Press release

Emerging Growth Patterns Driving Expansion in the Claims Co-Pilot Artificial Intelligence (AI) Market

The claims co-pilot artificial intelligence (AI) market is set to experience remarkable expansion in the coming years, driven by technological advancements and growing adoption across industries. As AI becomes more integrated into insurance and claims management, the market is positioned for significant growth and innovation. Let's explore the current market size, key drivers, leading companies, emerging trends, and major segments shaping this evolving sector.Strong Growth Forecast for the Claims Co-Pilot Artificial Intelligence (AI) Market

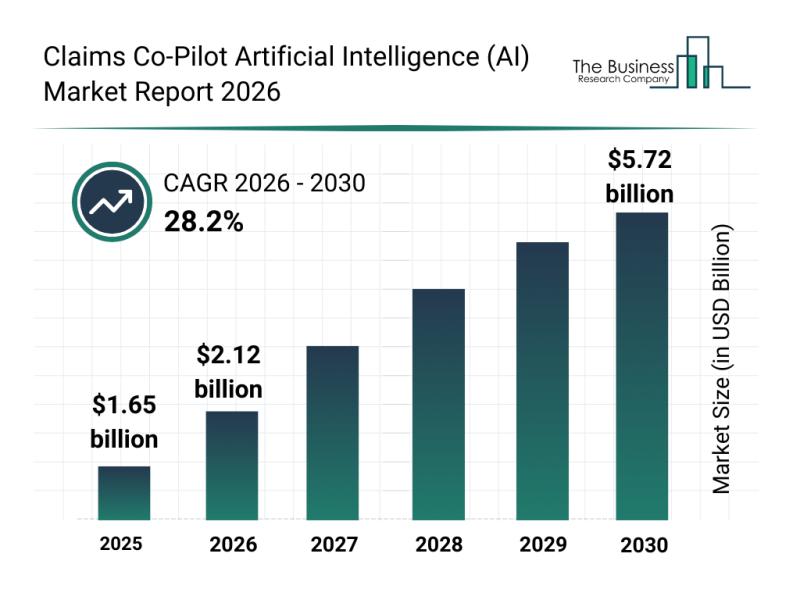

The claims co-pilot AI market is projected to grow substantially, reaching a market size of $5.72 billion by 2030. This impressive expansion reflects a compound annual growth rate (CAGR) of 28.2% during the forecast period. Several factors are fueling this growth, including the increased use of AI technologies within the insurance sector, rising investments in insurtech solutions, a stronger focus on regulatory compliance, and the expansion of cloud-based claims platforms. Additionally, there is a growing emphasis on enhancing customer experience through faster, more accurate claims processing.

Download a free sample of the claims co-pilot artificial intelligence (ai) market report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=30910&type=smp

Key Drivers Propelling Market Expansion

One of the main forces behind the growth of the claims co-pilot AI market is the rapid adoption of AI technologies by insurance companies to streamline operations and reduce costs. Cloud-based claim solutions allow for more scalable and flexible handling of claims data, enabling faster settlements and improved operational efficiency.

Another significant factor boosting the market involves the growing importance of regulatory compliance amid evolving industry standards. AI-powered platforms assist insurers in meeting these requirements more effectively by automating complex workflows and ensuring data accuracy, which reduces risks associated with manual processes.

Top Companies Leading the Claims Co-Pilot AI Market

Several prominent organizations dominate the claims co-pilot AI landscape. Key players include Google LLC, Microsoft Corporation, International Business Machines Corporation, Salesforce Inc., Solera Holdings LLC, Pegasystems Inc., Guidewire Software Inc., CCC Intelligent Solutions Holdings Inc., Shift Technology SAS, FINEOS Corporation Holdings plc, Snapsheet Inc., UnifyApps Technologies Pvt. Ltd., H2O.ai Inc., Tractable Ltd., FRISS Fraudebestrijding B.V., Claim Genius Inc., BriteCore Holdings Inc., Claimable Inc., CogniSure InsurTech Private Limited, and RightIndem Inc. These companies are actively innovating and shaping the future of claims management through AI integration.

View the full claims co-pilot artificial intelligence (ai) market report:

https://www.thebusinessresearchcompany.com/report/claims-co-pilot-artificial-intelligence-ai-market-report

Noteworthy Collaborations Highlighting AI Impact

A milestone in advancing AI-driven claims processing was reached in June 2025 when Star Health Insurance, a retail health insurer based in India, joined forces with Medi Assist to modernize claims management. This partnership focuses on accelerating claim settlements, improving customer service, and leveraging AI tools to combat fraud and reduce waste. Medi Assist, an insurance technology firm based in India, supports these goals by providing digital innovation and AI-powered fraud detection capabilities.

Emerging Trends and Innovations in the Claims Co-Pilot AI Market

Market leaders are increasingly developing sophisticated AI platforms designed to integrate seamlessly with existing enterprise systems and data sources. These platforms provide comprehensive tools and infrastructure that simplify the deployment and management of AI models across diverse applications.

For example, in November 2025, Aon plc, a UK-based professional services company, launched the Aon Claims Copilot platform. This AI solution combines the company's Broker Copilot and risk analysis tools to enhance claims resolution and analytics globally. The platform delivers standardized metrics and customized insights, enabling data-driven decision-making and consistent claims advocacy. It also offers benchmarking tools to evaluate claims handling quality and carrier accountability, alongside a secure client portal providing real-time claim status updates for greater transparency.

Breaking Down the Claims Co-Pilot AI Market Segments

The market is segmented into several key categories to better understand its structure:

1) By Component: Software and Services

2) By Deployment Mode: Cloud-Based and On-Premises

3) By Enterprise Size: Large Enterprises and Small and Medium Enterprises

4) By Application: Claims Processing, Fraud Detection, Customer Support, Risk Assessment, and Other Applications

5) By End-User: Insurance Companies, Third-Party Administrators, Healthcare Providers, and Other End-Users

Further detail within software includes subcategories such as claims automation platforms, document processing systems, decision support engines, fraud detection software, damage assessment software, and customer interaction software. The services segment covers claims processing, fraud detection, customer support, and risk assessment services. This segmentation highlights the diverse range of solutions and applications fueling the growth of the claims co-pilot AI market.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/,

Americas +1 310-496-7795,

Europe +44 7882 955267,

Asia & Others +44 7882 955267 & +91 8897263534,

Email us at info@tbrc.info.

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Emerging Growth Patterns Driving Expansion in the Claims Co-Pilot Artificial Intelligence (AI) Market here

News-ID: 4365831 • Views: …

More Releases from The Business Research Company

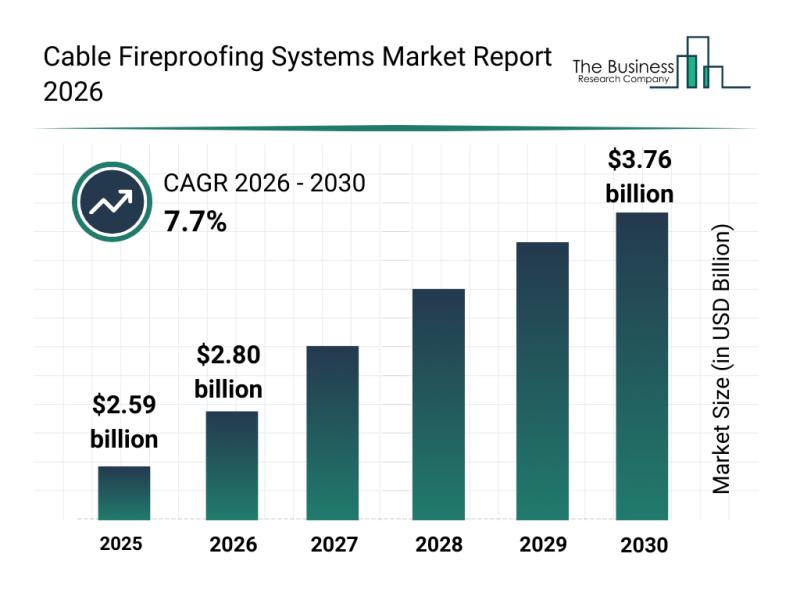

Analysis of Key Market Segments Driving the Cable Fireproofing Systems Market

The cable fireproofing systems market is set for impressive expansion in the coming years as industries place greater emphasis on fire safety and protection for electrical infrastructure. With evolving technologies and increasing regulatory requirements, this market is positioned to meet the growing demand worldwide. Let's explore the market size projections, key players, driving forces, trends, and segmentation that define this dynamic sector.

Anticipated Market Size and Growth of the Cable Fireproofing…

In-Depth Examination of Segments, Industry Trends, and Key Competitors in the Ca …

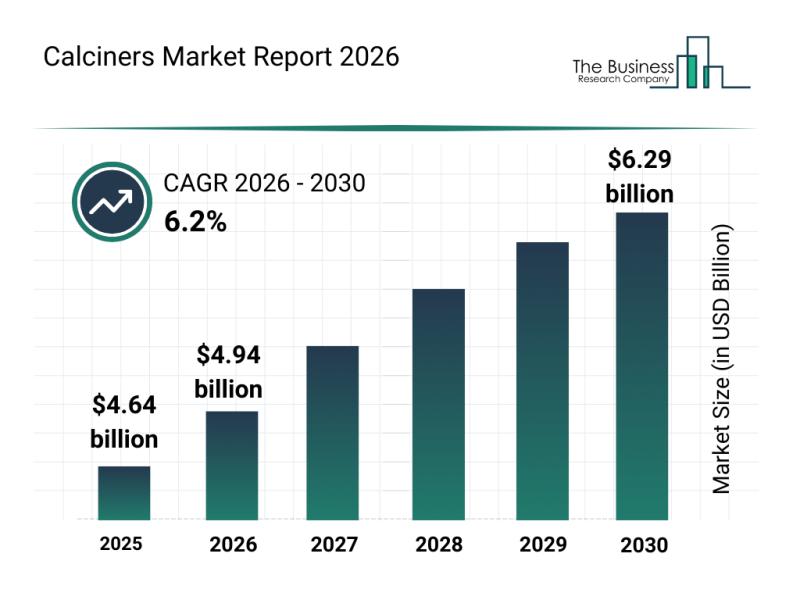

The calciners market is positioned for notable expansion over the coming years, driven by growing industrial and infrastructure demands globally. As urbanization accelerates and industries evolve, the need for efficient calcination processes increases, fostering advances in technologies and sustainable practices. This overview explores the market's size, key players, emerging trends, and important segments shaping its trajectory through 2030.

Forecasted Growth and Market Size of the Calciners Market

The calciners market…

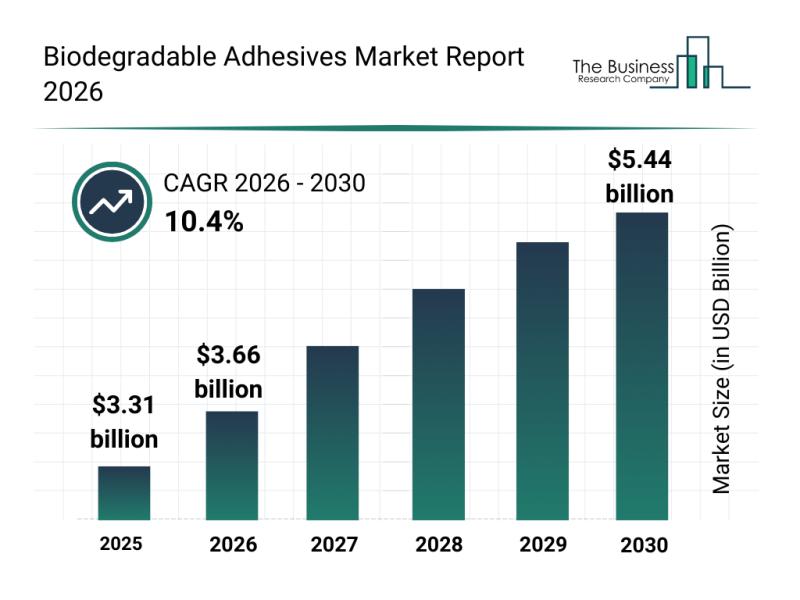

Global Trends Overview: The Rapid Development of the Biodegradable Adhesives Mar …

The biodegradable adhesives market is poised for significant expansion as industries worldwide increasingly seek sustainable alternatives to traditional petroleum-based adhesives. Driven by innovation and growing environmental awareness, this sector is set to experience robust growth through 2030. Let's explore the market's size, key drivers, major players, emerging trends, and its various segments in detail.

Projected Market Size and Growth Trajectory of the Biodegradable Adhesives Market

The biodegradable adhesives market is…

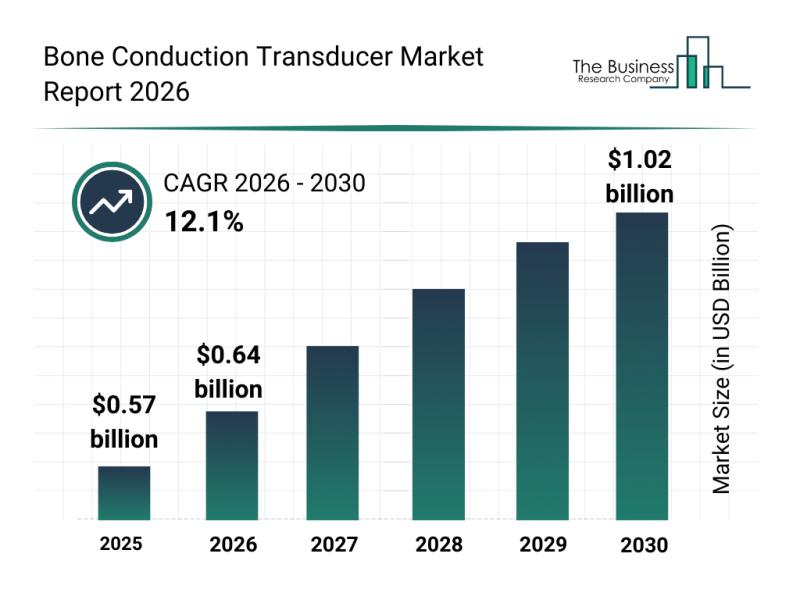

Top Players and Competitive Dynamics in the Bone Conduction Transducer Market

The bone conduction transducer market is gaining significant traction as its applications expand across various industries. With innovations enhancing performance and new partnerships increasing visibility, the market is set for substantial growth. Below, we explore the market's size, key players, emerging trends, and how the market is segmented to better understand its future trajectory.

Rapid Expansion Expected in the Bone Conduction Transducer Market by 2030

The bone conduction transducer market…

More Releases for Claim

American Investment Trust Services: FINRA Claim

The White Law Group Files a Claim against American Trust Investment Services

The White Law Group announces the filing of a FINRA arbitration claim against American Trust Investment Services for investment losses involving high risk TIC/DST investments.

The firm submitted a claim to FINRA Dispute Resolution on behalf of a group of investors alleging claims for violation of common law fraud, breach of fiduciary duty, negligence, and…

OSP Labs Accelerates Claim Processing Workflow Through Claim Data Management Sol …

Medical claims processing is one amongst the three core elements of the value-added insurance chain. One primary avenue of fostering medical claims processing growth is by robust claims data management solutions. OSP Labs engineered a real-time medical claim data management solutions to enhance medical claim management by study and evaluate the claims data to judge its suitability for further processing.

"Paper-based manual claims data management is time-consuming and requires additional efforts.…

Claim Management in Mobility Projects

Quedlinburg (12.09.2012) - New mobility projects, like construction of subways, fully automatic driverless metro systems, mainline railways and suburban train projects, are on their way currently on their all over the world. The implementations of such projects involve complex technologies, the management of various interfacing systems and tight time schedules. Not surprisingly, those projects are therefore often harmed by obstructions and hindrances leading to claims between the projects participants. We…

Claim Management in Mobility Projects

New mobility projects, like construction of subways, fully automatic driverless metro systems, mainline railways and suburban train projects, are on their way currently on their all over the world. The implementations of such projects involve complex technologies, the management of various interfacing systems and tight time schedules. Not surprisingly, those projects are therefore often harmed by obstructions and hindrances leading to claims between the projects participants. We have talked to…

HDFC ERGO launches “Health Claim Services” - in-house health claim servicing …

HDFC ERGO General Insurance, 4th largest private sector general insurance company in India announced the launch of Health Claim Services (HCS) - its in-house health claim servicing department.. The main objective behind this initiative is to facilitate faster and transparent claim settlement process.

On the announcement, Mr. Mukesh Kumar, Head – Strategic Planning Group said “In today's era, customer expects to interact with company directly. There is more trust generated…

Jury Rules Against Princess’s Insurance Claim

By CHRISTIAN NOLAN

The Estate of Frederick Mali and Lucretia Mali v. Federal Insurance Co.: A federal jury decided that a Russian princess, whose Litchfield County barn burned to the ground six years ago, fabricated numbers when she told her insurance company that the building and all of the antiques inside it were worth nearly $3 million.

Because the jury ruled that the woman had misrepresented the value of the barn, which…