Press release

India Non-Life Insurance Market Analysis: Regional Insights, Opportunities, Key Trends, and Future Outlook

India Non-Life Insurance Market was valued at USD 13, 7889 Mn. in 2021 and is expected to grow at USD 22,400 Mn. in 2029. India Non-Life Insurance Market size is expected to grow at a CAGR of 7.18 % through the forecast period.India Non-Life Insurance Market Overview:

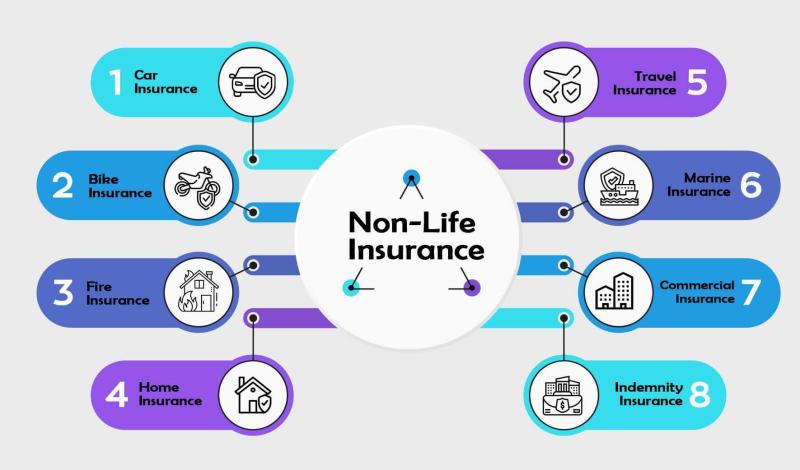

The India non-life insurance market, also known as the general insurance market, has been experiencing steady growth, driven by rising awareness of insurance products, increasing disposable incomes, and regulatory support from the Insurance Regulatory and Development Authority of India (IRDAI). The market covers a broad spectrum of products, including health insurance, motor insurance, property insurance, travel insurance, and liability insurance, catering to both individual and corporate customers.

Rapid urbanization, growing vehicle ownership, and increased risk awareness have boosted demand for motor and health insurance, while natural disasters and industrial growth are driving property and liability insurance uptake. Technological advancements, such as digital platforms, mobile apps, and online policy purchase systems, have simplified access to insurance products and enhanced customer engagement.

Additionally, the market is witnessing the emergence of innovative products, customized solutions, and usage-based insurance models, fueled by data analytics, artificial intelligence, and telematics. Regulatory initiatives promoting insurance penetration in rural areas and underinsured segments, combined with strategic partnerships between insurers and fintech companies, are further propelling market growth.

Download Free Sample & Check the Latest Market Analysis: https://www.maximizemarketresearch.com/request-sample/42091/

India Non-Life Insurance Market Dynamics:

The India non-life insurance market is driven by increasing awareness of risk protection, rising vehicle ownership, rapid urbanization, and growth in industrial and commercial activities, which collectively boost demand for motor, health, property, and liability insurance. Technological advancements, including digital platforms, mobile apps, and AI-powered analytics, are enhancing customer engagement, simplifying policy purchases, and enabling personalized insurance solutions. Regulatory support from IRDAI, along with initiatives to increase penetration in rural and underinsured segments, further strengthens market growth. However, challenges such as low insurance literacy, intense competition, and pricing pressures persist. Opportunities lie in innovative products, usage-based insurance, telematics, and partnerships with fintech and InsurTech companies, positioning the market for sustained expansion in the coming years.

India Non-Life Insurance Market Key Drivers of Growth:

The growth of the India non-life insurance market is primarily driven by rising awareness of insurance products and increasing risk consciousness among individuals and businesses. Rapid urbanization, higher vehicle ownership, and expanding industrial and commercial activities are boosting demand for motor, health, property, and liability insurance. Technological advancements, such as digital platforms, mobile apps, AI, and data analytics, are enhancing customer experience, simplifying policy purchases, and enabling personalized offerings. Additionally, regulatory support from IRDAI, government initiatives to promote insurance penetration in rural areas, and strategic collaborations with fintech and InsurTech companies are further fueling market expansion.

Get a Customized Market View in One Click: https://www.maximizemarketresearch.com/market-report/india-non-life-insurance-market/42091/

India Non-Life Insurance Market Segment Analysis:

by Product

• Motor insurance

• Health insurance

• Fire insurance

• Marine insurance

• Others

by New Policies Issued

• Public insurer

• Private insurer

• Specialize insurer

by Distribution Channel

• Individual agents

• Corporate agents - banks

• Corporate agents - others

• Brokers

• Direct business

• Others

India Non-Life Insurance Market Regional Analysis:

The India non-life insurance market shows varied growth patterns across regions, driven by differences in urbanization, industrial activity, and insurance awareness. North India, including Delhi, Haryana, and Uttar Pradesh, contributes significantly due to high vehicle density, commercial hubs, and strong adoption of motor and health insurance. Western India, led by Maharashtra and Gujarat, benefits from industrial growth, corporate presence, and higher disposable incomes, boosting property, fire, and liability insurance demand. Southern India, with states like Karnataka, Tamil Nadu, and Telangana, shows robust growth in health and motor insurance, aided by urbanization and tech-savvy consumers. Eastern and Northeastern India are emerging regions, with increasing government initiatives, rural insurance penetration, and awareness campaigns driving adoption, though overall penetration remains lower compared to other regions. Overall, regional disparities are narrowing as digital platforms, government schemes, and awareness campaigns expand access to insurance products across the country.

Opportunities in the India Non-Life Insurance Market:

The India non-life insurance market offers significant growth opportunities, driven by rising awareness of insurance products and increasing demand from underpenetrated rural and semi-urban areas. Digital transformation, including mobile apps, online portals, and InsurTech solutions, enables easier access to insurance and personalized offerings. Emerging segments such as usage-based motor insurance, cyber insurance, and climate risk coverage present avenues for product innovation. Strategic partnerships with banks, fintech companies, and corporate clients, along with government initiatives promoting insurance penetration, further expand market reach. Additionally, the growing middle class, increasing vehicle ownership, and heightened risk consciousness among individuals and businesses position the market for sustained expansion.

Download Free Sample & Check the Latest Market Analysis: https://www.maximizemarketresearch.com/request-sample/42091/

India Non-Life Insurance Market Future Outlook:

The India non-life insurance market is poised for steady growth over the coming years, driven by increasing risk awareness, rising vehicle ownership, and expanding urbanization. Digital adoption, including mobile platforms, AI-powered analytics, and InsurTech innovations, will continue to enhance customer experience, streamline policy purchases, and enable personalized solutions. Emerging segments such as cyber insurance, usage-based motor insurance, and climate risk coverage, along with government initiatives to boost rural insurance penetration, are expected to create new growth avenues. With strong regulatory support, technological advancements, and evolving consumer preferences, the market is set to become more inclusive, innovative, and competitive, offering significant opportunities for insurers and stakeholders alike.

Some of the most prominent and loved players in the India Non-Life Insurance Market from all over the world are:

• Agriculture Insurance Company of India Limited

• Bajaj Allianz General Insurance Company Limited

• HDFC ERGO General Insurance Company Limited

• ICICI Lombard General Insurance Company Limited

• IIFCO Tokio General Insurance

• National Insurance Company Limited

• Oriental Insurance Company Limited

• Star Health and Allied Insurance Company Limited

• Tata AIG General Insurance Company Limited

• The New India Assurance Company Limited

• The Insurance Times

• ICICI Bank

• Mahindra Insurance Brokers Limited

• Royal Sundaram General Insurance Co. Limited

• Universal Sompo General Insurance Co. Ltd.

What are the major key trends in the India Non-Life Insurance Market:

The India non-life insurance market is witnessing several notable trends shaping its growth. Digital transformation is accelerating, with mobile apps, online portals, and InsurTech solutions enabling easier policy purchases, claim processing, and personalized offerings. Usage-based and telematics-driven motor insurance is gaining traction, allowing premiums based on driving behavior. Rising demand for cyber, health, and climate risk insurance reflects changing risk awareness among individuals and businesses. Bancassurance and corporate partnerships continue to expand distribution channels, while AI, data analytics, and automation are being leveraged for underwriting, claims management, and customer engagement. Additionally, government initiatives and rural outreach programs are driving insurance penetration in underinsured and semi-urban regions, broadening the market's reach.

Trending Reports:

Human Capital Management (HCM) SaaS Market https://www.maximizemarketresearch.com/market-report/global-human-capital-management-hcm-saas-market/106233/

Next-Gen Video Codecs Market https://www.maximizemarketresearch.com/market-report/global-next-gen-video-codecs-market/79931/

Data Enrichment Solutions Market https://www.maximizemarketresearch.com/market-report/global-data-enrichment-solutions-market/94203/

Electronic navigational charts market https://www.maximizemarketresearch.com/market-report/electronic-navigational-charts-market/79180/

Zigbee Market https://www.maximizemarketresearch.com/market-report/global-zigbee-market/62684/

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Bangalore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Non-Life Insurance Market Analysis: Regional Insights, Opportunities, Key Trends, and Future Outlook here

News-ID: 4366248 • Views: …

More Releases from Maximize Market Research Pvt. Ltd.

Ready-to-Drink Beverages Market Size to Reach USD 1,227.81 Billion by 2032

Ready-to-Drink Beverages Market is poised for substantial growth over the forecast period, driven by changing consumer lifestyles, rising disposable income, expanding urbanization, and increasing demand for convenient beverage solutions. According to recent industry analysis, the global Ready-to-Drink Beverages Market was valued at USD 766.69 Billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.22% from 2025 to 2032, reaching nearly USD 1,227.81 Billion…

Second hand Product Market Set to Surpass USD 1451.34 Billion by 2032, Expanding …

Second hand Product Market was valued at USD 594.45 Billion in 2025 and is projected to grow at a robust CAGR of 13.6% from 2025 to 2032, reaching nearly USD 1451.34 Billion by 2032. The rapid expansion of resale ecosystems, increasing consumer preference for cost-effective purchasing, and rising sustainability awareness are significantly driving the growth of the Second hand Product Market globally.

Market Overview

The Second hand Product Market is undergoing a…

Tungsten Market to Reach USD 10.99 Billion by 2032, Driven by Expanding Aerospac …

The Global Tungsten Market is poised for significant expansion over the coming years, with the market size valued at USD 6.41 Billion in 2025 and projected to grow at a CAGR of 8% from 2025 to 2032, reaching nearly USD 10.99 Billion by 2032. Rising industrial demand, technological advancements in material science, and increasing applications in high-performance sectors are collectively driving this steady growth trajectory.

Tungsten, recognized for its exceptional hardness,…

System-on-Chip (SoC) Market to Reach USD 391.61 Billion by 2032, Driven by 5G, A …

The global System-on-Chip (SoC) Market is poised for significant growth over the forecast period, reflecting the rapid evolution of semiconductor technologies and increasing demand for high-performance, energy-efficient electronic devices. Valued at USD 228.06 Billion in 2025, the market is projected to grow at a CAGR of 8.03% from 2025 to 2032, reaching nearly USD 391.61 Billion by 2032.

♦ Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/33954/

System-on-Chip (SoC) Market Overview

A…

More Releases for India

India Smart Air Purifier Market Set to Witness Significant Growth by 2035 | Phil …

India smart air purifier market was valued at $125.8 million in 2024 and is projected to reach $298.7 million by 2035, growing at a CAGR of 8.3% during the forecast period (2025-2035).

India Smart Air Purifier Market Overview

The Indian smart air purifier market is experiencing significant growth, driven by increasing concerns over air pollution and its impact on health. Consumers are increasingly adopting smart air purifiers equipped with advanced features…

Ayurvedic Service Market is Flourishing Like Never Before | Patanjali Ayurved Li …

RnM newly added a research report on the Ayurvedic Service market, which represents a study for the period from 2020 to 2026.

The research study provides a near look at the market scenario and dynamics impacting its growth. This report highlights the crucial developments along with other events happening in the market which are marking on the growth and opening doors for future growth in the coming years. Additionally, the…

Pasta Market Report 2018 Companies included Bambino (India), Nestle (USA), Field …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides detailed segmentation on the…

Interior Designers India, Designers and Architects India, Interior Design Consul …

Synergy Corporate Interiors Pvt. Ltd. are offer Designers and Architects India Our architects, designers are working an national and international client base. The final design output is then integrated with the various technical and engineering aspects and taken into production. The expression is also individualistic, based on the communication of the correct corporate identity. Our designers, engineers and architects perform any plan successfully combine handy knowledge with creative ideas into…

Domain Registration India, Web Hosting India, VPS Hosting India , SSL Certificat …

All the Domain Registration services are at affordable price and assure you for the 100% quality.

India Internet offers cheap domain name registration for many domain extensions available. We are a full-service web site solutions provider. We offer a full range of web services including domain registration India, Web Hosting India, Web design, SEO marketing and etc.

We offer different standard and different Windows .NET low-cost, full-featured, all-inclusive web hosting and domain…

Domain Registration India, Web Hosting India, Payment Gateway India

Indiainternet.in is a Quality Web Hosting Company India, provide all web related support and Web hosting services like linux web hosting, windows web hosting, web hosting packages, domain registration in india, Corporate email solution, business email hosting, payment gateway integration, SSL with supports like free php, cgi, asp, free msaccess, free cdonts, free webmail, web based control panel, unlimited ftp access, unlimited data transfer.

During the domain registration process, you will…