Press release

Glass Manufacturing Plant (DPR) 2026: Machinery Requirement, Setup Cost and Profit Margin

IntroductionThe glass manufacturing industry stands as a cornerstone of modern industrial infrastructure, serving critical sectors including construction, automotive, packaging, electronics, and telecommunications. The India glass market, valued at USD 5.16 Billion in 2025, demonstrates robust growth potential as urbanization and infrastructure development accelerate globally. According to market projections, the industry is expected to reach USD 8.87 Billion by 2034, exhibiting a compound annual growth rate (CAGR) of 6.2% from 2026 to 2034. This growth trajectory reflects the increasing demand for glass across diverse applications-from window glazing and structural insulation to fiber optic cables and vehicle components-making it an attractive investment opportunity for entrepreneurs and industrial investors seeking to capitalize on foundational industrial materials with consistent demand.

Market Overview and Growth Potential

The global glass market is experiencing significant expansion driven by multiple industrial megatrends. Key market drivers include rapid urbanization-with more than half of the world's population now living in cities and towns, and an estimated increase to about 5 billion by 2030 according to UNFPA. The construction sector's growing need for energy-efficient glass, windows, and facades fuels demand as infrastructure projects expand globally. Additionally, the automotive industry's shift toward lightweight vehicles and advanced safety features creates sustained demand for specialized glass products. The food and beverage industry's continued reliance on glass packaging due to its non-reactivity and sustainability further supports market growth. Technological advancements in smart glass and energy-efficient coatings are propelling demand in electronics and automotive applications, while the inherent recyclability of glass ensures its continued relevance as sustainability becomes a priority across industries.

Plant Capacity and Production Scale

The proposed glass manufacturing facility is designed with strategic flexibility in mind, featuring an annual production capacity ranging between 200,000 - 500,000 MT. This capacity range enables significant economies of scale while maintaining operational adaptability to market demands. The production scale allows manufacturers to serve multiple market segments simultaneously including construction, building materials, automotive, telecommunications, electronics, and aerospace industries. The facility's design accommodates various glass production processes, from float and container glass to specialty glass products such as bottles, jars, architectural glass, and fiber optic components. This diversified production capability positions the plant to capture value across high-growth segments while mitigating risks associated with dependence on single market verticals.

IMARC Group's report, "Glass Manufacturing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," offers a comprehensive guide for establishing a plant. The glass manufacturing plant setup report offers insights into the process, financials, capital investment, expenses, ROI, and more for informed business decisions.

Request Sample: https://www.imarcgroup.com/glass-manufacturing-plant-project-report/requestsample

Financial Viability and Profitability Analysis

The glass manufacturing project demonstrates strong financial fundamentals under normal operating conditions. Gross profit margins typically range between 25-35%, supported by stable demand patterns and value-added applications across multiple end-use industries. Net profit margins are projected at 10-15%, reflecting efficient cost management and economies of scale. The financial projections have been developed based on realistic assumptions related to capital investment, operating costs, production capacity utilization, pricing trends, and demand outlook. These projections provide a comprehensive view of the project's financial viability, return on investment (ROI), profitability, and long-term sustainability. The project's financial structure is designed to weather market fluctuations while delivering consistent returns, with break-even analysis and payback period calculations supporting investment decision-making. The combination of healthy margins, diversified revenue streams, and growing market demand creates an attractive risk-return profile for potential investors.

Operating Cost Structure

Understanding the operating cost structure is critical for assessing the project's long-term profitability. In a glass manufacturing plant, the operating expenditure (OpEx) is primarily driven by two major components. Raw materials account for 35-45% of total operating expenses, with key inputs including silica sand, soda ash, and limestone. These foundational materials undergo high-temperature processing to create glass products, making their consistent supply and cost management essential to profitability. Utilities represent 40-50% of OpEx, reflecting the energy-intensive nature of glass production, which requires substantial electricity, water, and steam for melting, forming, and finishing processes.

In the first year of operations, the operating cost is projected to be significant, covering raw materials, utilities, depreciation, taxes, packing, transportation, and repairs and maintenance. By the fifth year, total operational costs are expected to increase substantially due to inflation, market fluctuations, and potential rises in key material costs. Additional factors including supply chain disruptions, rising consumer demand, and shifts in the global economy are expected to contribute to this increase. Effective cost management strategies, including long-term supplier contracts and process optimization, are essential to maintain competitive margins throughout the operational lifecycle.

Capital Investment Requirements

Establishing a glass manufacturing plant requires substantial capital investment across multiple categories. The total capital expenditure depends on plant capacity, technology selection, and location. Machinery costs account for the largest portion of total capital expenditure, encompassing essential equipment for the complete production process. Key machinery includes batch mixers for raw material preparation, furnaces or melters for high-temperature processing, forming machines for float, container, or fiber glass production, annealing lehrs for controlled cooling, cutting and edging units for precision finishing, tempering ovens for strength enhancement, coating lines for specialized applications, and comprehensive inspection and packaging systems.

Speak to an Analyst: https://www.imarcgroup.com/request?type=report&id=9070&flag=C

Land and site development cost form a substantial part of the overall investment, including charges for land registration, boundary development, and related infrastructure expenses. This allocation ensures a solid foundation for safe and efficient plant operations. Civil works cost cover construction of manufacturing facilities, storage areas, quality control laboratories, and administrative buildings. Other capital cost includes preliminary expenses, contingencies, working capital, and pre-operative costs. The infrastructure must support reliable transportation, utilities, and waste management systems while ensuring compliance with local zoning laws and environmental regulations. The layout should be optimized to enhance workflow efficiency, safety, and minimize material handling, with separate designated areas for raw material storage, production, quality control, and finished goods storage, while incorporating space for future expansion to accommodate business growth.

Major Applications and Market Segments

Glass manufacturing serves diverse applications across multiple high-value market segments. The production process encompasses melting and forming operations utilizing glass furnaces, forehearth systems, and advanced forming equipment. Float and container glass production represents major product categories, employing float baths, molds, and specialized shaping machinery to create flat glass for construction and containers for packaging applications. Processing and finishing operations include cutting, grinding, polishing, and tempering lines that transform raw glass into finished products meeting precise specifications.

Primary applications include window glazing for residential and commercial buildings, structural insulation for energy-efficient construction, fiber optic cables for telecommunications infrastructure, circuit boards for electronics manufacturing, vehicle glazing for automotive safety and design, and reinforcement composites for aerospace and advanced manufacturing. End-use industries span construction and building materials, automotive manufacturing, telecommunications networks, electronics and semiconductor production, and aerospace engineering. This broad application base provides revenue diversification and reduces exposure to cyclical fluctuations in any single industry segment.

Why Invest in Glass Manufacturing?

Glass manufacturing presents compelling strategic advantages for investors seeking stable, long-term returns in essential industrial materials. As a foundational industrial material, glass is critical across construction, automotive, packaging, electronics, pharmaceuticals, and renewable energy-making it indispensable for modern infrastructure, urbanization, and consumer goods. The industry benefits from moderate but defensible entry barriers. While less capital-intensive than semiconductor manufacturing, glass production demands high-temperature furnaces, precise process control, strict quality standards, and long customer qualification cycles-creating meaningful barriers that favor experienced producers with consistent quality and cost discipline.

The sector demonstrates strong megatrend alignment. Increasing construction activity, automotive glazing requirements, solar roofing panels, consumer packaging, and electronic devices drive rapidly increasing demand for flat containers and building construction glass. The development of new energy-efficient construction forms worldwide further accelerates adoption. Policy and infrastructure support bolsters the industry, with government spending on housing, smart cities, renewable energy (solar glass), transportation infrastructure, and domestic manufacturing initiatives such as Make in India and green building codes indirectly boosting demand for glass products.

Localization and supply-chain reliability create significant competitive advantages. Developers, original equipment manufacturers (OEMs), and engineering, procurement, and construction (EPC) contractors increasingly prefer local glass suppliers to reduce logistics costs, ensure timely delivery, manage energy and raw-material volatility, and maintain consistent quality. This trend creates opportunities for regional manufacturers with integrated operations and dependable supply chains. The recyclability of glass ensures its continued relevance as sustainability becomes a priority, with manufacturers increasingly adopting green production processes to meet environmental standards and consumer preferences.

Industry Leadership

The global glass industry is dominated by several multinational companies with extensive production capacities and diverse application portfolios. Leading manufacturers include Saint-Gobain, Guardian Industries, Asahi Glass Co., O-I Glass, and Corning Inc., all of which serve end-use sectors such as construction, building materials, automotive, telecommunications, electronics, and aerospace. These industry leaders set benchmarks for quality, innovation, and operational efficiency, demonstrating the market's maturity and the opportunities for well-positioned new entrants to capture market share through strategic positioning, technological advancement, or regional supply advantages.

Buy Now: https://www.imarcgroup.com/checkout?id=9070&method=2175

Recent industry developments underscore the sector's growth momentum. In January 2025, Borosil Renewables announced plans to expand its production capacity by 50% in solar glass manufacturing, increasing capacity to 1,500 tons per day from 1,000 TPD, equivalent to 6.5 GW per annum. In April 2024, O-I Glass, Inc. achieved a major milestone in constructing its glass packaging production facility in Bowling Green, KY, hosting a Topping-Off event to commemorate the placement of the final beam. These investments by established players validate the industry's positive outlook and growth potential.

Browse Related Reports:

Palm Oil Processing Plant Cost: https://industrytoday.co.uk/manuacturing/palm-oil-processing-plant-dpr-unit-setup-2026-machinery-and-project-cost

Epoxy Resin Production Plant Cost: https://industrytoday.co.uk/chemicals/epoxy-resin-production-plant-dpr-unit-setup-2026-machinery-and-project-cost

Corrugated Box Manufacturing Plant Cost: https://industrytoday.co.uk/packaging/corrugated-box-manufacturing-plant-dpr-2026-raw-materials-cost-and-roi-analysis

Ethernet Cable Manufacturing Plant Cost: https://industrytoday.co.uk/Construction/ethernet-cable-manufacturing-plant-report-dpr-2026-unit-setup-cost-and-requirements

Recycled Paper Manufacturing Plant Cost: https://industrytoday.co.uk/energy_and_environment/recycled-paper-manufacturing-plant-dpr-2026-machinery-requirement-setup-cost-and-profit-margin

Conclusion

Diversified applications across construction, automotive, telecommunications, electronics, and aerospace provide revenue stability and growth potential. The presence of global industry leaders validates market maturity, while recent capacity expansions by major players confirm positive industry momentum. For entrepreneurs and industrial investors seeking exposure to essential materials with consistent demand, defensive characteristics, and growth aligned with urbanization and technological advancement, glass manufacturing represents a strategically sound investment opportunity with the potential for sustainable, long-term value creation.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Glass Manufacturing Plant (DPR) 2026: Machinery Requirement, Setup Cost and Profit Margin here

News-ID: 4365014 • Views: …

More Releases from IMARC Group

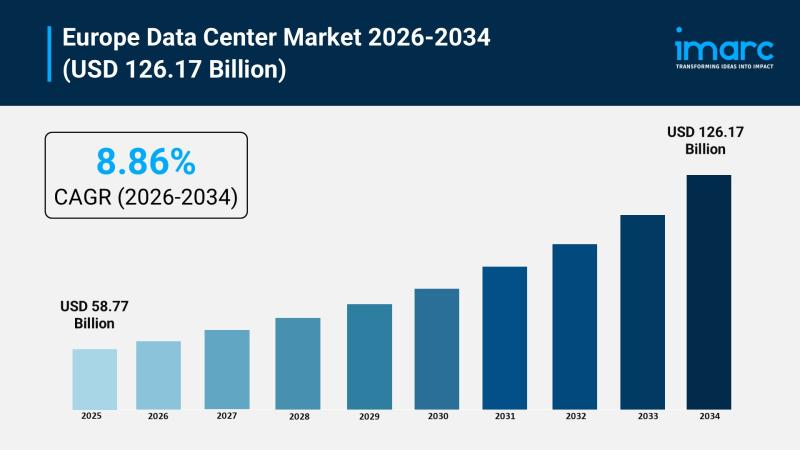

IMARC Group Forecasts 8.86% CAGR for Europe Data Center Market Amidst AI and Clo …

The Europe data center market is experiencing a critical phase of infrastructure evolution, having reached a valuation of USD 58.77 Billion in 2025. Propelled by the accelerating digitalization of the region's economy and sovereign cloud ambitions, the market is projected to reach USD 126.17 Billion by 2034. This growth trajectory represents a solid Compound Annual Growth Rate (CAGR) of 8.86% during the forecast period of 2026-2034.

Key Market Trends &…

Hot Sauce Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Proje …

Setting up a hot sauce manufacturing plant positions investors within one of the fastest-growing and flavor-driven segments of the global condiment industry, fueled by rising consumer appetite for spicy, bold, and ethnic flavors, increasing demand for clean-label and premium condiment products, and expanding utilization of hot sauce across food service, retail, and food processing applications. Made primarily from chili peppers, vinegar, salt, and complementary flavoring ingredients, hot sauce is recognized…

Glyoxylic Acid Prices Q4 2025: US Stable While Europe Remains High Price Trend

The Glyoxylic Acid Price Trend Analysis indicates dynamic shifts in global supply-demand balance, feedstock volatility, and regional trade flows. In 2026, Glyoxylic Acid Prices are reflecting fluctuations in raw material costs and downstream demand from pharmaceuticals, cosmetics, and agrochemicals. Market participants closely track the Glyoxylic Acid price index and forecast data to understand pricing momentum, risk exposure, and procurement strategies across key global regions.

Glyoxylic Acid Current Glyoxylic Acid Price Movements:

Recent…

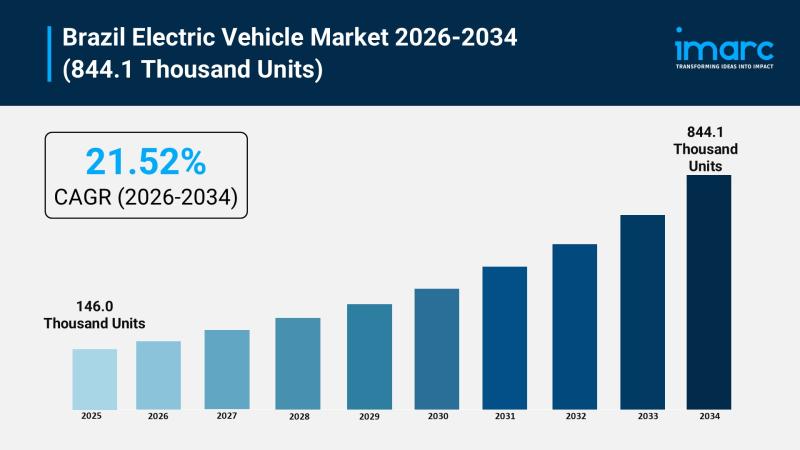

IMARC Group Forecasts 21.52% CAGR for Brazil EV Market as BYD and GWM Ramp Up Lo …

The Brazil electric vehicle (EV) market is currently witnessing an unprecedented surge, having reached a volume of 146.0 Thousand Units in 2025. Fueled by a combination of stringent environmental policies and a strategic shift toward domestic production by global automakers, the market is projected to reach 844.1 Thousand Units by 2034. This rapid expansion represents a robust Compound Annual Growth Rate (CAGR) of 21.52% during the forecast period of 2026-2034.

Key…

More Releases for Plant

How to Establish a Modular Switch manufacturing plant Plant

Setting up a modular switch manufacturing facility necessitates a detailed market analysis alongside granular insights into various operational aspects, including unit processes, raw material procurement, utility provisions, infrastructure setup, machinery and technology specifications, workforce planning, logistics, and financial considerations.

IMARC Group's report titled "Modular Switch Manufacturing Plant Project Report 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" offers a comprehensive guide for establishing a modular…

How To Setup a Plant Growth Hormones Manufacturing Plant

Setting up a plant growth hormones manufacturing facility necessitates a detailed market analysis alongside granular insights into various operational aspects, including unit processes, raw material procurement, utility provisions, infrastructure setup, machinery and technology specifications, workforce planning, logistics, and financial considerations.

IMARC Group's report titled "Plant Growth Hormones Manufacturing Plant Project Report 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" offers a comprehensive guide for establishing…

Plant-Powered Eating: Trends in the Plant-Based Food Market

The plant-based food market has experienced exponential growth in recent years, driven by increasing consumer awareness of health, environmental sustainability, and ethical considerations. This burgeoning sector encompasses a wide range of products, from plant-based meat alternatives to dairy-free beverages and vegan snacks. In this overview, we'll explore key points, trends, and recent industry news shaping the plant-based food market.

Download a Free sample copy of Report:https://www.marketdigits.com/request/sample/3771

Key Companies Profiled

Amy's Kitchen

Danone S.A.

Atlantic…

Chocolate Syrup Manufacturing Plant Cost 2023-2028: Manufacturing Process, Plant …

Syndicated Analytics latest report titled "Chocolate Syrup Manufacturing Plant Project Report: Industry Trends, Project Report, Manufacturing Process, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue 2023-2028" covers all the aspects including industry performance, key success and risk factors, manufacturing requirements, project costs, and economics, expected returns on investment, profit margins, etc. required for setting up a chocolate syrup manufacturing plant. The study, which is based both on desk…

Garlic Powder Manufacturing Plant 2023-2028: Manufacturing Process, Plant Cost, …

Syndicated Analytics latest report titled "Garlic Powder Plant Project Report: Industry Trends, Manufacturing Process, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue 2023-2028" covers all the aspects including industry performance, key success, and risk factors, manufacturing requirements, project costs, and economics expected returns on investment, profit margins, etc. required for setting up a garlic powder manufacturing plant. The study, which is based both on desk research and multiple…

Frozen Food Manufacturing Plant 2023-2028: Project Report, Business Plan, Plant …

Syndicated Analytics latest report titled "Frozen Food Manufacturing Plant Project Report: Industry Trends, Manufacturing Process, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue 2023-2028" covers all the aspects including industry performance, key success, and risk factors, manufacturing requirements, project costs, and economics, expected returns on investment, profit margins, etc. required for setting up a frozen food manufacturing plant. The study, which is based both on desk research and…