Press release

Market Trend Analysis: The Impact of Recent Advances on the Exception Management for Banking Operations Market

The exception management for banking operations market is set to experience significant expansion in the coming years, driven by technological innovations and increasing operational demands. This report delves into the market's current valuation, key players, emerging trends, and segmented outlook, offering a detailed perspective on what lies ahead for this evolving industry.Projected Market Valuation and Growth Expectations for the Exception Management for Banking Operations Market

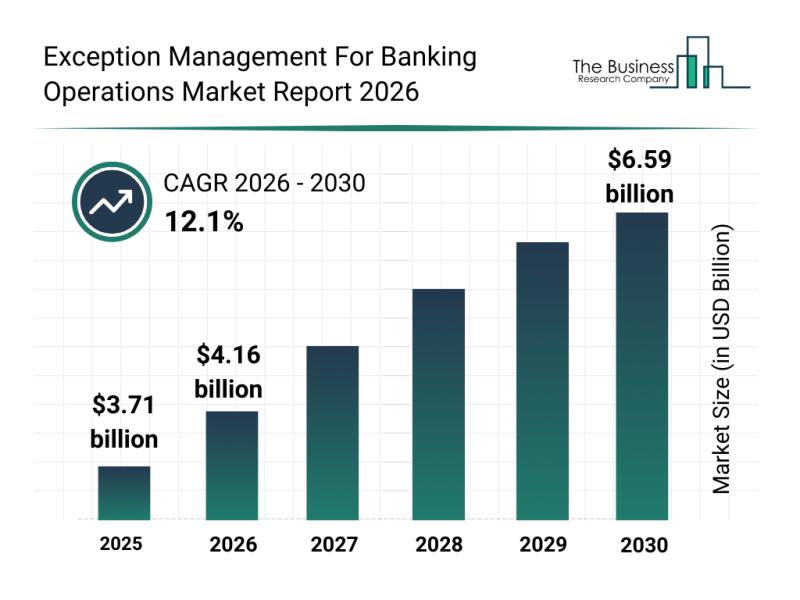

The market size for exception management in banking operations is anticipated to grow rapidly, reaching $6.59 billion by 2030, with a solid compound annual growth rate (CAGR) of 12.1%. This surge is largely fueled by the rising need for automated exception handling, a growing emphasis on improving operational efficiency, expanding partnerships with fintech companies, heightened regulatory oversight, and an increasing focus on enhancing customer experiences. Key trends supporting this growth include advancements in artificial intelligence (AI) and machine learning, innovations in workflow automation, improvements in risk management software, progress in fraud detection technologies, wider adoption of cloud and edge computing, and enhancements in predictive analytics.

Download a free sample of the exception management for banking operations market report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=30961&type=smp

Driving Forces Behind the Expansion of the Exception Management for Banking Operations Market

One of the primary factors propelling this market is the escalating demand for automation in exception handling processes, which helps banks reduce manual intervention and cut operational costs. Financial institutions are eager to adopt technologies that streamline workflows and improve accuracy amid growing transaction volumes.

Another important growth driver is the increasing regulatory scrutiny in the banking sector. Compliance requirements compel banks to implement efficient exception management systems capable of handling complex rules and reporting needs. This, combined with an industry-wide focus on delivering superior customer experiences, is pushing banks to upgrade their operational frameworks and reduce errors that could impact client satisfaction.

Leading Companies Influencing the Exception Management for Banking Operations Industry

Several prominent organizations are shaping the landscape of exception management for banking operations globally. These include accenture* plc, Oracle Corporation, Tata Consultancy Services, Capgemini SE, Intellect Design Arena Limited, Fiserv Inc., Cognizant Technology Solutions Corporation, HCL Technologies Limited, Wipro Limited, Fidelity National Information Services Inc., Experian plc, Finastra Group Holdings Limited, DXC Technology, SAS Institute Inc., Sopra Banking Software, Jack Henry & Associates Inc., Teradata Corporation, ACI Worldwide Inc., Temenos AG, and Bottomline Technologies Inc.

A notable development occurred in February 2024 when Duco, a UK-based AI-powered data automation firm, acquired Belgium's Metamaze. This acquisition aims to enhance Duco's platform by integrating adaptive Intelligent Document Processing (IDP) capabilities, enabling seamless end-to-end automation of structured and unstructured data lifecycles. Metamaze's AI-driven exception management tools are specifically designed for banking and financial services, addressing operational and compliance bottlenecks.

View the full exception management for banking operations market report:

https://www.thebusinessresearchcompany.com/report/exception-management-for-banking-operations-market-report

Upcoming Trends Reshaping the Exception Management for Banking Operations Market

Industry players are increasingly introducing cutting-edge technologies such as agentic AI-powered payment exception handling workflows. These are intelligent, autonomous systems that identify, assess, and resolve payment discrepancies with minimal human involvement, improving straight-through processing and speeding up dispute resolutions.

For example, in December 2024, Pegasystems Inc., a US-based enterprise software provider, launched Pega Smart Investigate Enterprise Edition. This version features generative AI tools including Pega GenAI Blueprint for natural language workflows, GenAI Coach for on-the-spot guidance, Knowledge Buddy for quick document access, AI-generated case summaries, swift message translations, and integration with Pega Customer Service. It also supports MT/ISO interoperability to reduce manual efforts. The Agentic edition further introduces native AI agents to handle tasks like email processing and new payment workflows, alongside parallel orchestration capabilities, aiming to advance straight-through processing to meet G20 goals on sub-hour cross-border payments.

Comprehensive Segmentation Overview of the Exception Management for Banking Operations Market

The exception management for banking operations market is categorized into multiple key segments:

1) By Component: Software and Services

2) By Deployment Mode: On-Premises and Cloud

3) By Organization Size: Large Enterprises and Small and Medium Enterprises (SMEs)

4) By Application: Transaction Monitoring, Compliance Management, Risk Management, Fraud Detection, and Reconciliation

5) By End User: Retail Banking, Corporate Banking, and Investment Banking

Further breakdown within these segments includes:

- Software: Core Banking Software, Fraud Detection Software, Risk Management Software, Workflow Automation Software, and Compliance Management Software

- Services: Consulting Services, Implementation Services, Support and Maintenance Services, Training and Education Services, and Managed Services

This detailed segmentation helps stakeholders understand the diverse components and applications shaping the exception management market in banking, preparing them to capitalize on opportunities and navigate challenges effectively.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/,

Americas +1 310-496-7795,

Europe +44 7882 955267,

Asia & Others +44 7882 955267 & +91 8897263534,

Email us at info@tbrc.info.

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Market Trend Analysis: The Impact of Recent Advances on the Exception Management for Banking Operations Market here

News-ID: 4366216 • Views: …

More Releases from The Business Research Company

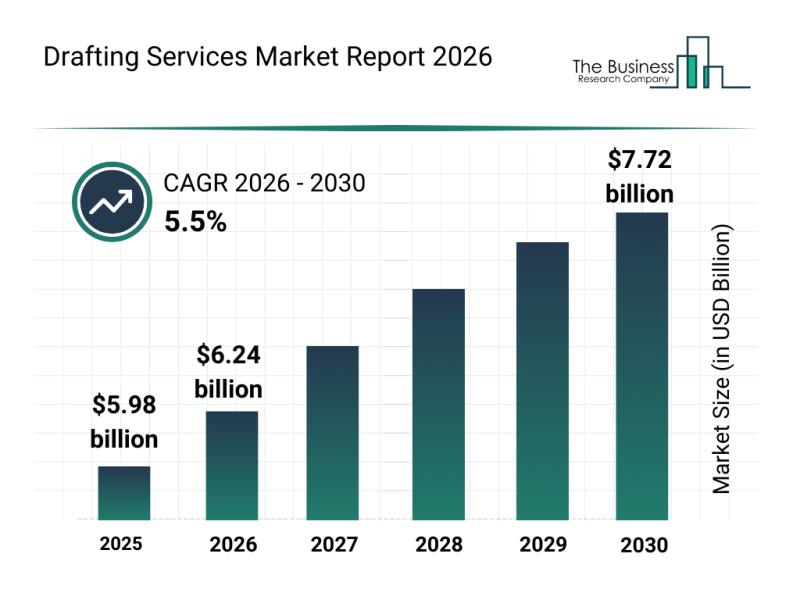

Future Perspective: Key Trends Shaping the Drafting Services Market Until 2030

The drafting services industry is poised for considerable expansion in the coming years as technological advancements and evolving construction needs drive demand. With a wide range of applications across sectors, this market is set to experience steady growth fueled by innovation and increasing adoption of digital tools. Let's explore the current market size, influential factors, key players, emerging trends, and segmentation in this dynamic field.

Projected Growth and Market Size of…

Emerging Sub-Segments Transforming the Digital Rights Management Market Landscap …

The digital rights management (DRM) market is positioned for remarkable expansion in the coming years, driven by technological advancements and increasing concerns over content security. As digital media consumption grows and new platforms emerge, DRM solutions are becoming essential to protect intellectual property and ensure the authorized use of digital assets. Let's explore the current market size, key players, prevailing trends, and the main segments shaping the future of this…

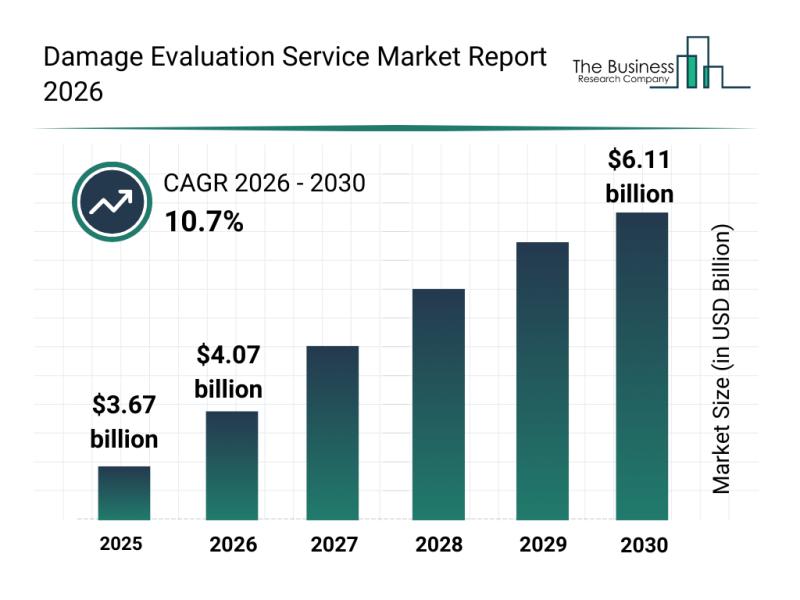

Market Trend Insights: The Impact of Recent Advances on the Damage Evaluation Se …

The damage evaluation service market is on the brink of substantial growth as advancements in technology and increasing demand for efficient damage assessment methods gain momentum. This sector is evolving rapidly with the integration of innovative tools and techniques that enhance accuracy and speed in evaluating damages across various industries.

Forecasted Market Size and Growth Trajectory of the Damage Evaluation Service Market

The damage evaluation service market is projected to…

Corporate Training Market: Segmentation Analysis, Market Trends, and Competitive …

The corporate training sector is on a path of significant growth as organizations increasingly recognize the importance of continuous employee development. With rapid technological advances and shifting workforce needs, this market is expected to expand steadily, driven by innovative solutions and evolving learning preferences. Below, we explore the market's size projections, key players, emerging trends, and segmentation insights to provide a comprehensive overview of the corporate training landscape.

Projected Growth and…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…