Press release

United States Contactless Payments Market to grow at 20% CAGR | North America leads with 35% share | Top Companies - Gemalto, Infineon Technologies AG, Ingenico

Leander, Texas and Tokyo, Japan - Jan.28.2026As per DataM intelligence research report "The Global Contactless Payments Market is Expected to reach at a CAGR of 20% within the forecast period (2023-2030)."

The market is driven by rapid adoption of NFC-enabled smartphones, digital wallets, and card-based tap-and-pay solutions. Retail, transportation, and hospitality dominate usage. Security, speed, and convenience fuel adoption, supported by government cashless initiatives and growing smartphone penetration.

Download your exclusive sample report today: (corporate email gets priority access):

https://www.datamintelligence.com/download-sample/contactless-payments-market?prasad

Contactless Payments Market: Competitive Intelligence

Gemalto, Infineon Technologies AG, Ingenico, Wirecard AG, Verifone, Giesecke+Devrient, IDEMIA, On Track Innovations, CPI Card Group

In the Contactless Payments Market, Gemalto, Infineon Technologies AG, Ingenico, Wirecard AG, Verifone, Giesecke+Devrient, IDEMIA, On Track Innovations, and CPI Card Group are leading players providing secure, fast, and convenient payment solutions for consumers, merchants, and financial institutions. These companies develop contactless-enabled cards, NFC-enabled devices, secure payment terminals, and digital authentication systems that support cashless transactions, enhance payment security, and improve transaction speed, driving adoption across retail, transportation, and financial services.

The market is strengthened by complementary strengths across technology, security, and infrastructure. Gemalto, IDEMIA, and Giesecke+Devrient focus on secure payment cards, digital IDs, and authentication technologies. Infineon Technologies AG and On Track Innovations provide semiconductor solutions and NFC chips that enable contactless payment functionality. Ingenico, Verifone, and CPI Card Group offer point-of-sale (POS) terminals, software platforms, and integrated payment solutions that facilitate seamless merchant adoption and transaction processing. Wirecard AG contributes digital wallet and mobile payment solutions, enhancing ecosystem connectivity and consumer convenience.

Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/contactless-payments-market?prasad

Fund Raisings

✅ January 2026 - MoonPay (United States)

MoonPay is reportedly in talks for a significant funding round led by potential investment from Intercontinental Exchange parent ICE to support expansion of stablecoin and contactless payment infrastructure. The anticipated raise at a multibillion-dollar valuation is intended to deepen its U.S. footprint and broaden its crypto-enabled checkout capabilities.

Product Launches & Partnerships

✅ December 2025 - Fiuu (United States)

Fiuu unveiled its "Tap to Pay on iPhone" contactless payments service using the Fiuu VT iOS app, enabling merchants to accept NFC payments including Apple Pay and other digital wallets with just an iPhone. This launch simplifies merchant acceptance of contactless payments without requiring dedicated POS hardware.

✅ October 2025 - Adyen Japan (Japan)

Adyen Japan began offering iPhone-based tap-to-pay contactless acceptance for merchants, allowing businesses to process NFC card and digital wallet transactions securely using only a supported iPhone. This expansion supports Japan's broader shift toward mobile-first contactless acceptance in local retail environments.

✅ October 2025 - NPCI & NTT DATA Partnership (Japan)

NPCI International Payments partnered with NTT DATA to enable acceptance of UPI at Japanese merchant locations, facilitating easier digital payments for visiting Indian tourists and expanding cross-border QR payment interoperability. This collaboration enhances the contactless payment ecosystem in Japan by integrating QR-based mobile payment acceptance.

Mergers & Acquisitions

✅ January 2026 - Capital One & Brex (United States)

Capital One Financial agreed to acquire fintech Brex in a deal valued at over USD 5 billion to strengthen its corporate card and payments technology capabilities. The acquisition is expected to enhance Capital One's position in payment infrastructure and expand solutions for business and contactless transactions.

Segment Covered in the Contactless Payments Market:

By Device

The market is segmented into Smartphones & Wearables 50%, Point-of-Sales (POS) Terminals 35%, and Smart Cards 15%, with smartphones and wearables dominating due to widespread mobile adoption, NFC-enabled devices, and the convenience of digital wallets. POS terminals remain critical for merchant adoption, while smart cards maintain niche usage in banking and government programs.

By Solution

Solutions include Payment Terminal Solutions 30%, Security & Fraud Management 25%, Transaction Management 20%, Hosted POS 15%, and Analytics 10%, with payment terminals leading as the core enabler of contactless transactions. Security and fraud management is rapidly growing due to increasing cyber threats. Transaction management and hosted POS solutions are gaining traction among retailers and SMEs.

By Application

Applications comprise Retail 35%, Transportation 20%, Hospitality 15%, Healthcare 10%, Restaurants & Bars 10%, Government 5%, and others 5%, with retail dominating due to high-frequency consumer payments. Transportation and hospitality sectors are expanding adoption to enhance customer convenience and operational efficiency.

Buy Now & Unlock 360° Market Intelligence:

https://www.datamintelligence.com/buy-now-page?report=contactless-payments-market

Regional Analysis

North America - ~35% Share

North America leads the market due to advanced digital infrastructure, high smartphone penetration, and strong adoption of NFC payments in the U.S. and Canada. Retail and transportation are key application sectors, and smartphones & wearables dominate device usage.

Europe - ~25% Share

Europe holds 25% share driven by widespread card and mobile wallet adoption, advanced payment terminals, and government initiatives supporting cashless transactions in the UK, Germany, France, and Nordic countries.

Asia Pacific - ~25% Share

Asia Pacific captures 25% share fueled by high adoption of mobile wallets, contactless cards, and POS terminals in China, India, Japan, and Southeast Asia. Retail and transportation are leading application areas, supported by digital payment initiatives.

Latin America - ~10% Share

Latin America represents 10% share with rising adoption in Brazil, Mexico, and Argentina. Retail and hospitality are key sectors, with smartphones and POS terminals widely used.

Middle East & Africa - ~5% Share

Middle East & Africa captures 5% share, driven by increasing digital infrastructure, government-driven cashless initiatives, and adoption in retail, transportation, and banking sectors. Smartphones and wearables dominate devices, particularly in urban areas.

Request for 2 Days FREE Trial Access:

https://www.datamintelligence.com/reports-subscription?prasad

✅ Competitive Landscape

✅ Technology Roadmap Analysis

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Consumer Behavior & Demand Analysis

✅ Import-Export Data Monitoring

✅ Live Market & Pricing Trends

Have a look at our Subscription Dashboard:

https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release United States Contactless Payments Market to grow at 20% CAGR | North America leads with 35% share | Top Companies - Gemalto, Infineon Technologies AG, Ingenico here

News-ID: 4366979 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

Platform as a Service (PaaS) Market to Reach US$ 445.54 Billion by 2032 at 22.31 …

The Platform as a Service (PaaS) market reached US$ 88.96 billion in 2024 and is expected to reach US$ 445.54 billion by 2032, growing at a CAGR of 22.31% during the forecast period 2025-2032. Market growth is driven by rising enterprise adoption of cloud-native application development, increasing demand for scalable "as-a-service" models, and the need to accelerate application deployment while reducing infrastructure management complexity.

Additional growth drivers include commercialization of 5G…

Plastic Recycling Market is set to reach USD 60.2 billion by 2031, Asia Pacific …

Global Plastic Recycling Market reached USD 28.3 billion in 2022 and is expected to reach USD 60.2 billion by 2031, growing with a CAGR of 8.9% during the forecast period 2024-2031.

The Plastic Recycling Market is growing due to rising environmental awareness, government regulations, circular economy initiatives, increasing plastic waste, and innovations in advanced recycling technologies driving sustainable material recovery.

Get a Free Sample PDF Of This Report (Get Higher Priority for…

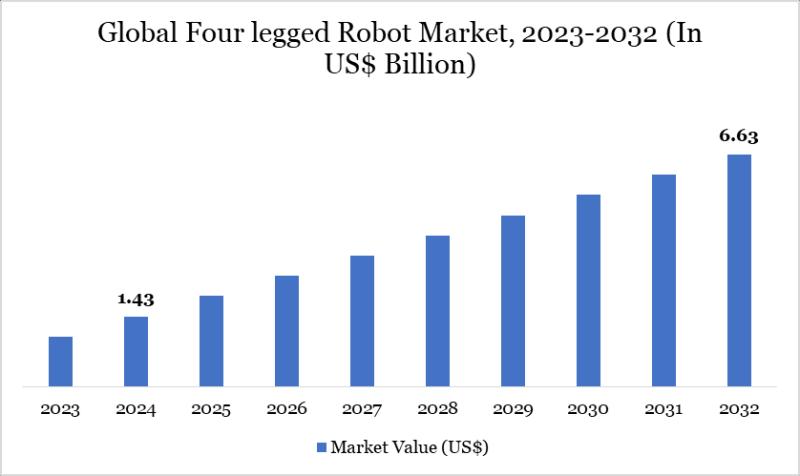

Four-legged Robot Market Set for Explosive Growth to USD 6.63 Billion by 2032, L …

The Global Four-legged Robot Market reached USD 1.43 billion in 2024 and is expected to reach USD 6.63 billion by 2032, growing with a CAGR of 18.54% during the forecast period 2025-2032.

Market growth is driven by rising demand for autonomous inspection and surveillance in industries like oil & gas, construction, and mining, increasing adoption in defense and security applications, and strong performance in disaster response scenarios. Advancements in AI-driven mobility,…

Online Lottery Market to Reach US$ 38.72 Billion by 2032 at 15.3% CAGR; North Am …

The Online Lottery Market reached US$ 12.41 billion in 2024 and is expected to reach US$ 38.72 billion by 2032, growing at a CAGR of 15.3% during the forecast period 2025-2032. Market growth is driven by increasing internet penetration, widespread smartphone adoption, and the shift of traditional lottery systems toward digital and mobile platforms that offer greater convenience, transparency, and accessibility.

The market is high in Europe, supported by strong regulatory…

More Releases for Pay

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Mobile Wallet (NFC, Digital Wallet) Market to Witness Stunning Growth | Apple Pa …

HTF MI recently introduced Global Mobile Wallet (NFC, Digital Wallet) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Apple Pay, Google Pay, Samsung Pay, PayPal, Alipay, WeChat Pay,…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…