen vegetable processing offers a proven pathway to creating substantial value while contributing to food security, agricultural economic development, and sustainable food system solutions. The sector's robust fundamentals, supported by favorable lifestyle trends, mature processing technologies, diverse application opportunities, and stable baseline demand, combined with ongoing innovation in product development and sustainability practices, ensure continued market relevance and attractive opportunities for well-planned and professionally executed processing ventures delivering consistent quality, food safety excellence, and nutritional value across diverse market applications.

Browse Related Reports:

Polycarboxylate Ether (Pce) Production Plant Cost: https://industrytoday.co.uk/chemicals/polycarboxylate-ether-pce-production-report-2025-technical-requirements-cost-structure-and-roi-analysis

Methylene Diphenyl Diisocyanate (Mdi) Production Plant Cost: https://industrytoday.co.uk/chemicals/methylene-diphenyl-diisocyanate-mdi-production-cost-analysis-2025-capex-opex-and-roi-evaluation-for-plant-setup

Ethylene Glycol Dimethyl Ether Production Plant Cost: https://industrytoday.co.uk/chemicals/ethylene-glycol-dimethyl-ether-production-plant-setup-cost-2025-industry-trends-and-economics-details

Used Car Dealership Business Plan: https://industrytoday.co.uk/automotive/how-to-start-an-used-car-dealership-business-in-2025-investment-revenue-model-roi

Motorcycle Dealership Business Plan: https://industrytoday.co.uk/automotive/motorcycle-dealership-business-2025-costs-setup-and-profit-potential

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Services:

• Plant Setup

• Factoring Auditing

• Regulatory Approvals, and Licensing

• Company Incorporation

• Incubation Services

• Recruitment Services

• Marketing and Sales

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Frozen Vegetable Processing Plant Cost 2026: Comprehensive Project Report, Machinery Requirements and Investment Scope here

News-ID: 4373082 • Views: …

More Releases from IMARC Group

Drones Market Forecast 2025-2033 Reveals Strong Growth Opportunities Across Comm …

Market Overview

The global Drones Market was valued at USD 30.7 Billion in 2024 and is forecasted to reach USD 74.8 Billion by 2033. The market is expected to expand at a CAGR of 10.41% during 2025-2033. Growth is driven by increasing AI adoption for autonomous navigation, smart city demand for surveillance, advancements in materials and battery technology, and enhanced IoT integration enabling real-time data and urban utility.

Study Assumption Years

• Base Year:…

Geotextiles Manufacturing Cost Report 2026: Feasibility Study, Plant Setup and P …

The global geotextiles industry represents a compelling investment opportunity driven by expanding infrastructure development and increasing adoption of sustainable construction practices. Geotextiles are permeable textile materials, predominantly made of polymers, applied to rock, soil, or other geotechnical media to enhance the performance of civil engineering projects. These engineered materials are designed to perform critical functions including separation, filtration, drainage, strengthening, and protection across diverse applications.

Manufactured as woven (interlaced yarns) or…

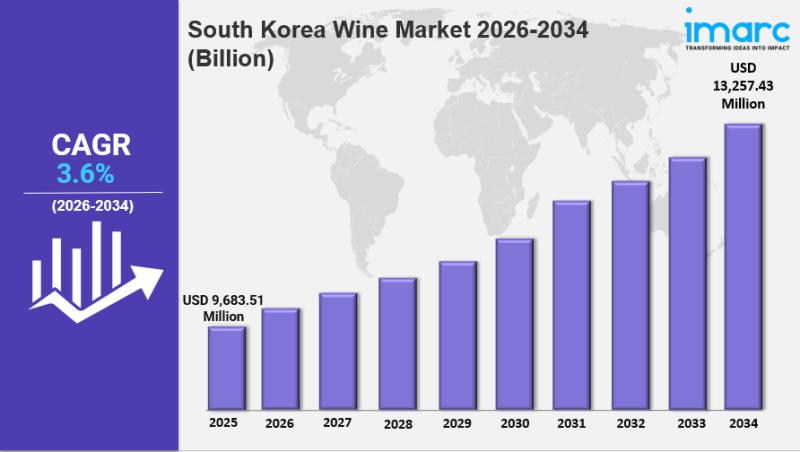

South Korea Wine Market Size, Share, Industry Overview, Trends and Forecast 2026 …

IMARC Group has recently released a new research study titled "South Korea Wine Market Size, Share, Trends and Forecast by Product Type, Color, Distribution Channel, and Region, 2026-2034", which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

South Korea Wine Market Report Overview

The South Korea wine market size was valued at USD 9,683.51 Million in 2025.…

Global Chiral Chemicals Market Edition 2025: Industry Size to Reach USD 259.42 B …

Market Overview

The global Chiral Chemicals Market was valued at USD 88.52 Billion in 2024. The market is projected to grow at a CAGR of 11.67% during the forecast period 2025-2033, reaching USD 259.42 Billion by 2033. Growth is driven by increasing demand in pharmaceuticals for enantiopure drugs, rising use in agrochemicals for eco-friendly pesticides, and advancements in chiral synthesis technologies. North America holds the largest share, supporting the market through…

More Releases for Cost

Steel Production Cost - Process Economics, Raw Materials, and Cost Drivers

Steel is the backbone of modern industry, and its production cost is one of the most closely tracked indicators across construction, infrastructure, automotive, and manufacturing sectors. Unlike niche chemicals or APIs, steel economics are driven by scale, energy intensity, and raw material volatility.

Here's the thing: steel production cost isn't just about iron ore prices. It's a layered equation involving coking coal, electricity, labor, emissions compliance, logistics, and technology choice. A…

Egg Powder Manufacturing Plant Setup Cost | Cost Involved, Machinery Cost and In …

IMARC Group's report titled "Egg Powder Manufacturing Plant Project Report 2024: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" provides a comprehensive guide for establishing an egg powder manufacturing plant. The report covers various aspects, ranging from a broad market overview to intricate details like unit operations, raw material and utility requirements, infrastructure necessities, machinery requirements, manpower needs, packaging and transportation requirements, and more.

In addition to…

Glucose Manufacturing Plant Cost Report 2024: Requirements and Cost Involved

IMARC Group's report titled "Glucose Manufacturing Plant Project Report 2024: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" provides a comprehensive guide for establishing a glucose manufacturing plant. The report covers various aspects, ranging from a broad market overview to intricate details like unit operations, raw material and utility requirements, infrastructure necessities, machinery requirements, manpower needs, packaging and transportation requirements, and more.

In addition to the operational…

Fatty Alcohol Production Cost Analysis: Plant Cost, Price Trends, Raw Materials …

Syndicated Analytics' latest report titled "Fatty Alcohol Production Cost Analysis 2023-2028: Capital Investment, Manufacturing Process, Operating Cost, Raw Materials, Industry Trends and Revenue Statistics" includes all the essential aspects that are required to understand and venture into the fatty alcohol industry. This report is based on the latest economic data, and it presents comprehensive and detailed insights regarding the primary process flow, raw material requirements, reactions involved, utility costs, operating costs, capital…

Corn Production Cost Analysis Report: Manufacturing Process, Raw Materials Requi …

The latest report titled "Corn Production Cost Report" by Procurement Resource, a global procurement research and consulting firm, provides an in-depth cost analysis of the production process of the Corn. Read More: https://www.procurementresource.com/production-cost-report-store/corn

Report Features - Details

Product Name - Corn Production

Segments Covered

Manufacturing Process: Process Flow, Material Flow, Material Balance

Raw Material and Product/s Specifications: Raw Material Consumption, Product and Co-Product Generation, Capital Investment

Land and Site Cost: Offsites/Civil Works, Equipment Cost, Auxiliary Equipment…

Crude Oil Production Cost Analysis Report: Manufacturing Process, Raw Materials …

The latest report titled "Crude Oil Production Cost Report" by Procurement Resource, a global procurement research and consulting firm, provides an in-depth cost analysis of the production process of the Crude Oil. Read More: https://www.procurementresource.com/production-cost-report-store/crude-oil

Report Features - Details

Product Name - Crude Oil

Segments Covered

Manufacturing Process: Process Flow, Material Flow, Material Balance

Raw Material and Product/s Specifications: Raw Material Consumption, Product and Co-Product Generation, Capital Investment

Land and Site Cost: Offsites/Civil Works, Equipment Cost,…