Press release

Neo and Challenger Bank Market Forecast to Reach USD 2,510.63 Billion by 2034

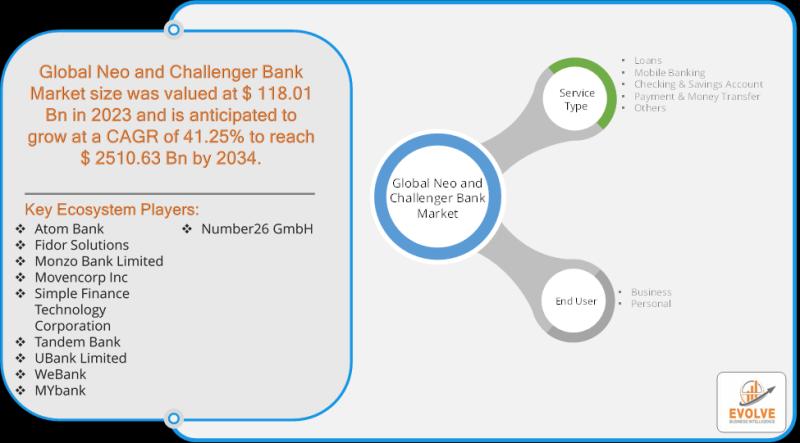

The global financial landscape is undergoing a profound transformation, with neo and challenger banks leading the charge towards a fully digital banking experience. This burgeoning market presents an unparalleled opportunity for checking and savings accounts, driven by evolving consumer preferences and technological advancements. Projections indicate a remarkable trajectory for the Global Neo and Challenger Bank Market, which is expected to surge from USD 120.65 Billion in 2024 to USD 2510.63 Billion by 2034, exhibiting a robust Compound Annual Growth Rate (CAGR) of 41.25%.Download the full report now to discover market trends, opportunities, and strategies for success.

https://evolvebi.com/report/global-neo-and-challenger-bank-market-analysis/

Unlocking Potential: Checking & Savings Accounts as a Core Offering

While mobile banking currently dominates the neo and challenger bank service types, checking and savings accounts remain fundamental pillars attracting a vast clientele. Their appeal lies in simplified digital interfaces, competitive pricing, and unparalleled accessibility, particularly for tech-savvy consumers and underserved populations in emerging markets.

The significant demand for digital banking services provides a fertile ground for these accounts. Neo and challenger banks are uniquely positioned to innovate, offering not just traditional checking and savings functionalities but also integrated services like automated savings, personal finance management tools, and seamless peer-to-peer transfers, further solidifying their value proposition.

Navigating Challenges: Cybersecurity and Data Privacy

Despite the immense opportunities, the market faces significant hurdles, primarily concerning cybersecurity and fraud risks. The entirely digital nature of these banks makes them vulnerable to sophisticated cyberattacks and data breaches. Building and maintaining robust security measures is a substantial, and often costly, undertaking, especially for smaller or emerging players. This also ties into widespread data privacy and security concerns among potential customers, which can act as a deterrent to adoption.

Download the full report now to discover market trends, opportunities, and strategies for success.

https://evolvebi.com/report/global-neo-and-challenger-bank-market-analysis/

Paving the Way Forward: Solutions for Sustainable Growth

Addressing these challenges and maximizing the market's potential requires strategic implementation of innovative solutions:

• Leveraging Advanced Technologies: The adoption of cutting-edge technologies like Artificial Intelligence (AI), blockchain, big data analytics, and cloud computing is paramount. These technologies can enable faster, more personalized services, such as instant loan approvals and smart budgeting tools, while simultaneously bolstering cybersecurity defenses.

• Embracing Open Banking and APIs: Integrating with third-party services through open banking initiatives and Application Programming Interfaces (APIs) can significantly enhance the customer experience by offering a broader and more personalized array of financial products and services.

• Prioritizing Efficiency and Simplicity: A core appeal of neo and challenger banks is their ability to offer low-cost solutions, straightforward account administration, and real-time financial information. Maintaining this focus on efficiency and simplicity is crucial for continued customer acquisition and retention.

• Targeting Emerging Markets: The widespread availability of smartphones and affordable internet access in emerging economies presents a substantial opportunity to reach populations with limited access to traditional banking infrastructure, further driving the adoption of digital checking and savings accounts.

External Pressures: US Tariff Implications

While not directly targeting the banking sector, US tariffs can have an indirect yet significant impact on the Global Neo and Challenger Bank Market. Tariffs disrupt international trade flows, leading to economic uncertainty that can dampen business investment and consumer spending globally. This can translate into reduced demand for loans and other financial services, affecting the overall profitability and loan growth of banking institutions, including neo and challenger banks.

For banks with significant international exposure, tariffs can lead to volatility in financial markets and complicate cross-border transactions and investments. Furthermore, industries heavily reliant on global supply chains, such as manufacturing and logistics, are particularly vulnerable to increased costs due to tariffs. If these businesses face financial strain, it can increase the risk of loan defaults, impacting the asset quality of banks. Neo and challenger banks, while often more agile, are not immune to these macroeconomic shifts and must navigate a potentially cautious lending environment and increased credit risk.

Download the full report now to discover market trends, opportunities, and strategies for success.

https://evolvebi.com/report/global-neo-and-challenger-bank-market-analysis/

Explore Further Opportunities

The Global Neo and Challenger Bank Market is a dynamic and rapidly evolving space. To understand further and explore opportunities in this market or any related industry, please share your queries/concern at info@evolvebi.com.

Evolve Business Intelligence

C-218, 2nd floor, M-Cube

Gujarat 396191

India

Email: sales@evolvebi.com

Website: https://evolvebi.com/

Evolve Business Intelligence is a market research, business intelligence, and advisory firm providing

innovative solutions to challenging pain points of a business. Our market research reports include data

useful to micro, small, medium, and large-scale enterprises. We provide solutions ranging from mere

data collection to business advisory.

Evolve Business Intelligence is built on account of technology advancement providing highly accurate

data through our in-house AI-modelled data analysis and forecast tool - EvolveBI. This tool tracks real-

time data including, quarter performance, annual performance, and recent developments from

fortune's global 2000 companies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Neo and Challenger Bank Market Forecast to Reach USD 2,510.63 Billion by 2034 here

News-ID: 4365370 • Views: …

More Releases from Evolve Business Intelligence

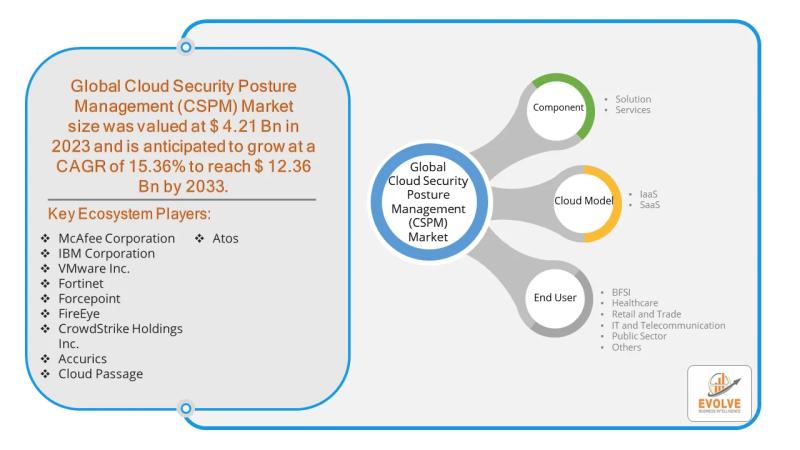

Cloud Security Posture Management (CSPM) Market Forecast to Reach USD 12.36 Bill …

As businesses worldwide accelerate their digital transformation, the shift to cloud infrastructure has opened up a new frontier for security. In this evolving landscape, Cloud Security Posture Management (CSPM) has emerged as a critical discipline, creating a high-opportunity market for the IT and Telecommunication sectors. CSPM solutions are designed to address the unique security challenges of the cloud, providing a robust framework for managing risks and ensuring compliance. This article…

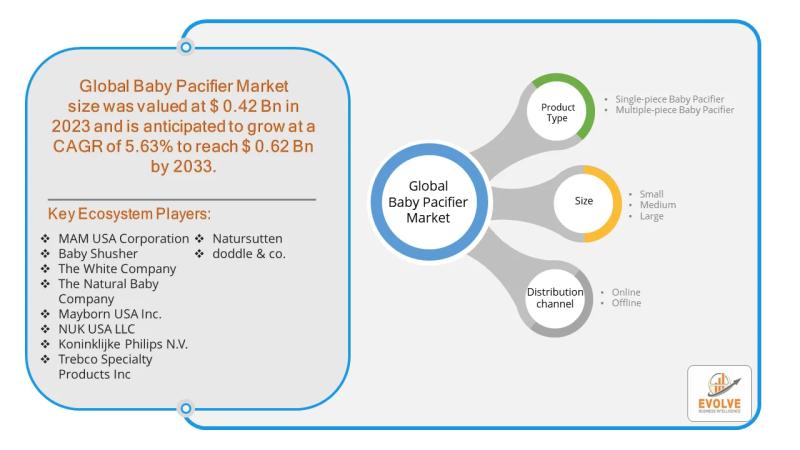

Baby Pacifier Market Forecast to Reach USD 0.62 Billion by 2033, Driven by Risin …

The global baby pacifier market is a dynamic and growing industry, driven by rising birth rates and increasing parental awareness of child care products. Within this landscape, a significant opportunity is emerging for multiple-piece baby pacifiers, which offer a compelling solution to some of the industry's most persistent challenges. This innovative product design has the potential to address key consumer concerns, enhance market share, and pave the way for a…

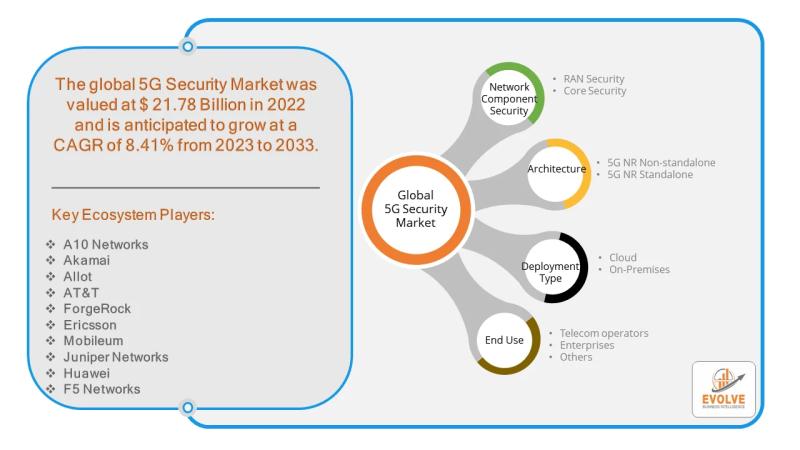

5G Security Market Forecast to Reach USD 10.32 Billion by 2033, Driven by Rising …

The rapid expansion of 5G networks, promising unprecedented speeds and connectivity, is also opening a new front in cybersecurity. While the global 5G security market is projected to reach a significant USD 10.32 billion by 2033, growing at a remarkable Compound Annual Growth Rate (CAGR) of 38.41%, a key opportunity lies in the on-premises segment.

Download the full report now to discover market trends, opportunities, and strategies for success.

https://evolvebi.com/report/5g-security-market-analysis/

The Problem with…

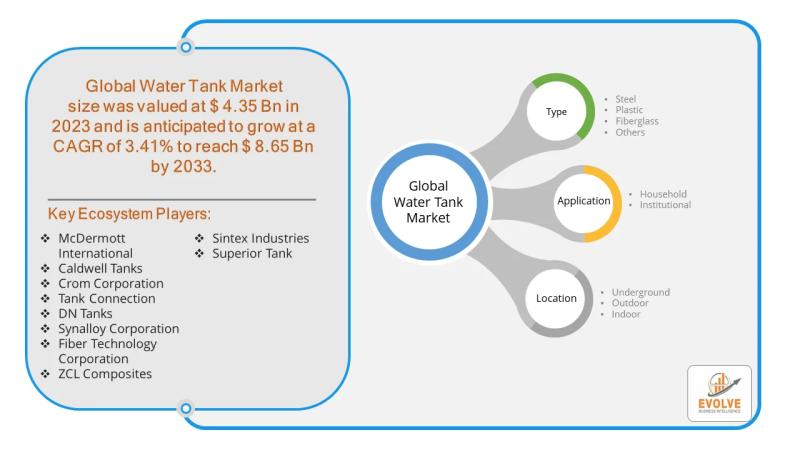

Water Tank Market Forecast to Reach USD 1.3 Billion by 2034, Driven by Rising Ad …

The global demand for efficient and durable water storage solutions is at an all-time high, driven by aging infrastructure and a pressing need for modern, sustainable systems. While traditional materials like steel and concrete have long dominated the market, fiberglass-reinforced plastic (FRP) is emerging as a game-changer, poised to capture significant market share and address some of the industry's most critical challenges. The U.S. fiberglass tanks market alone is projected…

More Releases for Neo

Horizon Neo ANC Earbuds Review 2022:(Must Read!) Facts about Horizon Neo ANC Ear …

To illustrate how far technology has come, think of earphones. However, that is not all. Small wireless earphones with strong batteries have also been developed and are widely used.

The development of active noise cancellation (ANC) technology has progressed the technological field and allowed manufacturers to produce earbuds that allow users to block out background noise and enjoy the finer details of their favourite music or noises.

The Horizon Neo ANC Earbuds…

Smart Intelligent Lithium NEO-Q ENG Battery| NEO SEMITECH

NEO SEMITECH Co., Ltd. is a smart factory-based IoT, ICT application technology company, and Smart Multi Sensing Technology (SMST) Series, Semiconductor measuring equipment, and semiconductor facilities such as the Analog-Digital Converter (ADC) and the Ion Decay Time Analyzer.

NEO SEMITECH Solution: Detects and analyzes all situations that may occur during the operation of a precise and sensitive semiconductor facility. Real-time monitoring and control are possible by applying state-of-the-art information and communication…

NEO Q Battery Pack Product | NEO SEMITECH

NEO SEMITECH CO., LTD. is a smart factory-based company specialized in IoT, ICT application technology. The semiconductor equipment is its main product that consists of Smart Multi Sensing Technology (SMST) Series products, and semiconductor facilities such as the Analog-Digital Converter (ADC) and the Ion Decay Time Analyzer.

Based on its advanced research facilities, excellent research personnel, abundant experience, and accumulated technology, it promises to continue to do its best to…

NEO Q Battery Pack Product | NEO SEMITECH

NEO SEMITECH CO., LTD. is a smart factory-based company specialized in IoT, ICT application technology. The semiconductor equipment is its main product that consists of Smart Multi Sensing Technology (SMST) Series products, and semiconductor facilities such as the Analog-Digital Converter (ADC) and the Ion Decay Time Analyzer.

Based on its advanced research facilities, excellent research personnel, abundant experience, and accumulated technology, it promises to continue to do its best to…

NEO Q Battery Pack Product | NEO SEMITECH

NEO SEMITECH CO., LTD. is a smart factory-based company specialized in IoT, ICT application technology. The semiconductor equipment is its main product that consists of Smart Multi Sensing Technology (SMST) Series products, and semiconductor facilities such as the Analog-Digital Converter (ADC) and the Ion Decay Time Analyzer.

Based on its advanced research facilities, excellent research personnel, abundant experience, and accumulated technology, it promises to continue to do its best to…

Neo and Challenger Bank Market by Type of Bank (Neo Bank and Challenger Bank)

Neo and Challenger Bank Market is registering a CAGR of 50.6% during the forecast period 2016-2020. Neo and challenger bank market has witnessed healthy growth rate in terms of customer base over the past few years, and is expected to witness optimistic growth in the near future.

Access Full Report: https://www.alliedmarketresearch.com/neo-and-challenger-bank-market

The global market is driven by factors such as government regulations, convenience offered to consumers, and low interest rates as compared…