Press release

Mexico Ports Infrastructure Market Size, Growth, Latest Trends and Forecast 2025-2033

IMARC Group has recently released a new research study titled "Mexico Ports Infrastructure Market Size, Share, Trends and Forecast by Port Type, Construction Type, Application, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.Market Overview

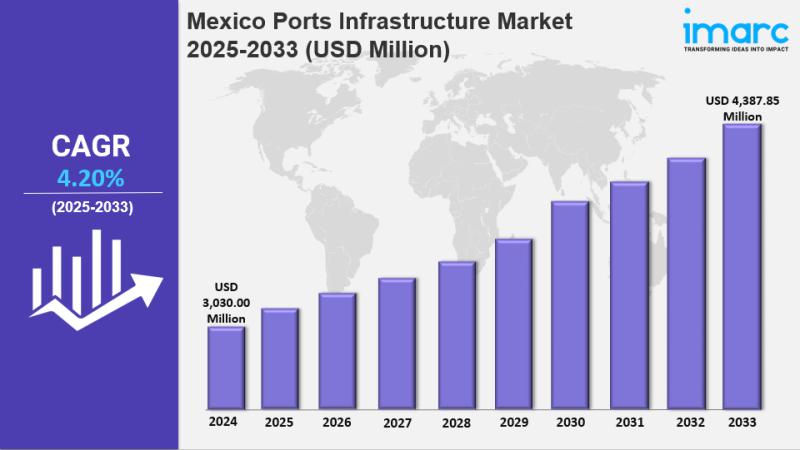

The Mexico ports infrastructure market size reached USD 3,030.00 Million in 2024, with a forecast to reach USD 4,387.85 Million by 2033. The market is projected to grow at a CAGR of 4.20% during the forecast period of 2025-2033. Key growth drivers include expansion of trade agreements, government infrastructure initiatives, digitalization of port operations, and strategic public-private partnerships enhancing Mexico's role as a logistics hub.

Study Assumption Years

• Base Year: 2024

• Historical Year/Period: 2019-2024

• Forecast Year/Period: 2025-2033

Mexico Ports Infrastructure Market Key Takeaways

• Current Market Size: USD 3,030.00 Million in 2024

• CAGR: 4.20% (2025-2033)

• Forecast Period: 2025-2033

• Mexico's Port of Manzanillo is undergoing a USD 3 Billion expansion to increase container handling capacity from 3.5 million TEU to 10 million TEU by 2030.

• Trade agreements including USMCA and CPTPP significantly boost port modernization and capacity.

• Government programs such as the National Infrastructure Program (NIP) support infrastructure development.

• Public-private partnerships are instrumental in modernizing port facilities and encouraging private sector participation.

• Digitalization and smart port initiatives are improving operational efficiencies and multimodal connectivity.

Sample Request Link: https://www.imarcgroup.com/mexico-ports-infrastructure-market/requestsample

Mexico Ports Infrastructure Market Growth Factors

The expansion of Mexico's international trade agreements has played a pivotal role in market growth. Agreements like USMCA and CPTPP have elevated Mexico's status as a strategic logistics and trade hub. This has led to substantial investments in port modernization and capacity upgrades. Export industries depend heavily on efficient maritime channels, increasing the demand for advanced port facilities. The focus on supply chain optimization is also tightly linked to Mexico's improved trade positioning.

Government-led initiatives form another key growth factor. Programs such as the National Infrastructure Program (NIP) and the Special Program for Ports and Merchant Marine (PEPyMM) demonstrate strong policy commitment to maritime infrastructure enhancement. State and federal budgets are significantly allocated to upgrading ports, reducing logistical bottlenecks and enabling seamless cargo movement to sustain competitiveness in global trade.

Technological advancements and private sector involvement further fuel growth. Automation, digital tracking, sustainable energy solutions, and smart port initiatives are being integrated into operations. Public-private partnerships are enhancing modernization efforts to meet global standards. The Manzanillo port expansion, led by Mexican Naval Ministry (SEMAR), exemplifies these trends, aiming to become Latin America's largest container port with environmentally sustainable development.

Buy Report Now: https://www.imarcgroup.com/checkout?id=33700&method=3682

Mexico Ports Infrastructure Market Segmentation

Breakup By Port Type:

• Sea Port: Includes maritime ports handling sea cargo and passenger traffic.

• Inland Port: Includes facilities located inland serving as transshipment and logistics hubs.

Breakup By Construction Type:

• Terminal: Infrastructural facilities designed for cargo handling and passenger services.

• Equipment: Machinery and technology used for port operations and cargo management.

Breakup By Application:

• Passenger: Infrastructures and services related to passenger traffic and transport facilitation.

• Cargo: Facilities and operations focused on freight handling and logistics.

Breakup By Region:

• Northern Mexico: Includes ports and infrastructure servicing northern regional trade.

• Central Mexico: Covers inland and coastal infrastructure in central areas.

• Southern Mexico: Encompasses infrastructure supporting southern maritime and inland logistics.

• Others

Regional Insights

Northern Mexico, Central Mexico, and Southern Mexico are all covered as major regional markets, but the report does not explicitly specify which region is dominant or provide detailed statistics on regional market shares. The comprehensive analysis includes these primary regions along with others to highlight port infrastructure trends and growth potential. Specific numeric regional data such as market share or CAGR by region is not provided in the source.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=33700&flag=C

Recent Developments & News

On January 2, 2024, Genesee & Wyoming Inc. (G&W) announced that Grupo México Transportes (GMXT) will become its new joint venture partner in CG Railway (CGR), pending regulatory approvals. GMXT will purchase SEACOR Holdings' stake in CGR, which operates a rail-ferry service between Mobile, Alabama, and Coatzacoalcos, Veracruz. This partnership aims to enhance CGR's service capacity and network reach, supporting increasing cross-border trade between the U.S. and Mexico.

Competitive Landscape

The market research report covers a comprehensive competitive landscape analysis including market structure, key player positioning, winning strategies, competitive dashboards, and company evaluation quadrants. Detailed profiles of all major companies have been provided.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mexico Ports Infrastructure Market Size, Growth, Latest Trends and Forecast 2025-2033 here

News-ID: 4365873 • Views: …

More Releases from IMARC Group

Green Tea Bags Manufacturing Plant DPR 2026: Investment Cost, Market Growth & RO …

Setting up a green tea bags manufacturing plant positions investors within one of the steadily expanding and health-oriented segments of the global beverage industry, driven by increasing consumer awareness of wellness, rising preference for natural antioxidants, and growing demand for convenient herbal drink options. Green tea is widely valued for its perceived health benefits, including metabolism support and antioxidant properties, making it popular among health-conscious urban populations.

The shift toward…

Calcium Acetate Prices Q4 2025: USA Reaches USD 1,165/MT While China Trades at U …

North America Calcium Acetate Price Outlook Q4 2025:

United States Calcium Acetate Price Overview:

In Q4 2025, calcium acetate prices in the United States reached USD 1165 per metric ton. The market remained firm due to steady demand from food processing, pharmaceuticals, and wastewater treatment sectors. Stable consumption patterns and moderate production costs supported pricing levels. Supply chain efficiency and consistent raw material availability helped prevent sharp fluctuations during the quarter.

Get the…

Automotive Radiator Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis …

Setting up an Automotive Radiator manufacturing plant positions investors in one of the most critical and high-demand segments of the global automotive components and thermal management industry, backed by sustained global growth driven by rising vehicle production, increasing regulatory focus on engine efficiency and emission reduction, and the growing adoption of electric and hybrid vehicles requiring advanced cooling solutions. As global automotive production expands across emerging economies, regulatory frameworks continue…

Watch Manufacturing Plant DPR & Unit Setup - 2026: Machinery, CapEx/OpEx, ROI an …

Setting up a watch manufacturing plant positions investors at the convergence of precision engineering, consumer lifestyle, luxury goods, and wearable technology - one of the most dynamic and diversified segments of the global consumer goods industry - driven by rising demand for luxury and premium accessories, increasing adoption of smart and hybrid watches, growing disposable incomes across emerging markets, and expanding e-commerce and organized retail channels enabling access to global…

More Releases for Mexico

Egg Freezing in Mexico: Leading Mexico City Clinics Launch 2026 Programs

Enlistalo Fertilidad offers expanded egg freezing services for international patients, including Americans, seeking fertility preservation.

Mexico City, Mexico - January 22, 2026 - Egg freezing is becoming an increasingly popular option for patients worldwide, and Mexico City continues to emerge as a leading destination for those seeking high-quality, affordable fertility care.

In 2026, Enlistalo Fertilidad stands out for its personalized approach, advanced medical standards, and focus on supporting international patients through every…

Human Resources Mexico Releases Employer Guide To Mexico 2026 Minimum Wage Compl …

Mexico's National Minimum Wage Commission (CONASAMI) has confirmed the new minimum wage levels that will take effect on January 1, 2026. The general daily minimum wage will increase to MXN [315.04], while the Northern Border Free Zone rate will rise to MXN [440.87] for 2026.

Image: https://www.globalnewslines.com/uploads/2025/12/d53f76670eba46736b7e94c6a16fb975.jpg

The adjustment reflects an estimated 13 percent increase for the general zone and about 5 percent for the Northern Border Free Zone compared to 2025.…

Mexico Rooftop Solar Market Research Report Segmented by Applications, Geography …

Mexico Rooftop Solar Market by Component, Application, Services, and Region- Forecast to 2025

The Global Mexico Rooftop Solar Market Research Report 2021-2025 published by Market Insights Reports is a significant source of keen information for business specialists. It furnishes the Mexico Rooftop Solar business outline with development investigation and historical and futuristic cost analysis, income, demand, and supply information (upcoming identifiers). The research analysts give a detailed depiction of the Mexico…

Mexico Rooftop Solar Market Research Report Segmented by Applications, Geography …

Mexico Rooftop Solar Market by Component, Application, Services, and Region- Forecast to 2025

The Global Mexico Rooftop Solar Market Research Report 2021-2025 published by MarketInsightsReports is a significant source of keen information for business specialists. It furnishes the Mexico Rooftop Solar business outline with development investigation and historical and futuristic cost analysis, income, demand, and supply information (upcoming identifiers). The research analysts give a detailed depiction of the Mexico Rooftop Solar…

The Mexico Online On-demand Home Services Market , Major Keyplayers - Aliada Inc …

Mexico Online On-demand Home Services Market 2021

Mexico online on-demand home services market offer a range of services within the comfort of home as well as save time and money. Additionally, these services help in bridging the gap between the real-world services and instant online services with improved efficiency. Recently, the demand for Mexico online on-demand home services marekt has started witnessing huge growth due to convenience and accessibility. The growing…

Mexico Agriculture Market, Mexico Agriculture Industry, Mexico Agriculture Grain …

Mexico Agriculture has been crucial sector of the country’s economy traditionally and politically even if it currently accounts for a really little share of Mexico’s GDP. Mexico is one in all the cradles of agriculture with the Mesoamericans emerging domesticated plants like maize, beans, tomatoes, squash, cotton, vanilla, avocados, cacao, number sorts of spices, and more. Domestic turkeys and Muscovy ducks were the solely domesticated fowl within the pre-Hispanic amount and little dogs…