Press release

Hearthfire Holdings Announces Acquisition of Class A CubeSmart Self-Storage Asset in Syracuse, New York

Philadelphia-Based Firm Expands Northeast Footprint with Institutional-Grade, Climate-Controlled Facility in Undersupplied Top-100 MarketPHILADELPHIA, PA. - January 27, 2026 - Hearthfire Holdings [https://hfirecapital.com/], a real estate investment firm that works with investors to buy selfstorage properties, announced today that it has closed a Class A selfstorage purchase at 615 Erie Boulevard West in Syracuse, New York, representing the firm's 24th asset across 10 states. The capital raise for this property was fully funded from existing relationships in roughly two weeks without any formal promotion. The transaction shows that Hearthfire Holdings is expanding into markets where storage space supply is limited and entry is difficult.

Located in downtown Syracuse with close proximity to Syracuse University, the facility benefits from strong surrounding demographics, including more than 135,000 residents within a three-mile radius and a median household income of approximately $63,000. The new Syracuse property is a Class A conversion with 45,399 rentable square feet, 509 units, and is 100% climatecontrolled. The project finished in September 2024.

"The acquisition checks every box we look for - quality, product, a good city location, and a market that does not have enough supply," said Sergio Altomare [https://www.linkedin.com/in/sergio-altomare-7823294/], CEO of Hearthfire Holdings. "This is a top-100 market deal in Syracuse, and the asset puts us in a position for leasing and for sale options."

CubeSmart Self Storage, one of the nation's most experienced selfstorage operators, will manage the Syracuse property.

"The lease-up strategy is disciplined," Altomare added. The investment shows the kind of risk-adjusted opportunity that the investors expect from Hearthfire."

According to Altomare, market fundamentals support the investment, with a supply of roughly 3.2 square feet per capita, including approximately 2.1 climate-controlled square feet and 1.1 non-climate-controlled square feet. "The supply points to a shortage of climate-controlled inventory," Altomare said. "Within the three-mile trade area, there are two developments that total 68,000 net rentable square feet, and two more developments are in the planning stages. I've also seen that one project has been stalled since 2022."

At acquisition, the property had 28% of its space leased, and rents were set at $20 per square foot. Hearthfire's business plan assumes a small rate change to expedite lease-up, and then expects market rents to return to $20-22 per square foot when the property stabilizes.

The transaction also includes leasing back 200 parking spaces from the office building across the street. The annual rent for one of these spaces will be $40,000, payable in equal monthly installments of $3,333.33. The lease for these spaces runs for 10 years at signing, with rent increasing by 15% every five years, beginning in the sixth year. Hearthfire anticipates buyer demand at exit, on a single-asset basis.

Acknowledgments

Hearthfire Holdings gratefully acknowledges the contributions of the following partners:

*

Brokers: Aaron Carter, Senior Associate & Richard Riddle, Executive Vice President, Skyview Advisors

*

Debt Partners: Tim Jefferies, Senior Vice President & Rachel Murphy, Assistant Vice President, WSFS Bank; Deanna Ellis, Senior Title Officer, Stewart Title

*

Legal Counsel: Jonathan Gremminger, Esq., Sherman, Silverstein, Kohl, Rose & Podolsky, P.A.

*

Legal Counsel for WSFS: Stacy Bedwick, Esq., Kurtz and Partners, P.C.

For those interested in a private briefing, contact Hearthfire at investors@hfireholdings.com [mailto:investors@hfireholdings.com]. All media inquiries and interview requests should be directed to Thomas Mustac, Senior Publicist at Otter PR, at thomas.mustac@otterpr.com [mailto:thomas.mustac@otterpr.com].

About Hearthfire Holdings

Hearthfire Holdings is a real estate and private equity firm focused on self-storage investments. The company boasts more than $180 million in assets under management and nine successful exits, with an established reputation for selection of markets, operational sophistication, and investor-aligned structures. Led by Sergio Altomare, co-founder and former Executive Director of Technology at the Federal Reserve, Hearthfire applies institutional-level financial management, advanced technology, and highly disciplined real estate execution to locate and monetize underperforming assets and development opportunities.

Media Contact

Company Name: Otter PR

Contact Person: Thomas Mustac

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=hearthfire-holdings-announces-acquisition-of-class-a-cubesmart-selfstorage-asset-in-syracuse-new-york]

Phone: 3478049500

Address:100 E Pine St Suite 110

City: Orlando

State: Florida

Country: United States

Website: http://OtterPR.com

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Hearthfire Holdings Announces Acquisition of Class A CubeSmart Self-Storage Asset in Syracuse, New York here

News-ID: 4365538 • Views: …

More Releases from ABNewswire

Simple Simon's Pizza Relocating from Joplin to New Route 66 Location in Webb Cit …

Webb City, MO - Simple Simon's Pizza [https://simplesimonspizza.com/] is officially relocating from Joplin to a brand-new location just off historic Route 66 in Webb City, Missouri, bringing its well-known pizza and hometown atmosphere to a growing local community.

Image: https://www.abnewswire.com/upload/2026/01/c5b467993d801f4dec4a9550fa602861.jpg

The new restaurant is currently under construction at 111 N. East St., Webb City, MO 64870, and will serve as the next chapter for the locally owned business. The Webb City location…

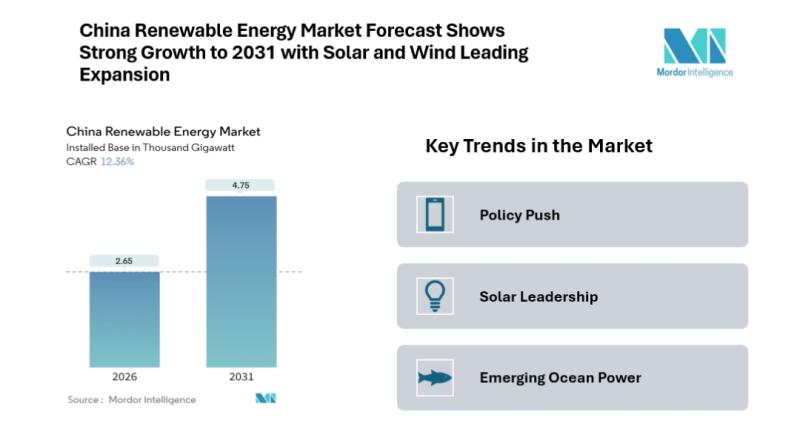

China Renewable Energy Market Growth Accelerates: Solar Leadership and Energy St …

Mordor Intelligence has published a new report on the "China Renewable Energy Market," offering a comprehensive analysis of trends, growth drivers, and future projections.

According to Mordor Intelligence, the China renewable energy market [https://www.mordorintelligence.com/industry-reports/china-renewable-energy-market?utm_source=abnewswire] Size is expected to reach 4.75 thousand gigawatts by 2031, up from 2.65 thousand gigawatts in 2026, reflecting a 12.36% CAGR. This growth is anchored in Beijing's commitment to achieving carbon neutrality by 2060, reinforced by policy…

Best Cost Segregation Companies in 2026: Top Firms Ranked for Faster Depreciatio …

Image: https://www.abnewswire.com/upload/2026/01/02467f7bfc65824d32cc3e95ed9a3a8b.jpg

If you own income-producing real estate, cost segregation can be one of the most powerful tools to improve cash flow. A properly prepared study reclassifies parts of a building into shorter-life asset categories, often 5, 7, and 15-year property, so you can depreciate more of your purchase or construction costs sooner instead of waiting 27.5 years (residential rental) or 39 years (commercial).

But the results depend heavily on the provider.…

Angels and the Devil Were Never Supernatural - They Were Behavioral Models

The Actulint Church Reframes Good and Evil as Human Patterns, Not External Forces

ATLANTA, GA - January 27, 2026 - The Actulint Church has released a new statement challenging one of religion's most enduring narratives: that angels and the devil are supernatural beings acting upon human lives.

According to Actulint, these figures were never meant to be literal entities. They were early behavioral models, symbolic frameworks used to explain discipline, impulse, restraint,…

More Releases for Hearthfire

Hearthfire Holdings Announces Landmark Year of Strategic Expansion, New Developm …

2025 achievements strengthen Hearthfire's national footprint in self-storage development and position the firm for accelerated growth in 2026

Philadelphia, PA - January 5th, 2026 - Hearthfire Holdings [https://hfirecapital.com/], a vertically integrated real estate development and investment firm focusing on Class-A self-storage assets, announced a year of significant growth and strategic advancement across its national platform.

Throughout 2025, Hearthfire expanded its portfolio through ground-up development and strategic acquisitions, strengthened its leadership team, and…

Hearthfire Holdings Closes on Taylor, MI Class-A Self-Storage Facility, Several …

Hearthfire Strengthens Detroit MSA Presence with Flagship Asset

PHILADELPHIA, Pa. - November 18, 2025 - Hearthfire Holdings [https://hfirecapital.com/], a private real estate investment firm with a focus on self-storage assets, today announced the successful closing of a recently constructed, Class-A self-storage facility in Taylor, Michigan. The transaction marks a strategic expansion into the Detroit metro market and complements Hearthfire's nearby Romulus development.

This new construction asset is a fully climate-controlled property with…

Hearthfire Holdings Expands Tampa Bay Expansion with Hudson, FL Acquisition of P …

Company Targets Underserved Segment through Expansion, Proximity, and Demographic Advantage

PHILADELPHIA, PA - September 16th, 2025 - Hearthfire Holdings [https://hfirecapital.com/], an institutional-quality real estate investment firm that invests in self-storage properties, today announced that it has acquired a strategically located facility in Hudson, Florida, as part of its expanding activity within high-growth markets across the United States.

The building located at 10522 State Road 52 in Hudson has a total of 38,387…

Hearthfire Holdings Announces Promotion of Peter McDaniel to Chief Development O …

Philadelphia, PA - September 9, 2025 - Hearthfire Holdings [https://hfirecapital.com/], a leader in direct access institutional-grade self-storage assets, announces the promotion of Peter (Pete) McDaniel [https://www.linkedin.com/in/peter-mcdaniel-a54134152/] to the position of Chief Development Officer (CDO) following his successful tenure as Director of Construction at Hearthfire Holdings.

"Pete's promotion is a testament to his ability to create an expandable construction system for the company and his strong commitment to Hearthfire's core values," states…

Hearthfire Holdings Declares Strategic Vision for National Self-Storage Growth

Company Targets Under-Served, High-Growth Markets with Institutional-Quality Investments

PHILADELPHIA, PA - September 4th, 2025 - Hearthfire Holdings [https://hfirecapital.com/], a real estate investment firm that specializes in self-storage, reiterated today its long-term growth strategy of acquiring, developing, and operating institutional-grade storage assets in undersupplied, high-demand markets across the United States.

"Our growth is founded on discipline - selecting the right markets, placing intelligently structured investments, and managing assets with the highest degree of…

Hearthfire Holdings Increases Chicago Metro Footprint with Crest Hill Self-Stora …

Philadelphia-Based Investment Company Acquires Fourth Chicago-Area Property, Forms Joint Venture with Condev Land and Development Group

PHILADELPHIA, PA - August 28th, 2025 - Hearthfire Holdings [https://hfirecapital.com/], a real estate investment company focused on self-storage assets, today announced another closed Joint Venture with the purchase of a shovel-ready development site in Crest Hill, Illinois, its fourth project in the Chicago metro market.

The purchase kicks off a joint venture partnership with Condev Land…