Press release

Singapore Cards and Payments Market to Reach US$ 9.54 Billion by 2034 at 8.2% CAGR; Credit and Charge Cards Dominate Transactions | Key Players DBS Group, Visa, Mastercard

The Singapore Cards and Payments market was valued at US$ 5.72 billion in 2025 and is projected to reach US$ 9.54 billion by 2034, growing at a CAGR of 8.2% during the forecast period 2026-2034. Market growth is driven by strong consumer preference for cashless transactions, widespread adoption of contactless cards, rapid expansion of e-commerce, and government-led initiatives promoting a digital payments ecosystem. Credit and charge cards dominate overall transaction value, supported by high urbanization, strong banking penetration, and advanced payment infrastructure.The market is witnessing steady momentum from investments in contactless payment terminals, merchant acceptance expansion, and digital payment innovation across retail, transport, hospitality, and online platforms. Singapore's highly banked population and tech-savvy consumers continue to accelerate card usage for everyday transactions. Credit and charge cards account for over 67% of total card payment value, while debit cards maintain strong usage for routine spending. The country remains a regional leader in digital payments, supported by regulatory stability, fintech collaboration, and continuous upgrades to payment security and efficiency.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/singapore-cards-and-payments-market?sai-v

The Singapore Cards and Payments market refers to the sector of financial services and technologies in Singapore that enable and process card-based and digital payment transactions, including credit, debit, contactless, mobile, and e-payment solutions, driven by widespread digital adoption, cashless initiatives, and advanced payment infrastructure.

Key Developments

✅ January 2026: The Singapore cards and payments market showed strong momentum driven by high digital adoption, widespread contactless card usage, and expanding e-commerce activity, with leading players such as DBS Group, OCBC Bank, United Overseas Bank (UOB), Visa, and Mastercard supporting secure, high-volume card transactions across retail and online channels.

✅ January 2026: Growth of Buy Now, Pay Later (BNPL) and real-time payments accelerated through platforms like PayNow, FAST, and NETS, with participation from Grab Financial Group, SeaMoney, Atome, and local banks enabling flexible consumer payment options and faster merchant settlements.

✅ December 2025: Banks and fintech companies including DBS, Standard Chartered Singapore, Revolut, and Wise expanded virtual card offerings and AI-driven fraud detection systems to enhance transaction security, reduce payment fraud, and improve digital onboarding experiences.

✅ December 2025: Cross-border payment capabilities strengthened as DBS Group, Ant International, and Visa expanded international QR and card interoperability, supporting regional trade, tourism spending, and SME participation in global commerce.

✅ November 2025: Regulatory and infrastructure enhancements led by the Monetary Authority of Singapore (MAS) improved governance of national payment schemes such as PayNow, FAST, and GIRO, strengthening system resilience, interoperability, and innovation readiness.

✅ October 2025: Rising acceptance of contactless card and QR payments across transport networks, hawker centres, and small retailers increased transaction volumes, with credit and debit cards from Visa, Mastercard, and American Express maintaining strong market penetration due to rewards, instalments, and convenience.

Mergers & Acquisitions

✅ January 2026: Airwallex acquired Paynuri Co. Ltd., a licensed payment services provider, to expand payment gateway capabilities, strengthen regulatory coverage, and accelerate cross-border card and payment services across Asia.

✅ December 2025: Singapore-based fintech firms including Airwallex, Nium, and Xendit completed strategic acquisitions and minority stake investments in regional payment processors to scale transaction volumes, enhance FX capabilities, and broaden merchant networks.

✅ November 2025: Nium acquired a regional card issuing and processing technology provider to enhance its global card issuance platform, improve transaction routing efficiency, and support enterprise clients with multi-currency card and payment solutions.

Key Players

HSBC | Royal Bank of Scotland | Barclays | Nationwide Building Society | Santander Singapore plc | The Co-operative Bank p.l.c | Virgin Money | Clydesdale Bank | GoCardless | PayPal UK | Worldpay | Others

Key Highlights

HSBC holds 24% market share, driven by its strong retail and corporate banking presence, advanced digital payment infrastructure, and extensive domestic and international customer base.

Barclays holds 21% market share, supported by its leadership in digital banking, payment processing capabilities, and strong adoption across consumer and merchant services.

Royal Bank of Scotland holds 15% market share, leveraging its established banking network, SME-focused financial services, and robust transaction processing systems.

Nationwide Building Society holds 10% market share, driven by its strong retail banking footprint, member-focused financial products, and growing digital payments adoption.

Santander Singapore plc holds 8% market share, supported by its international banking expertise, cross-border payment services, and expanding digital banking offerings.

Worldpay holds 7% market share, focusing on merchant acquiring, payment gateway services, and large-scale transaction processing for enterprises and SMEs.

PayPal UK holds 6% market share, driven by its strong online payment adoption, secure digital wallets, and widespread e-commerce integration.

Virgin Money holds 4% market share, supported by its digital-first banking approach and growing consumer payments portfolio.

Clydesdale Bank holds 3% market share, leveraging its regional banking presence and SME payment solutions.

The Co-operative Bank p.l.c holds 1% market share, driven by ethical banking offerings and niche customer segments.

GoCardless holds 1% market share, focusing on direct debit payment solutions and recurring payment management for businesses.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=singapore-cards-and-payments-market?sai-v

(Single User Report: USD 4350 & One Year Database Subscription: USD 12K)

Market Drivers

- Rising demand for custom business applications and digital transformation initiatives driving growth of application development software.

- Increasing adoption of low-code and no-code platforms to accelerate development cycles and empower non-technical users.

- Growth of mobile, web, and cloud-native applications requiring scalable, flexible development tools and frameworks.

- Rising focus on improving developer productivity, collaboration, and time-to-market through integrated development environments (IDEs) and DevOps toolchains.

- Advancements in AI, automation, and API-first architectures enabling faster coding, testing, and deployment.

Industry Developments

- Integration of AI-assisted programming tools, smart code completion, and automated testing capabilities within development environments.

- Expansion of low-code/no-code platforms to support enterprise app creation with minimal coding expertise.

- Adoption of cloud-based development and DevOps-as-a-service solutions for scalable, remote, and collaborative workflows.

- Strategic partnerships between platform providers, cloud hyperscalers, and enterprise customers to deliver industry-specific application frameworks.

- Enhanced security and compliance features embedded in application development software to support data protection and regulatory requirements.

Regional Insights

North America - 42% share: "Driven by strong presence of tech enterprises, high R&D investment, mature developer ecosystems, and widespread adoption of advanced development tools."

Europe - 26% share: "Supported by growing digital transformation initiatives, robust software development communities, and increasing adoption of cloud-native and low-code platforms."

Asia Pacific - 24% share: "Fueled by rapid digitalization across SMEs, expanding IT services sector, and rising demand for mobile and enterprise applications."

Latin America - 5% share: "Driven by growing software development activities, outsourcing services, and adoption of modern development tools."

Middle East & Africa - 3% share: "Supported by increasing technology investments, digital government initiatives, and rising demand for customized software solutions."

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/singapore-cards-and-payments-market?sai-v

Key Segments

By Payment Methods

Debit cards account for a significant share due to their widespread acceptance, ease of use, and direct linkage to bank accounts for everyday transactions. Credit, charge, and purchasing cards hold a strong position, supported by their use in higher-value transactions, corporate spending, and benefits such as credit periods and rewards. Cash continues to play a role, particularly in small-value and informal transactions, despite growing digitalization.

Direct debit and Bacs direct debit are widely adopted for recurring payments such as utilities, subscriptions, and insurance premiums, driven by reliability and automation. Faster payments and other remote banking methods are expanding rapidly, supported by real-time fund transfers and increasing adoption of digital banking platforms. CHAPS is primarily used for high-value, time-critical transactions. Standing orders remain relevant for fixed, regular payments, while cheques and other methods continue to see limited but ongoing use in specific business and legacy applications.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Singapore Cards and Payments Market to Reach US$ 9.54 Billion by 2034 at 8.2% CAGR; Credit and Charge Cards Dominate Transactions | Key Players DBS Group, Visa, Mastercard here

News-ID: 4370678 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

United States Automotive Transmission Market expected to reach US$ 154.14 billio …

DataM Intelligence has published a new research report on "Automotive Transmission Market Size 2025". The report explores comprehensive and insightful Information about various key factors like Regional Growth, Segmentation, CAGR, Business Revenue Status of Top Key Players and Drivers. The purpose of this report is to provide a telescopic view of the current market size by value and volume, opportunities, and development status.

Get a Sample PDF Of This Report (Get…

Animal Health Market Size to Reach US$ 119.44 Billion by 2033, Driven by Rising …

AUSTIN, Texas and TOKYO -- According to DataM Intelligence, The Animal Health Market Size reached US$ 58.64 Billion in 2023, rose to US$ 62.69 Billion in 2024 and is projected to grow to US$ 119.44 Billion by 2033, expanding at a CAGR of 7.5% between 2025 and 2033. The Animal Health Market is transforming veterinary care by prioritizing prevention, diagnostics, and sustainable practices across production and companion animals.

The shift from…

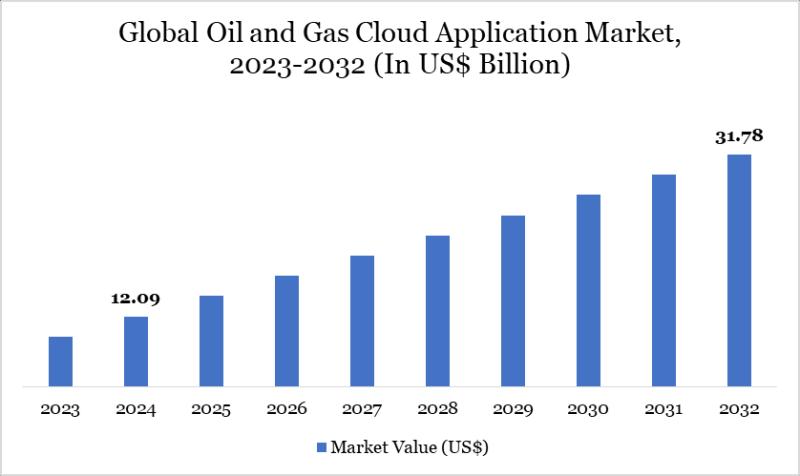

Oil and Gas Cloud Application Market Poised for Robust Expansion to USD 31.78 Bi …

The Oil and Gas Cloud Application Market reached USD 12.09 billion in 2024 and is expected to reach USD 31.78 billion by 2032, growing at a robust CAGR of 12.84% during the forecast period 2025-2032.

Market growth is driven by the escalating demand for digital transformation in upstream, midstream, and downstream operations, rising adoption of cloud-based analytics for predictive maintenance, and enhanced operational efficiency amid volatile energy prices. Advancements in AI-integrated…

Clinical Laboratory Incubator Market is set to reach 6.295 USD Billion by 2035, …

Clinical Laboratory Incubator Market Size was estimated at 3.727 USD Billion in 2024. The Laboratory Incubator industry is projected to grow from 3.908 USD Billion in 2025 to 6.295 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 4.88% during the forecast period 2025 - 2035

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):-https://www.datamintelligence.com/download-sample/clinical-laboratory-incubators-market?prtk

United States: Key Industry Developments

✅ January 2026: Laboratory…

More Releases for Singapore

Singapore Tour Packages

TripNest Launches "Explore Singapore Your Way" - A Customized Singapore Tour Package for Every Traveler

Mysore, India - [Date] - TripNest, a leading travel and holiday planning company, proudly announces the launch of its new "Explore Singapore Your Way" tour package - an exclusive travel experience crafted for Indian travelers seeking the perfect balance of adventure, leisure, and luxury in the Lion City.

Designed with flexibility and personalization in mind, TripNest's Singapore…

Singapore Probiotic Food Supplement Market Statistical Forecast, Growth Insights …

Singapore Probiotic Food Supplement Market Research Report By DataM Intelligence: A comprehensive analysis of current and emerging trends provides clarity on the dynamics of the Singapore Probiotic Food Supplement market. The report employs Porter's Five Forces model to assess key factors such as the influence of suppliers and customers, risks posed by different entities, competitive intensity, and the potential of emerging entrepreneurs, offering valuable insights. Additionally, the report presents research…

Singapore Memories: The Pinnacle of Perfumery in Singapore

In the heart of Singapore lies an olfactory haven that has garnered acclaim and admiration from both locals and tourists alike. Singapore Memories, widely celebrated as the best perfume shop in Singapore, continues to captivate scent enthusiasts with its exquisite collection of fragrances that pay homage to the rich cultural heritage and diverse flora of the region.

Unparalleled Perfumery Craftsmanship

Singapore Memories stands out in the competitive landscape of the perfume industry…

Singapore Bunker Fuel Market: Fueling Maritime Commerce | Singapore 3.5% Growing

According to a new report published by Allied Market Research, The Singapore bunker fuel market size was valued at $17.6 billion in 2020, and is projected to reach $24.5 billion by 2030, growing at a CAGR of 3.5% from 2021 to 2030.

Singapore is one of the world's largest bunkering ports and is a significant hub for the supply and trading of bunker fuel. Bunker fuel is a type of fuel…

Payroll services Singapore: Automating Businesses In Singapore Becoming More Pop …

What is payroll

Payroll is the method used to pay employees' salaries. Making a list of the personnel who need to be paid comes first, and recording the expenses comes last. It's a complicated procedure that requires cooperation from numerous teams, including payroll, HR, and finance.

1. Save money on the best payroll processing available.

In order to give you the finest service possible, a payroll services firm is always updating…

Peoplewave selected for Startup Station Singapore by Facebook and IMDA Singapore

20 February 2019, Singapore – Peoplewave, Asia’s leading data-driven HR technology company, has been selected to participate in Startup Station Singapore 2019.

Startup Station Singapore is a partnership between Facebook and the Infocomm Media Development Authority (IMDA) Singapore. Kicking off in February 2019, this programme will empower data-driven startups to accelerate their businesses in new and cutting-edge ways, while continuing to keep peoples’ trust, transparency and control over their data at…