Press release

Outlook on the Agentic Artificial Intelligence (AI) Insurance Market: Major Segments, Strategic Developments, and Leading Companies

The agentic artificial intelligence (AI) insurance market is on the brink of remarkable expansion, driven by rapid technological advancements and growing industry adoption. As insurers increasingly embrace AI-driven solutions, the landscape is set for transformative growth and innovation in the coming years. Below, we explore the market's expected size, key players, influential trends, and detailed segment insights.Agentic Artificial Intelligence Insurance Market Size and Growth Outlook

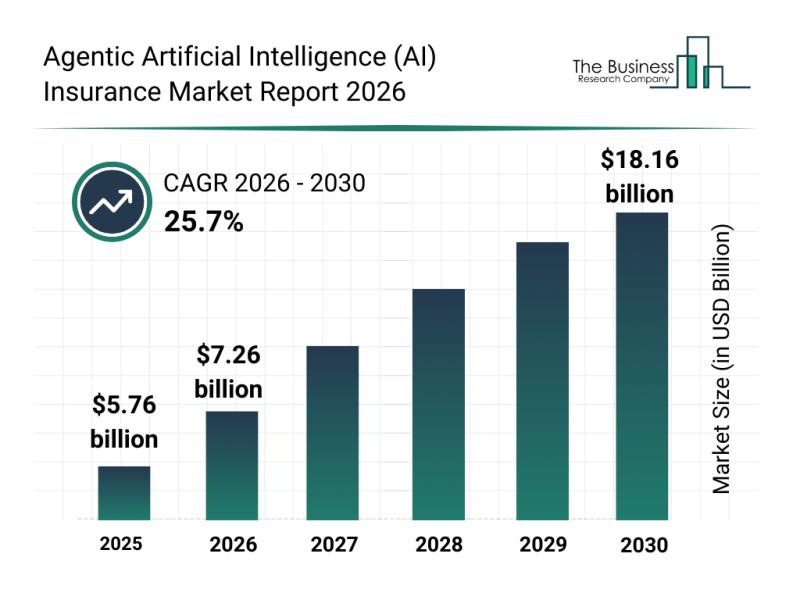

The agentic artificial intelligence insurance market is projected to surge dramatically, reaching a valuation of $18.16 billion by 2030. This represents an impressive compound annual growth rate (CAGR) of 25.7%. Several factors are fueling this growth, including the rising use of cloud-based platforms, the increasing availability of big data, consumer demand for round-the-clock support, ongoing digital transformation within insurance companies, and the growing complexity of insurance products. Key industry trends expected to shape this market include advancements in autonomous underwriting systems, improvements in real-time claims processing, enhanced fraud detection and prevention techniques, greater accuracy and speed in underwriting decisions, and the development of innovative, personalized insurance products.

Download a free sample of the agentic artificial intelligence (ai) insurance market report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=30806&type=smp

Top Companies Driving the Agentic Artificial Intelligence Insurance Market

Several prominent organizations are leading the agentic AI insurance market, including Salesforce Inc., Cognizant Technology Solutions Corporation, Genpact, LTIMindtree Limited, Hexaware Technologies Limited, Hyland Software Inc., Newgen Software Technologies Limited, Duck Creek Technologies Inc., EIS Group, Kellton Tech Solutions Ltd., Foncière INEA, Earnix, Tractable Ltd., FRISS, Angular Minds, Gradient AI, Simplifai, ZestyAI, Intellivon, Roots, and FurtherAI Inc.

In a notable move in July 2024, Applied Systems Inc., a US-based cloud insurance software provider, acquired Planck Resolution Ltd., an Israel-based company specializing in agentic AI for insurance. This acquisition aims to significantly boost Applied Systems' AI capabilities and enhance its underwriting and distribution processes by utilizing Planck's real-time data insights.

View the full agentic artificial intelligence (ai) insurance market report:

https://www.thebusinessresearchcompany.com/report/agentic-artificial-intelligence-ai-insurance-market-report

Important Trends Set to Influence the Agentic Artificial Intelligence Insurance Market

Industry leaders are heavily investing in agentic AI technologies that perform autonomous, task-specific actions with minimal human oversight. Agentic AI systems can plan, reason, and execute decisions independently to meet defined objectives.

For example, in September 2025, Shift Technology SAS, a French company specializing in AI-driven insurance decision solutions, unveiled Shift Claims. This platform leverages agentic AI to revolutionize claims management by automatically reviewing all claim documents to evaluate complexities such as coverage, liability, damages, subrogation, and litigation risks. It categorizes and prioritizes claims, deciding which can be fully automated and which require human intervention, while guiding human reviewers throughout the process and continuously updating the claim file.

Segment-Wise Breakdown of the Agentic Artificial Intelligence Insurance Market

This market report segments the agentic AI insurance industry into several categories:

1) Insurance Type: Life Insurance, Health Insurance, Property and Casualty Insurance, Commercial Insurance, Travel and Microinsurance, and Other Insurance Types

2) Deployment Mode: On-Premise and Cloud-Based (SaaS)

3) Technology Stack: Cognitive Agents, Autonomous Decision Engines, Multi-Agent Systems, Large Language Model (LLM) Integration with Guardrails, Explainable AI (XAI), and Other Technologies

4) Application Areas: Underwriting Automation, Claims Management, Customer Engagement, Product Personalization, Compliance and Governance, and Other Uses

5) End Users: Insurance Carriers, InsurTech Companies, Third-Party Administrators (TPAs), Brokers and Agencies, Reinsurers, and Other Users

Further subsegments include:

Life Insurance applications such as automated policy recommendation tools, AI-based risk scoring, digital underwriting agents, beneficiary management automation, AI-powered policy renewal, and fraud detection systems.

Health Insurance offerings include AI-driven claims triage, medical data analysis agents, automated pre-authorization tools, wellness and preventive AI agents, cost estimation tools, and health risk prediction engines.

Property and Casualty Insurance uses computer vision for damage assessment, AI telematics analysis, automated incident reporting, smart claims adjustment, risk monitoring, and fraud detection alerts.

Commercial Insurance features automated business risk profiling, AI underwriting agents, portfolio optimization, regulatory compliance automation, liability assessment, and premium modeling tools.

Travel and Microinsurance covers AI-based travel risk assessment, automated trip protection, instant microinsurance issuance, lost baggage verification, smart claim settlement, and micro-policy pricing engines.

Other insurance types include AI agents for pet insurance, cyber risk evaluation, agricultural insurance models, marine and aviation risk monitoring, specialty policy automation, and predictive risk analytics tools.

This comprehensive segmentation offers a clear understanding of the diverse applications and technology stacks driving innovation and growth within the agentic artificial intelligence insurance market.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/,

Americas +1 310-496-7795,

Europe +44 7882 955267,

Asia & Others +44 7882 955267 & +91 8897263534,

Email us at info@tbrc.info.

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Outlook on the Agentic Artificial Intelligence (AI) Insurance Market: Major Segments, Strategic Developments, and Leading Companies here

News-ID: 4365795 • Views: …

More Releases from The Business Research Company

Competitive Analysis: Leading Companies and New Entrants in the 5G mmWave Infras …

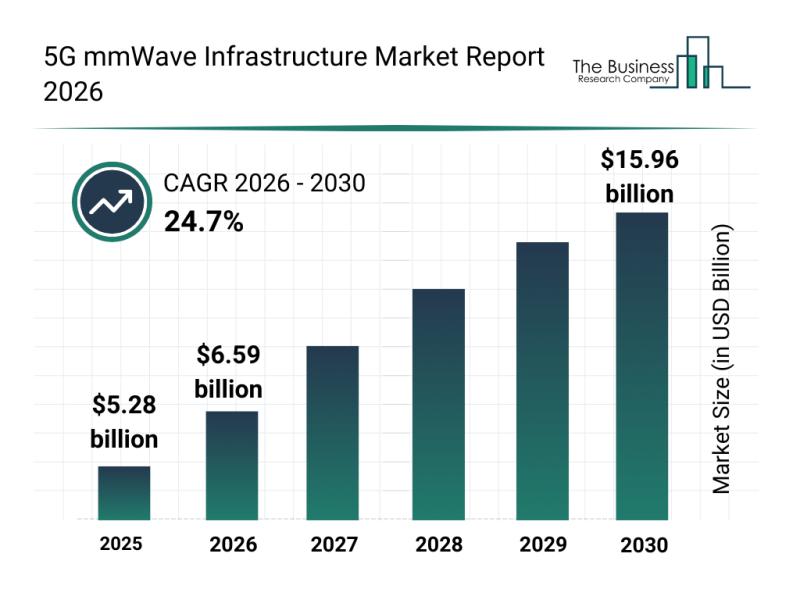

The rapidly evolving telecommunications landscape is setting the stage for remarkable advancements in 5G mmWave infrastructure. As global demand for faster and more reliable wireless connectivity intensifies, this segment is poised for significant expansion in the coming years. Below, we explore the anticipated market growth, key players, emerging trends, and major segments shaping the future of 5G mmWave infrastructure.

Projected Market Growth and Value of the 5G mmWave Infrastructure Market …

Analysis of Segments and Major Growth Areas in the Adaptogen Beverage Can Market

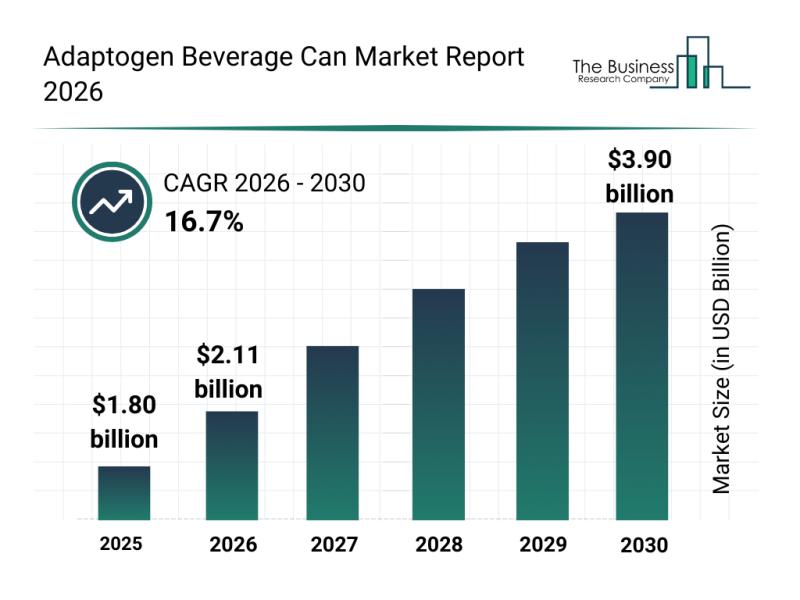

The adaptogen beverage can market is poised for remarkable expansion in the coming years, driven by increasing consumer interest in health-focused drinks. As more people turn toward natural and functional beverages to support mental and physical wellness, the market is set to experience significant growth and innovation. Let's explore the current market size, key players, emerging trends, and detailed segments shaping this dynamic industry.

Projected Market Value and Growth of the…

Key Strategic Developments and Emerging Changes Shaping the 3D E-Commerce Market …

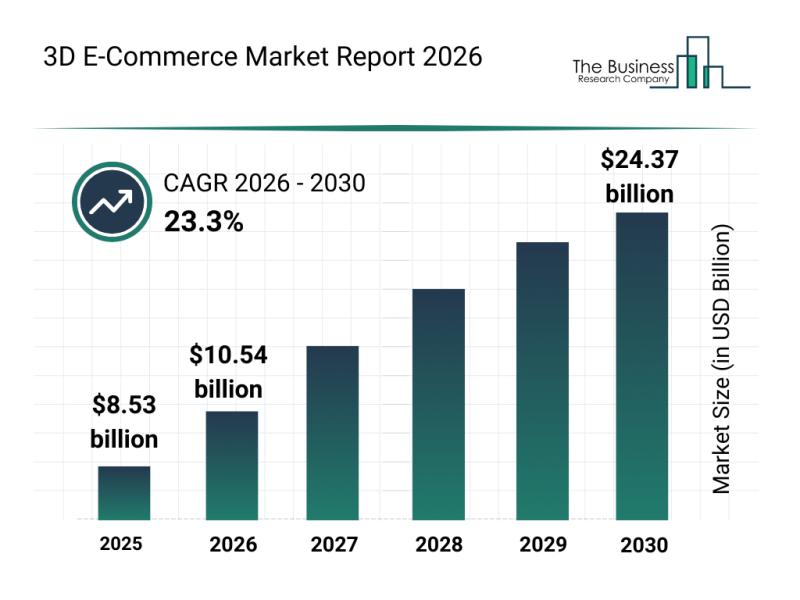

The 3D e-commerce market is on the brink of substantial expansion, driven by technological innovations and increasing demand for immersive online shopping experiences. As retailers and consumers embrace more interactive and personalized digital tools, this sector is set to transform the way products are showcased and purchased online. Let's explore the market's growth outlook, key players, emerging trends, and critical segments shaping this dynamic industry.

Forecasted Growth and Market Size of…

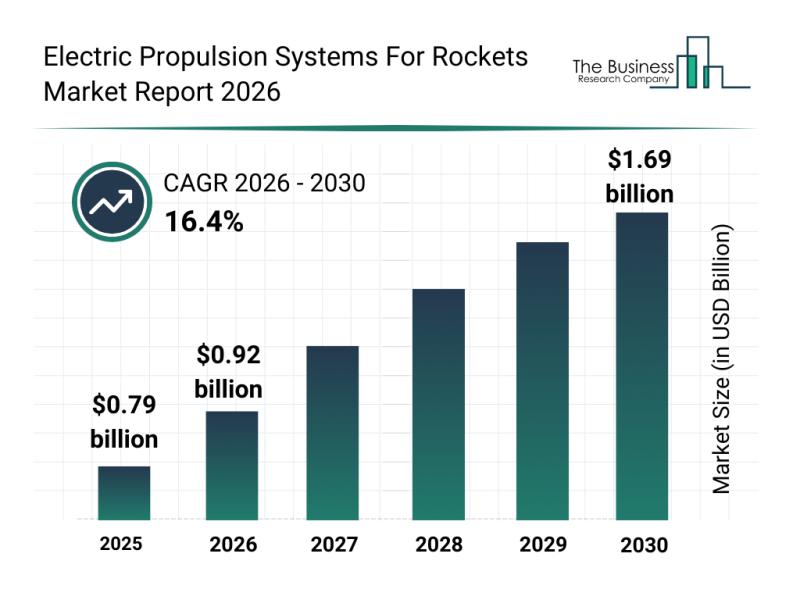

Future Perspectives: Key Trends Shaping the Electric Propulsion Systems for Rock …

The market for electric propulsion systems used in rockets is gearing up for significant expansion as space technologies continue to advance. Increasing interest from commercial, defense, and scientific sectors is set to drive innovation and adoption, making this a pivotal area for the future of spacecraft maneuverability and mission capabilities. Below is an overview of the market's size, key players, emerging trends, and segmentation that outline its promising trajectory toward…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…