Press release

Debt Collection Software Market to Reach US$ 16.3 Billion by 2033 at 9.9% CAGR; North America Leads with 39% Share | Key Players FICO, Sopra Banking Software, Katabat

The global Debt Collection Software market was valued at US$ 5.8 billion in 2024 and is projected to reach US$ 16.3 billion by 2033, expanding at a CAGR of 9.9% during the forecast period 2025-2033. Market growth is driven by rising consumer and commercial debt levels, increasing credit card and loan usage, and the growing need for efficient, compliant, and automated debt recovery processes. Organizations are steadily replacing manual and paper-based collection methods with digital platforms that improve recovery rates, streamline workflows, and ensure adherence to evolving financial regulations.The market is benefiting from strong investments in cloud-based platforms, automation-driven collection tools, and regulatory-compliant systems that help lenders and collection agencies manage high account volumes with better transparency and control. Financial institutions are prioritizing software upgrades to reduce operational costs and improve customer engagement during the recovery process. North America holds the largest market share, supported by high debt volumes, strong financial infrastructure, and early adoption of digital collection systems. Asia-Pacific is the fastest-growing region, driven by expanding credit markets, rapid digitization of financial services, and increasing demand for structured debt management solutions, while Europe continues to show steady growth supported by strict compliance standards and mature banking systems.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/debt-collection-software-market?sai-v

The Debt Collection Software market refers to the sector of software solutions designed to help businesses automate, manage, and optimize the process of recovering outstanding debts from customers.

Key Developments

✅ January 2026: In North America, adoption of AI-driven debt collection software increased among major banks and fintech lenders such as Fiserv, FIS, Equifax, and TransUnion, using automated risk scoring and predictive segmentation to improve recovery rates and reduce delinquency.

✅ January 2026: In Europe, enterprises including Experian, Sage Group, TSYS, and regional banks expanded deployment of cloud-based collection platforms with advanced analytics and compliance modules to align with GDPR and updated regulatory requirements, strengthening cross-border receivables management.

✅ December 2025: In Asia-Pacific, growth in consumer credit and digital lending pushed adoption of integrated debt collection systems by Tech Mahindra, Tata Consultancy Services (TCS), NCS Group, and regional financial institutions to automate communication workflows and enhance debtor engagement.

✅ December 2025: Globally, integration of machine learning and natural language processing into debt collection solutions advanced voice- and text-based debtor outreach, with SAP, Oracle, Verint, and NICE Systems enabling automated contact prioritization, compliance monitoring, and sentiment analysis to boost recovery efficiency.

✅ November 2025: In the Middle East and Africa, financial services providers such as Standard Chartered, Absa Group, and Emirates NBD adopted modular debt collection suites to improve regulatory reporting, multilingual communication, and credit risk management.

✅ October 2025: Worldwide, increased focus on digital transformation and cloud-native architectures accelerated demand for API-driven debt collection platforms integrating with core banking and CRM systems, led by Microsoft Dynamics 365, Salesforce, and Zendesk.

Mergers & Acquisitions

✅ January 2026: Fiserv, Inc. acquired CollectTech Solutions, a debt collection automation software provider, to expand receivables management capabilities and enhance AI-based scoring and workflow automation for financial services clients.

✅ December 2025: Sage Group plc acquired DebtFlow Analytics, a European debt collection platform specialist, to strengthen its SMB footprint and embed advanced analytics into cloud ERP and receivables solutions.

✅ November 2025: Verint Systems acquired Nexa Collections, an AI-powered debtor engagement and workflow automation company, to broaden enterprise customer experience offerings and extend omnichannel debt recovery capabilities.

Key Players

FICO | Totality Software | Seikosoft | Sopra Banking Software | My DSO Manager | Agreeya Solutions | Indus Software | CSS Impact | Pamer Systems | Advantage Software Factory | Katabat | Debtrak | Others

Key Highlights

FICO holds 23% share, driven by its industry-leading analytics, credit decisioning platforms, and widespread adoption of its debt collection and recovery solutions by global financial institutions.

Sopra Banking Software holds 17% share, supported by its end-to-end banking platforms, strong European presence, and deep integration of collections, recoveries, and core banking systems.

Katabat holds 12% share, leveraging cloud-native SaaS collections platforms, configurable workflows, and strong traction among mid-to-large financial services firms.

Debtrak holds 10% share, driven by its specialized debt management and collections software, compliance-focused design, and strong presence in public sector and utilities.

Totality Software holds 8% share, focusing on scalable collections management systems and long-standing deployments across banks and credit unions.

CSS Impact holds 7% share, supported by its enterprise collections systems, multi-channel customer engagement tools, and global implementation experience.

My DSO Manager holds 6% share, concentrating on accounts receivable and credit management software with strong adoption among SMEs and corporate finance teams.

Pamer Systems holds 5% share, driven by its niche expertise in credit and collections software for financial institutions and healthcare organizations.

Agreeya Solutions holds 4% share, contributing through customized debt recovery platforms and IT services for BFSI clients.

Seikosoft holds 3% share, focusing on regional banking and financial software solutions.

Indus Software holds 2% share, supporting localized collections and financial management platforms.

Advantage Software Factory holds 2% share, providing specialized recovery and compliance software solutions.

Others hold 2-5% share, comprising regional vendors and emerging fintech companies expanding digital debt collection and recovery capabilities.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=debt-collection-software-market?sai-v

(Single User Report: USD 4350 & One Year Database Subscription: USD 12K)

Market Drivers

- Rising levels of consumer and commercial debt increasing demand for efficient, automated debt recovery solutions across financial institutions and collection agencies.

- Growing regulatory scrutiny and compliance requirements encouraging adoption of structured, auditable, and compliant debt collection software platforms.

- Increasing need to improve collection efficiency, reduce operational costs, and enhance recovery rates through automation and analytics.

- Expansion of digital payment channels and omnichannel communication driving demand for software that supports SMS, email, IVR, chatbots, and self-service portals.

- Advancements in AI, machine learning, and data analytics enabling smarter segmentation, predictive scoring, and personalized collection strategies.

Industry Developments

- Integration of AI-driven analytics for debtor profiling, payment behavior prediction, and optimized collection workflows.

- Shift toward cloud-based and SaaS debt collection software offering scalability, remote access, and lower total cost of ownership.

- Incorporation of omnichannel communication tools to improve customer engagement and increase repayment success rates.

- Strategic partnerships between software vendors, fintech firms, and financial institutions to enhance product capabilities and market reach.

- Enhanced focus on compliance management features, including audit trails, data security, and adherence to regional debt collection regulations.

Regional Insights

North America - 39% share: "Driven by high consumer debt levels, strong presence of collection agencies, advanced financial IT infrastructure, and strict regulatory compliance requirements."

Europe - 28% share: "Supported by mature banking sectors, robust regulatory frameworks, and growing adoption of compliant digital collection platforms."

Asia Pacific - 24% share: "Fueled by expanding credit usage, rapid digitization of financial services, and increasing demand for automated debt recovery solutions."

Latin America - 6% share: "Driven by rising consumer lending, improving financial infrastructure, and adoption of digital collection tools."

Middle East & Africa - 3% share: "Supported by developing credit markets, gradual adoption of financial technologies, and growing focus on structured debt recovery systems."

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/debt-collection-software-market?sai-v

Key Segments

By Deployment Type

Cloud deployment dominates the market due to its scalability, cost efficiency, and ease of integration with existing enterprise systems, enabling organizations to rapidly deploy and update solutions. On-premises deployment continues to hold a significant share, particularly among enterprises with strict data security, compliance requirements, and legacy infrastructure preferences.

By End User

The BFSI sector represents a major share, driven by the need for secure data management, risk mitigation, and regulatory compliance. Healthcare is a fast-growing end-user segment, supported by increasing digitalization of patient data and demand for secure, interoperable systems. Telecom holds a substantial share due to large-scale data processing needs and network optimization requirements, while other sectors such as retail, manufacturing, and government are steadily adopting these solutions to improve operational efficiency.

By Offering Type

Software offerings account for the largest share, as organizations prioritize advanced analytics, automation, and platform-based solutions. Services are expanding rapidly, driven by growing demand for implementation support, customization, training, and ongoing maintenance to maximize solution effectiveness.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Debt Collection Software Market to Reach US$ 16.3 Billion by 2033 at 9.9% CAGR; North America Leads with 39% Share | Key Players FICO, Sopra Banking Software, Katabat here

News-ID: 4368629 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

U.S. Alzheimer Drugs Market Set for Explosive Growth to USD 8.84 Billion by 2031 …

Leander Texas -

The Alzheimer Drugs Market reached US$ 4.46 billion in 2023 and is expected to reach US$ 18.33 billion by 2031, growing at a CAGR of 19.4% during the forecast period 2024-2031.

The Alzheimer's drugs market growth is driven by key US-Japan collaborations and approvals, including the JCR Pharma-Acumen Pharmaceuticals partnership to develop a novel blood-brain barrier Alzheimer therapy and expanded use of Eisai/Biogen's lecanemab with new subcutaneous application and…

Micro Nuclear Reactors (MNRs) Market to Reach US$ 4,865.85 Million by 2032 at 18 …

The Micro Nuclear Reactors (MNRs) Market reached US$ 1,434.55 million in 2024 and is projected to reach US$ 4,865.85 million by 2032, growing at a CAGR of 18.26 percent during the forecast period 2025 to 2032.

Market growth is driven by increasing demand for reliable, low-carbon energy solutions, supportive government policies promoting clean power generation, and the need for decentralized power in remote and industrial applications. Micro nuclear reactors offer scalable,…

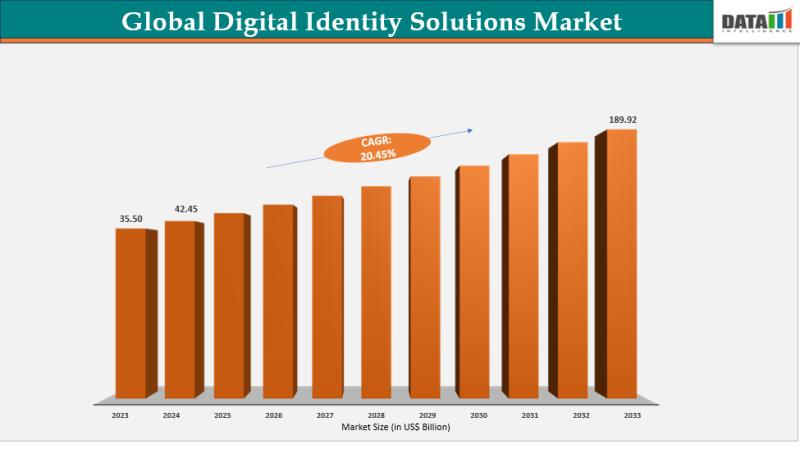

Digital Identity Solutions Market Set for Explosive Growth to US$189.92 Billion …

The Global Digital Identity Solutions Market reached US$35.50 billion in 2023, with a rise to US$42.45 billion in 2024, and is expected to reach US$189.92 billion by 2033, growing at a CAGR of 20.45% during the forecast period 2025-2033.

Market growth is driven by escalating cybersecurity threats, surging demand for secure authentication in remote work and e-commerce, and widespread adoption of biometric and blockchain-based verification. Advancements in AI-powered fraud detection, expanding…

Iron Ore Mining Market Set for Strong Growth to USD 620.7 Billion by 2031, Led b …

Leander Texas -

Iron Ore Mining Market reached US$ 330.2 billion in 2022 and is expected to reach US$ 620.7 billion by 2031, growing with a CAGR of 8.2% during the forecast period 2024-2031.

The Iron Ore Mining Market's strong growth is boosted by rising infrastructure and steel demand in the U.S. and Japan, coupled with strategic developments like Japanese firms acquiring stakes in global iron ore assets and collaborations with U.S.…

More Releases for Software

Takeoff Software Market May See a Big Move | Sage Software, Bluebeam Software, Q …

Latest Study on Industrial Growth of Takeoff Software Market 2023-2028. A detailed study accumulated to offer Latest insights about acute features of the Takeoff Software market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future trends and developments…

Robot Software Market Analysis by Software Types: Recognition Software, Simulati …

The Insight Partners provides you global research analysis on “Robot Software Market” and forecast to 2028. The research report provides deep insights into the global market revenue, parent market trends, macro-economic indicators, and governing factors, along with market attractiveness per market segment. The report provides an overview of the growth rate of the Robot Software market during the forecast period, i.e., 2021–2028.

Download Sample Pages of this research study at: https://www.theinsightpartners.com/sample/TIPRE00007689/?utm_source=OpenPR&utm_medium=10452…

HR Software Market Analysis by Top Key Players Zenefits Software, Kronos Softwar …

HR software automates how companies conduct business with relation to employee management, training and e-learning, performance management, and recruiting and on-boarding. HR professionals benefit from HR software systems by providing a more structured and process oriented approach to completing administrative tasks in a repeatable and scalable manner. Every employee that is added to an organization requires management of information, analysis of data, and ongoing updates as progression throughout the company…

HR Software Market by Top Manufacturers – Zenefits Software, Kronos Software, …

Global HR Software market could be classified into different regions and countries for a clear understanding of business prospects available across the globe. This intelligence research study presents a wide-ranging study of the global market by evaluating the growth drivers and detaining factors at length. This detailed study of significant factors supports the market participants in understanding the issues they will be facing while operative in this market over a…

HR Software Market by Top Manufacturers – Zenefits Software, Kronos Software, …

Global HR Software market could be classified into different regions and countries for a clear understanding of business prospects available across the globe. This intelligence research study presents a wide-ranging study of the global market by evaluating the growth drivers and detaining factors at length. This detailed study of significant factors supports the market participants in understanding the issues they will be facing while operative in this market over a…

HR Software Market Analysis by Top Key Players – Zenefits Software, Kronos Sof …

HR software helps HR personnel automate many necessary tasks, such as maintaining employee records, time tracking, and benefits, which allows HR professionals to focus on recruiting efforts, employee performance and engagement, corporate wellness, company culture, and so on. These human management tools can be purchased and implemented as on premise or cloud-based software.

This market studies report on the Global HR Software Market is an all-inclusive study of the enterprise sectors…