Press release

Paper Bag Manufacturing Plant Cost 2026: Complete Feasibility Study, Project Economics and Market Potential Analysis

The global paper bag manufacturing industry represents a rapidly expanding segment of the sustainable packaging sector, positioned at the intersection of environmental responsibility, regulatory transformation, and evolving consumer preferences. As governments worldwide implement increasingly stringent restrictions on single-use plastics and consumers demonstrate growing preference for eco-friendly packaging alternatives, the paper bag manufacturing sector offers exceptional investment opportunities for entrepreneurs and established businesses seeking to capitalize on this fundamental market shift. This comprehensive guide provides an authoritative exploration of the technical, financial, and strategic dimensions of establishing a paper bag manufacturing plant, leveraging current market intelligence and industry insights to support informed investment decision-making.Market Overview and Growth Potential

The paper bag manufacturing sector is experiencing robust and accelerating growth driven by powerful, interconnected market forces that reflect fundamental shifts in environmental policy, consumer consciousness, and packaging industry dynamics. The industry's expansion is propelled by several critical factors:

• Increasing restrictions on single-use plastics across multiple jurisdictions

• Growing environmental awareness among consumers

• Rising demand for sustainable packaging solutions

• Expanding applications across retail, foodservice, and industrial sectors

The global paper bag market was valued at USD 6.24 Billion in 2025, establishing a substantial foundation for sector growth. According to comprehensive market analysis, the industry is projected to reach USD 8.88 Billion by 2034, exhibiting a strong CAGR of 4.0% from 2026 to 2034. This impressive growth trajectory significantly outpaces general economic expansion, reflecting the structural transformation occurring within the packaging industry as businesses and consumers transition away from plastic-based solutions.

The market expansion is fundamentally driven by regulatory interventions addressing plastic pollution concerns. Mounting evidence of plastic's environmental impact has prompted governments across developed and emerging markets to implement comprehensive bans or restrictions on single-use plastic bags, creating immediate and sustained demand for paper-based alternatives. Research data illustrates this transition's magnitude: in a 2023 survey of Vermont residents, results showed a 91% decline in plastic bag usage, with three-quarters of participants supporting the regulatory measure. Simultaneously, paper bag usage increased by more than 6% over the same period, demonstrating the direct substitution effect driving market growth. Consumer behavior is evolving in parallel with regulatory changes, as environmental consciousness influences purchasing decisions and brand perceptions. Businesses across retail, foodservice, and e-commerce sectors increasingly recognize that sustainable packaging represents both a compliance imperative and a competitive

differentiator, further accelerating paper bag adoption.

IMARC Group's report, "Paper Bag Manufacturing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," offers a comprehensive guide for establishing a plant. The paper bag manufacturing plant cost report offers insights into the process, financials, capital investment, expenses, ROI, and more for informed business decisions.

Plant Capacity and Production Scale

The proposed paper bag manufacturing facility is designed with strategic production capacity and operational flexibility as foundational principles. The annual production capacity ranges between 50 to 100 million pieces, enabling significant economies of scale while maintaining the operational agility necessary to serve diverse customer requirements and product specifications.

This capacity range positions the plant to serve multiple market segments effectively:

• Retail and Consumer Goods Sector: Shopping bags for apparel, electronics, specialty goods, and general merchandise retail

• Foodservice and HoReCa (Hotel, Restaurant, Café) Sector: Takeaway and delivery packaging for restaurants, quick-service establishments, and food delivery platforms

• Grocery and Supermarket Chains: Carry bags for daily-use products replacing traditional plastic bags

• E-commerce Packaging: Sustainable shipping and fulfillment packaging for online retail

• Industrial and Commercial Packaging: Lightweight bulk packaging and promotional distribution applications

The production facility can manufacture diverse product formats addressing varied functional requirements:

• Flat bags: Simple, economical designs for basic packaging needs

• Gusseted bags: Expandable designs providing increased carrying capacity

• Square-bottom bags: Self-standing formats ideal for retail presentation

• Handled bags: Enhanced convenience for shopping and carry applications

• Custom printed bags: Branded packaging serving marketing and promotional objectives

Financial Viability and Profitability Analysis

The paper bag manufacturing business demonstrates compelling financial fundamentals supported by growing market demand, favorable regulatory environment, and opportunities for product differentiation through customization and branding capabilities. The project offers healthy profitability potential with gross profit margins typically ranging between 25-35%, driven by efficient production processes, value-added services, and premium positioning opportunities for branded and custom-printed products.

Net profit margins are projected at 10-15%, reflecting operational efficiency achievable through optimized manufacturing processes, effective raw material procurement strategies, automation investments, and capacity utilization management. These margin profiles compare favorably to traditional packaging segments while supporting sustainable business growth and market competitiveness.

The financial projections developed for this project incorporate comprehensive analysis across all investment and operational cost components. Capital investment modeling addresses land acquisition and site development, building construction and infrastructure, machinery procurement and installation, utilities setup, and initial working capital requirements. Operating cost analysis encompasses raw material expenses (particularly kraft paper), adhesives and printing inks, utility consumption, labor costs, maintenance and repairs, and distribution expenses.

These detailed financial models provide stakeholders with transparent visibility into project economics, including capital expenditure (CapEx) breakdowns by category, operating expenditure (OpEx) structures and sensitivity factors, income projections across product types and customer segments, expected return on investment (ROI) and payback timelines, net present value (NPV) calculations under various scenarios, and long-term profitability trajectories supporting informed decision-making.

Operating Cost Structure

Understanding the operating cost structure is fundamental to effective business planning and margin optimization in paper bag manufacturing. The cost architecture reflects raw material intensity, production efficiency requirements, and customization capabilities.

In paper bag manufacturing operations, raw materials account for approximately 70-80% of total operating expenses (OpEx), with kraft paper representing the predominant cost component as the primary structural material.

Request for a Sample Report: https://www.imarcgroup.com/paper-bag-manufacturing-plant-project-report/requestsample

Key Raw Materials Include:

• Kraft paper: Primary structural material available in various grades, weights, and quality levels

• Adhesives: Bonding agents for seams and construction

• Printing inks: For branding, logos, and decorative elements on custom bags

• Handles: Optional components for carry bags (paper twisted handles, flat handles)

• Reinforcement materials: For enhanced durability in heavy-duty applications

Utilities represent 5-10% of OpEx, covering electricity for machinery operation and compressed air systems, minimal water requirements for adhesive preparation and equipment cleaning, and climate control for maintaining paper quality during storage and production.

Additional operating costs encompass:

• Transportation for raw material delivery and finished product distribution to customers

• Minimal packaging costs for finished product bundling and protection during shipping

• Salaries and wages for machine operators, quality control personnel, maintenance staff, and administrative teams

• Depreciation on specialized bag-making machinery and printing equipment

• Taxes and regulatory compliance costs

• Repairs, maintenance, and spare parts for production equipment

Raw material procurement strategies represent a critical success factor, emphasizing the importance of establishing reliable supplier relationships with kraft paper manufacturers, negotiating favorable volume-based pricing agreements, maintaining quality consistency across paper grades, and potentially exploring backward integration opportunities for larger operations.

Capital Investment Requirements

Establishing a paper bag manufacturing plant requires comprehensive capital investment across multiple categories, reflecting the specialized machinery, production infrastructure, and operational systems essential for efficient, high-quality production.

Capital Expenditure Components:

• Land and Site Development Costs: Land acquisition, registration, boundary development, site leveling and preparation

• Civil Works Costs: Factory building construction, raw material and finished goods storage facilities, utilities infrastructure, administrative offices

• Machinery Costs: Largest portion of total capital expenditure

• Other Capital Costs: Pre-operative expenses, regulatory licensing, initial working capital, contingency reserves

Site Selection Considerations:

Strategic location selection must evaluate several critical factors:

• Easy access to key raw materials including kraft paper from paper mills or distribution centers

• Proximity to target markets minimizing distribution costs and enabling responsive customer service

• Robust infrastructure including reliable transportation networks for raw material inbound logistics and finished goods distribution, consistent electricity supply for continuous production, and waste management systems

• Compliance with local zoning laws and environmental regulations governing manufacturing operations and paper handling

• Space for future expansion accommodating capacity increases and additional machinery installation

Essential Machinery Requirements:

High-quality, reliable machinery tailored for paper bag manufacturing represents the technical foundation:

• Paper bag making machines: Core production equipment available in various configurations (flat bag, square-bottom, gusseted designs) with automation levels ranging from semi-automatic to fully automatic systems

• Printing units: Flexographic or offset printing systems for custom branding and decorative applications

• Handle pasting machines: Automated or semi-automated equipment for attaching handles to carry bags

• Cutting and folding systems: Precision equipment for accurate sizing and consistent bag construction

• Drying units: For adhesive curing and ink drying in printed applications

• Inspection tools: Quality control equipment for dimensional accuracy, print quality, and structural integrity verification

Machinery selection decisions significantly impact production efficiency, product quality, and operational flexibility. Equipment specifications should address production capacity targets, product format versatility (ability to produce multiple bag styles), automation levels balancing capital investment against labor costs, printing capabilities for branded product production, and maintenance requirements and spare parts availability.

Civil works costs cover factory building construction meeting operational requirements, segregated storage areas for raw materials (paper rolls) and finished goods, quality control testing areas, and administrative facilities. Other capital costs include utilities installation (electrical systems, compressed air), regulatory approvals and licensing fees, initial inventory of raw materials and consumables, and working capital reserves for operational expenses during ramp-up periods.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=7462&flag=C

Manufacturing Process Overview

The paper bag manufacturing process involves sequential operations designed to transform kraft paper rolls into finished bags meeting specific dimensional, structural, and aesthetic specifications:

Unit Operations Involved:

• Paper roll feeding: Loading kraft paper rolls onto machinery feeding systems

• Cutting and sizing: Precision cutting to specified bag dimensions

• Folding and gluing: Creating bag structure through sequential folding operations and adhesive application along seams

• Handle pasting: Attaching handles where applicable for carry bag variants

• Printing: Applying branding, logos, or decorative elements (for custom orders)

• Quality inspection: Dimensional verification, structural integrity testing, print quality assessment

• Packing: Bundling finished bags in specified quantities for shipment

Quality Assurance Criteria:

Comprehensive quality control systems must monitor dimensional accuracy ensuring consistent bag sizing, structural integrity verification confirming adequate strength for intended applications, print quality assessment for custom-printed products, adhesive bonding effectiveness preventing seam failures, and overall appearance meeting customer specifications.

Technical Tests:

Laboratory and production-line testing includes dimensional measurement verifying length, width, and gusset specifications, tensile strength testing assessing load-bearing capacity, adhesive bond strength evaluation, handle attachment strength verification, and print quality assessment for color consistency and resolution.

Major Applications and Market Segments

Paper bag manufacturing serves multiple essential applications across diverse commercial and institutional categories:

Primary Applications:

• Shopping Bags: Retail carry bags for apparel stores, boutiques, electronics retailers, and specialty shops

• Takeaway Food Bags: Restaurant and quick-service packaging for food delivery and carryout

• Grocery Bags: Supermarket and grocery store carry bags for daily purchases

• Promotional and Branded Packaging: Custom-printed bags serving marketing and brand awareness objectives

• Bulk Packaging Solutions: Industrial applications for lightweight product distribution

End-Use Industries:

• Retail and Consumer Goods: Primary market segment across diverse retail categories

• Foodservice and HoReCa Sector: Restaurants, cafes, hotels, and catering services

• Grocery and Supermarket Chains: Daily-use packaging applications

• E-commerce Packaging: Online retail fulfillment and shipping

• Industrial Packaging: Commercial distribution and promotional applications

The diversity of applications and end-use sectors creates natural demand stability and reduces dependence on any single customer segment or market vertical.

Why Invest in Paper Bag Manufacturing?

Multiple strategic factors converge to make paper bag manufacturing an exceptionally attractive investment proposition:

✓ Ban on Single-Use Plastics: Regulatory restrictions across multiple jurisdictions worldwide are accelerating the mandatory shift toward paper-based packaging, creating structural demand growth independent of economic cycles.

✓ Rising Sustainability Awareness: Consumers and brands increasingly prefer recyclable and biodegradable packaging solutions, with sustainable packaging becoming a key brand differentiator and consumer purchase criterion.

✓ Branding and Customization Demand: Paper bags allow easy printing and customization for marketing purposes, creating value-added opportunities and premium pricing potential compared to commodity plastic bags.

✓ Expanding Retail and Food Delivery Sector: Growth in organized retail, e-commerce, and food delivery services supports sustained and growing demand for paper bag packaging across multiple application segments.

✓ Scalable and Capital-Efficient Setup: Paper bag manufacturing requires moderate capital investment compared to other packaging manufacturing sectors while supporting modular capacity expansion as business grows.

✓ Recyclability and Circular Economy Alignment: Paper bags integrate seamlessly into established recycling infrastructure, supporting circular economy principles and enhancing environmental credentials.

✓ Versatile Product Portfolio: Ability to produce diverse bag formats, sizes, and customization options enables serving multiple market segments and customer requirements from a single production facility.

Industry Leadership

The global paper bag manufacturing industry features several established leaders with extensive production capacities and diverse market reach:

Leading Paper Bag Manufacturers:

• Paperbags Ltd.

• Novolex Holdings, Inc.

• United Bag, Inc.

• International Paper Company

• Global-Pak, Inc.

• York Paper Company Ltd.

These established manufacturers serve end-use sectors including retail and consumer goods, foodservice and HoReCa sector, grocery and supermarket chains, e-commerce packaging, and industrial packaging industries across multiple geographic markets. Their market presence demonstrates the scalability and profitability potential of professional paper bag manufacturing operations while highlighting opportunities for new entrants to serve regional markets, specialized segments, or differentiate through superior customization capabilities and customer service.

Buy Now: https://www.imarcgroup.com/checkout?id=7462&method=2175

Latest Industry Developments

The paper bag sector continues to experience innovation and market development:

• July 2025: EP Group launched the 'Bag as Brand' campaign, promoting its RePapaPac reusable paper bag for fashion retailers. Designed for durability with high-impact printing capabilities and reuse up to 50 times, the bag doubles as a walking advertisement and potential revenue source for retailers.

• June 2025: Mondi revealed its re/cycle PaperPlus Bag Advanced, a high-performance, environmentally friendly bag for products sensitive to humidity. With 60% less plastic than conventional bags, it ensures effective moisture protection while supporting recycling and fitting smoothly into current manufacturing lines.

These developments underscore ongoing industry innovation, growing demand for enhanced functionality combining sustainability with performance, and opportunities for product differentiation supporting premium market positioning.

Conclusion

The paper bag manufacturing sector presents an exceptionally compelling investment opportunity characterized by strong market fundamentals, favorable regulatory tailwinds, attractive profit margins, and accelerating growth prospects driven by the global transition away from single-use plastics.

For entrepreneurs and businesses seeking to participate in the essential packaging industry transformation toward sustainability, paper bag manufacturing offers a proven pathway to creating substantial value while contributing to environmental solutions and meeting fundamental market needs. The sector's robust growth trajectory, supported by regulatory mandates, consumer preferences, and technological capabilities enabling functional and aesthetic product development, ensures continued market relevance and attractive opportunities for well-planned and professionally executed manufacturing ventures delivering consistent quality, innovation, and environmental responsibility.

Browse Related Reports:

Meal Subscription Business Plan: https://industrytoday.co.uk/market-research-industry-today/how-to-reduce-costs-when-setting-up-a-meal-subscription-business

Packers and Movers Business Plan: https://industrytoday.co.uk/market-research-industry-today/packers-and-movers-business-plan-revenue-costs-margins

CCTV Installation Business Plan: https://industrytoday.co.uk/market-research-industry-today/cctv-installation-business-plan-2025-costs-setup-and-profit-potential

Coffee Shop Business Plan: https://industrytoday.co.uk/market-research-industry-today/coffee-shop-project-report-2025-market-trends-and-business-opportunities

Food Truck Business Plan: https://industrytoday.co.uk/market-research-industry-today/food-truck-business-plan-2025-setup-costs-roi

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Services:

• Plant Setup

• Factoring Auditing

• Regulatory Approvals, and Licensing

• Company Incorporation

• Incubation Services

• Recruitment Services

• Marketing and Sales

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Paper Bag Manufacturing Plant Cost 2026: Complete Feasibility Study, Project Economics and Market Potential Analysis here

News-ID: 4368596 • Views: …

More Releases from IMARC Group

India B2B Events Market: Industry Trends & Growth Forecast by 2034

The India B2B events market size was valued at USD 1,688.72 Million in 2025 and is expected to reach USD 2,750.10 Million by 2034, growing at a compound annual growth rate (CAGR) of 5.57% from 2026 to 2034. The market growth is driven by increasing corporate spending on marketing, networking initiatives, and brand-building across industries, supported by government development of world-class MICE infrastructure and adoption of digital and hybrid event…

India Cold Chain Logistics Market to Reach USD 27.00 Bn by 2033 at 8.90% CAGR Am …

Source: IMARC Group | Category: Transportation and Logistics

Report Introduction

According to IMARC Group's latest report titled "India Cold Chain Logistics Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033", this study offers a granular analysis of the country's developing temperature-controlled supply chain. The study offers a profound analysis of the industry, encompassing market share, size, growth factors, key trends, and regional insights. The report covers critical market dynamics,…

India Plastic Packaging Market is set to reach USD 17.3 Billion by 2034 | Indust …

The India plastic packaging market size reached USD 13.2 Billion in 2025. The market is expected to reach USD 17.3 Billion by 2034, growing at a CAGR of 3.10% from 2026-2034. The market is majorly driven by the advancements in plastic materials and technologies, development of lightweight packaging solutions, creation of flexible packaging options, and innovation in barrier-enhanced packaging that extends shelf life and improves product performance.

Key Highlights in India…

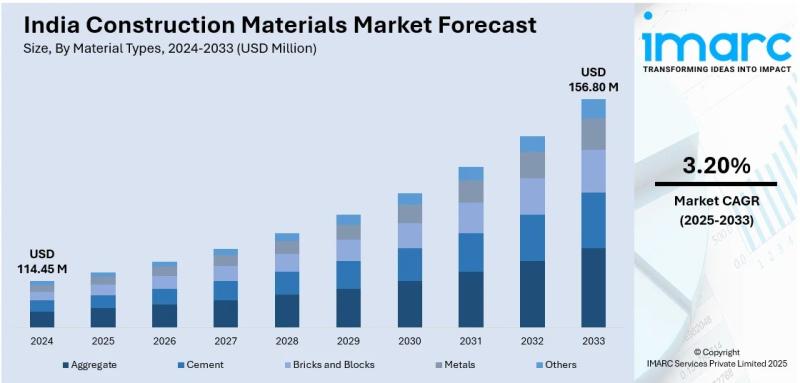

India Construction Materials Market to Hit USD 156.80 Mn by 2033 at 3.20% CAGR D …

Source: IMARC Group | Category: Chemical & Materials

Report Introduction

According to IMARC Group's latest report titled "India Construction Materials Market Size, Share, Trends and Forecast by Material Type, End User, and Region, 2025-2033", this study offers a granular analysis of the country's booming construction sector. The study offers a profound analysis of the industry, encompassing market share, size, growth factors, key trends, and regional insights. The report covers critical market…

More Releases for Paper

Newsprint Paper Market | Alberta Newsprint, BO Paper Group, Daio Paper, Emami Pa …

Introduction:

The introduction to the report serves as a gateway into the comprehensive world of the newsprint paper market. As industries continue to evolve and adapt to changing consumer demands and technological advancements, understanding the market dynamics becomes paramount for industry stakeholders. The report takes on the responsibility of offering a profound and all-encompassing analysis of the newsprint paper market, catering to the needs of a diverse audience that includes manufacturers,…

Paraffin Paper Market to Witness Massive Growth by 2027 | Patty Paper, Dunn Pape …

A new research document released by HTF MI with title "Global Paraffin Paper Market SWOT analysis by Size, Status and Forecast 2022 to 2027" provides a complete assessment of Paraffin Paper Market. The study focuses on changing market dynamics, geopolitical and regulatory policies, key players Strategies to better analyse demand at risk across various product type. Some of the major and emerging players analysed in the study are Dunn Paper,…

Pulp and Paper Market Key Player Analysis By sappi, Lee & Man Paper, Nippon Pape …

Global Pulp and Paper Market Research Report 2018–2025 is a historical overview and in-depth study on the current & future market of the Pulp and Paper Industry. The report represents a basic overview of the market status, competitor segment with a basic introduction of key vendors, top regions, product types and end industries. This report gives a historical overview of the market trends, growth, revenue, capacity, cost structure, and…

Global Waste Paper Recycling Market Forecast 2019-2026 Miami Waste Paper, Dixie …

Market study on Global Waste Paper Recycling 2019 Research Report presents a professional and complete analysis of Global Waste Paper Recycling Market on the current market situation.

Report provides a general overview of the Waste Paper Recycling industry 2019 including definitions, classifications, Waste Paper Recycling market analysis, a wide range of applications and Waste Paper Recycling industry chain structure. The 2019's report on Waste Paper Recycling industry offers the global…

Book Paper Market Report 2018 Companies included Stora Enso, Oji Paper, Nippon P …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com *********

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides…

Global Pulp and Paper Market 2018 Key Players: sappi, Lee & Man Paper, Nippon Pa …

Pulp and Paper Market:

WiseGuyReports.com adds “Pulp and Paper Market 2018 Global Analysis, Growth, Trends and Opportunities Research Report Forecasting 2025” reports tits database.

Executive Summary

Global Pulp and Paper Market valued approximately USD XX billion in 2017 is anticipated to grow with a healthy growth rate of more than XXX% over the forecast period 2017-2025. Pulp and paper producers produces and sells cellulose-based products, derived from wood. Packaging paper, graphic paper and…