Press release

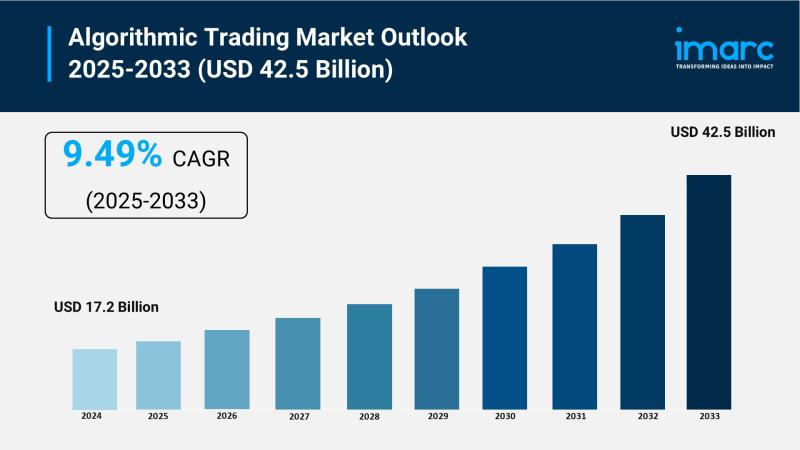

Algorithmic Trading Market to Reach USD 42.5 Billion by 2033, Growing at a CAGR of 9.49%

Market Overview:The Algorithmic Trading Market is experiencing explosive expansion, driven by Growing Use of Artificial Intelligence and Machine Learning, Rising Demand for High-Frequency Trading And Need for Better Efficiency and Lower Costs. According to IMARC Group's latest research publication, "Algorithmic Trading Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global algorithmic trading market size reached USD 17.2 billion in 2024. Looking forward, IMARC Group expects the market to reach USD 42.5 billion by 2033, exhibiting a CAGR of 9.49% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/algorithmic-trading-market/requestsample

Our Report Includes:

● Market Dynamics

● Market Trends and Outlook

● Competitive Analysis

● Industry Segmentation

● Strategic Recommendations

Growth Factors in the Algorithmic Trading Industry:

● Growing Use of Artificial Intelligence and Machine Learning

Financial companies are using more advanced AI and machine learning to improve trading decisions. Earlier systems relied on fixed rules, but modern AI models can learn and adapt over time. These systems analyze many types of data at once, such as live market prices, news headlines, social media trends, and even alternative data like satellite images. By studying all this information together, AI can spot patterns that humans or older systems might miss. Some trading firms now use AI that learns from past trades and adjusts its strategy automatically as market conditions change. This helps improve accuracy, reduce risk, and generate better long-term returns.

● Rising Demand for High-Frequency Trading

Speed is extremely important in today's financial markets. Many trading firms are focused on placing orders in milliseconds to take advantage of very small price differences. As stock exchanges in developing regions upgrade their systems to be faster, demand for high-frequency trading continues to grow. Companies are investing in special hardware, such as advanced chips and ultra-fast communication networks, to reduce delays. Many firms also place their systems physically close to exchange servers to gain speed advantages. This intense competition keeps high-frequency trading a key driver of market liquidity and trading volume.

● Need for Better Efficiency and Lower Costs

With tighter profit margins and stricter regulations, trading firms are turning to automation to cut costs and work more efficiently. Algorithmic trading reduces mistakes caused by manual trading and lowers transaction costs by placing orders in smarter ways. Automation also helps manage risk, reporting, and compliance tasks. By automating these processes, firms can handle larger trading volumes across many markets without hiring many more employees, improving overall profitability.

Key Trends in the Algorithmic Trading Market

● Shift Toward Cloud-Based Trading Systems

More trading firms are moving away from expensive in-house servers to cloud-based platforms. Cloud systems offer strong computing power that can be scaled up or down as needed. This makes it easier to test trading strategies and run complex simulations. Modern cloud providers now offer low-delay environments designed for financial trading, allowing even smaller firms to run advanced strategies that were once only possible for large banks.

● Use of Quantum-Inspired Optimization

Some firms are beginning to use quantum-inspired methods to solve very complex financial problems. While true quantum computers are still under development, these new algorithms can run on regular computers and handle difficult tasks like portfolio balancing and risk analysis more efficiently. This approach helps firms make better decisions about where to invest and how to manage risk.

● Growing Importance of Social Sentiment Analysis

Trading algorithms are now paying close attention to public opinion. Using language analysis tools, systems scan social media, online forums, and financial news to understand how investors feel. These insights help detect sudden changes in market mood, especially among retail investors. By combining sentiment data with price movements, trading systems gain an advantage in fast-moving and volatile markets.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=1641&flag=E

Leading Companies Operating in the Global Algorithmic Trading Industry:

● Vela Trading Systems LLC

● Meta-Quotes Limited

● Trading Technologies International Inc.

● Software AG

● AlgoTrader

● uTrade Solutions Private Limited

● Automated Trading SoftTech Private Limited

● Kuberre Systems Inc.

● InfoReach Inc.

● Virtu Financial Inc.

● Tata Consultancy Services

● Argo Group International Holdings Limited

● Thomson Reuters Corporation

● iRageCapital Advisory Private Limited

● 63 Moons Technologies Ltd.

● Algorithmic Trading Market Report Segmentation:

By Type:

● Foreign Exchange (FOREX)

● Stock Markets

● Exchange-Traded Fund (ETF)

● Bonds

● Cryptocurrencies

● Others

Stock markets represent the largest segment due to high liquidity, extensive data availability, and widespread adoption of algorithmic strategies by institutional investors.

Breakup by Components:

● Solutions

● Platforms

● Software Tools

● Services

● Professional Services

● Managed Services

Algorithmic trading software and infrastructure are going through an innovation phase driven by the solutions component. As technology progresses, traders constantly look for more advanced systems and platforms that can maximize their win.

By Deployment:

● Cloud-Based

● On-Premises

On-premises holds the biggest market share as large financial institutions prefer maintaining direct control over trading infrastructure for security, latency, and regulatory compliance reasons.

Breakup by Organization Size:

● Small and Medium Enterprises

● Large Enterprises

Small and medium enterprises (SMEs) are driven by advancements in technology.

Regional Insights:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

North America enjoys a leading position in the algorithmic trading market on account of advanced financial market infrastructure, high technology adoption rates, and presence of major financial institutions and trading firms.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201-971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Algorithmic Trading Market to Reach USD 42.5 Billion by 2033, Growing at a CAGR of 9.49% here

News-ID: 4370973 • Views: …

More Releases from IMARC Group

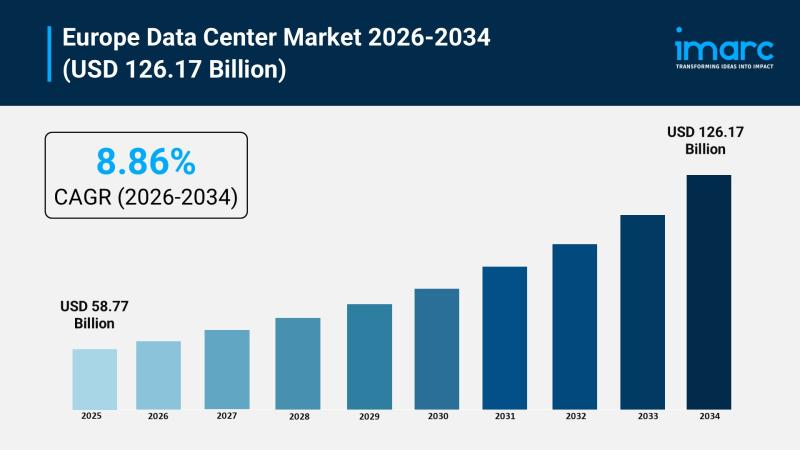

IMARC Group Forecasts 8.86% CAGR for Europe Data Center Market Amidst AI and Clo …

The Europe data center market is experiencing a critical phase of infrastructure evolution, having reached a valuation of USD 58.77 Billion in 2025. Propelled by the accelerating digitalization of the region's economy and sovereign cloud ambitions, the market is projected to reach USD 126.17 Billion by 2034. This growth trajectory represents a solid Compound Annual Growth Rate (CAGR) of 8.86% during the forecast period of 2026-2034.

Key Market Trends &…

Hot Sauce Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Proje …

Setting up a hot sauce manufacturing plant positions investors within one of the fastest-growing and flavor-driven segments of the global condiment industry, fueled by rising consumer appetite for spicy, bold, and ethnic flavors, increasing demand for clean-label and premium condiment products, and expanding utilization of hot sauce across food service, retail, and food processing applications. Made primarily from chili peppers, vinegar, salt, and complementary flavoring ingredients, hot sauce is recognized…

Glyoxylic Acid Prices Q4 2025: US Stable While Europe Remains High Price Trend

The Glyoxylic Acid Price Trend Analysis indicates dynamic shifts in global supply-demand balance, feedstock volatility, and regional trade flows. In 2026, Glyoxylic Acid Prices are reflecting fluctuations in raw material costs and downstream demand from pharmaceuticals, cosmetics, and agrochemicals. Market participants closely track the Glyoxylic Acid price index and forecast data to understand pricing momentum, risk exposure, and procurement strategies across key global regions.

Glyoxylic Acid Current Glyoxylic Acid Price Movements:

Recent…

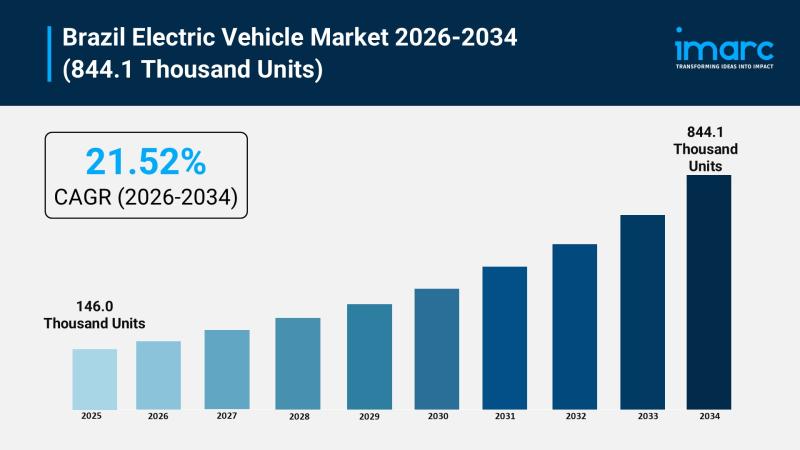

IMARC Group Forecasts 21.52% CAGR for Brazil EV Market as BYD and GWM Ramp Up Lo …

The Brazil electric vehicle (EV) market is currently witnessing an unprecedented surge, having reached a volume of 146.0 Thousand Units in 2025. Fueled by a combination of stringent environmental policies and a strategic shift toward domestic production by global automakers, the market is projected to reach 844.1 Thousand Units by 2034. This rapid expansion represents a robust Compound Annual Growth Rate (CAGR) of 21.52% during the forecast period of 2026-2034.

Key…

More Releases for Trading

Algorithmic Trading Market Showing Impressive Growth : Hudson River Trading, Jum …

The competitive landscape which incorporates the Algorithmic Trading Market ranking of the major players, along with new service/product launches, partnerships, business expansions and acquisitions in the past five years of companies profiled are also highlighted in the Algorithmic Trading Market report. Extensive company profiles comprising of company overview, company insights, product benchmarking and SWOT analysis for the major Algorithmic Trading Market players.

Top 10 key companies…

Increasing Awareness about Algorithmic Trading Market In Coming Years By Virtu F …

Global Algorithmic Trading Industry 2019 Research report provides information regarding market size, share, trends, growth, cost structure, capacity, revenue and forecast 2025. This report also includes the overall and comprehensive study of the Algorithmic Trading market with all its aspects influencing the growth of the market. This report is exhaustive quantitative analyses of the Algorithmic Trading industry and provides data for making Strategies to increase the market growth and effectiveness.

Algorithmic…

Algorithmic Trading Market 2024 SWOT Analysis by Key Players like Virtu Financia …

Algorithmic trading is a method of executing a large order (too large to fill all at once) using automated pre-programmed trading instructions accounting for variables such as time, price, and volume to send small slices of the order (child orders) out to the market over time. Algorithmic Trading are mainly used in investment banks, pension funds, mutual funds, hedge funds, etc.

Key trend which will predominantly effect the market in coming…

Automated Trading Market By Top Key Players- Citadel, KCG, Optiver, DRW Trading, …

The report "Automated Trading Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2016 - 2024", has been prepared based on an in-depth market analysis with inputs from industry experts.

An automated trading system, also referred to as mechanical trading system or algorithmic trading system, enables vendors to set up specific rules for money management, trade entries, and trade exits. Automated trading systems are generally programmed in a way…

Search4Research Announced Algorithmic Trading Market Forecast to 2024 - Virtu Fi …

Algorithmic trading is a method of executing a large order (too large to fill all at once) using automated pre-programmed trading instructions accounting for variables such as time, price, and volume to send small slices of the order (child orders) out to the market over time.

Algorithmic Trading Market provides a detail overview of latest technologies and in-depth analysis that reflect top vendor’s portfolios and technology; examines the strategic planning, challenges…

Algorithmic Trading Market 2019 | Flow Traders, Jump Trading, Spot Trading, DRW …

Global Algorithmic Trading market is also presented to the readers as a holistic snapshot of the competitive landscape within the given forecast period. The report also educates about the market strategies that are being adopted by your competitors and leading organizations. The report also focuses on all the recent industry trends. It presents a comparative detailed analysis of the all regional and player segments, offering readers a better knowledge of…