Press release

Textile Waste Shredding Unit DPR - 2026, Market Trends, Machinery Cost and ROI

Textile waste shredding units represent an essential mechanical system designed to break down discarded textile materials-including fabric scraps, garments, and mixed fiber waste-into smaller pieces or fiber segments. These industrial systems enable recycling, repurposing, and further processing through heavy-duty shredders, cutting blades, conveyors, and sorting assemblies. By reducing waste volume and preparing material feedstock for recycling lines, these units help minimize landfill burden, recover reusable fibers, and support sustainability goals across manufacturing, construction, automotive, and non-woven sectors.IMARC Group's report, titled "Textile Waste Shredding Unit Setup Cost 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," provides a complete roadmap for setting up a textile waste shredding unit. It covers a comprehensive market overview to micro-level information, such as unit operations involved, raw material requirements, utility requirements, infrastructure requirements, machinery and technology requirements, manpower requirements, packaging requirements, transportation requirements, etc.

MARKET OVERVIEW AND GROWTH POTENTIAL

The textile waste shredding unit market is expanding due to global sustainability mandates and increased environmental awareness among manufacturers and municipal authorities. The global textile waste management market size was valued at USD 28.70 Billion in 2025. According to IMARC Group estimates, the market is expected to reach USD 72.82 Billion by 2034, exhibiting a robust CAGR of 10.9% from 2026 to 2034.

Regulations targeting waste minimization, extended producer responsibility (EPR), and circular economy goals are compelling enterprises to invest in efficient shredding and recycling infrastructure. Market drivers include technological advancements such as automated feeding systems and energy-efficient motors, which fuel adoption by lowering operational costs and enhancing throughput.

The rising volume of textile waste from fast fashion, industrial processes, and post-consumer streams is driving demand for size-reduction machinery that supports recycling and material recovery operations. The union textiles minister of India stated that the country's textiles market is projected to reach USD 350 billion by 2030, highlighting the massive scale of the industry and corresponding waste management requirements.

Request for Sample Report: https://www.imarcgroup.com/textile-waste-shredding-unit-project-report/requestsample

PLANT CAPACITY AND PRODUCTION SCALE

The proposed facility is designed with an annual production capacity ranging between 1,000 - 10,000 tons of shredded waste, enabling economies of scale while maintaining operational flexibility. This capacity range allows operators to serve multiple market segments simultaneously, from small-scale recycling operations to large industrial clients requiring consistent, high-volume feedstock for downstream applications.

The flexible capacity design accommodates varying raw material availability and market demand fluctuations while optimizing equipment utilization and operational efficiency. This production scale positions the unit to capture opportunities across diverse end-use industries including textile recycling, waste management, automotive interiors, furniture manufacturing, and insulation production.

FINANCIAL VIABILITY AND PROFITABILITY ANALYSIS

The textile waste shredding unit project demonstrates healthy profitability potential under normal operating conditions. Financial projections indicate attractive margins supported by stable demand, diverse application markets, and value-added processing capabilities.

Gross profit margins typically range between 20-40%, reflecting efficient processing operations, economies of scale, and the value creation inherent in transforming waste materials into usable feedstock. Net profit margins are projected at 5-15%, demonstrating solid bottom-line performance after accounting for all operational expenses, depreciation, taxes, and other costs.

These profitability metrics have been developed based on realistic assumptions related to capital investment, operating costs, production capacity utilization, pricing trends, and demand outlook. The financial projections provide a comprehensive view of the project's financial viability, return on investment (ROI), and long-term sustainability, making this an attractive investment opportunity for stakeholders seeking to capitalize on the growing circular economy trend.

OPERATING COST STRUCTURE

The operating cost structure of a textile waste shredding unit is characterized by moderate raw material costs combined with significant utility requirements, reflecting the energy-intensive nature of industrial shredding operations.

Raw materials account for approximately 10-30% of total operating expenses (OpEx). The primary raw material is textile waste itself, sourced from garment manufacturers, recycling facilities, industrial workshops, and commercial establishments. This relatively modest raw material cost structure is advantageous compared to many manufacturing operations, as the feedstock consists of waste materials often available at low or negative cost.

Utilities represent 30-50% of OpEx, encompassing electricity for operating heavy-duty shredders, conveyors, sorting systems, and dust extraction equipment. The substantial utility component reflects the mechanical energy required to process tough textile materials and maintain continuous operations. Efficient equipment selection and process optimization can help manage these costs while maintaining throughput and quality standards.

Additional operating expenses include maintenance parts such as blades and belts, which require regular replacement due to the abrasive nature of textile processing. Labor costs, packaging expenses for baled output, transportation for raw material collection and finished product delivery, and general administrative expenses complete the operational cost picture.

Buy Now: https://www.imarcgroup.com/checkout?id=39129&method=2175

CAPITAL INVESTMENT REQUIREMENTS

Establishing a textile waste shredding unit requires careful financial planning across multiple capital expenditure categories. The total capital investment depends on plant capacity, technology selection, and location-specific factors.

Machinery costs account for the largest portion of total capital expenditure. Essential equipment includes:

• Industrial shredders - Heavy-duty units capable of processing diverse textile materials with varying composition and moisture content

• Textile sorters - Systems for separating different fiber types and material categories

• Bale breakers - Equipment for opening compressed textile bales and preparing material for shredding

• Conveyor systems - Material handling infrastructure connecting process stages

• Dust extraction and filtration units - Environmental control systems managing particulate emissions

• Baling presses - Equipment for compressing shredded output into manageable, transportable bales

• Automated packaging stations - Systems for efficient finished product handling

All machinery must comply with industry standards for safety, efficiency, and reliability. High-quality, corrosion-resistant equipment tailored for textile waste shredding ensures operational continuity and minimizes downtime.

Land and site development costs form a substantial investment component, covering land acquisition, site preparation, boundary development, registration charges, and infrastructure establishment. Location selection should prioritize access to textile waste sources, proximity to target markets, robust transportation networks, and compliance with local zoning and environmental regulations.

Civil works costs include construction of processing buildings, storage facilities for raw materials and finished goods, administrative offices, utilities infrastructure, and safety systems. The layout should be optimized to enhance workflow efficiency, minimize material handling, and provide adequate space for quality control and future expansion.

Other capital costs encompass pre-operative expenses, working capital requirements, contingency reserves, and initial inventory buildup. Comprehensive financial planning across all these categories ensures adequate funding and smooth project execution from inception through full operational ramp-up.

MAJOR APPLICATIONS AND MARKET SEGMENTS

Textile waste shredding units serve diverse applications across multiple industries, creating multiple revenue streams and market resilience:

Garment Industry - Processing fabric offcuts, defective garments, and production scraps generated during manufacturing operations. This segment provides consistent, high-volume feedstock from concentrated industrial sources.

Recycling Facilities - Supporting textile waste processing centers by preparing mixed waste streams for fiber recovery and material reuse. Shredded output becomes feedstock for secondary fiber production and non-woven applications.

Industrial Workshops - Breaking down textile remnants, industrial ropes, conveyor belts, and other technical textile products that reach end-of-life. This specialized segment often involves materials with unique composition requiring adapted processing approaches.

Commercial Establishments - Managing bulk textile waste from hotels (linens and towels), hospitality operations, uniform services, and other commercial sources generating regular waste volumes. This segment offers predictable material flows and potential for long-term service contracts.

End-use industries for shredded textile output include textile recycling operations, automotive interior component manufacturers, furniture and upholstery producers, insulation manufacturers, and composite material fabricators. This diverse application portfolio reduces market concentration risk and enables operators to optimize product mix based on prevailing market conditions and pricing.

Speak to an Analyst for Customized Report: https://www.imarcgroup.com/request?type=report&id=39129&flag=C

WHY INVEST IN TEXTILE WASTE SHREDDING?

Essential Waste Management Solution - Textile waste shredding units are critical for efficient handling of fabric scraps, offcuts, defective garments, and post-consumer textile waste. They enable recycling, fiber recovery, and sustainable waste management across garment, industrial, and commercial sectors, addressing a fundamental need that continues growing with textile consumption.

Moderate but Justifiable Entry Barriers - While requiring investment in machinery, consistent maintenance, and adherence to safety and efficiency standards, the operational know-how, process optimization, and quality consistency create entry barriers that favor experienced manufacturers focused on reliability and long-term service. This competitive moat protects established operators while rewarding operational excellence.

Alignment with Sustainability Megatrends - Growing awareness of circular economy principles, sustainability initiatives, and eco-friendly practices in fashion, hospitality, and industrial sectors drives consistent demand for textile waste shredding solutions. The global push for recycling and repurposing textiles is gaining momentum, supported by consumer preferences, corporate sustainability commitments, and investor environmental criteria.

Policy & Infrastructure Support - Government regulations promoting waste management, recycling mandates, and incentives for sustainable manufacturing, along with industrial modernization programs, indirectly boost demand for textile shredding solutions. Extended producer responsibility schemes and landfill diversion targets create favorable regulatory tailwinds.

Localization and Dependable Supply Chains - Businesses and recycling units prefer local, reliable suppliers to ensure timely delivery, maintain operational continuity, and reduce logistical challenges. This preference creates opportunities for regional manufacturers with efficient production systems and responsive support capabilities, enabling stable customer relationships and recurring revenue streams.

Technology Advantages - Automated feeding systems, energy-efficient motors, AI-powered sorting sensors, and advanced control systems improve processing efficiency, reduce operational costs, and enhance output quality. Operators investing in modern technology gain competitive advantages through superior economics and capability to handle diverse material streams.

INDUSTRY LEADERSHIP

These established manufacturers serve end-use sectors including textile recycling, waste management, automotive interiors, furniture manufacturing, and insulation production, demonstrating the breadth of market applications and the maturity of the industry supply base.

Browse Related Reports:

• Printed Paper Shopping Bags Manufacturing Plant: https://industrytoday.co.uk/manufacturing/printed-paper-shopping-bags-manufacturing-plant-dpr-unit-setup-2026-demand-analysis-and-project-cost

• Copper Pipe Manufacturing Plant: https://industrytoday.co.uk/manufacturing/copper-pipe-manufacturing-plant-setup-cost-2026-complete-project-report-with-capex-opex-and-roi

• Copper Recycling Plant: https://industrytoday.co.uk/recycling_and_waste/copper-recycling-plant-dpr-unit-setup-2026-demand-analysis-and-project-cost

• Aluminium Recycling Plant: https://industrytoday.co.uk/recycling_and_waste/aluminium-recycling-plant-dpr-2026-cost-structure-market-outlook-and-profitability-analysis

• IQF (Individually Quick Frozen) Food Processing Plant: https://industrytoday.co.uk/manufacturing/iqf-individually-quick-frozen-food-processing-plant-dpr-2026-complete-project-report-investment-guide

CONCLUSION

The textile waste shredding unit sector represents a compelling investment opportunity at the intersection of environmental necessity, technological advancement, and favorable market dynamics. With robust projected growth in the global textile waste management market through 2034, the fundamental demand drivers are firmly in place.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Textile Waste Shredding Unit DPR - 2026, Market Trends, Machinery Cost and ROI here

News-ID: 4365093 • Views: …

More Releases from IMARC Group

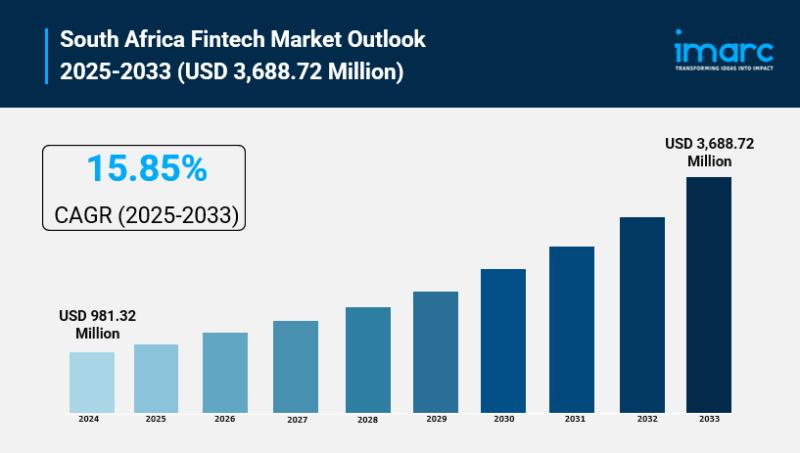

South Africa Fintech Market Size to Surpass USD 3,688.72 Million by 2033 | With …

South Africa Fintech Market Overview

Market Size in 2024: USD 981.32 Million

Market Size in 2033: USD 3,688.72 Million

Market Growth Rate 2025-2033: 15.85%

According to IMARC Group's latest research publication, "South Africa Fintech Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the South Africa fintech market size reached USD 981.32 Million in 2024. The market is projected to reach USD 3,688.72 Million by 2033, exhibiting a growth rate (CAGR) of 15.85%…

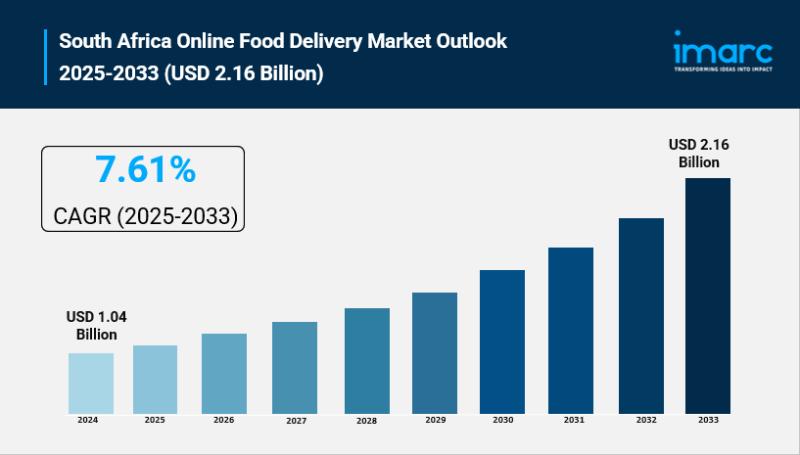

South Africa Online Food Delivery Market Size to Hit USD 2.16 Billion by 2033 | …

South Africa Online Food Delivery Market Overview

Market Size in 2024: USD 1.04 Billion

Market Size in 2033: USD 2.16 Billion

Market Growth Rate 2025-2033: 7.61%

According to IMARC Group's latest research publication, "South Africa Online Food Delivery Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the South Africa online food delivery market size reached USD 1.04 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.16 Billion…

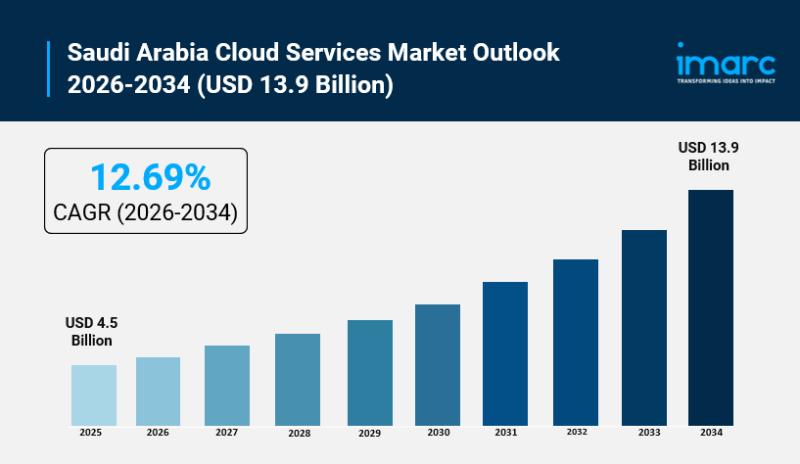

Saudi Arabia Cloud Services Market Poised for Explosive Growth to USD 13.9 Billi …

Saudi Arabia Cloud Services Market Overview

Market Size in 2025: USD 4.5 Billion

Market Forecast in 2034: USD 13.9 Billion

Market Growth Rate 2026-2034: 12.69%

According to IMARC Group's latest research publication, "Saudi Arabia Cloud Services Market Report by Deployment (Public Cloud, Private Cloud), End Use Industry (Oil, Gas, and Utilities, Government and Defense, Healthcare, Financial Services, Manufacturing and Construction, and Others), and Region 2026-2034", The Saudi Arabia cloud services market size reached USD…

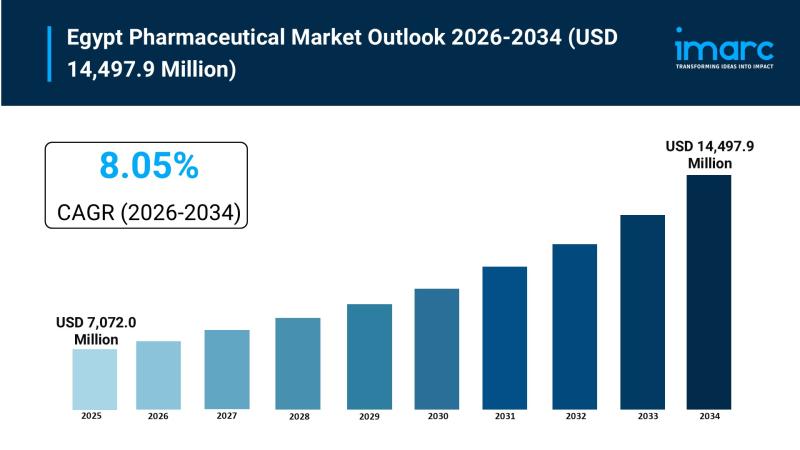

Egypt Pharmaceutical Market Size to Reach USD 14,497.9 Million by 2034 | With a …

Egypt Pharmaceutical Market Overview

Market Size in 2025: USD 7,072.0 Million

Market Size in 2034: USD 14,497.9 Million

Market Growth Rate 2026-2034: 8.05%

According to IMARC Group's latest research publication, "Egypt Pharmaceutical Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Egypt pharmaceutical market size reached USD 7,072.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 14,497.9 Million by 2034, exhibiting a growth rate (CAGR) of 8.05%…

More Releases for Textile

Textile Market Size, Growth Analysis 2031 by Key Vendors- INVISTA, Lu Thai Texti …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲: According to Verified Market Reports analysis, the global Textile Market size was valued at USD 593.9 Billion in 2023 and is projected to reach USD 775.2 Billion by 2031, growing at a CAGR of 4.3% during the forecasted period 2024 to 2031.

What is the current outlook for the textile market?

The textile market has shown resilience, recovering after global disruptions like the COVID-19 pandemic. According to industry reports,…

Expanding Textile Industry is Boosting the Indian Textile Chemicals Market

Indian textile chemicals market is estimated to grow at a substantial CAGR of 5.1% during the forecast period (2024-2031). The market growth is driven by the rising middle class, increasing urbanization, and the rising number of nuclear families, which have resulted in Westernized tastes and higher consumption and spending. In addition, technical textiles, and fast fashion trends are driving the market growth. Moreover, industrial manufacturing in the country has emerged…

Textile Tester Market Is Driven by Increasing Demand for Textile Testing from th …

A textile tester is a device that is used to test the physical and chemical properties of textile materials. It is used to determine the strength, durability, and other characteristics of textile materials.

Download Sample PDF Of This Report:

https://www.globalinsightservices.com/request-sample/GIS23209

Key Drivers

The key drivers of the Textile Tester market are the increasing demand for textile testing from the textile industry and the growing awareness of the importance of textile testing. The textile…

Textile Care Services Market Potential growth, Major Strategies, Future Industry …

"Worldwide Market Reports offers 𝐔𝐩𝐭𝐨 𝟕𝟎% 𝐝𝐢𝐬𝐜𝐨𝐮𝐧𝐭 on Textile Care Services Market Reports on Single User Access and Unlimited User Access"

The report discusses everything a marketer requires before investing in the global Textile Care Services during the forecast period 2023-2030. It provides detailed insight into current trends, shares, size, and sales value and volume. The data used for this report is obtained from reliable industry sources, paid resources, and validated…

Global Textile Colorant Market, Global Textile Colorant Industry, Textile Colora …

Textile colorants are specific products that can be added or applied to substrate to give color. They are commonly available in the form of pigments, dyes, and dry powder. They are manufactured with eco-friendly application with advanced technologies and regulations that supports the environment. In the composition context, textile colorant market can be categorized as thermo-chromic textile colorant and photochromic textile colorant. Textile industry accounts for largest consumption of colorants…

Global Household Textile Market Analysis 2023 – Top Players Fuanna Bedding and …

KD Market Insights has presented a detailed report on “Household Textile Market - By Product Type (Non-woven Textile, Woven Textile), By Application (Bed, Furniture, Door & Window, Dining & Wash, Ground), Global Region - Market Size, Share & Forecast 2018-2023” which includes the major application, advantages, and key market trends that are fostering the growth of the market during the forecasted span of 6 years. The research takes a step…