Press release

Magnesium Metal Manufacturing Plant DPR - 2026, Market Trends, Machinery and ROI Outlook

The global metals and materials industry is experiencing a significant transformation driven by the growing demand for lightweight, high-strength materials across automotive, aerospace, electronics, and energy sectors. At the forefront of this evolution stands magnesium metal-the lightest structural metal available-offering an exceptional strength-to-weight ratio combined with superior corrosion resistance and thermal conductivity. As industries worldwide accelerate their transition toward lightweight components for fuel efficiency, emission reduction, and advanced performance requirements, establishing a magnesium metal manufacturing plant presents a strategically compelling investment opportunity for entrepreneurs and industrial investors seeking to capitalize on this expanding market.Market Overview and Growth Potential

The global magnesium metal market demonstrates remarkable growth momentum, valued at USD 5.89 Billion in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach USD 9.46 Billion by 2034, exhibiting a robust CAGR of 5.4% from 2026 to 2034. This sustained expansion reflects the increasing adoption of magnesium in lightweight automotive components, aerospace applications, and consumer electronics manufacturing.

Magnesium metal serves as a critical alloying material across numerous industrial applications due to its unique combination of lightweight properties, corrosion resistance, and exceptional thermal conductivity. The material functions as an optimal solution where strength-to-weight balance is paramount, making it indispensable for lightweight structural components in vehicles, aircraft, and electronic devices. Beyond structural applications, magnesium plays essential roles in battery material production, fire-resistant product manufacturing, and as a reducing agent in various chemical processes. The automotive industry in India is projected to reach a total value of USD 300 billion in 2026, creating substantial demand for lightweight materials including magnesium metal.

Request for a Sample Report: https://www.imarcgroup.com/magnesium-metal-manufacturing-plant-project-report/requestsample

Plant Capacity and Production Scale

The proposed magnesium metal manufacturing facility is designed with an annual production capacity ranging between 50,000-100,000 MT per year, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to serve diverse market segments-from automotive structural components and aerospace parts to electronics casings and fire-resistant products-ensuring steady demand and consistent revenue streams across multiple industry verticals.

Financial Viability and Profitability Analysis

The magnesium metal manufacturing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

Gross Profit Margins: 25-35%

Net Profit Margins: 10-15%

These margins are supported by stable market demand across automotive, aerospace, electronics, and construction sectors, value-added manufacturing capabilities, and the critical nature of magnesium metal in lightweighting applications. The project demonstrates strong return on investment potential based on realistic assumptions related to capital investment, operating costs, production capacity utilization, pricing trends, and demand outlook, making it an attractive proposition for both new entrants and established industrial players looking to diversify their product portfolio in the advanced materials sector.

Buy Now: https://www.imarcgroup.com/checkout?id=9404&method=2175

Operating Cost Structure

Understanding the operating expenditure is crucial for effective financial planning and cost management. The cost structure for a magnesium metal manufacturing plant is primarily driven by:

Raw Materials: 50-60% of total OpEx

Utilities: 30-35% of OpEx

The primary raw materials include dolomite ore, ferrosilicon, coal serving as both reductant and fuel, and large vacuum retorts essential for the production process. The significant utility costs reflect the energy-intensive nature of magnesium production through electrolytic reduction or thermal reduction processes. Additional operating expenses encompass labor, packaging, transportation, maintenance, depreciation, and taxes. Establishing long-term contracts with reliable suppliers for dolomite ore and other key materials helps mitigate price volatility and ensures consistent material supply, which is critical for maintaining production efficiency and cost control.

Capital Investment Requirements

Setting up a magnesium metal manufacturing plant requires substantial capital investment across several critical categories. The total capital investment depends on plant capacity, technology selection, and geographical location. Machinery costs represent the largest portion of capital expenditure, while land acquisition, site development, and infrastructure establishment form substantial components of the overall investment.

Land and Site Development: Selection of an optimal location with strategic proximity to key raw materials such as dolomite ore, ferrosilicon, and coal. The site must offer easy access to target markets to minimize distribution costs and provide robust infrastructure including reliable transportation networks, utilities, and waste management systems. The location analysis must ensure compliance with local zoning laws and environmental regulations while incorporating space for future expansion to accommodate business growth.

Machinery and Equipment: The production facility requires specialized high-quality, corrosion-resistant machinery tailored for magnesium metal manufacturing. Essential equipment includes:

• Calcination kilns for processing dolomite ore

• Electrolytic cells for electrolytic reduction process

• High-temperature furnaces for Pidgeon or silicothermic reduction processes

• Casting machines for forming magnesium products

• Refining ladles for purification operations

• Advanced cooling systems for temperature management

• Milling or pelletizing units for final product processing

• Packaging lines for finished product handling

• Comprehensive quality control and analytical instruments

All machinery must comply with industry standards for safety, efficiency, and reliability, ensuring optimal performance and long-term operational sustainability.

Civil Works: Building construction and factory layout optimization designed to enhance workflow efficiency, ensure workplace safety, and minimize material handling complexities throughout the production process. Separate areas must be designated for raw material storage, production operations, quality control laboratories, and finished goods storage.

Other Capital Costs: Pre-operative expenses, machinery installation costs, regulatory compliance certifications, initial working capital requirements, and contingency provisions for unforeseen circumstances during plant establishment. These costs also include documentation, training programs, and systems for safety protocols and environmental compliance.

Major Applications and Market Segments

Magnesium metal finds extensive applications across diverse industrial sectors, demonstrating its versatility and critical importance in modern manufacturing:

Automotive: Lightweight structural components including transmission casings, steering wheels, seat frames, and electric vehicle weight-reduction parts critical for improving fuel efficiency and reducing emissions.

Electronics: Device housings, heat dissipation components, laptop and smartphone frames, and electromagnetic interference shielding enclosures that benefit from magnesium's excellent thermal management properties.

Construction: Lightweight panels, façade elements, window frames, and corrosion-protected structural components that leverage magnesium's favorable strength-to-weight characteristics.

Telecommunication: Antenna housings, base-station enclosures, and lightweight structural parts for transmission equipment requiring durable yet lightweight materials.

Why Invest in Magnesium Metal Manufacturing?

Several compelling factors make magnesium metal manufacturing an attractive investment opportunity:

Critical Lightweight Material for Modern Industries: Magnesium metal serves as a key enabler for lightweighting across automotive, electronics, aerospace, construction, and energy sectors. It supports crucial objectives including fuel efficiency enhancement, emission reduction, superior thermal management, and advanced design requirements in next-generation products. As global industries intensify their focus on sustainability and performance optimization, magnesium's role becomes increasingly indispensable.

Moderate but Defensible Entry Barriers: While less capital-intensive than semiconductor manufacturing, magnesium metal production demands strict process control, specialized metallurgical expertise, high-temperature handling capabilities, rigorous purity specifications, comprehensive safety compliance, and extended qualification cycles with original equipment manufacturers. These requirements create meaningful barriers that favor experienced, quality-focused producers and protect established players from casual market entry.

Megatrend Alignment: Global shifts toward electric vehicles, lightweight mobility solutions, renewable energy systems, consumer electronics miniaturization, and aerospace efficiency are accelerating magnesium adoption. The convergence of electric vehicle proliferation, electronics advancement, and sustainability-driven design trends drives sustained, long-term demand growth across multiple industrial sectors.

Policy and Infrastructure Support: Government initiatives promoting energy efficiency, emission reduction, domestic manufacturing capabilities, electric vehicle adoption, and strategic metals production create favorable market conditions. Incentives for automotive development, electronics manufacturing, and advanced materials production indirectly strengthen demand for magnesium metal while supporting industry growth.

Localization and Supply Chain Security: Manufacturers increasingly prioritize regional and reliable magnesium suppliers to reduce import dependence, mitigate geopolitical risks, stabilize pricing, and ensure uninterrupted supply chains. This trend creates strong opportunities for localized magnesium metal producers with integrated operations and efficient production capabilities, particularly in regions with growing automotive and electronics manufacturing sectors.

Industry Leadership

The global magnesium metal industry is led by established manufacturers with extensive production capabilities and diverse application portfolios. Key industry players include:

• China Northern Rare Earth Group High-Tech Co., Ltd.

• United Magnesium, Inc.

• Magnesium Elektron

• U.S. Magnesium LLC

These companies serve diverse end-use sectors including automotive, aerospace, electronics, construction, and telecommunications, demonstrating the broad market applicability and strategic importance of magnesium metal products across multiple industries.

Ask an Analyst: https://www.imarcgroup.com/request?type=report&id=9404&flag=C

Recent Industry Developments

December 2025: Tidal Metals and Alexander Chemical Corporation signed a Memorandum of Understanding for marketing, packaging, and distributing chlorine, a valuable co-product produced as part of Tidal Metals' revolutionary magnesium-from-seawater process, demonstrating innovative approaches to magnesium production and value chain optimization.

May 2025: Magrathea launched its next-generation magnesium chloride electrolyzer at its pilot facility in Oakland, California. This advanced machine utilizes electricity to split magnesium salts to produce magnesium metal, representing significant technological advancement in production efficiency and environmental sustainability.

Browse Full Related Report:

• Fish Fillets Manufacturing Plant: https://industrytoday.co.uk/manufacturing/fish-fillets-manufacturing-plant-setup-report-2025-a-comprehensive-guide

• Apparel Manufacturing Plant: https://industrytoday.co.uk/manufacturing/apparel-manufacturing-plant-setup-2025-raw-material-list-machinery-cost-and-industry-trends

• Tofu Manufacturing Plant: https://industrytoday.co.uk/manufacturing/tofu-manufacturing-plant-setup-cost-2025-investment-opportunities-and-business-plan

• Whiteboard Manufacturing Plant: https://industrytoday.co.uk/manufacturing/whiteboard-manufacturing-plant-setup-cost-2025-industry-trends-and-business-plan

• Mineral Oil Manufacturing Plant: https://industrytoday.co.uk/manufacturing/mineral-oil-manufacturing-plant-setup-2025-machinery-details-industry-trends-and-cost-involved

Conclusion

The magnesium metal manufacturing sector presents a strategically positioned investment opportunity at the intersection of technological innovation, industrial lightweighting, and sustainable materials development. With favorable profit margins ranging from 25-35% gross profit and 10-15% net profit, strong policy support through energy efficiency incentives and electric vehicle promotion programs, and accelerating global demand across automotive, aerospace, electronics, and construction sectors, establishing a magnesium metal manufacturing plant offers significant potential for long-term business success and sustainable returns. The combination of moderate entry barriers, proven production technologies, diverse application markets, growing infrastructure investment, and increasing focus on supply chain localization creates an attractive value proposition for serious industrial investors committed to quality manufacturing, operational excellence, and participation in the global transition toward lightweight, high-performance materials.

About IMARC Group

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its clients' business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Magnesium Metal Manufacturing Plant DPR - 2026, Market Trends, Machinery and ROI Outlook here

News-ID: 4371031 • Views: …

More Releases from IMARC Group

Global Smart Electric Meter Market Size projected to Reach USD 48.6 Billion by 2 …

Market Overview

The global smart electric meter market was valued at USD 27.4 Billion in 2024 and is anticipated to reach USD 48.6 Billion by 2033, growing at a CAGR of 6.6% during the forecast period 2025-2033. The market's growth is driven by increasing investments in smart grid infrastructure, government initiatives for energy efficiency, urbanization, renewable energy integration, and advancements in IoT-enabled technologies for real-time energy management.

Study Assumption Years

• Base Year: 2024

• Historical…

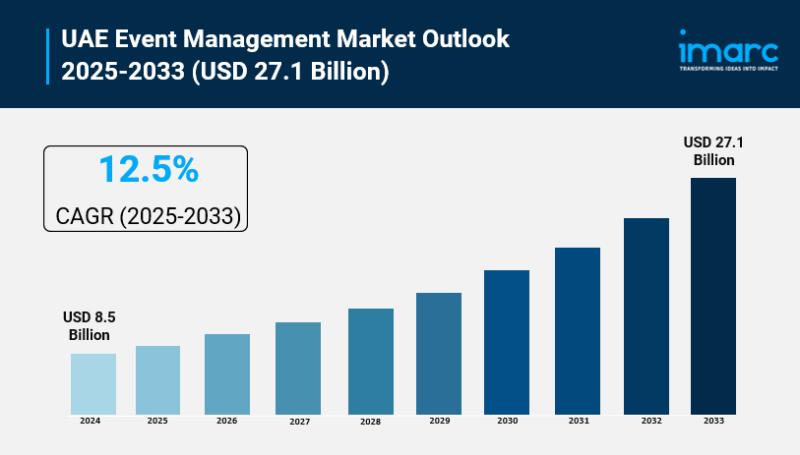

UAE Event Management Market Size To Exceed USD 27.1 Billion By 2033 | CAGR of 12 …

UAE Event Management Market Overview

Market Size in 2024: USD 8.5 Billion

Market Size in 2033: USD 27.1 Billion

Market Growth Rate 2025-2033: 12.5%

According to IMARC Group's latest research publication, "UAE Event Management Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The UAE event management market size reached USD 8.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 27.1 Billion by 2033, exhibiting a growth rate…

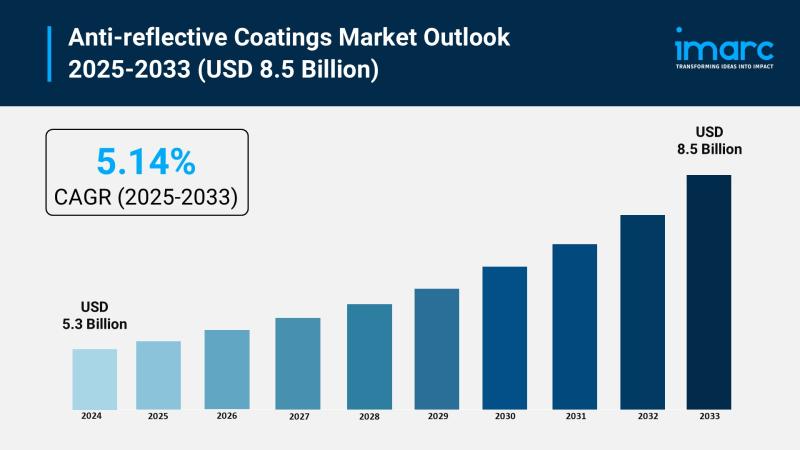

Anti-reflective Coatings Market Targets $8.5B by 2033: Growth & Insights

Market Overview:

The anti-reflective coatings market is experiencing rapid growth, driven by surging demand for solar energy efficiency, expansion of the consumer electronics ecosystem, and strategic investments in semiconductor manufacturing. According to IMARC Group's latest research publication, "Anti-reflective Coatings Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global anti-reflective coatings market size reached USD 5.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach…

Global Aerosol Paints Market Edition 2025: Industry Size to Reach USD 434.24 Mil …

Market Overview

The global aerosol paints market was valued at USD 272.82 Million in 2024 and is expected to reach USD 434.24 Million by 2033, with a CAGR of 4.88% during the forecast period 2025-2033. Growth is driven by convenience, versatility, technological advances such as low-VOC formulations, and the rising DIY culture. Asia Pacific holds the largest market share of over 33.8% in 2024, reflecting robust automotive and construction industry development.

Study…

More Releases for Magnesium

Magnesium and Magnesium Alloy Market Growth, Opportunity, Business Trend, and Fu …

The Magnesium and Magnesium Alloy Market research report added by MarketInsightsReports is an in-depth analysis of the latest trends, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market introduction, Magnesium and Magnesium Alloy market definition, regional market scope, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect elements analysis, Magnesium and Magnesium Alloy…

Magnesium and Magnesium Alloy Market Trend Expected to Guide by 2025: Focusing T …

Magnesium and Magnesium Alloy Industry research report delivers a close watch on leading competitors with strategic analysis, micro and macro market trend and scenarios, pricing analysis and a holistic overview of the market situations in the forecast period. It is a professional and a detailed report focusing on primary and secondary drivers, market share, leading segments and geographical analysis. Further, key players, major collaborations, merger & acquisitions along with trending…

Magnesium Metal Market - Global Industry Analysis, Size and Forecast 2022 by Wen …

Segmental Analysis

The segmentation of the Magnesium Metal Market globally is carried out on the basis of application and region. The application based segment of the market consists of desulphurization, die casting, aluminum alloy, metal reduction and others. The regions included in the market are APAC, North America, Europe and Rest of the World.

Receive a Sample Report @ https://www.marketresearchfuture.com/sample_request/1977

Detailed Regional Analysis

The regions included in the regional…

Metal Magnesium Market Size, Share, Growth, Revenue, Top Market Leaders - US Mag …

QYResearch is a leading market research publisher which pursuits high product quality with the belief that quality is the soul of business and consulting group has accumulated creative design methods on many high-quality markets investigation and research team with rich experience.

Report Description

Magnesium is the third most widely used structural material, after iron and aluminum. The main uses of magnesium are: making aluminum alloy, die-casting, desulfurization in steel production, and…

Magnesium Market Analysis by Top Companies: ICL, Ningxia Hui-Ye Magnesium Market …

In the recently published report, QY Research has provided a unique insight into the global Magnesium market for the forecasted period of 7-years (2018-2025). The report has covered the significant aspects that are contributing to the growth of the global Magnesium market. The primary objective of this report is to highlight the various key market dynamics such as drivers, trends, and restraints that are impacting the global Magnesium market. This…

Magnesium Metal Market Global Industry Analysis and Opportunity Assessment by To …

Segmental Analysis

The segmentation of the Magnesium Metal Market globally is carried out on the basis of application and region. The application based segment of the market consists of desulphurization, die casting, aluminum alloy, metal reduction and others. The regions included in the market are APAC, North America, Europe and Rest of the World.

Receive a Sample Report @ https://www.marketresearchfuture.com/sample_request/1977

Detailed Regional Analysis

The regions included in the regional…