Press release

Global FLNG Market Growth Driven by Offshore LNG Demand

According to a new report published by Allied Market Research, the Floating Liquefied Natural Gas (FLNG) Market was valued at $19.2 billion in 2022 and is projected to reach $51.6 billion by 2032, registering a robust CAGR of 10.8% from 2023 to 2032. The market is gaining strong momentum due to rising global demand for liquefied natural gas, increased offshore gas exploration, and the need for cost-effective alternatives to onshore LNG infrastructure.Download PDF Brochure: https://www.alliedmarketresearch.com/request-sample/A15554

Introduction to the Floating Liquefied Natural Gas (FLNG) Market

Floating liquefied natural gas refers to the process of extracting, liquefying, storing, and offloading natural gas directly from offshore gas fields using floating vessels. FLNG eliminates the need for expensive onshore liquefaction plants and long pipelines, making it a flexible and economical solution for monetizing offshore gas reserves, especially in remote or deepwater locations.

FLNG systems consist of several integrated components, including liquefaction units, storage tanks, offloading systems, and floating vessels. These vessels are either purpose-built or converted from conventional LNG carriers. Natural gas extracted from offshore wells is processed onboard, cooled to cryogenic temperatures to convert it into LNG, and stored safely in insulated tanks. The LNG is later transferred to LNG carriers through specialized offloading systems for transportation to global markets.

The Floating Liquefied Natural Gas (FLNG) Market is emerging as a critical solution for countries aiming to accelerate natural gas production while minimizing capital expenditure and development timelines.

Market Dynamics

Cost Efficiency and Deployment Flexibility Driving Growth

One of the major growth drivers of the Floating Liquefied Natural Gas (FLNG) Market is its cost-efficient and flexible deployment model. Traditional onshore LNG projects require extensive infrastructure development, including pipelines, liquefaction plants, and storage facilities. In contrast, FLNG projects significantly reduce capital costs by consolidating production, liquefaction, storage, and offloading on a single floating platform.

FLNG vessels can be redeployed to different gas fields over their operational life, enabling operators to maximize asset utilization. This mobility allows companies to monetize smaller or stranded gas reserves that were previously considered economically unviable. In addition, FLNG projects typically have shorter development timelines compared to onshore LNG plants, enabling faster access to global LNG markets.

Rising Global Demand for LNG

The increasing demand for cleaner energy sources is a key factor supporting the Floating Liquefied Natural Gas (FLNG) Market growth. LNG is widely regarded as a transition fuel due to its lower carbon emissions compared to coal and oil. Industrial, commercial, and power generation sectors are increasingly adopting LNG to meet energy needs while complying with emission reduction targets.

The ongoing energy security concerns, intensified by geopolitical tensions such as the Russia-Ukraine conflict, have pushed several countries to diversify their energy supply sources. This has resulted in higher investments in offshore gas exploration and FLNG projects, particularly in Asia-Pacific and emerging economies.

Challenges Related to Infrastructure and Financing

Despite its advantages, the Floating Liquefied Natural Gas (FLNG) Market faces several challenges. The development of FLNG projects is capital-intensive, requiring substantial investment in vessel construction, offshore pipelines, and support facilities. Securing financing for large-scale FLNG projects can be challenging, particularly in volatile economic environments.

In addition, the successful implementation of FLNG projects demands advanced engineering expertise and robust regulatory compliance. Environmental concerns, safety requirements, and complex offshore operations further add to project risks, potentially impacting market growth.

Buy This Report (266 Pages PDF with Insights, Charts, Tables, and Figures): https://www.alliedmarketresearch.com/floating-liquefied-natural-gas-market/purchase-options

Segmentation Analysis

The Floating Liquefied Natural Gas (FLNG) Market analysis is segmented based on technology, capacity, and region.

By Technology

Based on technology, the market is categorized into LNG FPSO, FSRU, and others. Among these, the FSRU (Floating Storage and Regasification Unit) segment dominated the market in 2022 and is expected to maintain its dominance during the forecast period.

FSRUs enable rapid and efficient delivery of regasified LNG and play a critical role in offshore LNG supply chains. Their lower capital costs, faster deployment, and environmentally friendly operations have significantly increased their adoption worldwide, contributing to the growth of the Floating Liquefied Natural Gas (FLNG) Market.

By Capacity

By capacity, the market is classified into small/mid-scale, large-scale, and others. The large-scale FLNG segment accounted for the highest revenue share in 2022 and is projected to grow at the fastest pace during the forecast period.

The rising demand for LNG from industrial and commercial consumers has led to bulk procurement, increased production capacity, and multiple planned expansions. These factors are driving investments in large-scale FLNG facilities, strengthening the overall Floating Liquefied Natural Gas (FLNG) Market outlook.

Regional Analysis

Region-wise, the Floating Liquefied Natural Gas (FLNG) Market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Asia-Pacific dominated the global market in terms of revenue in 2022 and is expected to grow at the highest CAGR during the forecast period. Countries in the region are expanding offshore LNG production to reduce dependence on imported energy and enhance energy security. The impact of geopolitical conflicts has further accelerated investments in FLNG infrastructure across Asia-Pacific.

Collaborations between regional governments and international energy companies are bringing technological expertise and financial resources into the Floating Liquefied Natural Gas Industry. Joint ventures and strategic partnerships are increasingly being adopted to overcome technical and financial challenges associated with FLNG projects.

Competitive Landscape

The Floating Liquefied Natural Gas (FLNG) Market is moderately consolidated, with major players focusing on collaborations, expansions, and technological advancements. Key companies operating in the market include Eni S.p.A., Shell plc, Höegh LNG, Golar LNG Limited, EXMAR, Woodside Energy Group Ltd., Mitsui O.S.K. Lines, Excelerate Energy Inc., BASF SE, ABB Ltd., and PETRONAS.

These players are investing in advanced FLNG vessel designs, modular construction techniques, and digital monitoring solutions to enhance operational efficiency and reduce project costs.

Get a Customized Research Report: https://www.alliedmarketresearch.com/request-for-customization/A15554

Conclusion

In conclusion, the Floating Liquefied Natural Gas (FLNG) Market is set to experience strong growth through 2032, driven by increasing LNG demand, offshore gas development, and the need for cost-efficient gas monetization solutions. While infrastructure and financing challenges remain, technological advancements and strategic collaborations are expected to unlock significant growth opportunities, positioning FLNG as a cornerstone of the global LNG supply chain.

Trending Reports in Energy and Power Industry:

Floating Liquefied Natural Gas (FLNG) Market

https://www.alliedmarketresearch.com/floating-liquefied-natural-gas-market-A15554

Floating Production Storage and Offloading (FPSO) Market

https://www.alliedmarketresearch.com/floating-production-storage-and-offloading-market-A07604

LNG Carrier Market

https://www.alliedmarketresearch.com/lng-carrier-market-A09307

LNG Engine Market

https://www.alliedmarketresearch.com/lng-engine-market-A325619

Bio-LNG Market

https://www.alliedmarketresearch.com/bio-lng-market-A187448

LNG Bunkering Market

https://www.alliedmarketresearch.com/lng-bunkering-market

Planned LNG Market

https://www.alliedmarketresearch.com/planned-lng-market

Large Scale LNG Terminals Market

https://www.alliedmarketresearch.com/large-scale-lng-terminals-market

Bunker Fuel Market

https://www.alliedmarketresearch.com/bunker-fuel-market

Marine Bunker Oil Market

https://www.alliedmarketresearch.com/marine-bunker-oil-market

Singapore Bunker Fuel Market

https://www.alliedmarketresearch.com/singapore-bunker-fuel-market-A14491

UAE Liquified Petroleum Gas Market

https://www.alliedmarketresearch.com/uae-liquified-petroleum-gas-market-A323615

Compressed Natural Gas Market

https://www.alliedmarketresearch.com/compressed-natural-gas-market

Floating Storage Regasification Unit (FSRU) market

https://www.alliedmarketresearch.com/floating-storage-regasification-unit-market-A07866

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

Web: www.alliedmarketresearch.com

Allied Market Research Blog:

https://blog.alliedmarketresearch.com

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

Pawan Kumar, the CEO of Allied Market Research, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global FLNG Market Growth Driven by Offshore LNG Demand here

News-ID: 4366280 • Views: …

More Releases from Allied Analytics LLP

Power Rental Market Growth Fueled by Construction, Oil & Gas, and Utility Sector …

According to a new report published by Allied Market Research, the global power rental market was valued at $9.5 billion in 2020 and is projected to reach $17.8 billion by 2030, growing at a CAGR of 6.6% from 2021 to 2030. The power rental market is gaining significant traction due to the rising demand for temporary and reliable electricity supply across various industrial and commercial sectors worldwide.

Download PDF Brochure: https://www.alliedmarketresearch.com/request-sample/2221

Power…

Rising Renewable Energy Demand Driving the Solar PV Inverter Market Growth

According to a new report published by Allied Market Research, the solar (PV) inverter market size was valued at $7.7 billion in 2020 and is projected to reach $17.9 billion by 2030, growing at a CAGR of 8.8% from 2021 to 2030. The solar (PV) inverter market is witnessing significant growth due to the rapid expansion of renewable energy infrastructure, rising adoption of solar power systems, and increasing investments in…

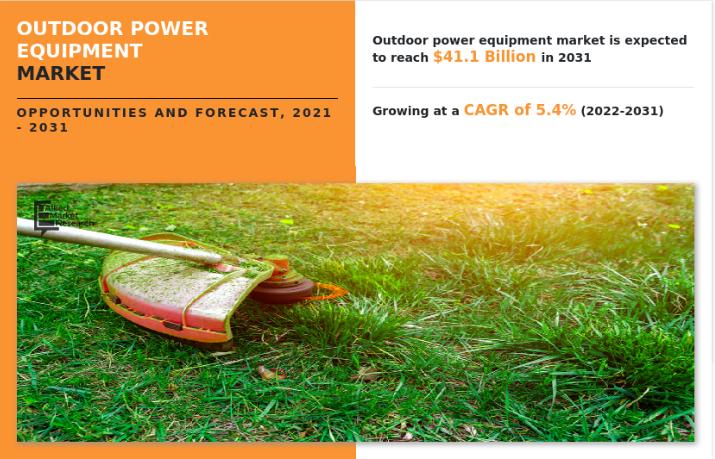

Outdoor Power Equipment Market to Reach $41.1 Billion by 2031 Driven by Rising G …

According to a new report published by Allied Market Research, the outdoor power equipment market size was valued at $24.4 billion in 2021 and is projected to reach $41.1 billion by 2031, growing at a CAGR of 5.4% from 2022 to 2031. The increasing demand for efficient lawn maintenance tools, rapid adoption of battery-powered equipment, and rising interest in gardening and landscaping activities are key factors fueling the growth of…

Solar Tracker Market to Reach $16 Billion by 2031 Driven by Rising Solar Energy …

According to a new report published by Allied Market Research, the solar tracker market size was valued at $8.9 billion in 2021 and is estimated to reach $16.0 billion by 2031, growing at a CAGR of 6.1% from 2022 to 2031. The increasing adoption of solar energy, supportive government policies, and growing need for efficient power generation systems are major factors driving the growth of the solar tracker market globally.

Download…

More Releases for LNG

LNG Bunkering Market Growth, Trends & Opportunities 2025 | Top key players - Tre …

LNG Bunkering Market, as analyzed in the study by DataM Intelligence, presents a detailed overview of the industry with in-depth insights, historical data, and key statistics. The report thoroughly examines market dynamics, competitive strategies, and major players, highlighting their product lines, pricing structures, financials, growth plans, and regional outreach.

The Global LNG Bunkering Market is expected to grow at a CAGR of 66.4% during the forecasting period (2024-2031).

Get a Free Sample…

Mea Floating Lng Power Vessel Market Emerging Trends and Growth Prospects 2034 | …

On April 8, 2025, Exactitude Consultancy., Ltd. released a research report titled "Mea Floating Lng Power Vessel Market". In-depth research has been compiled to provide the most up-to-date information on key aspects of the worldwide market. This research report covers major aspects of the Mea Floating Lng Power Vessel Market including drivers, restraints, historical and current trends, regulatory scenarios, and technological advancements. It provides the industry overview with growth analysis…

What's Driving the LNG Bunkering Market Trends? Key Companies are Skangass AS., …

A research report on 'LNG Bunkering Market' Added by DEC Research features a succinct analysis on the latest market trends. The report also includes detailed abstracts about statistics, revenue forecasts and market valuation, which additionally highlights its status in the competitive landscape and growth trends accepted by major industry players.

Request a sample of this research report @ https://www.decresearch.com/request-sample/detail/702

The size of LNG Bunkering Market was registered at USD 800 Million in…

LNG Bunkering Market Key Players Polskie LNG, Eagle LNG, ENN Energy, EVOL LNG, F …

The LNG Bunkering Market report add detailed competitive landscape of the global market. It includes company, market share analysis, product portfolio of the major industry participants. The report provides detailed segmentation of the LNG Bunkering industry based on product segment, technology, end user segment and region.

As per a recent news snippet, the Caribbean is one of the most lucrative regions for LNG bunkering market, as the shipping sector seeks compliance…

LNG Bunkering Industry to surpass $12bn by 2024:ENGIE,Polskie LNG,Eagle LNG, ENN …

LNG Bunkering Market size is set to exceed USD 12 billion by 2024.Growing demand for cleaner fuel coupled with strict emission regulations to reduce the airborne emissions predominantly in North America and Europe will stimulate LNG bunkering market. In 2015, International Maritime Organization (IMO) introduced Tier III norms to curb NOx emissions from marine vessels among Emission Control Areas (ECAs) under maritime boundaries.

Request for a sample copy of this…

Global Liquefied Natural Gas (LNG) Market 2018-22 : LNG bunkering, progressing L …

ResearchMoz presents Professional and In-depth Study of "Global Liquefied Natural Gas (LNG) Market: Industry Analysis & Outlook (2018-2022)" with coming years Industries Trends, Projections of Global Growth, Major Key Player and Case Study, Review, Share, Size, Effect.

' '

Liquefied Natural Gas (LNG) is a liquid form of natural gas, which is composed mainly of methane and other gases such as Ethane, Propane, Butane and Nitrogen. LNG liquefaction is a procedure…