Press release

Bancassurance Market Outlook 2026-2034: Expanding Role of Banks in Insurance Distribution

Market OverviewThe global Bancassurance Market was valued at USD 1,585.4 Billion in 2025 and is projected to reach USD 2,496.2 Billion by 2034, exhibiting a CAGR of 5.17% during the forecast period of 2026-2034. Growth is driven by rising demand for integrated financial services, efficiency in financial management, and customization trends across industries. Additionally, advancements in AI, fintech partnerships, and embedded insurance are enhancing accessibility and operational efficiency.

Study Assumption Years

• Base Year: 2025

• Historical Year/Period: 2020-2025

• Forecast Year/Period: 2026-2034

Bancassurance Market Key Takeaways

• The global market size was USD 1,585.4 Billion in 2025.

• The CAGR for the period 2026-2034 is 5.17%.

• The forecast period spans from 2026 to 2034.

• Asia Pacific region accounted for the largest market share of over 45.9% in 2025.

• The market growth is propelled by increased customer demand for integrated solutions and rising convenience in managing finances.

• Technological innovations such as AI-driven risk assessment and automated claims processing are fueling market expansion.

• Fintech and insurtech partnerships are strengthening insurance distribution channels globally.

Request for sample copy of this report: https://www.imarcgroup.com/bancassurance-market/requestsample

Market Growth Factors

The bancassurance market is fueled by financial inclusion, digital transformation, and shifting consumer requirements. The collaboration between banks and insurers offers integrated financial solutions supported by regulatory policies that emphasize transparency. Rising demand for retirement planning, health coverage, and investment-linked insurance products are key growth drivers. Technological solutions including AI-based risk evaluation, automated claims, and embedded insurance products are improving accessibility and operational efficiencies globally.

Economic growth and financial literacy improvements also play crucial roles in the market surge. The World Bank predicts steady global economic growth at 2.7% for 2025-2026. Enhanced income levels have increased consumer purchasing power for insurance. Financial literacy campaigns are raising awareness about insurance benefits, thereby increasing demand. Banks leverage their established relationships to effectively cross-sell insurance products, particularly in developing economies with lower insurance penetration, broadening market outreach.

Technological advances and the rise of digitization are significant market drivers. As of 2024, 22% of companies have integrated AI applications in organizational operations, with 45% evaluating AI benefits. Predictive analytics allow identification of receptive customer groups, while digital platforms facilitate convenient online policy management and claims processing. These technologies enhance customer satisfaction and operational efficiency, rendering bancassurance more profitable and expanding its market potential.

Market Segmentation

Analysis by Product Type:

• Life Bancassurance: Constitutes approximately 75.1% of the market in 2025, driven by financial security awareness, increased disposable incomes due to rise in dual-income households, technological facilitation of policy purchase via online banking, aging populations seeking retirement security, and regulatory changes enabling bank cross-selling.

• Non-Life Bancassurance: Included as a product type

Analysis by Model Type:

• Pure Distributor: Leading model with around 38.9% market share in 2025. Characterized by banks solely acting as distributors without underwriting risk, this model benefits from low operational costs, existing bank infrastructure utilization, supportive regulatory frameworks, and customer preference for integrated financial solutions.

• Exclusive Partnership, Financial Holding, Joint Venture

Regional Insights

Asia Pacific dominates the bancassurance market, holding over 45.9% market share in 2025. This growth is driven by a burgeoning middle class with rising disposable income and financial literacy, relatively low insurance penetration offering untapped opportunities, regulatory facilitation of bancassurance partnerships, and high digital adoption in countries such as Singapore, South Korea, and China. Digital platforms enhance access and convenience, while collaborations between local banks and global insurers expand tailored solutions.

Recent Developments & News

• March 2025: YES Bank and Axis Max Life Insurance celebrated 20 years of partnership, supporting 3.62 Lakh consumers, processing over 3,725 claims, and paying Rs 267 Crore in claims across India.

• February 2025: Oman Arab Bank partnered with Takaful Oman Insurance to provide clients access to comprehensive insurance solutions via OAB's branches and digital platforms.

• January 2025: FWD Hong Kong entered a long-term bancassurance agreement with Bank SinoPac targeting high-net-worth and business clients.

• August 2024: SBI General Insurance allied with HSBC India to distribute non-life insurance products.

• May 2024: Federal Bank partnered with TATA AIA Life Insurance to offer a full range of life insurance products through Federal Bank's network.

• June 2023: ING Group and Admiral Seguros launched a digital bancassurance collaboration.

• June 2023: Crédit Agricole Egypt and Allianz Egypt renewed their bancassurance contract.

• June 2023: NongHyup Financial Group signed an MOU with PVI Insurance to enhance cooperation across reinsurance, client base expansion, and new product creation.

Key Players

• ABN AMRO Bank N.V.

• The Australia and New Zealand Banking Group Limited

• Banco Bradesco SA

• The American Express Company

• Banco Santander, S.A.

• BNP Paribas S.A.

• The ING Group

• Wells Fargo & Company

• Barclays plc

• Intesa Sanpaolo S.p.A.

• Lloyds Banking Group plc

• Citigroup Inc.

• Crédit Agricole S.A.

• HSBC Holdings plc

• NongHyup Financial Group

• Société Générale

• Nordea Group

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Request for customization: https://www.imarcgroup.com/request?type=report&id=982&flag=E

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201-971-6302

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Bancassurance Market Outlook 2026-2034: Expanding Role of Banks in Insurance Distribution here

News-ID: 4372904 • Views: …

More Releases from IMARC Group

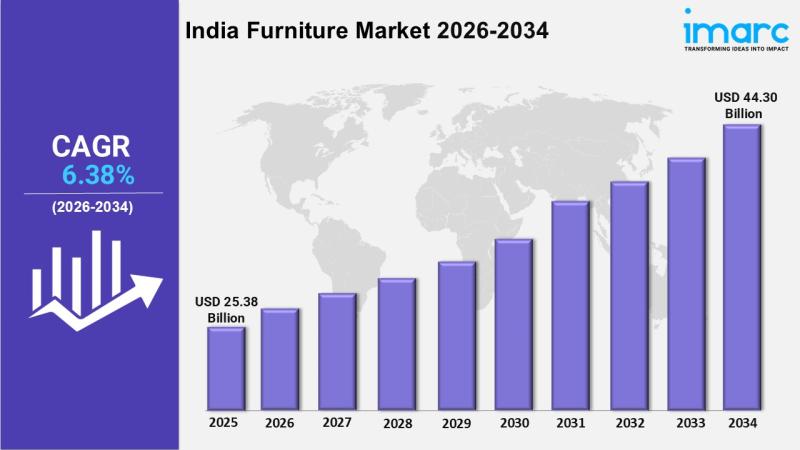

India Furniture Market to Reach USD 44.30 Billion by 2034 | 6.38% CAGR | Get Fre …

According to IMARC Group's report titled "India Furniture Market Size, Share, Trends and Forecast by Material, Distribution Channel, End Use, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Furniture Market Overview

The India furniture market size was valued at USD 25.38 Billion in 2025 and is projected to reach USD 44.30 Billion by 2034, growing at a compound annual…

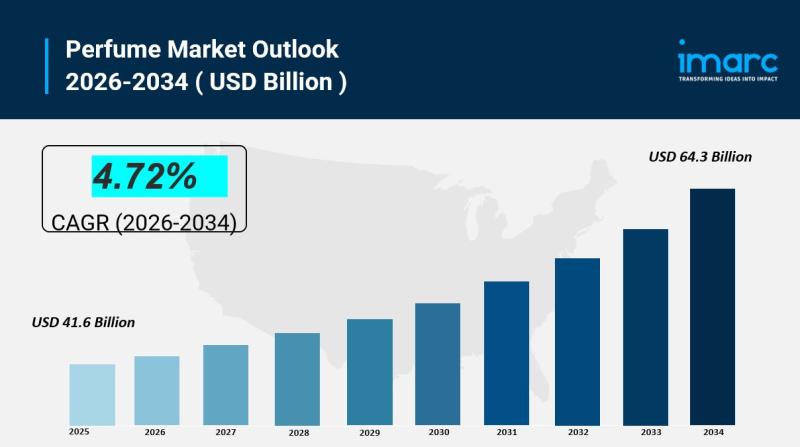

Perfume Market Size to Surpass USD 64.3 Billion by 2034 | At CAGR 4.72%

Perfume Market Overview:

The global Perfume Market was valued at USD 41.6 Billion in 2025 and is forecast to reach USD 64.3 Billion by 2034, growing at a CAGR of 4.72% during 2026-2034. This growth is driven by changing consumer trends and preferences, growing disposable income levels, rapid expansion of e-commerce and online retail, rising innovation in product development and marketing strategies, and expanding presence in emerging markets through globalization.

The global…

Global Ai In Media & Entertainment Market Report 2025: Size Projected USD 123.46 …

Market Overview

The global AI in media & entertainment market was valued at USD 19.78 Billion in 2024 and is projected to reach USD 123.46 Billion by 2033, growing at a CAGR of 22.56% during 2025-2033. Market growth is driven by rising demand for personalized content, rapid digital transformation, and advances in AI technologies. North America leads with a 33.8% market share in 2024, propelled by OTT platform growth and AI…

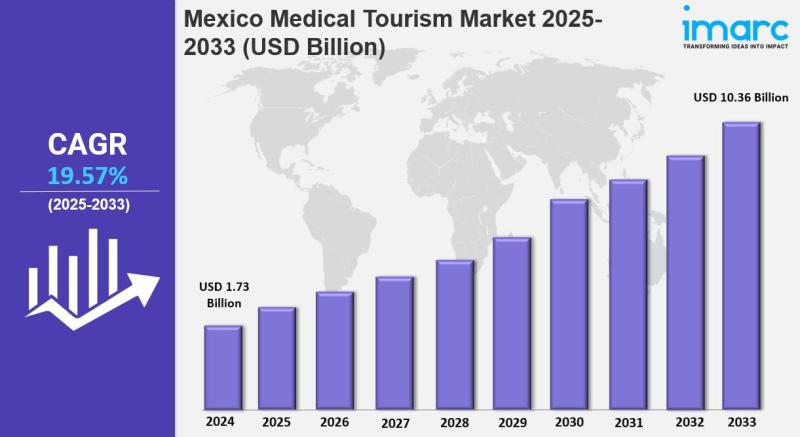

Mexico Medical Tourism Market is Projected to Reach USD 10.36 Billion by 2033 | …

IMARC Group has recently released a new research study titled "Mexico Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico medical tourism market was valued at USD 1.73 Billion in 2024 and is forecasted to reach USD 10.36 Billion…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…