Press release

Nut Bolt Manufacturing Plant DPR - 2026, Complete Project Cost, Machinery, and Profitability Guide

The global manufacturing, construction, and automotive industries stand firmly on the foundation of mechanical fasteners-small yet indispensable components that ensure structural integrity, mechanical stability, and operational safety across countless applications. Among these critical fastening solutions, nut bolts represent the most fundamental and universally utilized mechanical fasteners, serving as essential connectors joining components in buildings, bridges, vehicles, machinery, and industrial equipment worldwide. The automotive sector of India alone is expected to reach a total value of USD 300 billion in 2026, according to IBEF projections, demonstrating the massive industrial scale requiring billions of reliable fasteners annually. As infrastructure development accelerates globally, automotive manufacturing expands, renewable energy installations multiply, and industrial automation advances, the demand for high-quality, durable nut bolts continues growing steadily. Establishing a nut bolt manufacturing plant represents a strategically compelling investment opportunity for entrepreneurs and industrial investors seeking to capitalize on this essential component market serving construction, automotive, machinery, renewable energy, and aerospace sectors across diverse applications requiring strong, durable mechanical connections.Request for a Sample Report: https://www.imarcgroup.com/nut-bolt-manufacturing-plant-project-report/requestsample

Market Overview and Growth Potential

The global nut bolt market demonstrates solid growth trajectory and robust fundamentals. Valued at USD 93.15 Billion in 2025, the market is projected by IMARC Group to reach USD 126.95 Billion by 2034, exhibiting a steady CAGR of 3.5% from 2026 to 2034. This sustained expansion is primarily driven by increasing demand for reliable fasteners in construction sectors requiring structural connections, automotive industries demanding high-strength components, and industrial machinery sectors needing durable assemblies where strong and dependable connections are absolutely essential for structural integrity and consistent mechanical performance.

Nut bolts are mechanical fasteners universally utilized to join two or more components securely and reliably. These critical fasteners consist of two complementary parts: a nut (typically a hexagonal or square piece with precisely machined internal threading) and a bolt (a cylindrical rod featuring external threading matched to the nut specifications). The two components are ingeniously designed to be tightened together, creating clamping force that secures components firmly in place while allowing for controlled disassembly when necessary. These versatile fasteners are manufactured from numerous materials including carbon steel offering cost-effective strength, stainless steel providing superior corrosion resistance, and various specialized alloys delivering enhanced performance characteristics, with material selection depending on the specific application requirements and the level of mechanical strength, corrosion resistance, and temperature resistance required for reliable long-term service.

The nut bolt market is experiencing steady growth driven by multiple converging industry trends. The surge in infrastructure development projects worldwide, particularly within rapidly developing nations investing heavily in transportation networks, utilities, and commercial buildings, creates sustained demand for structural fasteners. Rising automotive manufacturing volumes and the ongoing transition toward electric vehicles requiring specialized high-strength fastening solutions support consistent fastener consumption. The renewable energy sector, including wind turbines, solar panel mounting systems, and energy transmission infrastructure, demands large quantities of durable, corrosion-resistant fasteners capable of withstanding harsh environmental conditions over decades of service. Industrial automation expansion requires precision fasteners for machinery assembly, robotics integration, and manufacturing equipment. The Asia-Pacific market is expected to remain dominant driven by a strong manufacturing base, especially in China and India where infrastructure investment and industrial expansion continue at unprecedented rates, while North America and Europe remain prominent markets due to developed industrial sectors, stringent quality standards, and emphasis on high-performance fastening solutions.

Plant Capacity and Production Scale

The proposed nut bolt manufacturing facility is designed with an annual production capacity ranging between 20,000-40,000 MT, enabling substantial economies of scale while maintaining operational flexibility to serve diverse customer specifications and market requirements. This strategically calibrated capacity range positions manufacturers to effectively serve multiple application segments-from construction contractors requiring structural bolts and anchor systems to automotive OEMs demanding precision-engineered engine fasteners, industrial equipment manufacturers needing heavy-duty assemblies, renewable energy developers requiring corrosion-resistant components, and aerospace companies demanding certified high-performance fasteners-ensuring steady production utilization, efficient material procurement, and diversified revenue streams across construction, automotive, machinery, renewable energy, and aerospace sectors.

Financial Viability and Profitability Analysis

The nut bolt manufacturing business demonstrates healthy profitability potential under normal operating conditions and stable steel pricing environments. The financial projections reveal attractive investment economics:

Gross Profit Margins: 25-35%

Net Profit Margins: 10-15%

These solid margins are supported by stable and growing demand across construction, automotive, and industrial sectors, the essential nature of mechanical fasteners ensuring consistent consumption across economic cycles, value-added manufacturing processes including heat treatment and surface coating commanding premium pricing, and diversified application base spanning multiple industries reducing market concentration risk. The project demonstrates strong return on investment (ROI) potential backed by proven cold forming and heat treatment technologies, established quality standards and testing protocols, growing infrastructure investment globally, expanding automotive production particularly in developing markets, and opportunities for product specialization serving high-value niche applications requiring custom specifications, making it a compelling proposition for manufacturing entrepreneurs, steel processors, and industrial investors seeking participation in essential industrial component markets.

Buy Now: https://www.imarcgroup.com/checkout?id=8671&method=2175

Operating Cost Structure

Understanding the operating expenditure (OpEx) structure is critical for effective financial planning, steel price risk management, and sustainable profitability. The cost structure for a nut bolt manufacturing plant is characterized by:

Raw Materials: 65-75% of total OpEx

Utilities: 15-20% of OpEx

Raw materials constitute the dominant portion of operating costs, with steel wire rods serving as the primary feedstock and most critical cost driver. High-quality steel wire in various grades and diameters provides the base material for cold heading operations forming bolt heads and nut bodies. Additional materials include plating chemicals such as zinc and chromate for corrosion protection and aesthetic appearance, threading lubricants facilitating thread rolling operations, heat treatment gases for controlled atmosphere furnaces, and packaging materials for finished product protection. Establishing reliable supply relationships with steel mills or metal service centers, implementing effective procurement strategies to manage steel price volatility, and optimizing material utilization to minimize and waste are absolutely essential for maintaining processing margins, ensuring production continuity, and managing the substantial commodity price risk inherent in metal fabrication operations.

Utility costs, representing 15-20% of operating expenses reflecting the energy-intensive nature of metal forming and heat treatment, encompass electricity for cold heading machines, thread rolling equipment, and material handling systems, natural gas or electricity for heat treatment furnaces maintaining precise temperature profiles, compressed air for pneumatic equipment, and water for cooling and quenching operations. Additional operational expenses include skilled labor for machine operation, quality control, and process management, maintenance programs ensuring equipment reliability and precision, quality control testing validating dimensional accuracy and mechanical properties, transportation costs for inbound steel and outbound fastener distribution, packaging for bulk or retail configurations, equipment depreciation on specialized cold forming machinery, applicable taxes, and environmental compliance costs including wastewater treatment and air quality management. Implementing energy-efficient equipment, optimizing heat treatment cycles to reduce gas consumption, maximizing material yield through improved tooling, and developing comprehensive preventive maintenance schedules can significantly reduce overall operating costs while improving product quality, dimensional consistency, and manufacturing throughput.

Capital Investment Requirements

Establishing a nut bolt manufacturing plant requires substantial capital investment strategically distributed across several critical categories:

Land and Site Development: Selection of an optimal manufacturing location with strategic proximity to steel wire rod suppliers ensuring reliable, cost-effective feedstock supply and minimizing transportation costs. The site must provide convenient access to major construction markets, automotive manufacturing clusters, and industrial zones. Essential infrastructure requirements include reliable transportation networks for receiving bulk steel deliveries and distributing finished fasteners, dependable utility supplies including three-phase electrical power, natural gas for heat treatment, and water, comprehensive waste management systems handling metal recycling and chemical waste disposal, and adequate storage facilities for steel inventory and finished product warehousing. The site selection process must carefully evaluate local zoning regulations applicable to metal manufacturing operations, environmental impact assessment requirements considering heat treatment emissions, regulatory compliance obligations, and proximity to skilled metalworking labor markets.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) is allocated to specialized metal forming equipment essential for nut bolt manufacturing operations. Key machinery includes:

• Wire Drawing Machines: Equipment reducing steel wire rod diameter to precise specifications required for cold heading operations

• Cold Headers: High-speed forging machines forming bolt heads and nut bodies through progressive metal deformation without heating

• Thread Rollers: Precision threading equipment creating external threads on bolts through cold forming process superior to thread cutting

• Heat Treatment Furnaces: Controlled atmosphere furnaces providing precise temperature profiles for hardening and tempering operations

• Quenching Systems: Rapid cooling equipment controlling metallurgical transformation and achieving specified mechanical properties

• Plating Tanks: Electroplating or hot-dip galvanizing systems applying protective zinc or other coatings for corrosion resistance

• Quality Inspection Stations: Automated testing equipment validating dimensional accuracy, thread quality, hardness, and tensile strength

• Packaging Lines: Automated weighing, counting, and packaging equipment for bulk containers or retail packaging configurations

Civil Works: Building construction including manufacturing halls with adequate floor loading capacity for heavy machinery, production facility layout optimization designed to enhance material flow from wire drawing through cold heading, threading, heat treatment, and finishing to packaging, dedicated warehousing facilities for steel wire inventory and finished fastener storage, quality control laboratories equipped with hardness testers, tensile testing machines, and dimensional inspection equipment, administrative offices, and comprehensive utility infrastructure including electrical substations, natural gas distribution, compressed air systems, water supply and treatment, and wastewater treatment facilities designed to ensure complete environmental compliance and operational safety throughout all manufacturing operations.

Other Capital Costs: Pre-operative expenses including comprehensive feasibility studies, detailed project planning and metal forming process engineering design, machinery installation and commissioning by specialized technicians, operator training programs on cold heading operations, heat treatment procedures, and quality control methods, environmental permits and regulatory approvals, initial working capital requirements covering steel wire inventory, plating chemicals, packaging materials, and operational reserves, plus contingency provisions allocated for unforeseen circumstances, tooling modifications, process optimization, or market-driven capacity adjustments during plant establishment and initial production ramp-up phases.

Major Applications and Market Segments

Nut bolts find critical and extensive applications across diverse sectors, demonstrating their fundamental importance to modern construction and manufacturing:

Automotive: Engine fasteners requiring high tensile strength and heat resistance, chassis bolts providing structural connections, suspension system nuts ensuring safe steering and handling, and high-strength structural components throughout vehicle assembly requiring precise specifications and consistent quality.

Industrial Machinery: Precision bolts for equipment assembly, heavy-duty fasteners for manufacturing machinery, and load-bearing assemblies in processing equipment, conveyors, and automation systems requiring dimensional accuracy and reliable mechanical properties.

Construction: Structural bolts for steel frame buildings and bridges, anchor bolts securing equipment and structural elements, threaded rods for connections and adjustable assemblies, and comprehensive fastening systems for steel structures requiring certified strength grades and corrosion protection.

Energy & Infrastructure: Fasteners for power generation facilities, wind turbine assembly bolts requiring exceptional fatigue resistance, pipeline connection hardware, and transmission tower structural fasteners serving critical infrastructure applications demanding long-term reliability under harsh environmental conditions.

End-use industries span construction, automotive, machinery, renewable energy, and aerospace sectors, all contributing to sustained and diversified demand that provides revenue stability, reduces dependency on single market segments, and creates multiple growth opportunities for nut bolt manufacturers serving comprehensive fastening requirements across diverse industrial and construction applications.

Why Invest in Nut Bolt Manufacturing?

Several compelling strategic factors make nut bolt manufacturing an attractive and viable investment opportunity:

Essential Industrial Component: Nut bolts are indispensable in ensuring mechanical integrity and structural stability across a wide range of industries including construction, automotive, aerospace, and machinery. Their fundamental role in creating reliable connections ensures consistent demand across economic cycles and technological changes.

Capital-Intensive but High-Demand: While establishing a nut bolt manufacturing unit requires significant capital investment in specialized cold forming and heat treatment equipment, the persistent demand for fasteners across key industrial sectors ensures long-term business viability, stable revenue streams, and attractive returns on capital deployed.

Megatrend Alignment: The rise of infrastructure projects globally, expanding automotive manufacturing particularly in developing economies, proliferating renewable energy systems requiring millions of specialized fasteners, and advancing industrial automation is driving consistent demand for reliable, high-performance fasteners capable of enduring demanding conditions and ensuring operational safety.

Government and Infrastructure Support: Policies supporting infrastructure development and industrial growth in key regions, including Make in India initiatives, infrastructure investment programs, and manufacturing incentives, boost demand for robust, durable fasteners while creating favorable business environments for domestic manufacturers.

Local Supply and Logistics Benefits: Local manufacturers are increasingly favored by OEMs and construction contractors due to cost-effective sourcing eliminating import duties and international shipping, faster delivery times supporting just-in-time manufacturing, stable supply chains reducing inventory requirements, and responsive technical support for custom specifications and quality requirements.

Ask an Analyst: https://www.imarcgroup.com/request?type=report&id=8671&flag=C

Industry Leadership

The global nut bolt manufacturing industry is led by established companies with extensive production capabilities and diverse product portfolios serving multiple industrial sectors. Key industry players include:

• ArcelorMittal

• Bosch

• Sundram Fasteners Ltd.

• Miller Products

• Bulten AB

These companies serve end-use sectors including construction, automotive, machinery, renewable energy, and aerospace, demonstrating the broad market applicability and commercial viability of nut bolt manufacturing across diverse geographical markets and application segments worldwide.

Recent Industry Developments

March 2025: Fontana Gruppo announced completion of acquiring a majority ownership stake in Right Tight Fasteners Pvt. Ltd., a leading player in the Indian fasteners market specializing in production of high-strength special bolts, including special nuts and bolts, demonstrating continued consolidation and investment in the fastener manufacturing sector.

November 2024: Sterling Tools Limited announced a strategic partnership with Kunshan GLVAC Yuantong New Energy Technology Co., Ltd., a subsidiary of China's Kunshan GuoLi Electronic Technology Co., Ltd. (GLVAC). Through its wholly-owned subsidiary Sterling Tech-Mobility Limited, Sterling Tools aims to localize production of advanced High Voltage Direct Current (HVDC) contactors and relays in India, essential components for managing current flow in electric and hybrid vehicles, reflecting the industry's evolution toward specialized automotive fastening solutions supporting electric vehicle growth.

Browse Full Related Report:

• Sanitary Pads Manufacturing Plant: https://industrytoday.co.uk/manufacturing/sanitary-pads-manufacturing-plant-setup-cost-2025-investment-opportunities-and-business-plan

• Travel Bags Manufacturing Plant: https://industrytoday.co.uk/packaging/travel-bags-manufacturing-plant-cost-2025-setup-details-capital-investments-and-business-plan

• Neem Powder Manufacturing Plant: https://industrytoday.co.uk/manufacturing/neem-powder-manufacturing-plant-setup-2025-machinery-requirements-and-cost-breakdown

• Palm Kernel Oil Manufacturing Plant: https://industrytoday.co.uk/manufacturing/palm-kernel-oil-manufacturing-plant-setup-2025-machinery-details-industry-trends-and-cost-involved

• Pharmaceutical Manufacturing Plant: https://industrytoday.co.uk/pharmaceutical/pharmaceutical-manufacturing-plant-setup-cost-2025-technology-equipment-and-roi-outlook

• Potato Flakes Manufacturing Plant: https://industrytoday.co.uk/manufacturing/potato-flakes-manufacturing-plant-setup-report-2025-industry-trends-and-machinery-cost-breakdown

Conclusion

The nut bolt manufacturing sector presents a strategically positioned investment opportunity at the intersection of essential industrial components, infrastructure development, and automotive expansion. With solid profit margins of 25-35% gross profit and 10-15% net profit, strong and diversified demand across construction, automotive, machinery, renewable energy, and aerospace sectors, favorable market growth projections with 3.5% CAGR reaching USD 126.95 Billion by 2034, and proven manufacturing technologies with established markets, establishing a nut bolt manufacturing plant offers significant potential for sustainable business success and attractive long-term returns. The combination of essential industrial component positioning ensuring consistent demand, infrastructure development driving fastener consumption globally, automotive sector growth projected to reach USD 300 billion in India alone by 2026, renewable energy expansion requiring specialized corrosion-resistant fasteners, capital-intensive operations creating entry barriers, megatrend alignment with construction and manufacturing growth, government infrastructure support policies, and local supply advantages creates a compelling value proposition for manufacturing entrepreneurs, steel processors, and industrial investors committed to quality manufacturing, operational excellence, and long-term participation in serving essential fastening requirements supporting global construction, automotive manufacturing, industrial machinery, and infrastructure development.

About IMARC Group

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its clients' business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Nut Bolt Manufacturing Plant DPR - 2026, Complete Project Cost, Machinery, and Profitability Guide here

News-ID: 4370543 • Views: …

More Releases from IMARC Group

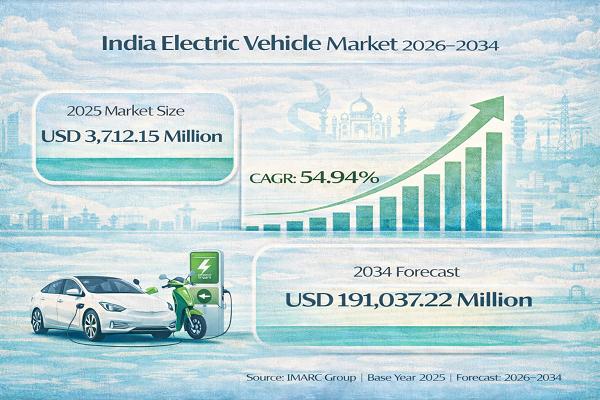

India Electric Vehicle Market Set to Reach USD 191,037.22 Million by 2034, Expan …

India Electric Vehicle Market : Report Introduction

According to IMARC Group's report titled "India Electric Vehicle Market Size, Share, Trends and Forecast by Vehicle Type, Price Category, Propulsion Type, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Free Sample Download PDF (Exclusive Offer on Corporate Email) : https://www.imarcgroup.com/india-electric-vehicle-market/requestsample

India Electric Vehicle Market Overview

The India electric vehicle market size was valued at…

United States Revenue Cycle Management Market Size, Trends, Growth and Forecast …

IMARC Group has recently released a new research study titled "United States Revenue Cycle Management Market Size, Share, Trends and Forecast by Type, Component, Deployment, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Connect with a Research Analyst Now:

https://www.imarcgroup.com/united-states-revenue-cycle-management-market/requestsample

United States Revenue Cycle Management Market Summary:

The United States revenue cycle…

LED Chip Manufacturing Plant Cost Report 2026: Demand Analysis, CapEx/OpEx & ROI …

Setting up an LED chip manufacturing plant involves strategic planning, substantial capital investment, and comprehensive understanding of semiconductor fabrication technologies. These high-performance components power everything from general illumination and displays to automotive lighting and consumer electronics. Success requires careful site selection, advanced epitaxial growth processes, sophisticated cleanroom facilities, reliable raw material sourcing, and compliance with stringent quality and environmental regulations to ensure profitable and sustainable operations.

IMARC Group's report, "LED Chip…

Eyewear Manufacturing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/OpEx, …

Setting up an eyewear manufacturing plant positions investors within a strategically important segment of the global optical and fashion accessories industry, driven by increasing demand for vision correction solutions, rising awareness of eye health, and growing fashion consciousness. As modern lifestyles advance, digital device usage expands, and the need for protective and corrective eyewear grows, eyewear continues to gain traction across prescription glasses, sunglasses, safety eyewear, and fashion accessories worldwide.…

More Releases for Plant

How to Establish a Modular Switch manufacturing plant Plant

Setting up a modular switch manufacturing facility necessitates a detailed market analysis alongside granular insights into various operational aspects, including unit processes, raw material procurement, utility provisions, infrastructure setup, machinery and technology specifications, workforce planning, logistics, and financial considerations.

IMARC Group's report titled "Modular Switch Manufacturing Plant Project Report 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" offers a comprehensive guide for establishing a modular…

How To Setup a Plant Growth Hormones Manufacturing Plant

Setting up a plant growth hormones manufacturing facility necessitates a detailed market analysis alongside granular insights into various operational aspects, including unit processes, raw material procurement, utility provisions, infrastructure setup, machinery and technology specifications, workforce planning, logistics, and financial considerations.

IMARC Group's report titled "Plant Growth Hormones Manufacturing Plant Project Report 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" offers a comprehensive guide for establishing…

Plant-Powered Eating: Trends in the Plant-Based Food Market

The plant-based food market has experienced exponential growth in recent years, driven by increasing consumer awareness of health, environmental sustainability, and ethical considerations. This burgeoning sector encompasses a wide range of products, from plant-based meat alternatives to dairy-free beverages and vegan snacks. In this overview, we'll explore key points, trends, and recent industry news shaping the plant-based food market.

Download a Free sample copy of Report:https://www.marketdigits.com/request/sample/3771

Key Companies Profiled

Amy's Kitchen

Danone S.A.

Atlantic…

Chocolate Syrup Manufacturing Plant Cost 2023-2028: Manufacturing Process, Plant …

Syndicated Analytics latest report titled "Chocolate Syrup Manufacturing Plant Project Report: Industry Trends, Project Report, Manufacturing Process, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue 2023-2028" covers all the aspects including industry performance, key success and risk factors, manufacturing requirements, project costs, and economics, expected returns on investment, profit margins, etc. required for setting up a chocolate syrup manufacturing plant. The study, which is based both on desk…

Garlic Powder Manufacturing Plant 2023-2028: Manufacturing Process, Plant Cost, …

Syndicated Analytics latest report titled "Garlic Powder Plant Project Report: Industry Trends, Manufacturing Process, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue 2023-2028" covers all the aspects including industry performance, key success, and risk factors, manufacturing requirements, project costs, and economics expected returns on investment, profit margins, etc. required for setting up a garlic powder manufacturing plant. The study, which is based both on desk research and multiple…

Frozen Food Manufacturing Plant 2023-2028: Project Report, Business Plan, Plant …

Syndicated Analytics latest report titled "Frozen Food Manufacturing Plant Project Report: Industry Trends, Manufacturing Process, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue 2023-2028" covers all the aspects including industry performance, key success, and risk factors, manufacturing requirements, project costs, and economics, expected returns on investment, profit margins, etc. required for setting up a frozen food manufacturing plant. The study, which is based both on desk research and…