Press release

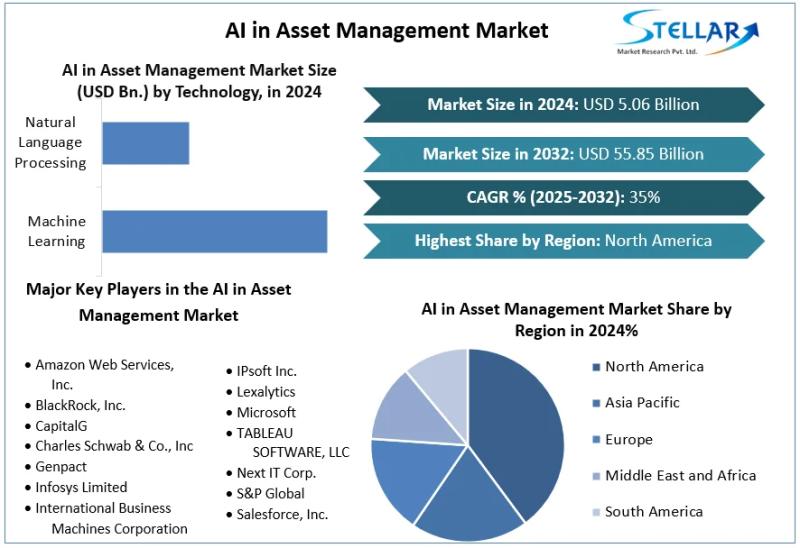

AI in Asset Management Market Growing at CAGR 35%, Ecpected To Reach USD 55.85 Billion 2032

The AI in Asset Management Market size was valued at USD 5.06 billion in 2024. The global AI in Asset Management Market is expected to reach USD 55.85 billion by 2032 with a CAGR of 35% from 2025 to 2032.The AI in asset management market is transforming the way financial institutions, investment firms, and wealth managers analyze data, manage portfolios, and serve clients. Asset management has always been driven by information, but the scale, speed, and complexity of modern financial data have made traditional approaches less efficient. Artificial intelligence brings a new layer of intelligence by enabling machines to learn from vast datasets, identify patterns, and support decision making with greater precision and speed.

➤ Request a Sample Copy of this Report (Complete TOC, Tables & Figures Included): https://www.stellarmr.com/report/req_sample/AI-in-Asset-Management-Market/1516

Today, AI is being used across the asset management value chain. From portfolio construction and risk management to trading strategies and client engagement, intelligent systems are helping firms improve performance and operational efficiency. Technologies such as machine learning, natural language processing, and predictive analytics allow asset managers to process structured and unstructured data, including market prices, financial reports, news, and even social sentiment.

The growing popularity of passive and quantitative investment strategies has further accelerated the adoption of AI. Investors are increasingly seeking data driven, transparent, and cost efficient solutions, and AI powered tools are well suited to meet these expectations. At the same time, competitive pressure in the financial services industry is pushing firms to innovate, reduce costs, and deliver more personalized investment experiences. As a result, AI is no longer a future concept in asset management but a core component of modern investment operations.

Market Dynamics

The dynamics of the AI in asset management market are shaped by technological progress, regulatory considerations, and changing investor expectations. One of the most important forces is the explosive growth of data. Financial markets generate enormous volumes of information every second, and human analysts alone cannot fully capture and interpret all of it in real time. AI systems, on the other hand, are designed to handle this scale and complexity, making them increasingly essential for competitive asset management.

Another key dynamic is the shift toward automation and efficiency. Asset management firms face constant pressure to lower fees and improve margins. By automating tasks such as data processing, reporting, compliance checks, and even parts of investment research, AI helps reduce operational costs and free up human talent for higher value activities.

However, the market also faces challenges. Data quality, model transparency, and regulatory compliance are critical concerns. Financial regulators require firms to explain their decision making processes, and some AI models are often seen as difficult to interpret. This has led to growing interest in explainable AI and robust governance frameworks. In addition, cybersecurity and data privacy remain important issues as firms rely more heavily on digital platforms and cloud based infrastructure.

Despite these challenges, ongoing improvements in computing power, cloud adoption, and AI algorithms continue to strengthen the business case for AI in asset management. The balance between innovation and risk management will remain a central theme shaping the market.

Key Drivers

One of the primary drivers of the AI in asset management market is the need for better investment decision making in increasingly complex markets. Global financial markets are influenced by a wide range of economic, political, and social factors, and AI helps firms analyze these variables more comprehensively and quickly than traditional methods.

Another major driver is the demand for personalization in wealth and asset management. Investors today expect solutions that match their individual goals, risk tolerance, and time horizons. AI enables the creation of more tailored portfolios and dynamic investment strategies by continuously learning from client behavior and market conditions.

Cost pressure and competition are also pushing adoption. The rise of low cost passive funds and digital investment platforms has forced traditional asset managers to improve efficiency and differentiate their offerings. AI driven automation and analytics help firms streamline operations, enhance performance measurement, and improve client service without significantly increasing costs.

Risk management and compliance requirements further support market growth. AI systems can monitor portfolios in real time, detect unusual patterns, and flag potential risks or compliance issues before they become serious problems. This proactive approach is becoming increasingly valuable in a tightly regulated and fast moving financial environment.

View the full coffee machines market report: https://www.stellarmr.com/report/AI-in-Asset-Management-Market/1516

Market Segmentation

By Technology

Machine Learning

Natural Language Processing

By Application

Portfolio Optimization

Conversational Platforms

Risk & Compliance

Data Analysis

Process Automation

Others

Regional Analysis

North America leads the AI in asset management market, supported by a strong financial services sector, advanced technology infrastructure, and high investment in innovation. The presence of major asset managers, fintech companies, and AI technology providers creates a dynamic ecosystem that encourages rapid adoption.

Europe is another significant market, driven by digital transformation in financial services and growing interest in data driven investment strategies. While regulatory requirements are strict, they also encourage the development of transparent and responsible AI systems.

Asia Pacific is emerging as a high growth region. Expanding capital markets, rising digital adoption, and strong interest in fintech innovation in countries such as China, Japan, India, and Singapore are creating new opportunities for AI driven asset management solutions.

Other regions, including Latin America and the Middle East and Africa, are gradually adopting these technologies as financial markets mature and digital infrastructure improves.

➤ Request a Sample Copy of this Report (Complete TOC, Tables & Figures Included): https://www.stellarmr.com/report/req_sample/AI-in-Asset-Management-Market/1516

Opportunities

The AI in asset management market offers substantial opportunities for future growth. One major opportunity lies in the development of explainable and trustworthy AI systems that meet regulatory and ethical standards while maintaining high performance. Firms that can combine advanced analytics with transparency will gain a strong competitive advantage.

Another promising area is the integration of alternative data sources such as satellite images, transaction data, and social media insights into investment models. AI is uniquely suited to process these unconventional datasets and turn them into actionable investment signals.

There is also growing potential in combining AI with human expertise through hybrid investment models. Rather than replacing fund managers, AI can act as a powerful decision support tool that enhances judgment, reduces bias, and improves consistency.

Overall, the AI in asset management market represents a fundamental shift in how investment decisions are made and delivered. As technology continues to mature and trust in intelligent systems grows, AI will play an increasingly central role in shaping the future of global asset management. If you want, I can also adapt this into LinkedIn content, a whitepaper style article, or an SEO optimized version.

AI in Asset Management Market key Players:

Amazon Web Services, Inc.

BlackRock, Inc.

CapitalG

Charles Schwab & Co., Inc

Genpact

Infosys Limited

International Business Machines Corporation

IPsoft Inc.

Lexalytics

Microsoft

TABLEAU SOFTWARE, LLC

Next IT Corp.

S&P Global

Salesforce, Inc.

Frequently Asked Questions

Q.1) What is the CAGR of the AI in Asset Management Market?

The Compound Annual Growth Rate (CAGR) of the AI in Asset Management Market is 35%.

Top Trending Reports:

BI and Analytics Market https://www.stellarmr.com/report/BI-and-Analytics-Market/1386

E-commerce Independent Software Vendors [ISVs] Market https://www.stellarmr.com/report/E-commerce-Independent-Software-Vendors-Market/1390

Kid's Digital Advertising Market https://www.stellarmr.com/report/Kids-Digital-Advertising-Market/1392

AI Voice Cloning Market https://www.stellarmr.com/report/AI-Voice-Cloning-Market/1395

Anime Merchandising Market https://www.stellarmr.com/report/Anime-Merchandising-Market/1406

Dark Fiber Network Market https://www.stellarmr.com/report/Dark-Fiber-Network-Market/1434

Mobile Content Management Market https://www.stellarmr.com/report/Mobile-Content-Management-Market-/1462

Virtual Content Creation Market https://www.stellarmr.com/report/Virtual-Content-Creation-Market/1472

Phase 3, Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor, Near,

Navale Brg, Narhe,

Pune, Maharashtra 411041

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release AI in Asset Management Market Growing at CAGR 35%, Ecpected To Reach USD 55.85 Billion 2032 here

News-ID: 4372513 • Views: …

More Releases from Stellar Market Research. PVT. LTD

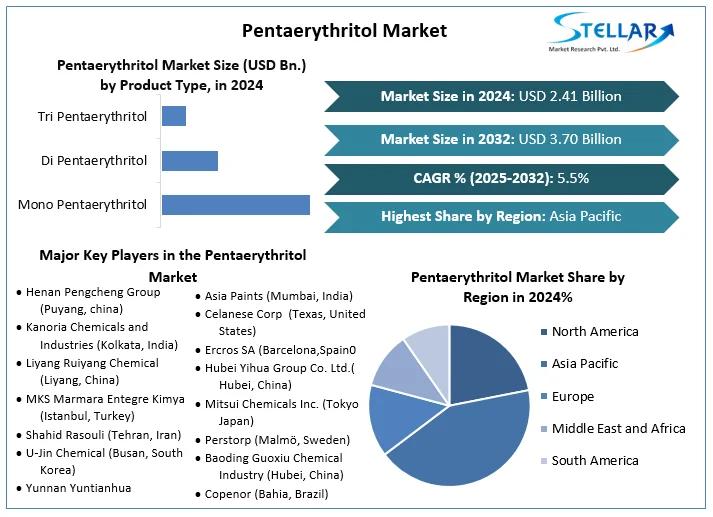

Pentaerythritol Market A Versatile Chemical Powering Modern Materials To Forecas …

Pentaerythritol Market was valued at USD 2.41 Billion in 2024. Global Pentaerythritol Market size is estimated to grow at a CAGR of 5.5 % over the forecast period.

The pentaerythritol market plays an important role in the global chemicals and materials industry, supporting a wide range of applications from coatings and resins to lubricants and explosives. Pentaerythritol is a polyhydric alcohol that serves as a key intermediate in the production of…

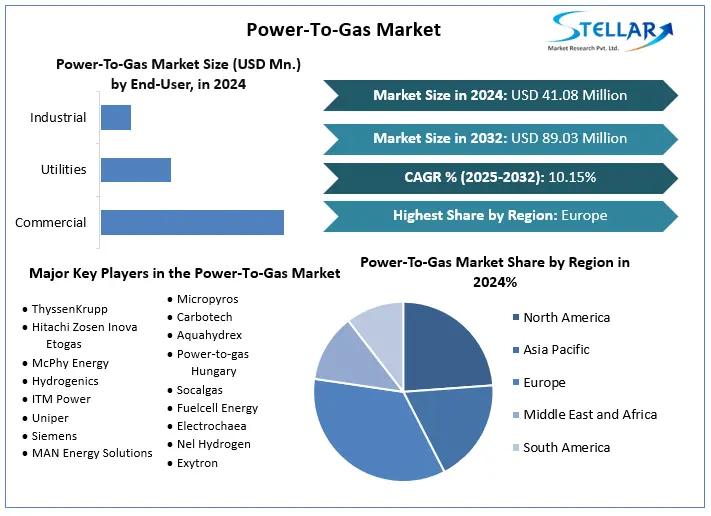

Power-To-Gas Market Growing at CAGR of 10.15%, To Reach USD 89.03 Million by 203 …

Power-To-Gas Market was valued at USD 41.08 Mn. in 2024, and it is expected to reach USD 89.03 Mn. by 2032 with a CAGR of 10.15% during the forecast period (2025-2032)

The power to gas market is emerging as an important solution for storing renewable energy and balancing modern energy systems. Power to gas refers to technologies that convert electricity, mainly from renewable sources such as wind and solar, into gaseous…

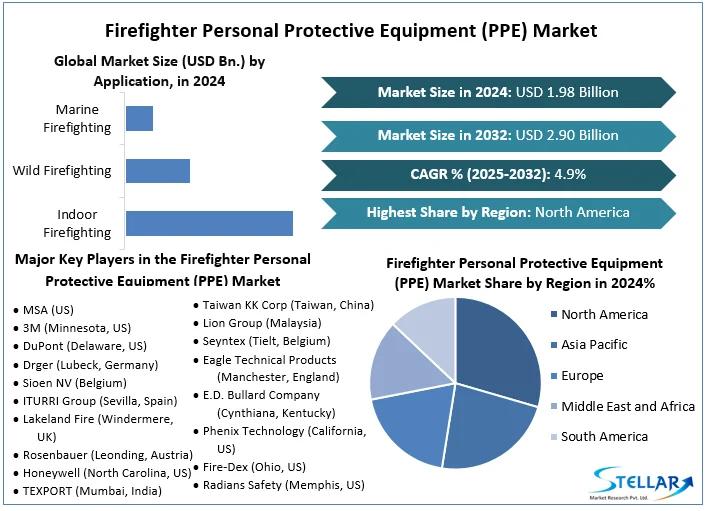

Firefighter Personal Protective Equipment Market Protecting Those Who Protect Us …

Firefighter Personal Protective Equipment (PPE) Market size was valued at USD 1.98 Bn. in 2024 and the total revenue is expected to grow at 4.9% through 2025 to 2032, reaching nearly USD 2.90 Bn. by 2032.

The firefighter personal protective equipment market plays a critical role in safeguarding the lives of firefighters who operate in some of the most dangerous environments in the world. Firefighter PPE includes a wide range of…

Raman Spectroscopy Market Unlocking Molecular Insights Across Science and Indust …

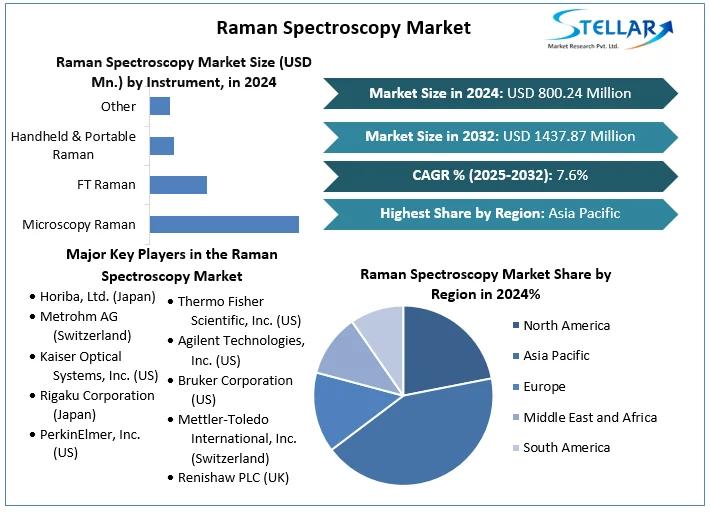

Raman Spectroscopy Market size was valued at USD 800.24 Million in 2024 and the total Raman Spectroscopy revenue is expected to grow at 7.6% through 2025 to 2032, reaching nearly USD 1437.87 Million.

The Raman spectroscopy market is gaining strong momentum as industries and research institutions increasingly rely on advanced analytical tools to understand material composition at the molecular level. Raman spectroscopy is a powerful, non destructive technique used to identify…

More Releases for Asset

Klydex Global Inc Expands Asset Coverage with New Multi-Asset Listing Framework

The new listing structure accelerates asset onboarding and improves market diversification.

Colorado, United States, 1st Dec 2025 - Klydex Global, Inc introduced an expanded multi-asset listing framework that accelerates the onboarding of high-quality digital assets. The new structure enhances screening procedures, technical integration, and market-readiness evaluation to support global asset diversification.

Klydex Global, Inc announced the launch of its enhanced multi-asset listing framework, representing a significant step toward diversifying asset choices for…

Asset Performance Management Market Is Driven By Asset Performance Management In …

Asset Performance Management (APM) has emerged as a critical solution for industries aiming to enhance the performance, reliability, and efficiency of their assets. APM systems utilize data analytics, predictive maintenance, and monitoring technologies to optimize asset performance, minimize downtime, and maximize operational efficiency. The global Asset Performance Management market is characterized by key drivers and notable trends that are reshaping how industries manage and maintain their critical assets.

Download Free PDF…

Asset Management Software

In today's dynamic business landscape, efficient asset management is more critical than ever. Sunsmart Asset Management Software is designed to empower organizations of all sizes and industries to streamline their asset-related processes, enhance control, and maximize the value of their assets.

Key Features and Benefits:

Comprehensive Asset Tracking: Our software provides a centralized platform to track and manage assets, offering real-time visibility into asset location, condition, and history, reducing the risk of…

Asset Evaluation Service Market 2023-2030 Comprehensive Research Study and Stron …

Infinity Business Insights published a new research publication on Asset Evaluation Service Market Insights, to 2030 with 113+ pages and enriched with self-explained Tables and charts in presentable format. The worldwide Asset Evaluation Service market is expected to grow at a booming CAGR during 2023-2030. It also shows the importance of the Asset Evaluation Service market main players in the sector, including their business overviews, financial summaries, and SWOT assessments.

The…

Big Boom in Asset Recovery Software Market 2020-2027 |HPE , Terrapin Systems , C …

According to a report on Asset Recovery Software Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Asset Recovery Software Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study…

Crypto Asset Management Market | Digital Asset Custody Company, Crypto Finance A …

Global Crypto Asset Management Market: Snapshot

The demand within the global market for crypto asset management has been rising on account of advancements in the field of crypto currency. The past years have been an era of advancements in the global digital industry and have paved way for several new technologies. In this stampede of digital transformations, crypto currency has emerged as a matter of discussion and recourse. Hence, the global…