Press release

Top 30 Indonesian Ceramic Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)PT Arwana Citramulia Tbk (ARNA)

PT Cahayaputra Asa Keramik Tbk (CAKK)

PT Intikeramik Alamasri Industri Tbk (IKAI)

PT Keramika Indonesia Assosiasi Tbk (KIAS)

PT Mulia Industrindo Tbk (MLIA)

PT Asahimas Flat Glass Tbk (AMFG) (glass & ceramic-adjacent)

PT Niro Ceramic Nasional Indonesia

PT Eleganza Tile Indonesia

PT Roman Ceramic International

PT Platinum Ceramics Industry

PT Granito (Citra Granito)

PT Diamond Keramik Indonesia

PT Indogress (Inti Keramik Sejahtera)

PT Indopenta Sakti Teguh

PT Sun Power Ceramics

PT Satyaraya Keramindo Indah (SRK)

PT Candra Jaya Surya

PT Royalboard Ceramics

PT Sandimas Intimitra

PT Terracotta Indonesia

PT Muliakeramik Industri Indah

PT Gemilang Mitra Sejahtera

PT Jui Shin Indonesia

PT Satya Langgeng Sentosa

PT Pusaka Marmer Indahraya (Pumarin)

PT Golden Stone Indonesia

PT Kuda Laut Mas (Mass Group)

PT Mark Dynamics Indonesia Tbk (components & related ceramics)

PT Satya Langgeng Sentosa

Royalboard Ceramics

2) Revenue results of major public companies in Indonesia summarized (per company)

PT Arwana Citramulia Tbk (ARNA) - Earnings (9M 2025): Revenue ~Rp 2,173.9 billion (~USD 130.2 M) and Net Profit ~Rp 302.1 billion (~USD 18.1 M) maintained solid profitability and margins despite rising production costs. ARNAs strong performance reflects continued domestic demand and strategic product innovation.

PT Cahayaputra Asa Keramik Tbk (CAKK) - Earnings (Q3 2025): 9M revenue ~Rp 238.9 billion (~USD 14.3 M) with a net loss of ~Rp 30.2 billion (~USD 1.8 M). While revenue grew year-on-year, CAKK continued to record structural net losses due to cost pressure and narrow margins.

PT Intikeramik Alamasri Industri Tbk (IKAI) - Available industry data notes Q3 revenues around ~Rp 71.9 billion (~USD 4.3 M) and recent quarter-on-quarter growth (~+71 % base comparison), signaling improving sales momentum. While full profitability figures arent publicly detailed, this suggests a potential return toward break-even.

PT Keramika Indonesia Assosiasi Tbk (KIAS) - Earnings (Q3 2025): Revenue ~Rp 143.6 billion (~USD 8.6 M TTM) with a net loss ~Rp 15.4 billion (~USD 0.9 M). KIAS continued to operate at a loss, reflecting competitive pressures and margin contraction in finished ceramic goods.

PT Mulia Industrindo Tbk (MLIA) (Ceramic tiles & glass) - MLIAs broader manufacturing (tiles/glass) typically shows stable demand. Financial performance has been shaped by global price cycles and input costs rather than strong profit growth.

PT Surya Toto Indonesia Tbk (TOTO) (Ceramic tiles & sanitaryware) - TOTO generally benefits from sanitaryware demand and maintains revenue tied to domestic construction cycles.

PT Mark Dynamics Indonesia Tbk (MARK) - While primarily known for porcelain and ceramic-related components. MARKs performance is influenced by broader industrial demand rather than pure tile revenue reporting.

PT Asahimas Flat Glass Tbk (AMFG) (Glass/ceramic adjacent) - Glass market participants like AMFG reported stable demand but margin pressure due to higher energy costs although not pure ceramics, AMFGs results impact the ceramic & building materials value chain.

Platinum Ceramics Industry & Roman Ceramic International - These companies are recognized industry players in tile manufacturing.

PT Granito (Citra Granito) & Diamond Keramik Indonesia - These ceramic producers are key market participants. their revenue performance generally tracks industry trends of moderate sales and tight margins.

3) Key trends & insights from Q3 2025

Revenue Growth vs. Profitability - Many ceramic producers reported top-line growth but struggled to convert sales into net profits, especially among smaller manufacturers.

Elevated Input Costs - Energy expenses and gas prices, critical for ceramic kiln operations, remained elevated, squeezing margins throughout Q3.

Competitive Pricing - Competitive dynamics in domestic markets kept pricing elastic, limiting the ability to pass cost increases to customers.

Capacity Utilization - Utilization rates improved from 2024 but are still below peak levels, restricting profitability and scaling benefits.

Domestic Demand & Export Balance - Domestic construction needs remain a core demand driver, while export markets, though promising, add cost and distribution challenges.

4) Outlook for Q4 2025 and beyond

Growth Drivers - Infrastructure and housing development are expected to sustain tile and ceramic demand into year-end and early 2026. Strategic capacity expansions and targeted product diversification (e.g., premium tiles) could enhance earnings.

Risks - Energy price volatility, particularly gas, remains the biggest operational risk. Pressure from imported ceramic goods could further compress local pricing power.

Strategic Priorities - Lean manufacturing, efficiency programs, and digital sales channels will be critical enablers of earnings improvement into 2026

5) Conclusion

As of Q3 2025, Indonesias ceramic industry demonstrates revenue resilience against a backdrop of profitability challenges. Key takeaways include:

Large players like ARNA remain profitable and maintain scale, though growth margins are compressing.

Mid and smaller ceramic firms face net losses or thin margins, evidencing competitive pressures and cost volatility.

Domestic demand remains the linchpin for stable revenue, while export strategies remain nascent for many mid-caps.

Forward guidance suggests cautious optimism: operational efficiencies and selective market expansion could lift earnings into Q4 2025 and early 2026 but risks from input cost volatility and pricing competition will persist.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top 30 Indonesian Ceramic Public Companies Q3 2025 Revenue & Performance here

News-ID: 4371479 • Views: …

More Releases from QY Research

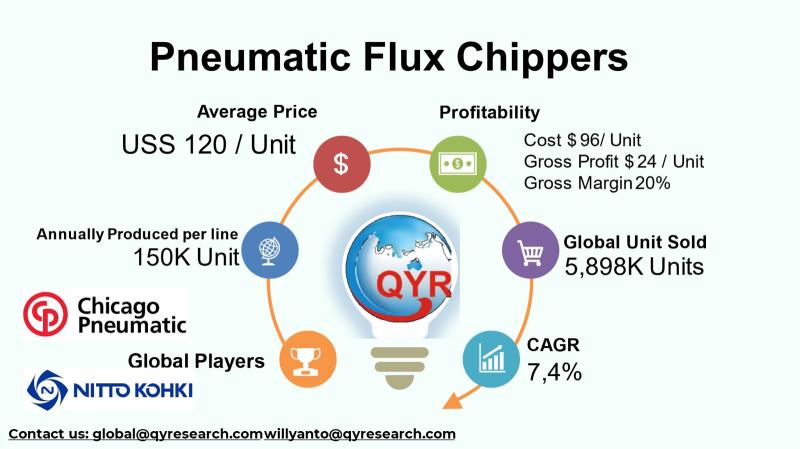

From Production to Profit: A Data-Driven Analysis of the Global Pneumatic Flux C …

Pneumatic Flux Chippers are compressed-air powered industrial hand tools used for post-weld slag and flux removal in fabrication and heavy industry. They are widely applied across shipbuilding, rail, steel fabrication, infrastructure, and heavy machinery sectors due to high impact force, minimal overheating risk, and rugged durability.

Global market size in 2024: USD 708 million expected to grow at CAGR 7.4% through 2031.

Key demand drivers: industrial production expansion, infrastructure growth, rising…

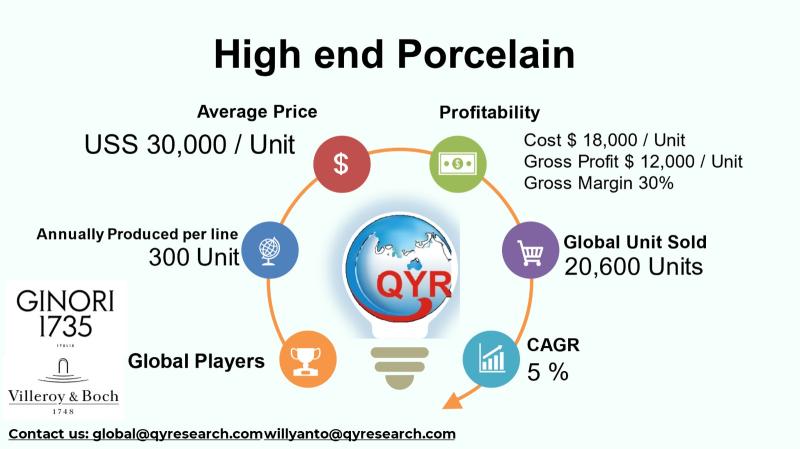

Smart Kilns & Luxury Demand: The Next Growth Cycle in High-End Porcelain

High-end porcelain refers to premium, luxury-grade ceramic and vitrified porcelain products characterized by high density, low porosity, superior translucency, aesthetic finish, and long service life.

Includes luxury tableware, sanitaryware, decorative artware, architectural porcelain panels, hotel & hospitality ware, and premium giftware.

Demand is driven by premiumization trends, luxury hospitality expansion, upscale real estate, and growth of high-income consumers in Asia-Pacific.

The sector combines traditional craftsmanship with advanced kiln automation, digital glazing, and smart…

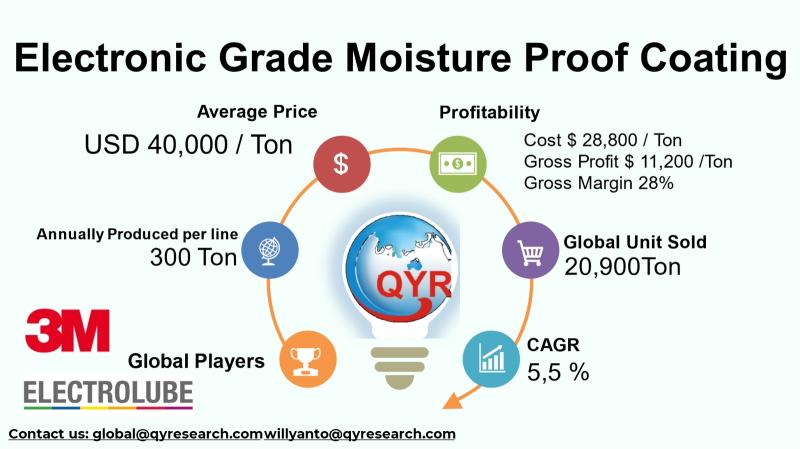

Investing in Moisture-Proof Coatings: Market Size, Regional Drivers, and Future …

Electronic grade moisture-proof coatings are advanced protective materials applied to electronic components and PCBs to shield against moisture, humidity, corrosion, and contaminants.

Core uses span consumer electronics, automotive electronics, IoT devices, telecom infrastructure, and industrial applications.

These coatings enhance device reliability and lifecycle performance, enabling operation in harsh environments and supporting miniaturization trends common in electronics manufacturing.

Global market size in 2024 was USD 836 million.

Forecast growth is supported by a CAGR…

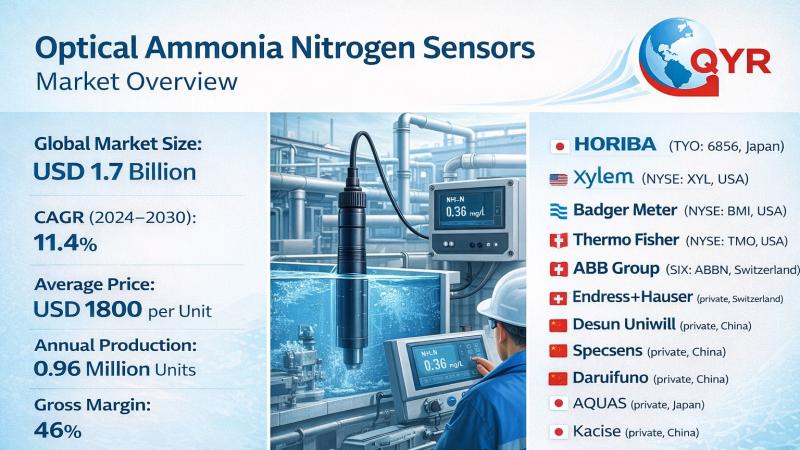

Global and U.S. Optical Ammonia Nitrogen Sensors Market Report, Published by QY …

QY Research has released a comprehensive new market report on Optical Ammonia Nitrogen Sensors, advanced water-quality monitoring instruments that measure ammonia nitrogen (NH3-N / NH4+-N) concentrations using optical detection principles rather than electrochemical reactions. By leveraging spectrophotometry, fluorescence, or colorimetric optical methods, these sensors deliver high selectivity, low drift, and reduced maintenance-making them increasingly essential for wastewater treatment, surface water monitoring, aquaculture, and industrial process control. This report provides an…

More Releases for Tbk

Indonesia Textile Industry Market Valuation Expected to Hit USD 28.57 billion by …

USA, New Jersey: According to Verified Market Research analysis, the global Indonesia Textile Industry Market size was valued at USD 21.7 Billion in 2023 and is projected to reach USD 28.57 Billion by 2031, growing at a CAGR of 3.50% from 2024 to 2031

How AI and Machine Learning Are Redefining the future of Indonesia Textile Industry Market?

AI-powered production planning systems optimize yarn selection, fabric blends, and loom utilization, improving output…

Infrastructure Market 2021 Strategic Assessments - PT. Acset Indonusa Tbk.., Pt. …

The Infrastructure Market report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The Infrastructure sector in Indonesia is…

Indonesia Telecom Tower Market Demand, Size, Share, Scope & Forecast To 2025 |To …

The Indonesia telecom tower market accounted to US$ 557.9 Mn in 2017 and is expected to grow at a CAGR of 27.1% during the forecast period 2018 – 2025, to account to US$ 3,695.5 Mn by 2025.

Get Sample Copy of this Indonesia Telecom Tower Market research report at - https://www.businessmarketinsights.com/sample/TIPRE00004113

The Business Market Insights provides you regional research analysis on “Indonesia Telecom Tower Market” and forecast to 2025. The research report…

Coal Mining in Indonesia Market 2022| PT Bumi Resources Tbk, PT Adaro Energy Tbk …

Researchmoz added Most up-to-date research on "Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption" to its huge collection of research reports.

Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption

Summary

GlobalData's "Coal Mining in Indonesia to 2022", provides a comprehensive coverage on Indonesias coal industry. It provides historical and forecast data on coal production by grade, reserves, consumption and exports by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes

Summary

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by type; exports, exports by type and exports by country. Detailed analysis of the…