Press release

Market Trend Analysis: The Impact of Recent Innovations on the Alternative Investment Funds Market

The alternative investment funds market is on track for substantial growth in the coming years, driven by a mix of evolving investor preferences and technological advancements. This sector is increasingly attracting interest from a wide array of participants who seek more resilient and diversified assets. Let's explore the market's size, key players, emerging trends, and the segments shaping its future trajectory.Projected Market Expansion of the Alternative Investment Funds Market

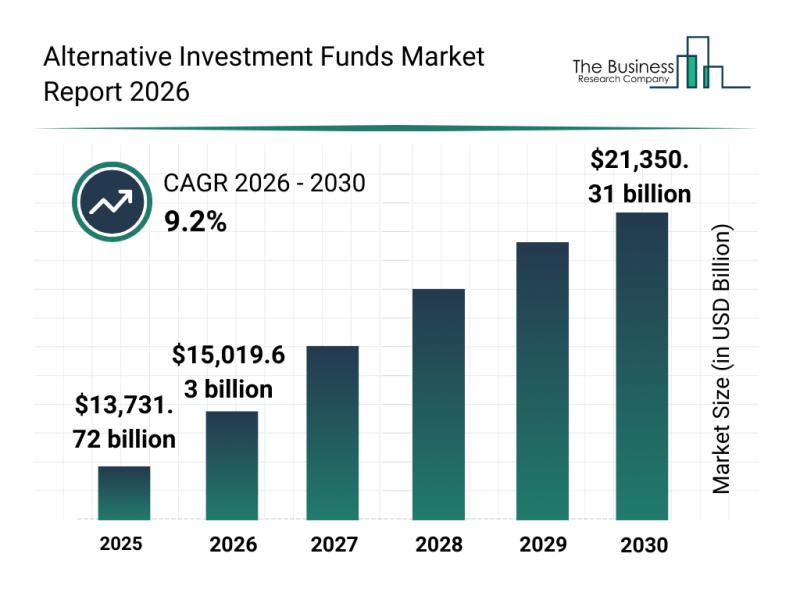

The alternative investment funds market is predicted to reach a valuation of $21,350.31 billion by 2030, growing at a compound annual growth rate (CAGR) of 9.2%. This expansion is supported by several factors including rising demand for assets that can withstand inflation, broader access to private market investments through digital platforms, and the growing involvement of pension and sovereign wealth funds worldwide. Additionally, improvements in data-driven due diligence and fund selection processes, together with the increasing adoption of sustainable and ESG-aligned investment strategies, are playing pivotal roles. Important trends anticipated during this period include the rise of tokenized alternative asset units, enhanced retail access to fractional private investments, the integration of AI-powered portfolio construction tools, a surge in niche thematic alternative investments, and greater transparency in fee structures.

Download a free sample of the alternative investment funds market report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=30811&type=smp

Major Players Leading the Alternative Investment Funds Industry

Several influential firms dominate the alternative investment funds landscape, including Brookfield Corporation, The Goldman Sachs Group Inc., Apollo Global Management Inc., BlackRock Inc., The Bank of New York Mellon Corporation, KKR & Co. Inc., State Street Investment Management, Blackstone Inc., Northern Trust Corporation, Amundi S.A., Ares Management Corporation, EQT AB, TPG Inc., Blue Owl Capital Inc., Man Group plc, The Carlyle Group Inc., CVC Capital Partners, Neuberger Berman Group LLC, Hamilton Lane Holdings Inc., Brookfield Asset Management Ltd., and Bain Capital LP.

A significant move in this sector occurred in December 2024, when BlackRock Inc., a US-based investment management giant, acquired HPS Investment Partners for about $12 billion. This acquisition aims to substantially enhance BlackRock's private credit capabilities and reinforce its standing in the global alternatives market. HPS Investment Partners is known for managing alternative investment funds in the US.

Emerging Trends Shaping the Future of Alternative Investment Funds

Leading firms in this market are focusing on the development of sophisticated investment vehicles like structured alternative investment funds (AIFs). These funds improve market access, offer greater strategic flexibility, and reduce the manual complexities of investing for experienced investors. Structured AIFs involve professionally managed funds using a variety of complex trading strategies, including leverage, to generate returns across different market cycles.

An example of innovation in this space was seen in July 2025, when Electrum Portfolio Managers, an India-based advisory and management firm, launched the AIF-Laureate. This SEBI-registered Category III Alternative Investment Fund targets accredited investors and uses a multi-strategy, market-neutral approach centered on arbitrage and relative value strategies. The fund aims to deliver consistent returns with low correlation to traditional equity and debt markets by employing a quantitative decision-making process backed by data-driven models. Its flexible mandate allows dynamic asset allocation, enabling it to exploit short-term market inefficiencies while maintaining strong risk controls.

View the full alternative investment funds market report:

https://www.thebusinessresearchcompany.com/report/alternative-investment-funds-market-report

Segments Defining the Alternative Investment Funds Market

This report categorizes the alternative investment funds market into several detailed segments:

1) By Fund Type: Private Equity Funds, Hedge Funds, Real Estate Funds, Infrastructure Funds, Venture Capital Funds, Private Debt Funds, and Other Types of Funds

2) By Technology: Computer Vision, Machine Learning, Internet of Things (IoT) Sensors, Robotics and Automation

3) By Deployment Mode: On-Premise, Cloud

4) By Investor Type: Institutional Investors, High-Net-Worth Individuals, Retail Investors, and Other Investor Types

5) By End User: Municipalities, Transportation Authorities, Smart City Agencies, Private Contractors

Further subsegments include:

- Private Equity Funds: Growth Equity, Leveraged Buyouts, Distressed Investments, Fund of Funds, Secondary Investments

- Hedge Funds: Long-Short Equity, Global Macro, Event Driven, Relative Value, Managed Futures

- Real Estate Funds: Residential Properties, Commercial Properties, Industrial Properties, Real Estate Development, Real Estate Fund of Funds

- Infrastructure Funds: Transportation Infrastructure, Energy Infrastructure, Social Infrastructure, Utilities Infrastructure, Digital Infrastructure

- Venture Capital Funds: Seed Stage Investments, Early Stage Investments, Growth Stage Investments, Late Stage Investments, Venture Fund of Funds

- Private Debt Funds: Direct Lending, Mezzanine Financing, Distressed Debt, Special Situations Debt, Structured Credit

- Other Funds: Commodity Funds, Art and Collectibles Funds, Natural Resources Funds, Multi-Asset Alternative Funds, Impact and Sustainable Investment Funds

This comprehensive segmentation allows for a nuanced understanding of the alternative investment funds market and highlights the wide variety of investment opportunities available to investors globally.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/,

Americas +1 310-496-7795,

Europe +44 7882 955267,

Asia & Others +44 7882 955267 & +91 8897263534,

Email us at info@tbrc.info.

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Market Trend Analysis: The Impact of Recent Innovations on the Alternative Investment Funds Market here

News-ID: 4365799 • Views: …

More Releases from The Business Research Company

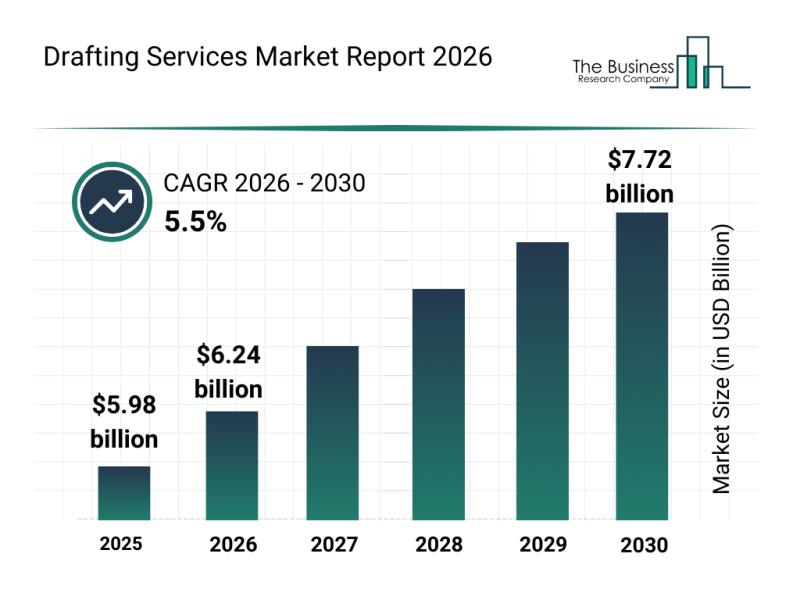

Future Perspective: Key Trends Shaping the Drafting Services Market Until 2030

The drafting services industry is poised for considerable expansion in the coming years as technological advancements and evolving construction needs drive demand. With a wide range of applications across sectors, this market is set to experience steady growth fueled by innovation and increasing adoption of digital tools. Let's explore the current market size, influential factors, key players, emerging trends, and segmentation in this dynamic field.

Projected Growth and Market Size of…

Emerging Sub-Segments Transforming the Digital Rights Management Market Landscap …

The digital rights management (DRM) market is positioned for remarkable expansion in the coming years, driven by technological advancements and increasing concerns over content security. As digital media consumption grows and new platforms emerge, DRM solutions are becoming essential to protect intellectual property and ensure the authorized use of digital assets. Let's explore the current market size, key players, prevailing trends, and the main segments shaping the future of this…

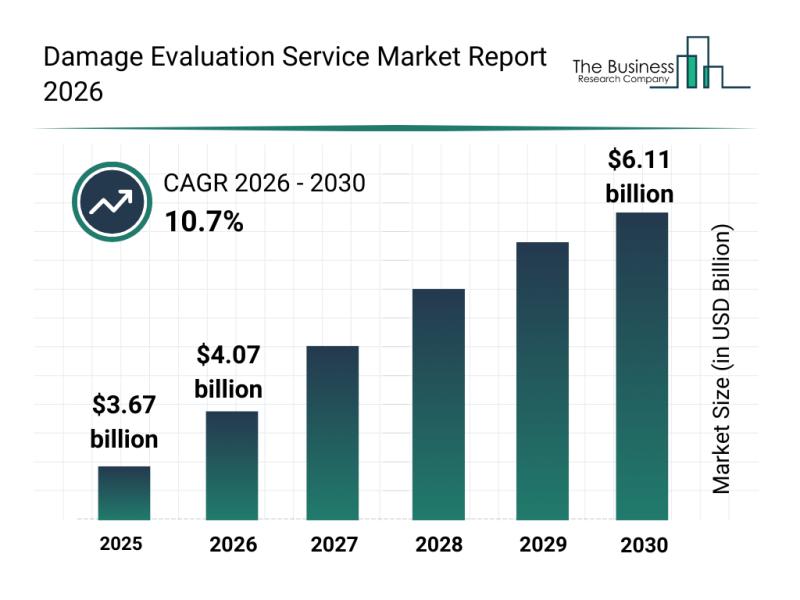

Market Trend Insights: The Impact of Recent Advances on the Damage Evaluation Se …

The damage evaluation service market is on the brink of substantial growth as advancements in technology and increasing demand for efficient damage assessment methods gain momentum. This sector is evolving rapidly with the integration of innovative tools and techniques that enhance accuracy and speed in evaluating damages across various industries.

Forecasted Market Size and Growth Trajectory of the Damage Evaluation Service Market

The damage evaluation service market is projected to…

Corporate Training Market: Segmentation Analysis, Market Trends, and Competitive …

The corporate training sector is on a path of significant growth as organizations increasingly recognize the importance of continuous employee development. With rapid technological advances and shifting workforce needs, this market is expected to expand steadily, driven by innovative solutions and evolving learning preferences. Below, we explore the market's size projections, key players, emerging trends, and segmentation insights to provide a comprehensive overview of the corporate training landscape.

Projected Growth and…

More Releases for Fund

Broad-Based Index Fund Market 2022: Industry Manufacturers Forecasts- Tianhong F …

The Broad-Based Index Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Broad-Based Index Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers…

Index Fund Market 2022: Industry Manufacturers Forecasts- Tianhong Fund, E Fund, …

The Index Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Index Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Exchange-Traded Fund Market 2022: Industry Manufacturers Forecasts- Tianhong Fun …

The Exchange-Traded Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Exchange-Traded Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Equity Mutual Fund Market 2022: Industry Manufacturers Forecasts- Tianhong Fund, …

The Equity Mutual Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Equity Mutual Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers…

Bond Mutual Fund Market 2022: Industry Manufacturers Forecasts- Tianhong Fund, E …

The Bond Mutual Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Bond Mutual Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers…

Money Market Funds Market 2022: Industry Manufacturers Forecasts- Tianhong Fund, …

The Money Market Funds research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Money Market Funds market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers…