Press release

Open Banking Market Empowers FinTech Innovation Through Seamless API Integration

DataM Intelligence has published a new research report on "Open Banking Market Size 2025". The report explores comprehensive and insightful Information about various key factors like Regional Growth, Segmentation, CAGR, Business Revenue Status of Top Key Players and Drivers. The purpose of this report is to provide a telescopic view of the current market size by value and volume, opportunities, and development status.Get a Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://datamintelligence.com/download-sample/open-banking-market?kb

Latest M & A

• Flutterwave acquires open banking specialist Mono - Payments and API‐driven open banking provider Mono was acquired by Flutterwave to deepen its open banking and payments infrastructure capabilities across African markets.

• BKN301 Group acquires Planky to boost AI + open banking intelligence - UK‐based BKN301 expanded its fintech stack with Planky's AI‐driven financial analytics tech, strengthening its open banking and data insights offerings.

• ACI Worldwide acquires Greek fintech Payment Components - The payment tech firm bolstered ACI Connetic with open banking, account aggregation APIs, and financial messaging components from Payment Components.

Key Players:

Banco Bilbao Vizcaya Argentaria S.A, Plaid Inc., TrueLayer Ltd, Finleap Connect, Finastra, Tink, Jack Henry & Associates, Inc, Mambu, MuleSoft and NCR Corporation.

Key Development:

January 2026

Leading banks accelerated API integrations to enhance real-time customer data access.

Regulatory bodies introduced updated guidelines to strengthen data privacy in Open Banking.

Fintech startups launched innovative open banking solutions targeting small businesses.

December 2025

Major collaborations between traditional banks and fintechs expanded cross-border payment capabilities.

Increased adoption of AI-powered analytics to personalize banking experiences.

Security frameworks were upgraded to combat rising cyber threats in Open Banking ecosystems.

November 2025

New Open Banking platforms debuted with enhanced user authentication methods.

Governments across multiple regions announced incentives to boost Open Banking adoption.

Data-sharing protocols standardized to improve interoperability among financial institutions.

Growth Forecast Projected:

The Global Open Banking Market is anticipated to rise at a considerable rate during the forecast period, between 2025 and 2032. In 2024, the market is growing at a steady rate, and with the rising adoption of strategies by key players, the market is expected to rise over the projected horizon.

Research Process:

Both primary and secondary data sources have been used in the global Open Banking Market research report. During the research process, a wide range of industry-affecting factors are examined, including governmental regulations, market conditions, competitive levels, historical data, market situation, technological advancements, upcoming developments, in related businesses, as well as market volatility, prospects, potential barriers, and challenges.

Latst Investments

Open Banking infrastructure platform Form3 secures strategic investment from Nationwide and BlackRock, boosting its U.S. expansion and API‐led payments growth.

Open Banking sector enters its next phase with the UK marking eight years of PSD2, laying foundations for agentic finance and deeper data‐driven services.

Argyle announces new funding round with Mastercard and leading VCs to accelerate open‐finance verification and real‐time payroll data connections.

Open Banking partnerships and platform launches expand globally, including new Visa A2A payment offerings and SME funding integrations via open banking data.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=open-banking-market?kb

Key Segments:

By Service: Digital Currencies , Banking & Capital Markets, Payments, Value Added Services

By Deployment: Cloud, On-premise, , By Distribution Channel, Bank Channels , App Markets, Distributors, Aggregators

Regional Analysis for Market:

⇥ North America (U.S., Canada, Mexico)

⇥ Europe (U.K., Italy, Germany, Russia, France, Spain, The Netherlands and Rest of Europe)

⇥ Asia-Pacific (India, Japan, China, South Korea, Australia, Indonesia Rest of Asia Pacific)

⇥ South America (Colombia, Brazil, Argentina, Rest of South America)

⇥ Middle East & Africa (Saudi Arabia, U.A.E., South Africa, Rest of Middle East & Africa)

Benefits of the Report:

Chapter 1: Lays the foundation by defining the scope of the report, highlighting core market segments across regions, product types, and applications. It delivers a clear snapshot of current market size, growth potential, and how the industry is expected to evolve in both the near and long term.

Chapter 2: Spotlights the most impactful market insights, unveiling the transformative trends and forces shaping the future of the industry.

Chapter 3: Provides a deep dive into the competitive landscape of , covering revenue shares, strategic initiatives, and notable mergers & acquisitions that are reshaping the market.

Chapter 4: Presents detailed company profiles of leading players featuring financial performance, product portfolios, profit margins, and key milestones that set them apart in the industry.

Chapters 5 & 6: Break down revenue analysis at both regional and country levels, offering precise data on market size, growth drivers, and expansion opportunities across global markets.

Chapter 7: Analyzes the market by product type, spotlighting segment-specific opportunities and helping stakeholders identify untapped, high-growth areas.

Chapter 8 :Explores the market through application-based segmentation, assessing demand across industries and pinpointing downstream sectors with the strongest potential for growth.

Chapter 9: Maps the industry's supply chain in detail, tracing upstream and downstream activities to provide clarity on value creation across the ecosystem.

Chapter 10: Wraps up with a concise summary of the report's key insights distilling the most critical findings and strategic takeaways for decision-makers and stakeholders.

Get Customization in the report as per your requirements: https://datamintelligence.com/customize/open-banking-market?kb

FAQ

Q1: What is the current size of the Open Banking Market?

A: The Open Banking Market was valued at US$ 20.9 billion in 2022 and is forecasted to reach US$ 129.8 billion by 2030

Q2: How rapidly will the Market expand?

A: The Open Banking market is projected to grow at a CAGR of 25.7% between 2024 and 2031.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription?kb

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg?kb

Contact Us For Custom Research: https://www.datamintelligence.com/custom-research?kb

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Open Banking Market Empowers FinTech Innovation Through Seamless API Integration here

News-ID: 4372797 • Views: …

More Releases from DataM Intelligence 4 Market Research LLP

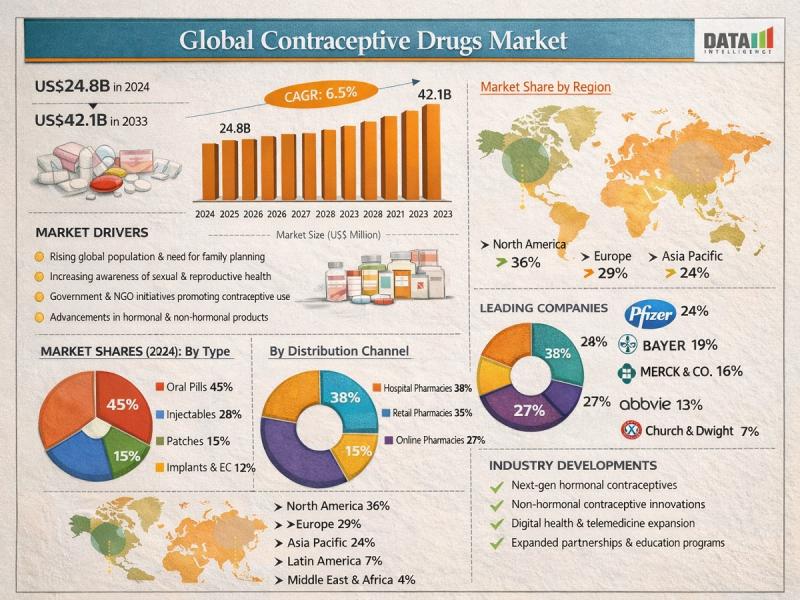

Contraceptive Drugs Market to Reach US$ 42.1 Billion by 2033 at 6.5% CAGR; North …

The global Contraceptive Drugs market was valued at US$ 24.8 billion in 2024 and is projected to reach US$ 42.1 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025-2033. Market growth is driven by increasing awareness of family planning, expanding access to contraceptive options, and strong demand for hormonal and non-hormonal contraceptives across reproductive age groups. Contraceptive pills, injectable contraceptives, implants, and emergency contraceptives are…

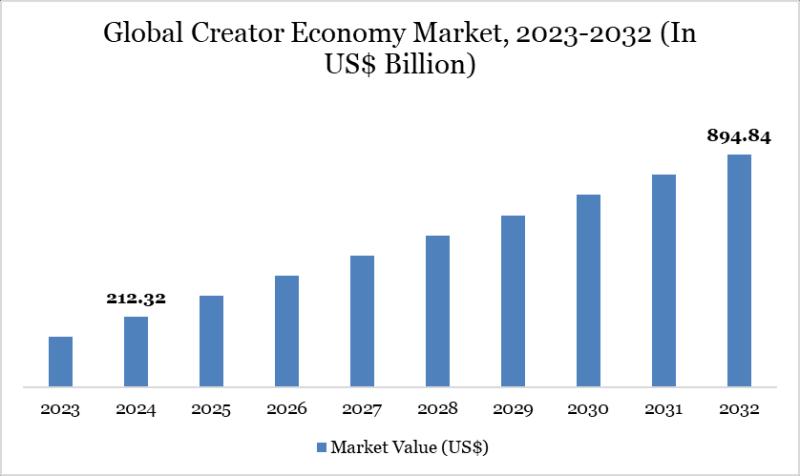

Creator Economy Market Set for Explosive Growth to USD 894.84 Billion by 2032, L …

The Global Creator Economy Market reached USD 212.32 billion in 2024 and is expected to reach USD 894.84 billion by 2032, growing at a robust CAGR of 19.70% during the forecast period 2025-2032.

Market growth is driven by the explosive rise in social media platforms, surging demand for authentic user-generated content, and expanding monetization opportunities through subscriptions, sponsorships, and digital merchandise. Advancements in AI-powered content tools, proliferation of short-form video formats,…

Precious Metal Market New Investment Avenues in Jewelry, Gold, Silver, and Finan …

DataM Intelligence has published a new research report on "Precious Metal Market Size 2025". The report explores comprehensive and insightful Information about various key factors like Regional Growth, Segmentation, CAGR, Business Revenue Status of Top Key Players and Drivers. The purpose of this report is to provide a telescopic view of the current market size by value and volume, opportunities, and development status.

Get a Sample PDF Of This Report (Get…

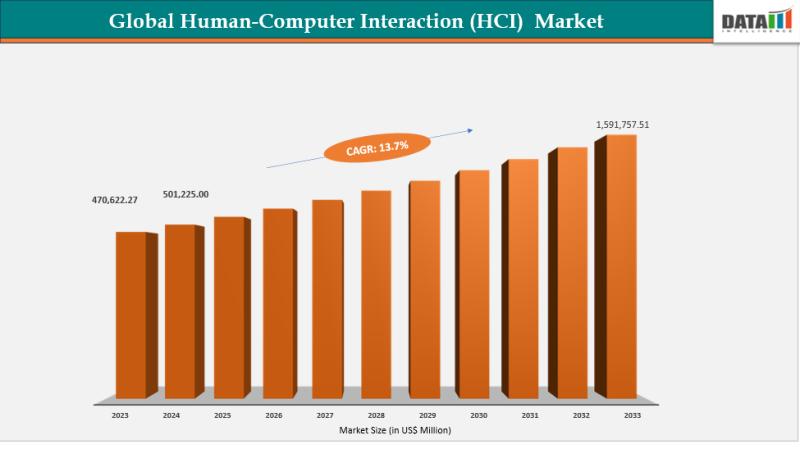

Human-Computer Interaction (HCI) Market Set for Explosive Growth to USD 1,591,75 …

The Global Human-Computer Interaction (HCI) market reached USD 501,225.00 million in 2024 and is expected to reach USD 1,591,757.51 million by 2033, growing at a CAGR of 13.7% during the forecast period 2025-2033.

Market growth is driven by the surging demand for intuitive user interfaces in consumer electronics, expanding adoption of AI-powered interactions in enterprise software, and rising integration of gesture, voice, and multimodal controls. Advancements in AR/VR technologies, proliferation of…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…