Press release

India Microfinance Market Forecast to Reach USD 13.78 Billion by 2031

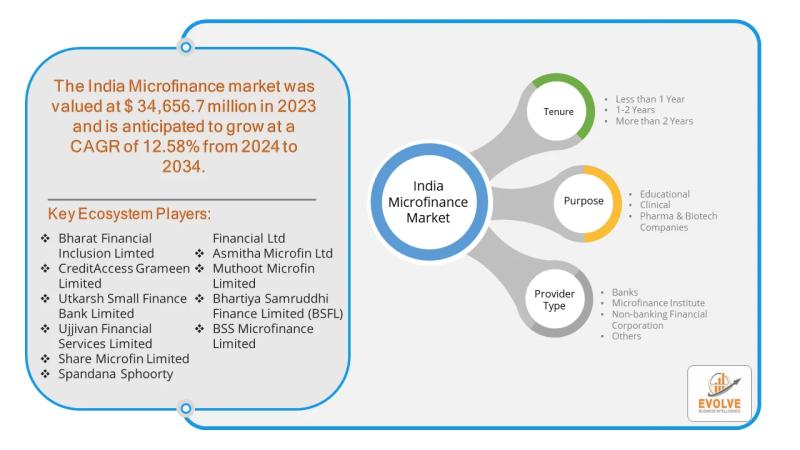

India's microfinance market is a dynamic and essential component of the nation's financial landscape, driven by a powerful mission: to extend financial services to the unbanked and underserved. Despite facing significant challenges, the sector is experiencing robust growth and presents a high-opportunity landscape for Microfinance Institutions (MFIs).Market Overview and Opportunity

The India Microfinance Market, valued at approximately USD 7.72 billion in 2025, is projected to reach USD 13.78 billion by 2031, exhibiting a compound annual growth rate (CAGR) of 10.20%. This impressive growth is underpinned by several key factors:

Download the full report now to discover market trends, opportunities, and strategies for success.

https://evolvebi.com/report/india-microfinance-market-analysis/

• Government-led Financial Inclusion: Initiatives such as the Pradhan Mantri Jan Dhan Yojana (PMJDY) and the Micro Units Development and Refinance Agency (MUDRA) scheme have successfully brought millions of people into the formal banking system. This creates a vast, untapped customer base for MFIs, especially in rural and semi-urban areas.

• Rural Entrepreneurship: The rise of micro-entrepreneurship in rural India, driven by improved connectivity and access to digital services, has fueled a strong demand for small loans. MFIs play a crucial role in bridging the credit gap for these entrepreneurs, who often lack collateral for traditional bank loans.

• Digital Transformation: The sector is rapidly embracing digital solutions, including digital lending platforms, mobile banking, and eKYC (Know Your Customer) with Aadhaar-linked banking. This digital shift streamlines loan disbursement and repayment, lowers operational costs, and expands outreach to remote areas.

• Women-Centric Lending: Women constitute over 99% of microfinance borrowers, with the sector recognizing their critical role in household and community development. The growth of Self-Help Groups (SHGs) and Joint Liability Groups (JLGs) has been instrumental in promoting financial independence and empowerment.

Problems Faced by the Sector

While the opportunities are vast, the India Microfinance Market is not without its hurdles. Key challenges that MFIs and borrowers face include:

• High Interest Rates: MFIs often charge higher interest rates (12-30%) compared to commercial banks. This is primarily due to the high operational costs associated with servicing small, unsecured loans in rural regions.

• Over-Indebtedness: A significant problem is the practice of multiple borrowing, where clients take loans from several MFIs simultaneously, leading to unsustainable debt burdens. This is exacerbated by inefficient risk management and a lack of real-time data sharing among lenders.

• Regulatory and Policy Uncertainty: Despite a more harmonized regulatory framework from the Reserve Bank of India (RBI), the sector is still susceptible to frequent policy changes and regulatory gaps. Issues like the lack of documentary proof for household income and delayed credit bureau data hinder accurate risk assessment.

• Limited Financial Literacy: A large portion of the target population, especially in rural areas, lacks basic financial literacy. This can lead to poor financial decisions, improper use of credit, and a general lack of awareness about the full range of financial services offered by MFIs.

Download the full report now to discover market trends, opportunities, and strategies for success.

https://evolvebi.com/report/india-microfinance-market-analysis/

A Proposed Solution

To mitigate these challenges and capitalize on the market's potential, a multi-pronged solution is necessary, with a focus on technology, regulation, and education.

1. Digital Integration and Real-Time Data: MFIs should fully embrace digital technologies to optimize operations. This includes leveraging Artificial Intelligence (AI) and machine learning for more accurate credit assessments. Furthermore, a unified, real-time credit bureau reporting system should be mandated to prevent over-indebtedness.

2. Enhanced Financial Literacy Programs: Financial education is crucial. MFIs should implement comprehensive financial literacy programs that go beyond basic loan terms to teach borrowers about savings, budgeting, and risk management. This empowers clients to make informed financial decisions and fosters a healthier credit culture.

3. Diversified Product Offerings: To move beyond a credit-only model, MFIs should expand their product portfolio to include savings, micro-insurance, and fund transfer facilities. This diversification not only reduces dependency on loan interest but also provides a more holistic and sustainable financial solution for clients, building long-term relationships.

US Tariff Implication on India Microfinance Market

While US tariffs on Indian goods do not directly target the microfinance sector, their macroeconomic effects can have a significant indirect impact. Recent tariffs, such as a 26% duty on various Indian exports, primarily affect sectors like steel, aluminum, gems, and textiles. However, the ripple effect on the broader economy is a concern.

These tariffs can lead to:

• Reduced Demand for Indian Exports: This could affect the livelihoods of small-scale entrepreneurs and micro-businesses that are part of the export value chain.

• Market Volatility and Inflation: A potential weakening of the Indian Rupee and increased inflationary pressures could force the RBI to tighten monetary policy and raise interest rates.

• Increased Risk of Defaults: A slowdown in economic activity and higher borrowing costs could impact the repayment capacity of microfinance borrowers, potentially increasing non-performing assets (NPAs) for MFIs.

Download the full report now to discover market trends, opportunities, and strategies for success.

https://evolvebi.com/report/india-microfinance-market-analysis/

Conclusion

The India Microfinance Market stands at a pivotal juncture, offering immense opportunities for sustainable, inclusive growth. By strategically addressing key challenges through digital innovation, proactive financial education, and diversified offerings, MFIs can strengthen their position as a cornerstone of India's financial ecosystem.

To understand further and explore opportunities in the India Microfinance Market or any related industry, please share your queries/concerns at info@evolvebi.com.

Evolve Business Intelligence

C-218, 2nd floor, M-Cube

Gujarat 396191

India

Email: sales@evolvebi.com

Website: https://evolvebi.com/

Evolve Business Intelligence is a market research, business intelligence, and advisory firm providing

innovative solutions to challenging pain points of a business. Our market research reports include data

useful to micro, small, medium, and large-scale enterprises. We provide solutions ranging from mere

data collection to business advisory.

Evolve Business Intelligence is built on account of technology advancement providing highly accurate

data through our in-house AI-modelled data analysis and forecast tool - EvolveBI. This tool tracks real-

time data including, quarter performance, annual performance, and recent developments from

fortune's global 2000 companies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Microfinance Market Forecast to Reach USD 13.78 Billion by 2031 here

News-ID: 4367963 • Views: …

More Releases from Evolve Business Intelligence

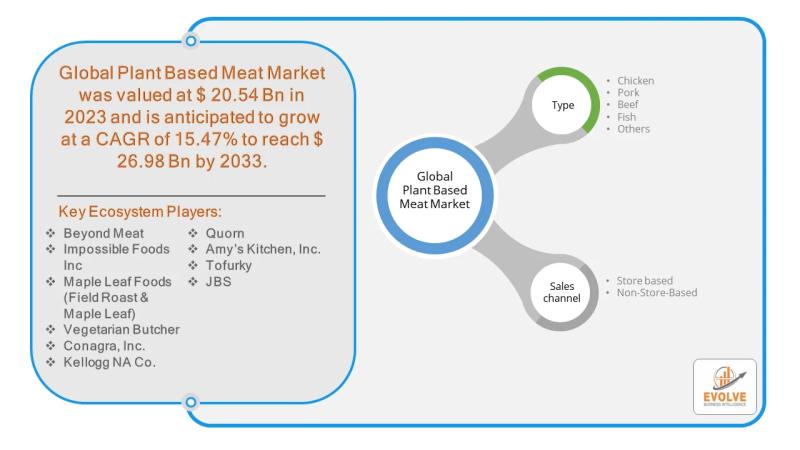

Plant-Based Meat Market Forecast to Reach USD 26.98 Billion by 2033

The plant-based meat market is at a pivotal point, marked by strong growth in the past decade but now facing headwinds. While traditional retail channels have seen recent slowdowns, the non-store-based segment, which includes direct-to-consumer (D2C) e-commerce, meal kits, and food service, presents a significant and largely untapped opportunity. This channel allows brands to bypass the challenges of traditional retail, such as intense competition for shelf space and high listing…

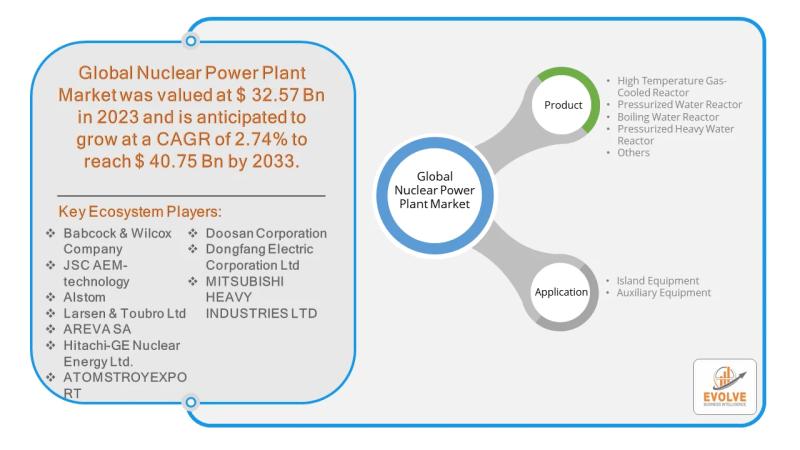

Nuclear Power Plant Market Forecast to Reach USD 40.75 Billion by 2033

As the world seeks a clean, reliable, and sustainable energy future, High Temperature Gas-Cooled Reactors (HTGRs) are emerging as a prime candidate to lead the next generation of nuclear power. This advanced reactor technology, which uses a graphite-moderated core and inert helium coolant, offers a unique blend of inherent safety and versatility that extends well beyond traditional electricity generation. While challenges remain, the opportunity for HTGRs to transform the nuclear…

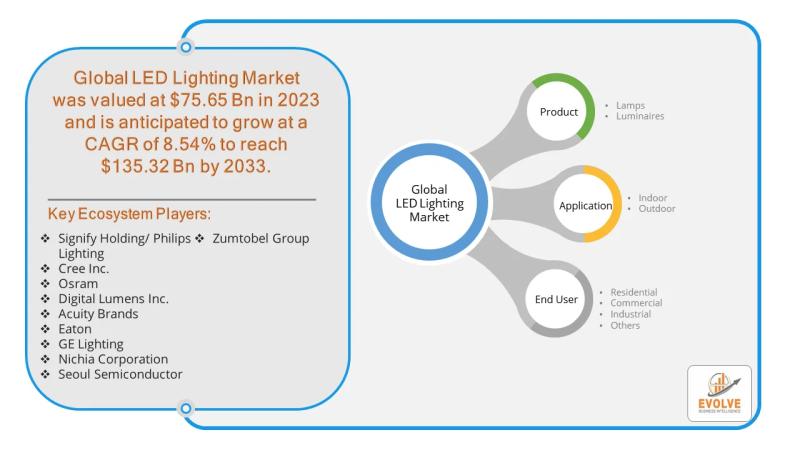

LED Lighting Market Forecast to Reach USD 255.92 Billion by 2035

The global LED lighting market is on a trajectory of significant expansion, fueled by the rising demand for energy-efficient and sustainable lighting solutions. While the market for LED lamps remains strong, luminaires-complete lighting fixtures with integrated LEDs-are emerging as the primary driver of future growth. Valued at an estimated USD 71.59 billion in 2023, the market is projected to surge to over USD 255.92 billion by 2035, with a compound…

Sensor Market Forecast to Reach USD 457.26 Billion by 2032

The global sensor market is at a pivotal point, poised for remarkable growth driven by the proliferation of smart devices, industrial automation, and the Internet of Things (IoT). The market, valued at an estimated USD 241.06 billion in 2024, is projected to expand significantly to approximately USD 457.26 billion by 2032, demonstrating a robust Compound Annual Growth Rate (CAGR) of about 8.5%. Within this dynamic landscape, a key player is…

More Releases for India

India Smart Air Purifier Market Set to Witness Significant Growth by 2035 | Phil …

India smart air purifier market was valued at $125.8 million in 2024 and is projected to reach $298.7 million by 2035, growing at a CAGR of 8.3% during the forecast period (2025-2035).

India Smart Air Purifier Market Overview

The Indian smart air purifier market is experiencing significant growth, driven by increasing concerns over air pollution and its impact on health. Consumers are increasingly adopting smart air purifiers equipped with advanced features…

Ayurvedic Service Market is Flourishing Like Never Before | Patanjali Ayurved Li …

RnM newly added a research report on the Ayurvedic Service market, which represents a study for the period from 2020 to 2026.

The research study provides a near look at the market scenario and dynamics impacting its growth. This report highlights the crucial developments along with other events happening in the market which are marking on the growth and opening doors for future growth in the coming years. Additionally, the…

Pasta Market Report 2018 Companies included Bambino (India), Nestle (USA), Field …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides detailed segmentation on the…

Interior Designers India, Designers and Architects India, Interior Design Consul …

Synergy Corporate Interiors Pvt. Ltd. are offer Designers and Architects India Our architects, designers are working an national and international client base. The final design output is then integrated with the various technical and engineering aspects and taken into production. The expression is also individualistic, based on the communication of the correct corporate identity. Our designers, engineers and architects perform any plan successfully combine handy knowledge with creative ideas into…

Domain Registration India, Web Hosting India, VPS Hosting India , SSL Certificat …

All the Domain Registration services are at affordable price and assure you for the 100% quality.

India Internet offers cheap domain name registration for many domain extensions available. We are a full-service web site solutions provider. We offer a full range of web services including domain registration India, Web Hosting India, Web design, SEO marketing and etc.

We offer different standard and different Windows .NET low-cost, full-featured, all-inclusive web hosting and domain…

Domain Registration India, Web Hosting India, Payment Gateway India

Indiainternet.in is a Quality Web Hosting Company India, provide all web related support and Web hosting services like linux web hosting, windows web hosting, web hosting packages, domain registration in india, Corporate email solution, business email hosting, payment gateway integration, SSL with supports like free php, cgi, asp, free msaccess, free cdonts, free webmail, web based control panel, unlimited ftp access, unlimited data transfer.

During the domain registration process, you will…